California State Capitol. (Photo: Kevin Sanders for California Globe)

Businesses Were Promised a Hiring Tax Credit; It Never Materialized

The California business community has lost out on over $1 billion in promised tax relief

By Chris Micheli, May 4, 2022 10:05 am

By Craig Winchester and Chris Micheli

In 2013, at the urging of Governor Jerry Brown, the Legislature passed and the Governor signed Assembly Bill 93 (Budget Committee; Ch. 69) to repeal California’s Enterprise Zone Program (“EZ”) and replace the program with three other incentive programs:

- $100M annually in a California Competes grant program administered by GO-Biz;

- a partial sales/use tax exemption for specified manufacturing equipment; and

- a new employment credit (“NEC”).

The opponents of AB 93, which included most of the business community, argued at the time that this was not a “revenue neutral” package (at that time, a revenue neutral tax bill only required a majority vote for passage, while a non-revenue neutral tax bill would have required a California constitution mandated 2/3 vote). There was concern that the NEC would never result in the promised tax benefits to the state’s business community. AB 93 barely passed with a majority vote.

As a result of the business community’s opposition to AB 93, there is a provision of the NEC that requires an annual report by the Franchise Tax Board (“FTB”) with recommendations for increasing usage of the NEC. As a result, pursuant to Revenue & Taxation Code Sections 17053.73 and 23626, the FTB has annually reported by March 1 to the Joint Legislative Budget Committee on the utilization of the NEC. This annual report provides Joint Legislative Budget Committee the total amount of the NEC credits claimed, a comparison of the total dollar amount of credits claimed under this section with respect to the FTB’s estimate, and identification of options for increasing annual claims of the credit so as to meet estimated amounts.

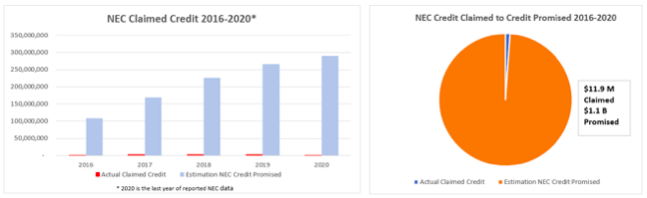

As the business community feared, the NEC program has been particularly challenged to achieve the promised goals. During the last five years tracked by the California FTB businesses have only claimed $11.9 million in credits out of the $1.2 billion in credits promised. The following statement is taken from the FTB’s most recent report to the JLBC about the NEC: “Credits Claimed: Estimates and Actual: At the time AB 93 was chaptered, the FTB had released estimates that $172 million in credits would be claimed for the 2017 tax year, and $229 million for the 2018 tax year. As of the date of this report, taxpayers have reported $2.5 million claimed on 2017 tax year returns, and $2.7 million claimed on 2018 tax year returns.” (Emphasis added) The following chart sets forth estimated v. actual usage of the NEC:

There have been proposals for the Legislature to expand utilization of the New Employment Credit. For example, this year’s AB 2035 by Assemblyman Carlos Villapudua (D-Stockton), would adopt a number of the proposals that the annual FTB report contains. It would make slight modifications to the eligibility requirements and the starting point of the qualifying wages. In addition, AB 2035 would enact changes to benefit the California restaurant community, who have been denied benefits under the NEC. This is especially problematic after the restaurant industry has been decimated due to government-ordered shutdowns during the pandemic. At the time of passage of AB 93, it was thought the restaurant industry did not need government assistance. Clearly that is not the case with California restaurants facing continue pandemic related issues including unprecedented labor shortages, increased supply costs and reduced demand.

It is also important to note, AB 2035 would maintain the geographical limitations of the NEC, it would keep the reservation requirements, and it would keep the same credit percentages. The NEC is scheduled to sunset in the next three years ending in 2025. All these safeguards will continue to meet the policy intent of the original NEC program which are modest assistance to businesses that increased employment and opportunity for hard to hire workers in regions in California with the highest unemployment.

At this point, the California business community has lost out on over $1 billion in promised tax relief from the enactment of AB 93. The Governor and Legislature should correct this situation by adopting AB 2035 allowing much needed relief to be granted to those businesses struggling.

Craig Winchester is leading a coalition to pass legislation making Restaurant Revitalization Fund grants exempt from California income taxes and the effort to include restaurants/ bars as eligible for the NEC program. To participate in this endeavor, please contact Craig.Winchester@ptaxadvisory.com.

- Deposition of Expert Witnesses - February 20, 2026

- Response to Interrogatories - February 20, 2026

- Insignia of Nonprofit Associations - February 19, 2026

One thought on “Businesses Were Promised a Hiring Tax Credit; It Never Materialized”