California Supreme Court Justices (courts.ca.gov)

California Supreme Court Finally Rules on Case Affecting Pensions

The decision was measured, but is considered a victory for the plaintiffs

By Edward Ring, July 30, 2020 3:32 pm

On Thursday the California Supreme Court issued its ruling in the case Alameda County Deputy Sheriff’s Association vs Alameda County Employees’ Retirement Association. In plain English, this was a case where attorneys representing government unions were challenging pension reforms enacted by California’s state legislature in 2013. The ruling, which had the potential to empower dramatic changes to pension benefit formulas, was measured. But it is generally considered a victory for the plaintiffs.

Pete Constant, CEO of the Retirement Security Initiative, which advocates “fair and sustainable public sector retirement plans,” found the ruling encouraging, told the Globe, “the court has confirmed that the public interest is of utmost concern when determining whether public pensions need reform.”

What advocates for financially sustainable pensions are up against is the so-called “California Rule,” an interpretation of California contract law that dramatically limits the ways in which elected officials, or voters in a ballot measure, can modify pension benefits for public employees. The prevailing interpretation of the California Rule is that it prohibits changes to pension benefit formulas for active public employees, even for work they have not yet been performed.

In practical terms, obeying the California Rule means that whatever pension benefit package was in place on the date a public employee was hired must be maintained throughout their career. If it is changed, the employee must be given a compensatory new benefit of equal value.

Pension benefit formulas for California’s state and local public employees are typically calculated based on three variables – how many years the employee worked, how much the public employee earned in their final year of employment, and a “multiplier” that is applied to the product of these two values. For example, a public employee who has worked for 30 years, making $100,000 in their final year of work, whose pension “multiplier” was 3 percent, would get a pension equal to 30 x $100K x 3%, or $90,000.

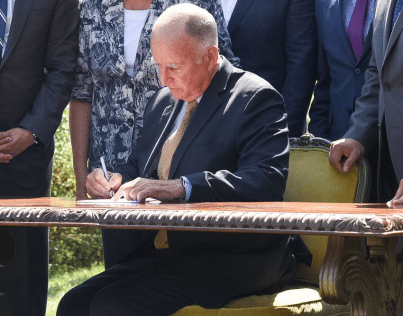

During Jerry Brown’s second eight year stint as Governor of California, he consistently advocated for pension reform, claiming the unforeseen and escalating costs to fund public employee pensions were putting an unsustainable burden on civic budgets and taxpayers. The reform he pushed through the California State Legislature, the Public Employee Pension Reform Act of 2013 (PEPRA), was an attempt to curb what were seen as abuses in public pension systems. Passage of PEPRA immediately generated litigation by attorneys representing public sector unions.

In an earlier case decided in 2019, Cal Fire Local 2881 v. California Public Employees’ Retirement System, the court upheld PEPRA’s prohibition of the purchase of so-called “airtime,” which manipulated a pension calculation variable by increasing the number of years an employee worked.

In this case, the court upheld PEPRA’s amended definition of another pension calculation variable: how much they earned in their final year of employment. This PEPRA provision was designed to “exclude or limit the inclusion of additional types of compensation in an effort to prevent perceived abuses of the pension system.”

The various ways in which PEPRA attempted to end these practices that critics refer to as “pension spiking” have been repeatedly challenged by public employee unions in court. Relying on the California Rule, the union argument might reduce to this: “if pension spiking was a common and accepted practice at the time we were hired, then we relied on the ability to eventually spike our pensions back when we made the decision to enter public service. It is a vested right which cannot be taken away.”

The court did not agree. Buried in its nearly 100 page opinion was the following: “They [the provisions of PEPRA] were enacted for the constitutionally permissible purpose of closing loopholes and preventing abuse of the pension system… Further, it would defeat this proper objective to interpret the California Rule to require county pension plans either to maintain these loopholes for existing employees or to provide comparable new pension benefits that would perpetuate the unwarranted advantages provided by these loopholes.”

The implications for future reform are mixed. Jon Holtzman, a partner with the Renne Public Law Group and an expert on the laws governing public sector pensions, was encouraged, telling the Globe, “This is a very positive ruling. The court concluded there was not a contractual right to spiking. A more notable aspect of the decision is they once and for all dispelled the notion that if you take away a benefit that you must give a comparable benefit.”

There are two ways this ruling chips away at this core element of the California Rule. First, as noted, the court does not recognize the obligation to “perpetuate the unwarranted advantages provided by these loopholes” by providing a comparable benefit when the loophole is closed. The second way this ruling undermines the California Rule is more ambiguous.

The concurring opinion summarizes this ambiguity. Justice J. Cuellar writes “The test the court applies here is merely a specific application, fit for this situation, of a more general inquiry: whether a reduction in pension rights without any comparable new advantages is ‘reasonable’ and ‘necessary’ to further ‘an important state interest…’”

There’s a lot to unpack here. First, the ruling does not invalidate the prevailing interpretation of the California Rule, it makes clear the court is looking at a specific application – namely, what constitutes pension eligible pay when calculating a retirement pension. Secondly, it is implying that if the plaintiff can demonstrate that a provision of PEPRA, or any other pension reform that might come along, requires unnecessary or unreasonable reductions to pension benefits in pursuit of “an important state interest,” then the California Rule may still be applicable, preventing those reforms. Finally, though, what constitutes an “important state interest?”

This question awaits another court case for further clarification, and it could be the answers continue to arrive only in the context of specific applications of the question. Yet on this question hinges the ability of pension reformers to enact more meaningful modifications to public sector pension formulas. At what point does modifying public sector pensions become an “important state interest?” When they’ve become too expensive? They’re already too expensive. Or when the burden of paying them propels an agency into bankruptcy? And what if instead of bankruptcy, agencies – cities and counties and special districts – simply cut services and staff in order to cover operating deficits, and leave the pensions intact?

Pete Constant, commenting on the limited scope of today’s ruling, said, “with the uncertainty we’re seeing today, this would have been a good time for the California Supreme Court to issue a broad decision.”

Carl DeMaio, the former San Diego City Councilman who has spent decades pushing for pension reform, was less subtle. In a blistering press release, he said “By crafting a narrow ruling that sidesteps the fundamental flaws with the notorious California Rule, the California Supreme Court seems hell bent on forcing California taxpayers to bear the excessive costs of unsustainable pension payouts for state and local government employees.”

They’re both right. The economic uncertainty ahead for California’s public agencies, as Constant warns, will demand further action to reduce pensions. Pension payouts, as DeMaio says, are excessive and unsustainable.

Future reforms, either initiated by the legislature, citizen initiatives, or bankruptcy courts, may have to take aim at more substantial elements of pension benefit formulas. To list just a few: reducing the multiplier for future work, reducing the cost-of-living adjustment for retirees, requiring active public employees to personally contribute more to the pension system via payroll withholding.

The ruling this week did not go far enough. But it reinforced earlier precedents that make clear the California Rule will not apply in all cases, and it left open the door to define an “important state interest” in a manner that is broad enough to empower more substantial reforms in the future.

- Ringside: Can Energy and Water Interests Find a Common Agenda? - February 26, 2026

- Ringside: What Will California Gas Prices Do in 2026? - February 19, 2026

- Ringside: Large Scale Desalination Belongs in California’s Water Strategy - February 12, 2026

Wishful thinking. This ruling is a one-off decision, affecting nothing except spiking. There are no other “loopholes”. The CA Democrat politician-public sector worker racketeering will continue unabated.