CalTax detailed description of the measures and the preliminary results. (Photo: screen capture CalTax)

California Voters Reject Nearly Half of the 236 Local Tax and Bond Measures in March Primary

Widespread defeat of numerous local bond and parcel taxes indicates voter tax fatigue

By Katy Grimes, March 9, 2020 7:56 am

‘Voters have delivered a statement that they are experiencing tax and bond fatigue, and they don’t trust either municipal or state politicians to spend that money effectively. A second California tax revolt could be upon us.’

~Jon Coupal, Howard Jarvis Taxpayers Association President

California voters just sent a loud message to California politicians by rejecting half of the 236 local tax and bond measures on the March ballot. Los Angeles County had nine different school bonds and three parcel taxes on the March 3rd Primary Election ballot.

“Of the 121 school bonds on the ballot in various parts of the state, 64 were rejected, 21 were approved and 36 are too close to call because they are within 3.5 percent of their 55 percent vote threshold with many mail-in and provisional ballots still being counted,” according to the California Taxpayers Association.

This is a significant change as voters typically approve school bond measures.

“The election results reinforce recent polling that said Californians across the political spectrum believe their state and local taxes are too high,” CalTax President Robert Gutierrez said. “We hope elected officials and special interests will listen to the public and drop their remaining plans to further increase the tax burden on hard-working Californians.”

Of particular note is the failure of school bond Proposition 13, which Jon Coupal, Howard Jarvis Taxpayers Association President says is the beginning of the modern tax revolt movement. “The 2020 version of Prop. 13 was a massive $15 billion school facility bond measure, the largest such bond in state history,” Coupal said. “The Howard Jarvis Taxpayers Association led the opposition with a guerrilla-style campaign relying on a relatively modest $250,000 statewide radio buy, social media and nearly a hundred interviews with television, radio and print media. This was in comparison to the more than $20 million spent by Gov. Gavin Newsom and his allies.”

The Democrat supermajority got greedy.

“The 237 tax and bond measures on local ballots marked a significant increase from the 87 that appeared on the June 2016 presidential primary ballots (67 of those measures were approved),” CalTax reported. “In November 2016, however, local ballots were loaded with 427 tax and bond measures, and 353 were approved.”

“Many school districts and local governments used biased ballot descriptions to encourage a ‘yes’ vote, and also spent tax dollars on pre-election “educational outreach” that clearly advocated for tax and bond measures,” CalTax reported. “The Los Angeles County Fire Department, for example, prepared an ‘impartial’ slideshow that included the Measure FD campaign’s talking points, but didn’t discuss how the tax increase would increase housing costs and retail prices for residents.”

Jon Coupal explains: “Local governments of all kinds are accustomed to these measures passing, but perhaps no more. One reason may be lack of voter confidence that the tax dollars they approve actually end up going where elected officials say they are going.”

CalTax’s detailed description of the measures and the preliminary results is here.

- California Lawmaker Making the State More Hostile to Business - April 18, 2024

- California Democrats’ Backdoor Reparations Scheme - April 17, 2024

- California’s Senate Democrats Reject Bill to Make Purchasing a Child for Sex a Felony - April 16, 2024

Extremely happy to see so many of these odious bonds and parcel taxes go down, and go down IN SPITE OF (illegal) propaganda efforts by the locals as well as all of the other dirty tricks and scare tactics we are now so used to seeing whenever these items show up on the ballot. Sure looks like a real tax revolt to me. May the trend continue. (Meanwhile knocking wood and crossing fingers until all the votes are counted.)

God Speed Please! Time we take Our State Back! #VoteRed #WWG1WGA #MCGA

Its bad enough to be lied to politically as “part of the game” but it’s another thing to redirect some or most of the funds for spending by obscuring and by trickery in the wording of the ballot summary itself. Today dedicated bond issue is likely to be 60% spent as promised, and 40% hustled off to parts unknown.

It took awhile, but people are finally realizing: one party press + one party politics = corruption.

Yes, it certainly does look like more people are finally starting to understand they’ve been “had,” are furious about it, and are now voting accordingly, no doubt across party lines, which would be a wonderful development. Fingers crossed that the trend continues.

