San Francisco City Attorney David Chiu. (Photo: Kevin Sanders for California Globe)

AB 71 – $2.4 Billion Tax Hike to Create a ‘Statewide Homelessness Solutions’ Program?

It makes clear some of the tax increase changes

By Chris Micheli, December 8, 2020 5:18 pm

On December 7, the first day of the California Legislature’s 2021-22 Session, Assembly Members Luz Rivas and David Chiu introduced AB 71, which would create a “statewide homelessness solutions program.” Currently, the bill is a statement of legislative intent. However, it makes clear some of the tax increase changes it will propose once substantive amendments are made to the bill.

AB 71 would state the intent of the Legislature to enact legislation to create a comprehensive, statewide homelessness solutions program. In addition, AB 71 would create the Bring California Home Fund in the State Treasury for the purpose of providing at least $2,400,000 annually to fund a comprehensive, statewide homeless solutions program upon appropriation by the Legislature. And, AB 71 would require the Bring California Home Fund to contain revenues derived from specified changes to the Personal Income Tax Law or the Corporation Tax Law that are enacted on or after the effective of the date of this bill.

In Section One of the bill, it makes eight legislative findings and declarations. Over 150,000 persons have experienced homelessness in California, with African Americans being disproportionately represented in that population. Also, “Homeless is a statewide crisis in California which requires a statewide, comprehensive solution that meets its scale.” As a result, it is the Legislature’s intent to “create a comprehensive, statewide homelessness solutions program.”

In addition, it is “the intent of the Legislature to enact legislation to fund this comprehensive program with new, ongoing revenues of at least $2.4 billion per year.”

In Section Two of the bill, the “Bring California Home Fund” would be created in the State Treasury for the purpose of providing at least two million four hundred thousand dollars ($2,400,000) annually to fund a comprehensive, statewide homeless solutions program upon appropriation by the Legislature.

The revenues to go into this fund would be derived from changes to California tax laws, including the following:

