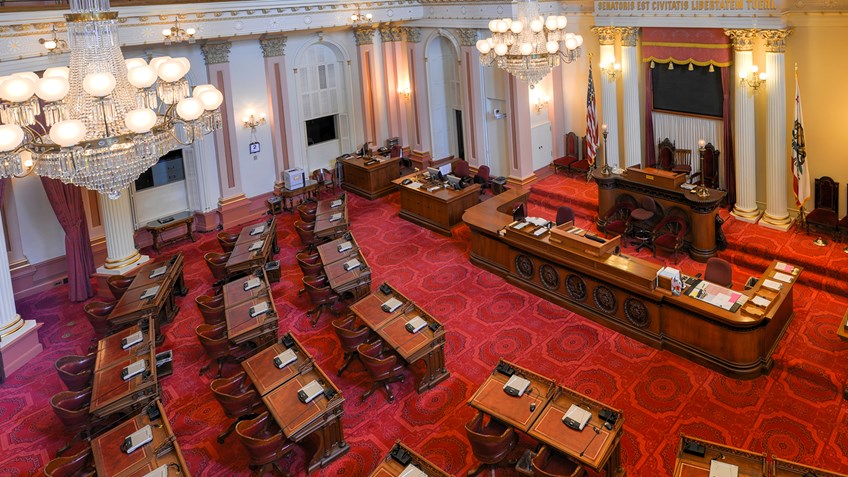

The Legislative Bill Room, California State Capitol. (Photo: ca.gov)

Frequently Asked Questions about Bill Drafting in California

Is there a single subject rule for legislation?

By Chris Micheli, October 22, 2023 7:55 am

For those not familiar, I put together the following questions and answers for those queries that are most often posed regarding bill drafting in California:

Which types of bills take effect immediately upon being signed by the Governor? Statutes calling elections, statutes providing for tax levies or appropriations for the usual current expenses of the State, and urgency statutes shall go into effect immediately upon their enactment.

Does an urgency clause bill require specific language? Yes, a statement of facts constituting the necessity must be set forth in one section of the bill.

Are there any limits on the types of urgency clause bills? Yes, an urgency statute may not create or abolish any office or change the salary, term, or duties of any office, or grant any franchise or special privilege, or create any vested right or interest.

Is there any limitation on bond issuances or constitutional amendments proposed by the Legislature? Yes, they cannot include or exclude any local areas of the state from the measure’s provisions based upon whether that local area approved or disapproved the measure, or based upon the casting of a specified percentage of votes in favor of the measure.

Is there a single subject rule for legislation? Yes, a statute “shall embrace but one subject, which shall be expressed in its title.”

What is the Reenactment Rule? It provides that a code section (i.e., a section of a statute) may not be amended unless the section is re-enacted as amended.

What does the budget bill need to include? The budget must be accompanied by a budget bill itemizing recommended expenditures.

Can any bill include multiple appropriations? No, only the budget bill may contain more than one item of appropriation.

What is the vote threshold for an appropriation from the General Fund bill? It is 2/3, except appropriations for the public schools and appropriations in the budget bill and in other bills providing for appropriations related to the budget bill.

What are “other bills providing for appropriations related to the budget bill”? They consist only of bills identified as related to the budget in the budget bill passed by the Legislature.

Are all bills required to be of general application? As a general rule, bills have uniform operation, but a local or special statute is allowed only in the case where a general statute cannot be made applicable.

What is the purpose of a bill’s Title? The title of every bill introduced is intended to convey an accurate idea of the contents of the bill and also indicate the scope of the act and the object to be accomplished.

Does each code section require a separate bill section? Yes, A bill amending more than one section of an existing law must contain a separate section for each section amended.

Do legislative rules dictate how to draft code sections? Yes, “bills that are not amendatory of existing laws must be divided into short sections, where this can be done without destroying the sense of any particular section, to the end that future amendments may be made without the necessity of setting forth and repeating sections of unnecessary length.”

Must an introduced bill include certain parts? Yes, a bill may not be introduced unless it is contained in a cover attached by the Legislative Counsel and it is accompanied by a digest, prepared and attached to the bill by the Legislative Counsel, showing the changes in the existing law that are proposed by the bill.

Does the Legislative Counsel’s Digest have to be changed when a bill has been amended? As a general rule, the Legislative Counsel must prepare an amended digest to show changes in the existing law that are proposed by the bill as amended, with any material changes in the digest indicated by the use of appropriate type.

Can a bill be amended to just add a co-author? An amendment is not in order when all that would be done to the bill is the addition of a coauthor or coauthors, unless the Committee on Rules of the house in which the amendment is to be offered grants prior approval.

How does the Office of Legislative Counsel determine whether a bill should be re-referred to the fiscal committee? Joint Rule 10.5 asks whether the bill would appropriate money; result in a substantial expenditure of state money; result in a substantial increase or loss of revenue to the state; or, result in substantial reduction of expenditures of state money by reducing, transferring, or eliminating any existing responsibilities of any state agency, program, or function.

