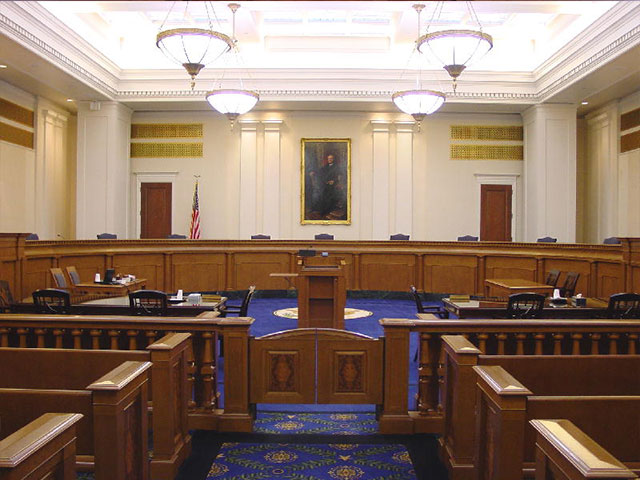

Courtroom (Photo: public domain)

Director of Child Support Services

Deals with the Director of the Department of Child Support Services

By Chris Micheli, January 26, 2026 6:29 pm

Division 17, Chapter 1, Article 3 of the California Family Code deals with the Director of the Department of Child Support Services.

Section 17300 requires the Governor, with the consent of the Senate, to appoint, to serve at the Governor’s pleasure, an executive officer who is the director of the department. In making the appointment the Governor is required to consider training, demonstrated ability, experience, and leadership in organized child support enforcement administration.

In addition, the Governor may appoint, to serve at the Governor’s pleasure, not to exceed two chief deputy directors of the department, and one deputy director of the department. The salaries of the chief deputy directors and the deputy director are fixed in accordance with law.

Section 17302 requires the director to do four specified tasks. Section 17303 includes four legislative findings and declarations.

Section 17304 requires each county to establish a new county department of child support services. Each department is also referred to in this division as the local child support agency. The local child support agency must be separate and independent from any other county department and be responsible for promptly and effectively establishing, modifying, and enforcing child support obligations, including medical support, enforcing spousal support orders established by a court of competent jurisdiction, and determining paternity in the case of a child born out of wedlock.

The director is required to negotiate and enter into cooperative agreements with county and state agencies to carry out the requirements of the state plan and provide services relating to the establishment of paternity or the establishment, modification, or enforcement of child support obligations. The cooperative agreements require that the local child support agencies are reasonably accessible to the citizens of each county and are visible and accountable to the public for their activities.

The director, in consultation with the impacted counties, may consolidate the local child support agencies, or any function of the agencies, in more than one county into a single local child support agency, if the director determines that the consolidation will increase the efficiency of the state program and each county has at least one local child support office accessible to the public.

The director has direct oversight and supervision of the state operations of the local child support agency, and no other local or state agency has any authority over the local child support agency as to any function relating to its operations. The local child support agency is responsible for the performance of child support enforcement activities required by law and regulation in a manner prescribed by the department. The administrator of the local child support agency must be responsible for reporting to and responding to the director on all aspects of the child support program.

Section 17305 provides that, in order to achieve an orderly and timely transition to the new system with minimal disruption of services, the director is required to begin the transition from the office of the district attorney to the local child support agencies. The director must transfer the appropriate number of counties, equaling at least 50 percent of the statewide caseload into the new system.

Section 17306 requires the Department of Child Support Services to develop uniform forms, policies, and procedures to be employed statewide by all local child support agencies. In addition, the department is required to do eight specified duties.

Section 17308 requires the director to assume responsibility for implementing and managing all aspects of a single statewide automated child support system that will comply with state and federal requirements. The director may delegate responsibility to, or enter into an agreement with, any agency or entity that it deems necessary to satisfy this requirement.

Section 17309 requires the department to operate a State Disbursement Unit as required by federal law.

Section 17309.5 provides that an employer who is required to withhold and, by electronic fund transfer, pay tax is required to make child support payments to the State Disbursement Unit by electronic fund transfer. All child support payments required to be made to the State Disbursement Unit are to be remitted to the State Disbursement Unit by electronic fund transfer. The following terms are defined: “electronic fund transfer,” “automated clearinghouse,” “automated clearinghouse debit,” “automated clearinghouse credit,” and “fedwire transfer.”

Section 17310 requires the director to formulate, adopt, amend, or repeal regulations and general policies affecting the purposes, responsibilities, and jurisdiction of the department that are consistent with law and necessary for the administration of the state plan for securing child support and enforcing spousal support orders and determining paternity.

Section 17311created the Child Support Payment Trust Fund in the State Treasury. The department administers the fund. The state may deposit child support payments received by the State Disbursement Unit into the Child Support Payment Trust Fund for the purpose of processing and providing child support payments. The fund is continuously appropriated for the purposes of disbursing child support payments from the State Disbursement Unit.

Section 17311.5 authorizes the department to enter into a trust agreement with a trustee or fiscal intermediary to receive or disburse child support collections. The trust agreement may contain provisions the department deems reasonable and proper for the security of the child support payments. Any trust accounts created by the trust agreements may be held outside the State Treasury.

Section 17311.7 requires any payment required to be made to a family through the State Disbursement Unit to be made directly to the obligee parent in the child support order requiring the payment, the conservator or guardian of the obligee parent, a special needs trust for the benefit of the obligee parent, the guardian of the person and the estate of the child subject to the order, any caregiver relative having custody or responsibility for the child, pursuant to a written record, or an alternate caregiver to whom the obligee under the child support order directs, in a written record, that payments be made.

Section 17312 required the department to adopt regulations, orders, or standards of general application to implement, interpret, or make specific the law enforced by the department. In adopting regulations, the department was required to strive for clarity of language that may be readily understood by those administering public social services or subject to those regulations.

Section 17314 requires the director to appoint any assistants and other employees that are necessary for the administration of the affairs of the department and prescribe their duties and, subject to the approval of the Department of Finance, fix their salaries. Also, the director is required to hire a sufficient number of regional state administrators to oversee the local child support agencies to ensure compliance with all state and federal laws and regulations.

The regions are divided based on the total caseload of each local child support agency. The responsibilities of the regional state administrators includes five specified tasks.

Section 17316 specifies that no person, while holding the office of director, is to be a trustee, manager, director, or other officer or employee of any agency performing any function supervised by the department or any institution that is subject to examination, inspection, or supervision by the department.

Section 17320 requires the department to coordinate with the State Department of Social Services to avoid the imposition of any federal penalties that cause a reduction in the state’s TANF grants.

Section 17325 states that, if child support payments are directly deposited to an account of the recipient’s choice, the payments may only be deposited to an account that meets the requirements of a qualifying account for deposit of child support payments. The term “qualifying account” is defined. The terms “insured depository financial institution” and “prepaid account” are defined.

- Director of Child Support Services - January 26, 2026

- Methods of Taking - January 26, 2026

- Time Limitations for Arbitration Awards - January 25, 2026