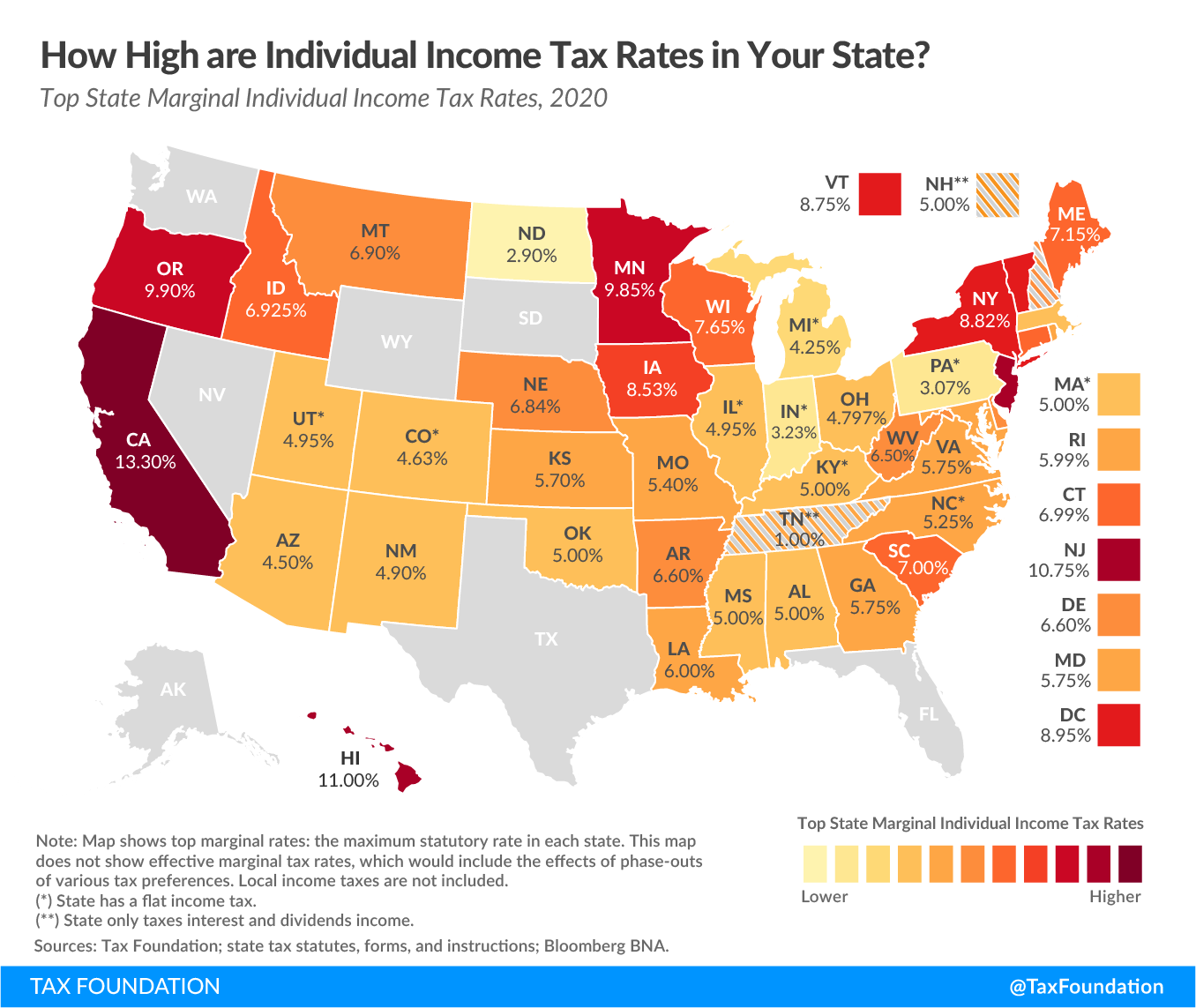

- An increase in the personal income tax on incomes over one million dollars ($1,000,000).

- An increase in the corporate income tax to historical rates, a more progressive corporate income tax, and conformity with the federal Tax Cuts and Jobs Act, including the inclusion of Global Intangible Low-Taxed Income (GILTI).

- Eliminating or limiting corporate tax loopholes, including the water’s edge election.

- Marking to market unrealized capital gains and the repeal of stepped-up in basis of inherited assets.

AB 71 is likely to be heard in its first policy committee in March 2021.

- Frequently Asked Questions on California Legislature Conducting Its Work - April 20, 2024

- What Information Has to Be on the LegInfo Website? - April 19, 2024

- New Assembly Bill Would Ban NDAs in Legislative Negotiations - April 19, 2024

So this tax will end up doing nothing but pay for more consultants and a task force of usual idiots, which will accomplish nothing!

Homeless housing will be running around a million a unit based on past history. 2.4 billion may only house 2,400 people. Sacramento spent around a half million per 250 square foot unit. I wish I was poor enough to get free government luxury housing.

Comrades

Yellow gloss paint in short supply….they bought it up for targets on your chubby chests…..

On the first day of their session all they can do is think of more potential tax increases. Is there a way that we can not have a legislature that meets all the time. All they do is think of ways to spend my money. It never ends with these folks.

Being a minority Republican lover of my State for 60 years; getting fed up with graft and theft and waste of my taxes. No plan again about how to house 150K dopers, just plain lazy, mental illness, unfit even for honest menial labor, they feel it is too demeaning for them to do stoop labor. I will bet you “dollars to donuts” you will not find a single Mexican making his home on the street!

Start arresting them, make them move on. If they stay in confinement, repeat and give them the option of cleaning and working in our timber , which needs constant attention. How to house those who are willing to try again to be useful, Tent cities away from people who love our state.

Do these planners to solve our 150K , who many are in need of a year in jail to reflect on their weakness?

How many do you think are mental problems versus just plain lazy?

Its only going to force more California’s out of California… business owners will have too close our door or operate illegally…

There go another half a million tax payers out of California.

This is sad to see. Businesses don’t need any more taxes….they are already overwhelmed. State need to run efficiently and cut down heavy baggage. Homelessness need to tackle from root with plan to completely remove homelessness from CA.