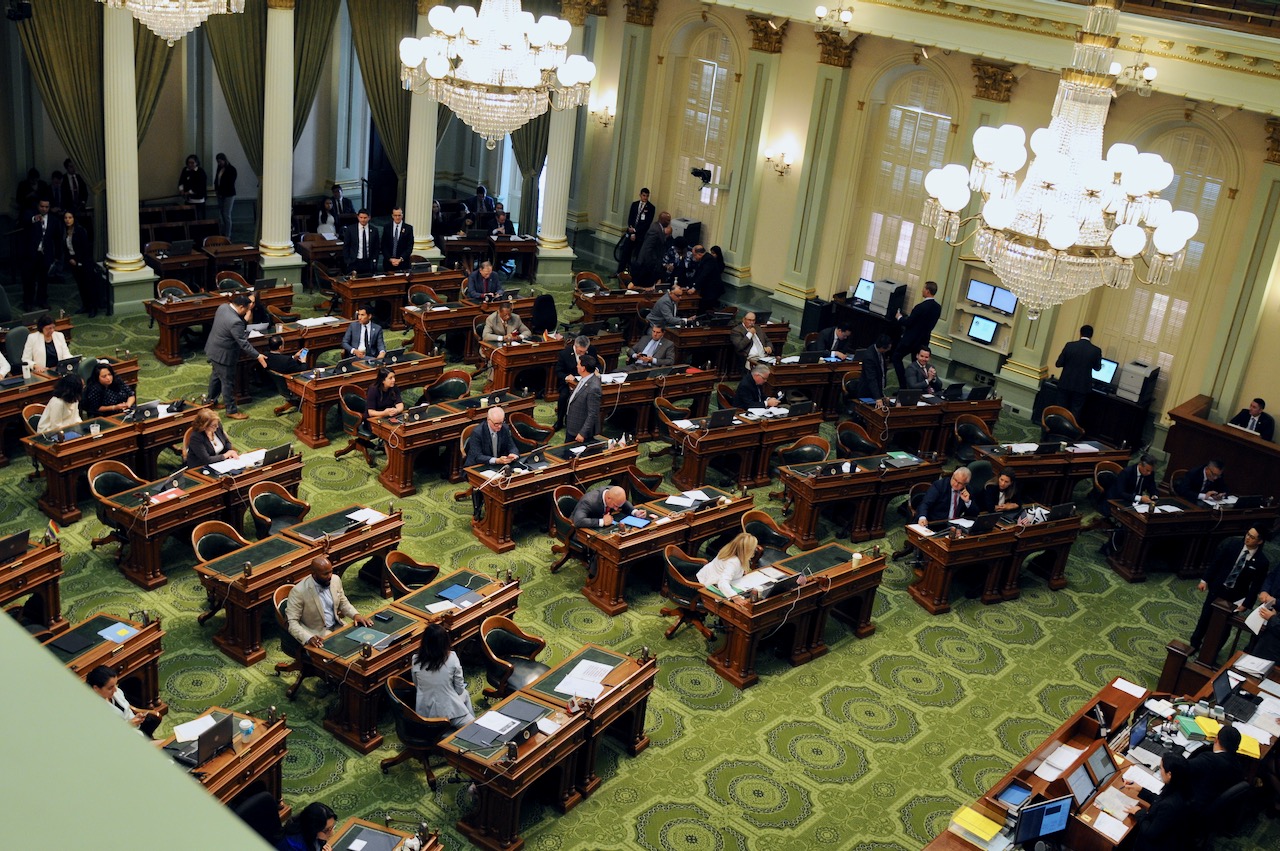

Assemblywoman Cottie Petrie-Norris. (Photo: Kevin Sanders for California Globe)

Exception to Business Incentives Suspension

Bill impacts net operating loss deduction and limitation on the use of business tax credits

By Chris Micheli, February 12, 2021 2:38 am

On February 11, Assembly Members Cottie Petrie-Norris, Tom Daly, Jacqui Irwin, and Kevin Mullin introduced Assembly Bill 593 to create exceptions to the current suspension of the net operating loss deduction and limitation on the use of business tax credits. The bill would amend Sections 17039.3, 17276.23, and 23036.3 of the Revenue and Taxation Code.

This bill would “exclude a taxpayer that performs clinical, biomedical, or other research, development, or testing needed for COVID-19 or other diseases from the above-described suspension of the deduction for net operating losses and the above-described limitation on the total credits allowable.”

Under current law, through the end of 2022, there is a cap on the use of business tax credits of $5 million. In addition, the net operating loss has been suspended for three years, for the 2020, 2021 and 2022 tax years. Section One of the bill would create the “Golden State Innovation Act of 2021.”

Section Two of the bill would amend Section 17039.3 of the Revenue and Taxation Code dealing with the cap on the use of business tax credits under the Personal Income Tax Law. It would provide that, for taxable years on or after January 1, 2021, and before January 2, 2023, the five-million-dollar ($5,000,000) limitation set forth in subdivision (a) or (b) shall not apply to taxpayers that perform clinical, biomedical, or other research, development, or testing needed for COVID-19 or other diseases.

Section Three of the bill would amend Section 17276.23 of the Revenue and Taxation Code dealing with the NOL deduction under the Personal Income Tax Law. It would provide that, for taxable years beginning on or after January 1, 2021, and before January 1, 2023, this section shall not apply to a taxpayer that perform clinical, biomedical, and other research, development, and testing needed for COVID-19 or other diseases.

Section Four of the bill would amend Section 23036.3 of the Revenue and Taxation Code dealing with the cap on the use of business tax credits under the Corporate Tax Law. It would provide that, for taxable years on or after January 1, 2021, and before January 2, 2023, the five-million-dollar ($5,000,000) limitation set forth in subdivision (a) or (b) shall not apply to taxpayers that perform clinical, biomedical, or other research, development, or testing needed for COVID-19 or other diseases.

Section Five of the bill sets forth legislative findings and declarations regarding specific goals, purposes and objectives for the bill. The intent is to encourage the activity of life sciences research in California and to incentivize more research into treatments, cures, and vaccines to address the global pandemic caused by COVID-19. It would also require the Franchise Tax Board to prepare a written report for the Legislature regarding aspects of these tax law changes.

The bill is likely to be heard in policy committee in late March.

- Frequently Asked Questions About Ethics Training for Local Agencies - April 24, 2024

- Frequently Asked Questions about Privileges of Voters in California - April 23, 2024

- Does a Bill Need Statutory Construction Guidance? - April 22, 2024

Eyes glaze over…