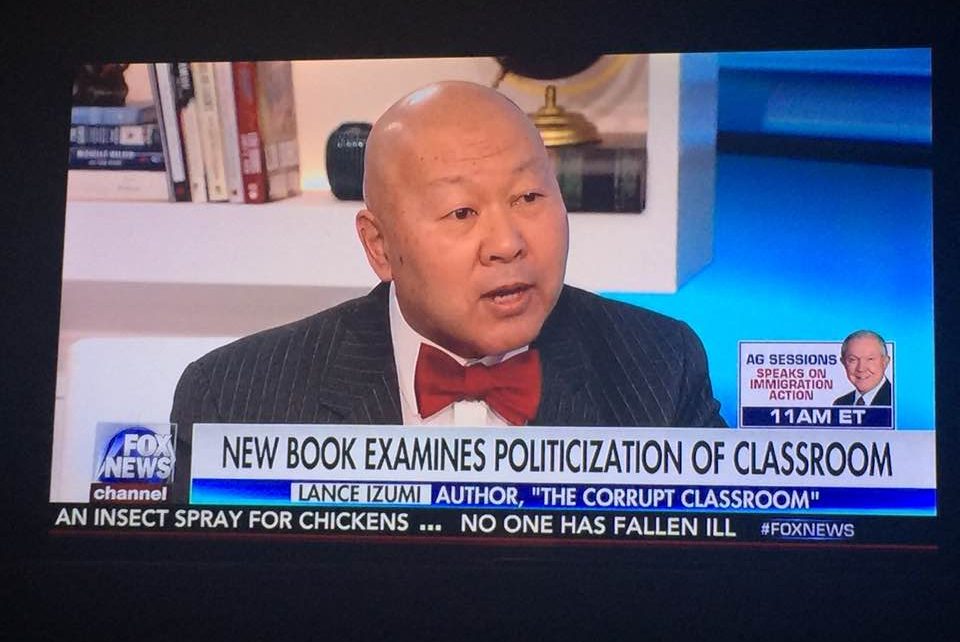

Lance Izumi. (Photo: Katy Grimes, screen capture, Fox News)

Gov. Newsom’s College Savings Account Proposal Falls Flat With Education Scholar

‘California public schools fail to prepare most California students for college’

By Katy Grimes, May 24, 2021 4:00 pm

“In his recently released revised budget, Governor Gavin Newsom put forward a group of proposals to ‘Re-Imagine California’s Public Schools.’ Sadly, most of these proposals will do little to raise student achievement in a public school system that was failing to do so even before the COVID-19 pandemic,” said Lance Izumi, Senior Director of the Center for Education at the Pacific Research Institute, in a new op ed.

In a recent conversation with Izumi about the governor’s education budget with the Globe, the gist of Izumi’s appraisal of this proposal is that Gov. Newsom’s savings accounts for students need to be at the front end of the child’s education, not at the back end.

“To make college more accessible to low-income California kids, the Governor proposes investing $2 billion to seed college savings accounts for vulnerable students currently enrolled in K-12 public schools, including a $500 base deposit for students from low-income families, English learners and foster youth, and a $500 supplemental deposit for foster and homeless youth,” the governor’s press release says. “The savings account can be used later in life for higher education or to start their own business.”

Izumi says because California public schools fail to prepare most California students, especially those from low-income families, for college, school-aged kids need the financial assistance up front in the form of education savings accounts (ESA), as well as school choice and vouchers.

Newson’s plan is about as helpful as throwing a drowning man both ends of the rope.

Izumi explains why:

In 2018-19, 60 percent of low-income students failed to meet grade-level standards in English and 73 percent of disadvantaged students failed to meet grade-level standards in math.

With low achievement in the basic subjects, many of these students will be fighting simply to stay in school, rather than planning a college education.

If Newsom really wants to have an impact on the future of California children, he should have proposed an education savings account (ESA) that is available to students at the front end of their K-12 schooling, rather than a college savings account that is targeted to the back end of their K-12 years.

Izumi discusses West Virginia’s recently enacted education savings account program as the best example:

“West Virginia, like California, suffers from poor-performing public schools, recently enacted the nation’s most expansive ESA program, which will create savings accounts for parents of students leaving the public school system to use 100 percent of state education dollars, or about $4,600 per year, to pay for private school tuition, homeschool curriculum, and other learning expenses,” Izumi said. “Under the provisions of the West Virginia ESA law, every child in a public school is eligible for an ESA, which means an amazing 90 percent of the state’s students will be able to use the ESAs.”

“Years ago, it would have been inconceivable that West Virginia, not California, would be the real leader in innovation,” Izumi said. “Yet, today, Gavin Newsom simply wants to shovel more tax dollars into the state’s failing public-school status quo, while West Virginia is truly re-imagining education.”

Izumi points to a new Georgia Public Policy Foundation study showing that ESAs would result in “higher lifetime earnings associated with increases in academic achievement,” large economic benefits to the state, and tax savings from reduced social costs such as crime.

Izumi summarizes: “The study’s author Corey DeAngelis, national director of research at the American Federation for Children, points out, “Funding students, as opposed to systems, would benefit families by empowering them to choose the education provider that best meets their needs—public or private, in-person or remote.”

- While Newsom Fiddles, California’s Gas & Oil Crisis Ramps Up with Tensions Between the US and Iran - February 22, 2026

- Trump Responds, Issues Global 10% Tariff on all Countries - February 21, 2026

- What is Trump’s Plan B After Supreme Court Strikes Down Tariffs? - February 20, 2026

“Scholarshare 529 college savings accounts were created in 1999 by the state to provide low-cost savings plans and portfolios to help families save for college education. Money can also be withdrawn tax-free at any time to help pay elementary, middle, or high school expenses.”

The West Virginia plan is a way to fund school choice. A fund to pay for K-12 education in California seems to already exist, to some extent in Scholarshare 529. Could this Scholarshare 529 program be modified and enhanced to provide school choice?

Are you sure that Newsom didn’t shovel the money to the teacher’s unions???

CriticalDfence9, no. You’re right. The unions have their fingers in every part of government. 🙁