Orange County Fire Authority. (Photo: Youtube)

Firefighting in Orange County – Part One, Firefighter Pay and Benefits

OCFA’s Operations Dept. personnel are actually making at least $15,000 more than reported

By Edward Ring, June 17, 2020 6:11 am

Total unfunded actuarial accrued liability was $5.7 billion, and the OCFA share of that totaled $380 million.

In June 2019 the City of Placentia, in a 3-1 council vote, decided to leave the Orange County Fire Authority and build their own fire department. The reasons for this decision, and the means to accomplish it, will be explored in greater detail in a follow up article. But the decision came down to this: a majority of members of the city council believed that they could build a fire department of equal or greater effectiveness, at an equal or lessor cost.

The consequences of this decision are significant. How Placentia manages their independent fire department could inspire other cities currently being served by OCFA to withdraw from their contracts and also build their own fire departments. Placentia’s experience may also inspire cities in Orange County that already have independent fire departments to renegotiate the terms of the collective bargaining agreements they’ve made with their firefighter unions.

The Orange County Fire Authority, or OCFA, originally served the cities of Cypress, Irvine, La Palma, Los Alamitos, Placentia, San Juan Capistrano, Tustin, Villa Park, and Yorba Linda, along with unincorporated areas of Orange County. Since then, new cities have incorporated, and existing cities have decided to choose OCFA services over managing their own fire department. These additional client cities are Aliso Viejo, Buena Park, Dana Point, Garden Grove, Laguna Hills, Laguna Niguel, Laguna Woods, Lake Forest, Mission Viejo, Rancho Santa Margarita, San Clemente, San Juan Capistrano, Santa Ana, Seal Beach, Stanton, Tustin, Villa Park, Westminster, and Yorba Linda.

So how much does it cost to be a client of OCFA, and what drives these costs? A quick look at page 60 of the OCFA’s most recent budget document shows that in the last three fiscal years, by far the biggest expense was salaries and employee benefits. In FY 2017/18 salaries and employee benefits consumed $357 million out of total expenditures of $418 million; 85 percent. In FY 2018/19 the budget estimate was $367 million for salaries and benefits out of total expenditures of $449 million; 82 percent. In FY 2019/20 the budget estimate was $386 million for salaries and benefits out of total expenditures of $464 million; 83 percent.

The conclusion that can be drawn from these numbers is unambiguous. Nearly all of the costs incurred by OCFA are to pay salaries and benefits.

The remainder of this analysis will report on how an annual salaries and benefits budget of nearly $400 million translates into individual compensation profiles for the average full time firefighter employed by OCFA. These numbers are not presented with an aim to criticize these levels of compensation, but merely to provide the information, because this information is not readily available either to local elected officials or to the general public. It is uncertain, frankly, whether or not even the managing board of OCERS sees compensation profiles presented from this perspective. So here goes.

OCFA’s Average Pay and Benefits for Full-Time Employees

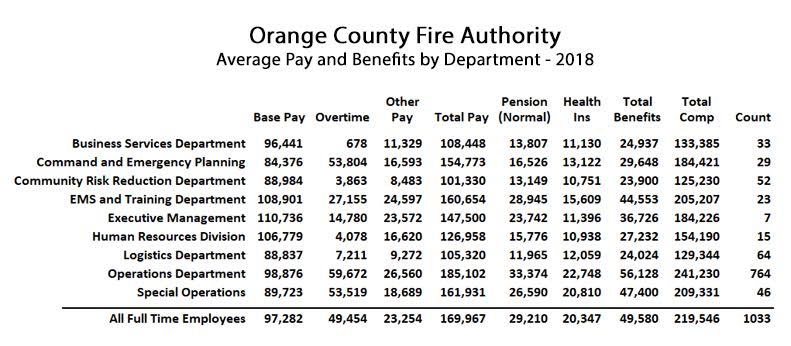

Using 2018 data provided by the California State Controller, it is possible to compile OCFA individual compensation averages both for categories of pay and benefits and also by department. Because detailed pay records are downloadable by individual payees, it is also possible to isolate the full-time employees. Failure to provide averages that are limited to full-time employees has often been a source of misleading information.