Can a bill Title include the name of a legislator? No, a bill may not add a short title that names a current or former Member of the Legislature.

Does a bill contain information regarding who asked the legislator to author the bill? No, a bill may not indicate in its heading or elsewhere that it was introduced at the request of a state agency or officer or any other person. A bill may not contain the words “By request” or words of similar import.

How is bill language distinguished between adding, amending, or repeal statutory language? If new matter is added by the amendment, the new matter is printed in italics in the printed bill; if matter is omitted, the matter to be omitted is printed in strikeout type.

Where are bill drafting rules found? The California Constitution, Government Code, Joint Rules, and the Office of Legislative Counsel’s Drafting Manual.

Are bills presumed to apply both prospectively and retroactively? No, the presumption is that, once they become a statute, are applied prospectively. unless there is clear evidence that the Legislature intended the statute to apply retroactively.

Do all parts of a bill must be reasonably germane the introduced version? Yes, amendments are supposed to be reasonably germane to a common theme or subject, which is commonly known as the single subject rule.

What is a state-mandated local program? If a statute would require a city or county to do a new program, or a higher level of service on an existing program, it is deemed by the Office of Legislative Counsel to be a state mandated local program. Government Code Section 17575 requires this and for the Legislative Counsel to make this determination known in the digest of the bill.

Does a bill enact codified or uncodified statutes? Both. A statute can enact both codified and uncodified provisions of law. codified means the statute is found in one of California’s 29 Codes, while uncodified means the statute is not found in one of those Codes.

What is “chaptering out” and how does a bill address it? “Chaptering out” refers to when a later enacted statute “chapters out” or repeals an earlier enacted statute from a different legislative session. It is addressed by double-jointing amendments.

Does the Office of Legislative Counsel advise the Legislature and all constitutional officers? No, only the Legislature and Governor, but not the other constitutional officers.

What is the purpose of the Legislative Counsel’s Digest? The Digest is intended to be an objective description of existing law and what the bill proposes to do.

Who determines a bill’s Digest Keys? The attorneys in the Office of Legislative Counsel.

If the fiscal committee Digest Key is marked yes, what happens to the bill? The bill will be re-referred to the fiscal committee, but does not have to be voted on. Also, the committee could waive review.

What is the difference between a spot bill and an intent bill? Spot bills contain nonsubstantive changes to an existing statute. Intent bills contain one sentence expressing legislative intent to enact a type of bill.

What are the three types of legislative measures? Bills enact statutes. Resolutions are used to express the view of the Legislature (there are three types of them – house, concurrent, and joint). Constitutional amendments place a proposed measure before the statewide electorate.

What is a “tax levy” bill? A tax levy changes the base, rate, or burden of a state tax. The Legislative Counsel indicates in the Title and Digest of the bill whether the bill is a tax levy.

What does contingent enactment mean? Contingent enactment means there is a section in a bill indicating that it is to become operative only upon the enactment of another measure.

What does double-jointing mean? Double-jointing amendments are amendments to a bill providing that the amended bill does not override (or “chapter-out”) the provisions of another bill where both bills propose to amend the same section of law.

Do all legislative measures have a “Relating Clause”? No, only bills are required to have a relating clause pursuant to Article IV, Section 9.

Does a tax increase bill require a higher vote threshold? Yes, a bill that imposes a new tax or increases an existing tax requires a 2/3 vote pursuant to Article XIIIA, Section 3.

Does enacted bills affect all cities the same? As a general rule, a charter city is exempt from legislative control, except for matters that are of statewide concern pursuant to Article XI, Section 5.

When is the general effective date for a new statute? The general effective date for statutes enacted by the California Legislature is January 1 of the following year after enactment, unless the bill is a type that takes effect immediately.

What is the difference between intent statements and findings and declarations? Findings and declarations are generally affirmative statements explaining the basis for a bill’s provisions, while intent statements explain how the Legislature intends the bill’s provisions to be interpreted or implemented.

Does a bill addressing a fiscal emergency need to contain any specific provisions? Yes, a bill addressing a fiscal emergency must contain a statement regarding the fiscal emergency pursuant to Article IV, Section 10.

Does a bill have to contain an Enacting Clause? The requirement for a bill to have an enacting clause is contained in Government Code Section 9501.5, provides that the enacting clause of every law is: “The people of the State of California do enact as follows:”.

Do California Codes contain any statutory construction guidelines? Yes, the general rules for the construction of statutes are contained in the preliminary provisions of the different codes, which is pursuant to Government Code Section 9603.

Can any existing statute be repealed? The general rule is that any statute may be repealed at any time. However, under Government Code Section 9606, a statute may not be repealed when vested rights would be impaired.

- Regulating Sales of Franchises - February 11, 2026

- What Is a ‘Loophole’ in California Tax Laws? - February 10, 2026

- Ecological Reserves - February 10, 2026

One thought on “Frequently Asked Questions about Bill Drafting in California”