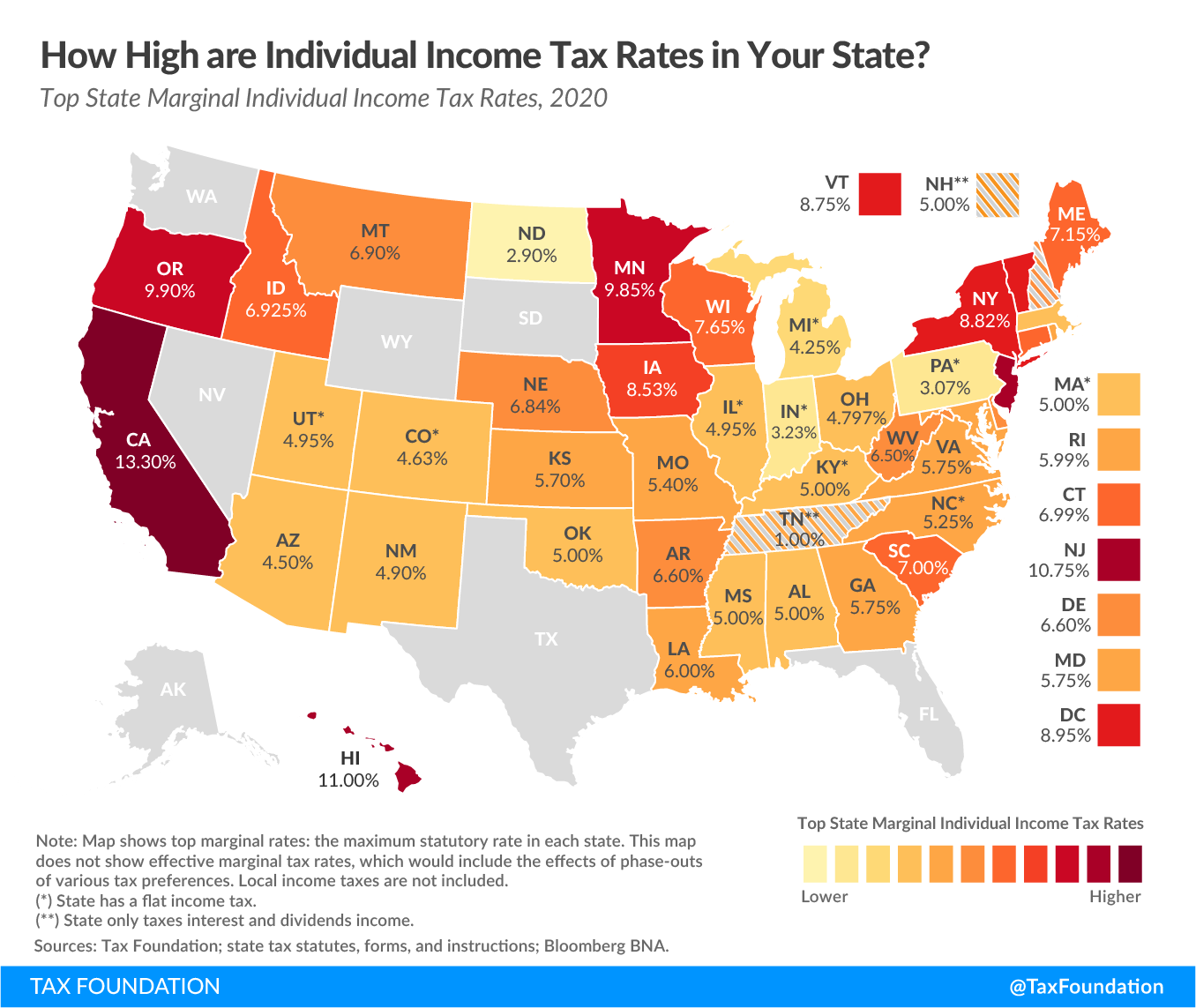

California has the highest income tqx in the nation, the highest sales tax in the nation, and the highest gas tax in the nation. Oregon gets by with no sales tax. Nevada gets by with no income tax. The only thing we have to show for all these taxes is an elite class of unionized public employees with salaries and pensions that the people who have to pay these taxes can only envy.

I have lived in California ALL OF MY LIFE! But this OVER RUN AND OVER TAXED STATE has recently LOST over 209,000 Californians who can no longer afford to live here and can’t afford to continue to support the illegals who are treated better than the LEGAL LONGTERM RESIDENTS! CALIFORNIA HAS BECOME A SAD STATE OF AFFAIRS!!!!

They have already started running ads for their revamped attack on prop 13. Refers to the original Prop 13 (but not by name), as a “shady scheme”, allowing wealthy investors (anyone with more than one home), and wealthy corporations (any business regardless of size), to cheat our schools and children out of deserved tax revenue. Credits for the ads state it was paid for by a coalition of “social justice” organizations. One contributor mentioned is the “Chan Zuckerberg Initiative”. Mark Zuckerberg and his wife! The other thing that bothers me is that they run these ads in both Spanish and English. Which LEGAL voters need ads in Spanish? We need to spread this info far and wide.

I guess that’s one way to win – “voter fatigue” (pure speculation) – sit on your hands and ponder your navel. Do nothing to stop the real reason that most local tax measures have passed over the past 40 years.

Honest ballots are a vague memory to anyone who’s voted over the past four decades. Local governing bodies intentionally, and without opposition, have violated the same law that prohibits the state from electioneering on statewide measures — Elections Code 9051(c). That law has always applied to local measures through Elections Code 10403(a)(2).

But in 2017, the Legislature made it explicit in AB-195. Not a single local tax measure that has passed since 2017 has conformed to AB-195.

If you want to see what happens to a tax measure that, more or less, conforms to AB-195, look no further than Tehama County Measure G sales tax.

“Tehama County Retail Transaction and Use Tax: Shall an ordinance be adopted authorizing the County of Tehama to collect one percent sales tax (Transactions and Use Tax) for a period of ten years, providing approximately $7,900,000 annually for unrestricted general revenue purposes?”

It’s got a whopping 16.11% yes votes. Honest ballots will kill almost all local governing bodies’ wet dreams.

AB-195 also makes any local tax measure that does not conform subject to an election contest (Division 16 of the Elections Code) on the grounds of “an offense against the elective franchise” through both Elections Code 18401 and Elections Code 18002.

Where are all the purported protectors of the taxpayer on this? Nowhere. Silent. Missing in action. Waiting for “voter fatigue.” It’s like you have the key to your own freedom, but it’s too much effort to turn the key. It’s pretty disgusting.

As I write, there are 88 local tax measures that are passing from the March 3, 2020 election. Each one violated a fundamental premise of elections — honest ballots. How many of you will file an election contest? How many of your will even talk about it?

Don’t believe that the myth propagated by government lawyers that you must have challenged the ballot language before the election. The grounds for an election contest did not exist before the ballots were printed and circulated.

Stop whining! The “woe is me” victim mentality is getting old. Take effective action now, or keep wishin’, and hopin’, and prayin’.

Government employees never rest until they stick their hands deep enough into your pocket to get what they want.

You should be filing 88 election contests. Then the winning percentage will be zero.

Ray Unseitig what ever trickles down: is regarded as “just bond money, no body cares”, says the contractor building our schools.