To develop representative averages that accurately represent what full-time OCFA employees make, four criteria have been employed: (1) verify that a record’s “base pay” is equal or greater than the “minimum pay for position,” (2) verify that the “base pay” is in excess of $30,000, (3) verify that the “pension benefit” field is not zero, and (3) verify that the “health dental vision benefit” field is not zero. While there are cases where full-time employees will be excluded using these criteria, especially 1 and 2, these are typically individuals who did not work a full year, making their data unrepresentative. In fact, individuals whose actual rate of pay may have exceeded the minimum may have in fact still only worked a partial year, so if anything, applying this criteria to screen individual records may still yield averages that are skewed lower than the actual reality. Here then are the average salaries for OCFA’s full-time employees:

As can be seen on the above chart, the largest department within OCFA is Operations, comprising 74 percent of all full-time personnel during 2018. The average pay and benefits package for these employees totaled $241,230 during 2018. As can be seen, their base pay averaged $98,876, but was augmented by “other pay” of $26,560, meaning that total pay, not taking into account the cost of benefits or overtime, averaged $125,436 for the average full-time Operations employee. On top of that, overtime averaged $59,672 per full-time employee, making their average pay before benefits $185,102.

Taking into account the cost of benefits yields some interesting discussions over what should be included, but what appears on this chart is probably the lowest calculation possible. This is because it does not take into account the cost of paying off the unfunded actuarial accrued liability (UAAL) for the pensions, only the ongoing so-called “normal” cost of the pension benefits. Also, these benefit calculations do not take into account the cost of pre-funding retirement health insurance benefits. By any normal accounting standards, the cost for any benefit that is promised in retirement must be recognized during an employee’s working years, since it is only while working that they are exchanging their labor for value – either current or future.

Not including these factors – the UAAL payment and pre-funding retirement health insurance – the average full-time OCFA Operations Dept. employee earned $56,128 in pension and health insurance benefits in 2018. This yields, again, a total pay and benefits package that averaged $241,230 during 2018. But what positions are within the OCFA Operations Department?

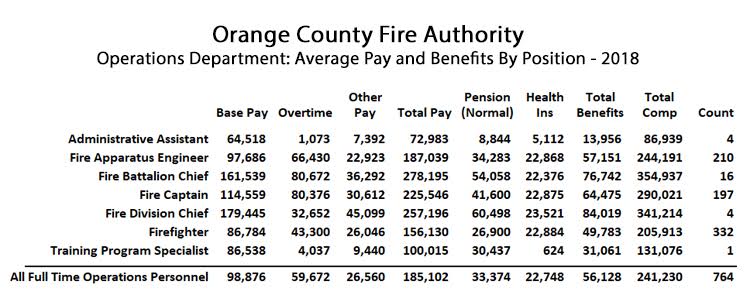

The next chart shows the seven positions within the OCFA Operations Department. Three stand out as occupying the most personnel: “Fire Apparatus Engineer,” “Fire Captain,” and “Firefighter.” During 2018, nearly 97 percent of all Operations personnel were filling one of these three positions. On average the total pay and benefits in 2018 for a full time OCFA Fire Apparatus Engineer was $244,191, for a Fire Captain it was $290,021, and for a Firefighter it was $205,913.

What about the true cost of pensions?

There are several ways to evaluate what the present cost of future pensions should be, and all of them rely on not one, but an entire basket of crystal balls. There is the crystal ball that will predict how long the individual will work, and another to predict when they will retire and when they will die. Then there’s another that will predict how much they will earn each year that they’re working, and how much pension eligible pay they’ll be earning the year they retire. And then the biggest crystal ball of all will be the one that predicts how much all that money set aside for their pension will earn, year after unique year, on the investment markets of the world. It takes a lot of balls to think you know how much you’re supposed to set aside each working year to fund an individual’s future retirement.

Taking all of this into account, the actuaries hired by the Orange County Employee Retirement System (OCERS), have concluded that as of 12/31/2018, their total unfunded actuarial accrued liability was $5.7 billion, and the OCFA share of that totaled $380 million. If you pay this $380 million back at the rate of average rate of return that OCERS claims their investments will earn each year, 7 percent, and you pay it back over 20 years, which is the term required by the Government Accounting Standards Board, that is equivalent to a payment of $36 million per year. But the question then becomes how does that stack up against the number of participants, and here is where it gets interesting.

According to Transparent California, OCERS paid out $70 million in pensions to 981 OCFA retirees in 2018. Since years of service are disclosed per individual record, it is possible to calculate an average pension benefit of $3,357 for every year worked. The average OCFA veteran retiring after 30 years service will earn a pension of $100,711. Of course since 26 percent of OCFA employees are not members of the more highly compensated Operations Dept., for that department one may surmise the average pensions after 30 years of work are measurably greater.

