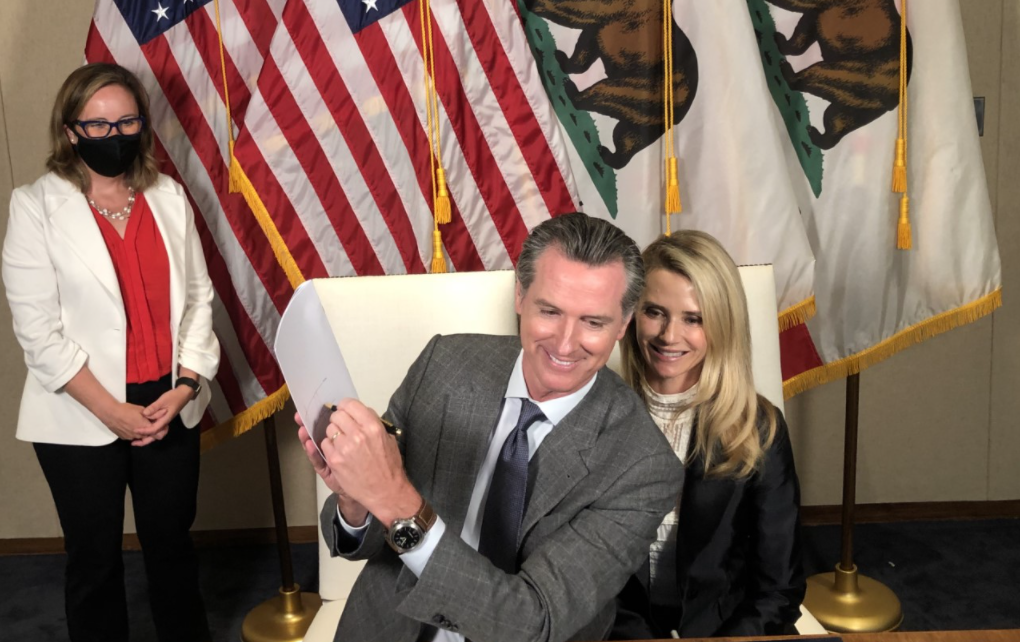

Governor Gavin Newsom signs SB 1383 into law alongside First Partner Jennifer Siebel Newsom on September 17, 2020. (Photo: ca.gov)

SVB Depositors Made Whole by Fed

Friends of California’s ‘First Partner’ Can Breathe a Sigh of Relief

By Thomas Buckley, March 12, 2023 8:26 pm

Silicon Valley Bank was closed Friday by the California Department of Financial Protection and Innovation, with the FDIC in charge of liquidation, the Globe reported. SVB was one of the largest banks in the country and one of the premier banks of Venture Capital firms and start-up companies.

After indicating Sunday morning there would be no help forthcoming, the Federal Reserve announced early Sunday evening that those with funds in the recently-failed Silicon Valley Bank will not lose their money, even if their account contained more than the FDIC insured amount.

Citing a “systemic risk” exception, all funds in SVB (as well as New York’s Signature Bank, which failed earlier today) are guaranteed to be available Monday morning.

“After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors,” reads a press statement issued by the Federal Reserve Sunday afternoon. “Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

This announcement comes despite Treasury Secretary Janet Yellen saying on CBS’ “Face the Nation” broadcast Sunday morning that there was not going to be a bailout of SVB. That statement was made about 8 hours before the joint Federal Reserve, FDIC, Treasury Department announcement of the depositor guarantees.

As to how the bailout will work, particularly with the additional guarantee that no tax money will be used, the statement read:

“The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

“With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP. The Federal Reserve does not anticipate that it will be necessary to draw on these backstop funds.”

It is also possible that other banks will forced to pay to help cover the bailout.

The SVB failure sent shockwaves through not only the Silicon Valley – where it was an integral part of the local venture capital and tech “start-up” economy – but also through the nation’s entire banking system. The failure of Signature – which bet heavily on the crypto market – was directly tied to SVB’s failure, said federal regulators.

Beyond its standard financial mission, as it were, SVB was a leader in the ESG – Environmental, Social, and Governance – sector, as the Globe reported. It is not yet clear how much this concept – which involves valuing firms and people and countries for not only their creditworthiness but also by how much putative “good” they do in their community and the world – played a role in SVB’s collapse, though many financial experts suspect that “going woke” led to “going broke.”

GOP presidential contender and Silicon Valley multi-millionaire Vivek Ramaswamy said over the weekend that the bank should not be bailed out, that it was poorly run, its failure was not actually a “systemic risk” to the financial system, and any such risk was being purposefully amplified to force the government to step in.

