EDD. (Photo: EDD.ca.gov)

California Borrowed $20.5 Billion From Feds For State Unemployment Payments

LAO estimates total employer payroll taxes will increase $17 billion to $20 billion

By Katy Grimes, May 28, 2021 2:40 am

Not many Californians know that California borrowed $20,501,188,129 billion from the federal government to pay unemployment claims. This loan will be repaid by the state and California employers.

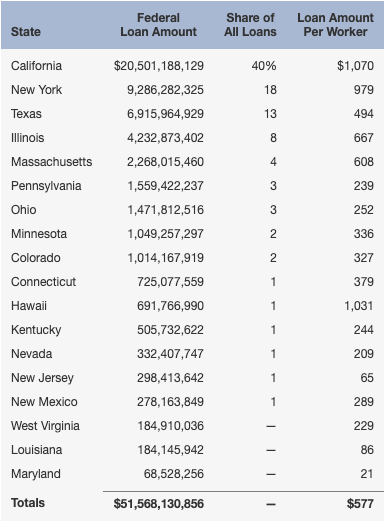

The California Legislative Analyst’s Office issued a report Wednesday about this loan which shows that California’s loan was 40% of the total $51,568,130,856 billion in loans 17 states borrowed. The next closest state, New York, borrowed $9 billion – less than half of California’s loan.

$31 Billion in Unemployment Fraud

In November, District Attorneys from across California exposed the massive unemployment benefits fraud in jails and prisons in California, calling it “the biggest fraud on taxpayers in California history.” Millions and quite possibly billions of dollars in unemployment claims was sent to inmates in California’s county jails, and state and federal prisons, while legitimate claimants have been stiffed for months.

The Globe spoke with several California unemployment claimants who reported that for months they didn’t received their benefits, and were continually put off for additional weeks by EDD employees. One said he was told by the EDD he had to provide his 2019 Federal tax return before his claims could be processed.

By January, the Globe reported as much as $31 billion may have been stolen by fraudsters, identity thieves and foreign criminals in unemployment benefits from California.

How will California pay this back?

The LAO explains how this $20.5 billion loan will be paid back:

To illustrate state and employer costs to repay the federal UI loans, our office produced a low-cost and a high-cost forecast of the state’s UI system based on different underlying economic scenarios. Under the low-cost scenario, employment quickly returns to pre-pandemic levels and interest rates remain historically low for the entire period. In this scenario, the state’s unemployment rate settles at a low 4.5 percent and the federal interest rates on UI loans averages 2.5 percent for the repayment period. Under the high-cost scenario, the state’s economic recovery is delayed several years, with unemployment remaining above 6 percent until 2025, and interest rates paid on the UI loans increase gradually to 4.5 percent after the recovery has taken hold.

Why did California borrow $20.5 billion from the federal government? The LAO explains:

State’s UI Trust Fund Became Insolvent Shortly After Pandemic Began. Prior to the pandemic, at the start of 2020, the state’s UI trust fund held $3.3 billion in reserves. Despite these reserves, the state’s UI trust fund became insolvent during the summer of 2020, a few months following the start of the pandemic and associated job losses. (As described above, federal law provides states automatic federal loans to continue paying state benefits should a state’s UI trust fund become insolvent.) As shown in Figure 1, by the end of 2020, the state’s UI trust fund had a negative $18 billion fund balance.

Under Both Scenarios, Federal UI Loans Would Take Many Years to Repay, the LAO reports.

Under the employer pay back scenarios, the LAO estimates total employer payroll taxes paid under the federal tax increase $17 billion to $20 billion. Employer costs would be higher under the high-cost scenario because the federal payroll tax increase used to repay the loans would be in effect for one additional year.

The LAO also says “under current federal law, the federal UI payroll tax rate on employers will increase by 0.3 percent for tax year 2022. However, employers will not pay this higher rate until 2023 when employers remit their 2022 payroll taxes to EDD.”

The LAO says:

The Governor’s 2021‑22 May Revision budget proposes $36 million General Fund to pay the first, partial payment on the state’s outstanding federal Unemployment Insurance (UI) loan and proposes to direct $1.1 billion in federal American Rescue Plan (ARP) Act funds to pay down a portion of the outstanding loan.

However, employers would not benefit from these lower costs for many years.

Obviously the amount of this federal loan the LAO is addressing is a staggering amount, together with the number of years that employers will be pay this back.

LAO says:

$1.1 Billion Repayment Would Lower State Interest Costs and Employer Costs… But Provide No Near-Term Economic Relief to Employers or Workers. Due to how federal law sets out the employer tax repayment structure, the Governor’s proposed $1.1 billion deposit would not benefit employers or their employees until well after the pandemic has ended. As discussed above, under our main projection, the earliest that the $1.1 billion deposit could provide business payroll tax relief would be in 2030.

Not only isn’t Gov. Gavin Newsom committing to help annually, but he’s using the one-time federal funds – the $1.1 billion in federal American Rescue Plan Act funds – to pay the federal government. The LAO even noted this: ” (Technically, the $1.1 billion payment will be made from the state’s Coronavirus State Fiscal Recovery Fund,)” the LAO said.

Meanwhile he is proposing to spend a billion dollars more annually on MediCal for illegal immigrants, rather than the state’s still-suffering small businesses.

To read the entire Legislative Analyst’s Office report, click here: Repaying the State’s Federal Unemployment Insurance Loan

- Trump State of the Union: Democrats Showed They’re Not On the Side of The American People - February 25, 2026

- Leaving California: Public Storage Relocates HQ from California to Texas - February 25, 2026

- California Democrats Propose Government Takeover of Healthcare, Banning Private Insurance - February 24, 2026

Why did Newsom borrow 20 Billion when he announced a month ago that we had excess reserves and threw stimulus checks to SOME Californians?? Political gain in recall election? Spent too much money on China masks? The train to nowhere? I cannot wait for the day he is kicked off the peoples property! Taxpayers will be suffering from Newsom’s very poor decisions and management of this state for a LONG time!

“To illustrate state and employer costs to repay the federal UI loans, our office produced a low-cost and a high-cost forecast of the state’s UI system based on different underlying economic scenarios. Under the low-cost scenario, employment quickly returns to pre-pandemic levels and interest rates remain historically low for the entire period. In this scenario, the state’s unemployment rate settles at a low 4.5 percent and the federal interest rates on UI loans averages 2.5 percent for the repayment period. Under the high-cost scenario, the state’s economic recovery is delayed several years, with unemployment remaining above 6 percent until 2025, and interest rates paid on the UI loans increase gradually to 4.5 percent after the recovery has taken hold.”

These projections by the LAO are based on the Federal Reserve’s stated policy of permanently low interest rates and their “feeling” that inflation is “transitory”. It is just as likely that inflation will be long-term and the Federal Reserve will have to raise interest rates. Constantly printing money to feed Wall Street and the economy (consumer spending) afloat cannot be sustained indefinitely without CONSEQUENCES. Just think about your own household budget if you juggled 20 credit cards and made minimum payments by using one card to pay others. How long before you are buried in debt? Using Modern Monetary Theory will lead to a disaster of epic proportions.

Isn’t there 60 billion missing from EDD? Gavin gave his friends in prison funds, sent our money overseas, and lined his pockets…I pray for the day Newsom is arrested…

Just another reason why CA employers will be looking to uproot and bail when the bill for CA legislators’ mismanagement and incompetence comes back to bite the private sector in the 6…