More to the point, how do you allocate a UAAL payment that ought to total at least $36 million per year between active employees and retirees? It is reasonable to argue that active employees should not have to have the full UAAL payment prorated onto the calculation of their true compensation, since retirees are also receiving pensions that became underfunded when they were employed. Taking this into account, consider the total pension eligible pay of the active OCFA employees, full and part-time, which is $118 million. If you apply half of the $36 million UAAL payment, $18 million, to these active employees, that equates to a UAAL overhead of 15.2 percent on top of base pay. Such a calculation would indicate that OCFA’s Operations Dept. personnel are actually making at least $15,000 more than reported, if you take the UAAL cost into account. And why wouldn’t you?

For decades, actuaries have peered into their crystal balls and delivered up predictions that were invariably too optimistic, and they still are too optimistic. Does anyone really believe that the rate-of-return in the aftermath of this overwrought, record setting bull market in stocks, bonds, and real estate, can be sustained over the next few years at a rate of 7 percent? OCERS will be lucky to break even in 2020, and that achievement will only occur in the wake of the most impetuous application of modern monetary theory in the history of the world, i.e., we just printed $3 trillion in magically materialized money. So yes, the stock market may indeed soar to new heights. In the Twittersphere, the wags are saying if you don’t believe that, you’re simply not cynical enough.

Or not. Buckle up. Five years from now, OCFA clients called upon to service their UAAL by only paying an additional $36 million per year may seem like an unbelievable bargain. Five years from now, OCFA clients may remember when the “official” UAAL for their firefighter pensions was only $380 million and marvel at how minuscule it was back in the good old days.

Predicting the fate of OCERS, or pension systems, much less the economic fate of nations, is well beyond the scope of this discussion. What has been offered is a context in which to gauge the looming breakaway of Placentia’s fire department from OCFA. How will Placentia, and any cities that eventually may join Placentia, choose to manage firefighter pay, pensions, overtime, and staffing? In part two, what Placentia hopes to achieve will be explored in greater detail.

Providing reliable and professional public safety is a fundamental obligation of local governments. Respect for public safety employees and the challenges they face is a given. But local governments are also obligated to manage their expenses in a manner that balances the needs and wants of public employees with the financial resources of the citizens they serve.

- Ringside: Can Energy and Water Interests Find a Common Agenda? - February 26, 2026

- Ringside: What Will California Gas Prices Do in 2026? - February 19, 2026

- Ringside: Large Scale Desalination Belongs in California’s Water Strategy - February 12, 2026

Relative is a Fire Captain in LA and is in his mid 40’s. These are his 2019 numbers:

Regular pay – $93,675.00

Overtime pay – $69,012.00

Other pay – $89,612.00

Total pay – $252,299.00

Benefits – $95,036.00

Total pay & benefits – $347,335.00

There are 5,000 Fire Captains, some making close to 1/2 million annually.

This is not sustainable.

You may want to look at the Orange County Grand Jury Report from 2011-2012 titled: “Can the Consumer Price Index-Urban Keep up with OCFA Wages?” It’s quite an eye-opening read.

Funny that they (firefighters) make more than physicians that start working later in their careers after finishing training (30s) and have 250k+ loans to pay back.

Why on earth do firefighters in orange county get away with this? Because they wont hire more people so it keeps their numbers low and then they require “overtime” rather than give it to new recruits, it would lower everyones wages across the board, then they couldnt have their boats, multiple houses, cars to live that orange county lifestyle, yet everyone turns a blind eye because firefighters are the “white knights ” of society since 9/11, interesting enough firefighters in new york make 60-90k only and its a lot tougher job than out here, ocfa is the true crooks of orange county i hope more cities wake up and something is done, these wages are out of control for a highschool graduate, thats all you need to apply and a emt license, woopty due heres half a million after u make captain!

Grand jury report came out back in 2009-1010 regarding Riverside County’s contract with CalFire. The report said it would be in the best interest if Riverside were to break away from Calfire and have their own independent fire department.

Take a look at what Calfire did to all the volunteer departments in San Diego County. The union got involved and they ran out all the volunteer departments. It has been a tumultuous disaster.

San Miguel Fire Department Decided to contract with Calfire for their services. This community after 3 years decided it was better when they had their own fire department. The contract was ended a year early.

Its the biggest problem facing the state. Unions want to control everything in California.