On a CNN appearance, Ramaswamy added, “So what’s happening right now is, a lot of Silicon Valley executives and V.C.s this weekend, many of them have even reached out to me to push this narrative that that’s going to create a bank run in America if Silicon Valley Bank isn’t actually bailed out. But what they’re doing is actually trying to create the fear of one. I think that can actually become a self-fulfilling prophecy, which is dangerous.”

Beyond its intimate ties to the tech industry and its faith in the ESG and DEI movements, SVB was also connected to a number of California’s major political players, including the wife of Gov. Gavin Newsom.

Just earlier today, the Globe published an article that noted:

“In looking at the SVB board and executive team bios, there is an interesting tie to California’s First Partner Jennifer Siebel Newsom – one of the SVB Executives sits on the board of Jennifer Siebel Newsom’s California Partners Project.” The entire story can be found here.

It is as yet not exactly known if and how politics played a role and who communicated with whom in the few hours between Yellen saying no and then – along with President Biden – saying yes.

The South China Morning Post reported that SVB provides massive amounts of funding to the China venture capital sector. It’s not surprsing that the CCP owned Biden regime is going to have its FDIC and Federal Reserve make good on all deposits in SVB since a significant portion of which are China-owned accounts? Peter Schweizer has written several books on the grifting that Biden crime family has been engaged in selling access to Joe Biden.

The WEF globalists on Wall Street (like hedge funder Bill Ackman) got exactly what they wanted from the Biden administration – a bailout of SVB and a pause/pivot in the Federal Reserve rate-hike cycle. Easy money (Quantitative Easing QE) has made them into billionaires and they want it to continue. Like the narcotic need of heroin addicts, the “easy money” habit is difficult to kick; to get back to normal. They just don’t want to go “cold turkey” and stop. This new bailout regime has the potential to give the Federal Reserve extraordinary power to have direct control of individual depositor accounts in every bank. Big Brother will be in control and you will be “happy”. (https://www.zerohedge.com/markets/schiff-federal-reserve-launches-qe-extra-lite-bail-out-banks)

“GOP presidential contender and Silicon Valley multi-millionaire Vivek Ramaswamy said over the weekend that the bank should not be bailed out, that it was poorly run, its failure was not actually a “systemic risk” to the financial system, and any such risk was being purposefully amplified to force the government to step in.”

P.S. I agree with Vivek. The Federal Reserve could have provided SVB temporary funds through existing channels.

Now that the CCP owned Biden regime is going to have its FDIC and Federal Reserve make good on all deposits in the bank including Jennifer Siebel Newsom’s California Partners Project, maybe she won’t have to email her producer buddy Harvey Weinstein for advice like she did with Gavin’s infidelities?

Thomas – I think you might have overlooked adding a hyperlink on the word “here” in the next to last paragraph of the article…

But my initial comment was to say that they’ll just fire up the printing presses to cover all of the potential losses, thereby increasing INFLATION in the economy, which the Fed will then ratchet up interest rates later this month to “tamp down inflation” (most of which was initially caused by Biden’s reflexive energy policies on Day1, coupled with “woke” minimum wage requirements that the “progressives” have lobbied long and hard for…)

The rank and file of us are basically toast, thanks to the policies instituted by brain-dead Democrats nationwide, and especially here in Commiefornia….

AND – I’ve wondered all weekend if this is really a “false flag” event to speed the introduction of their Central Bank Digital Currencies that will slap the economic handcuffs onto us permanently, thereby effectively ending any personal liberty & freedom that we have previously expected and enjoyed…

Indeed, CriticalDfence9. A digital fiat currency would make life so much easier for the government – a cumbersome printing press is no longer needed. Just push a button or two and voila. “OOOPS, we just pushed the wrong button and erased $31 trillion in national debt. Oh well, we can’t un-erase it now.” I’m being facetious but you get the idea.

That first line, Thomas, should give everyone pause: ‘Silicon Valley Bank closed by CALIFORNIA Dept of Financial

Protection & Innovation’ (Cothilde Hewlett, Commissioner) with FDIC named Receiver. It was a ‘State’, California

(or any state) that wielded the power and action that has had untold repercussions across the country and the

world (ie. Sweden Pension Fund) on people, banks, businesses, wall street, etc. …and it’s not over by a long shot.

This is a good article explaining what that means long-term: ‘The Federal Reserve Just Made an Emergency Decision Which Will Fundamentally Change Banking in America Forever’ (End of the American Dream.com).

Guaranteed this was planned for a very long time, by design and by the numbers (gematriaeffect.news)

What they can’t control is people ‘see’ and nothing can stop this beast system from failing completely.

Nesara/Gesara ‘Rainbow Currency’ . God has decreed it, we declare it, in the Name of Jesus Christ.

Biden is trying to blame Trump for the bank failures and broadening contagion. But the reality is that Biden is the CRASH President. Stock market CRASH. Train CRASH. Banking CRASH.