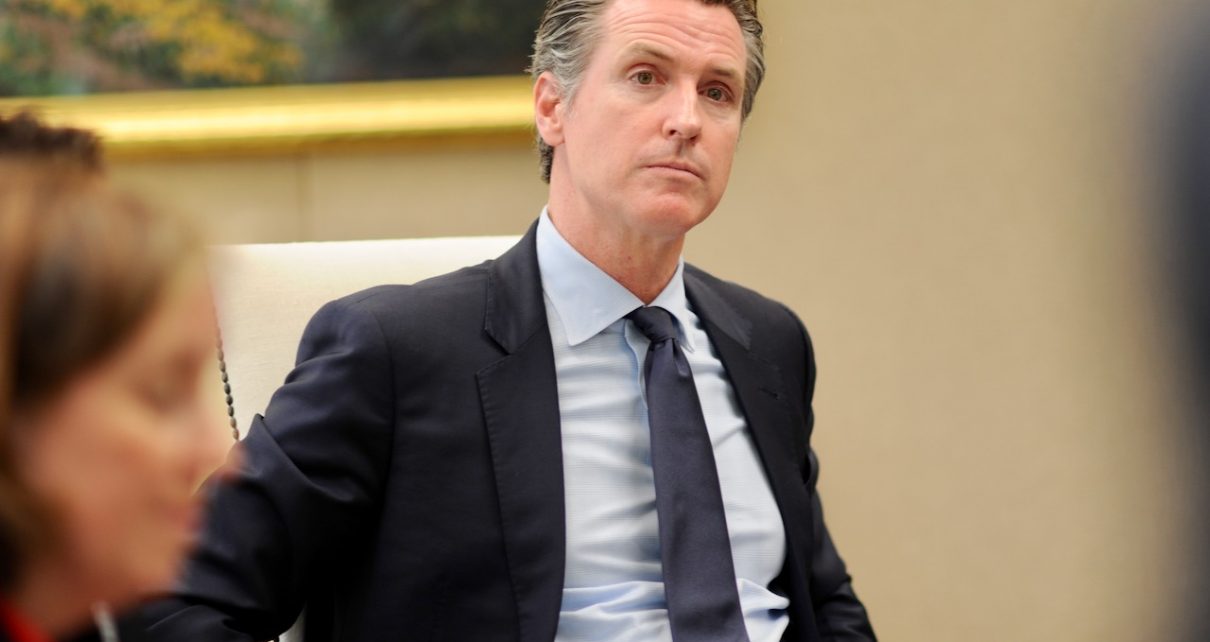

Gov. Gavin Newsom. (Photo: Kevin Sanders for California Globe)

Gov. Newsom’s ‘Conformity’ Tax Proposal Cherry-Picking Changes to Federal Law

Savings to small biz offset by enormous tax increase

By Katy Grimes, June 20, 2019 2:05 am

California Gov. Gavin Newsom’s proposed state budget contains more than $2 billion in new state taxes, even with $21 billion state surplus. Newsom proposed adopting some of the Trump federal tax code changes – and limiting deductions for business losses, resulting in the tax increases.

In 2017, President Donald Trump signed the Tax Cuts and Jobs Act. When federal tax laws change, some states automatically conform to the changes. California typically does not.

Trump’s 2017 tax law cut the corporate tax rate, reduced personal rates across the board, and did away with the State-and-Local-Tax deduction known as the SALT deduction. All taxpayers now, regardless of their income, cannot deduct more than $10,000 of total state and local taxes, including property taxes.

While giving a $200 million savings to small businesses, Newsom’s budget bill is also a $1.7 billion tax increase. Choosing which parts of the federal tax law to change isn’t conformity – it is a tax increase.

“Despite a budget surplus of $22 billion,” the governor is asking for billions in new taxes, said Senate Republican Leader Shannon Grove, R-Bakersfield. “California is already unaffordable for too many people.”

These new taxes are largely a result of Newsom’s tax “conformity” changes.

The San Jose Mercury News explained: Newsom’s budget includes a “tax conformity package,” which includes “flexibility for small businesses, capital gains deferrals and exclusions for Opportunity Zones and limitations on fringe benefit deductions,” among other measures, as “beneficial to California.”

Newsom’s budget plan provides $800 million in tax refunds for low-income people, a state earned income tax credit, which provides an earnings subsidy to low income families with at least one child. This refund will be possible because of the “conformity” tax changes. However, with California’s $22 billion surplus and an all-time high $215 billion spending plan, the state can support the Earned Income Tax Credit without raising taxes by $1.7 billion.

What is Being ‘Conformed?’

Specific areas of “conformity” include: Small business accounting reform and simplification rules, Student loan debt discharge due to death or disability, Technical terminations of partnerships, Limiting like-kind exchanges to Real Estate only, Limiting deductibility of excessive compensation to top employees, Limiting deductibility of fringe benefits such as meals and entertainment, ABLE accounts expansion for disabled individuals, Limiting non-corporate business losses to offset non-business income, Limiting Deductions FDIC deposit insurance premiums, Tax treatment of corporate mergers and acquisitions eliminates the differences between state and federal law, Eliminating net operating loss carry-backs.

The budget bill also includes a $120 million car tax. In California, 90 percent of electric and low-emission vehicles are leased. This car tax will serve to discourage Californians from trying electric or other zero-emission vehicles.

More Tax Increases Coming

“It’s possible other tax increases could be put on the 2020 ballot, such as an estate tax,” Sen. John Moorlach (R-Costa Mesa) recently wrote. “So let’s review what we already must put up with:”

“California’s top marginal tax rate of 13.3 percent is by far the highest of any state. Even the middle-class rate, beginning at about $55,000 of income, hits at a staggering 9.3 percent. Yet in the Bay Area now, the San Jose Mercury-News reported, even $400,000 in income leaves families “feeling strapped” because of high taxes, housing and other costs. Should they pay more taxes?”

“Taxes are not the solution, but the problem. You should vote against a “split roll” or any other tax on the ballot. Like abolitionist Wendell Phillips urged before the Civil War, “Eternal vigilance is the price of liberty.” Never take a tax increase proposal lightly. Your prosperity may depend on it.”

The struggles and challenges already occurring by poor and minority communities will also be hit by the tax increases of $1.7 billion.

The Governor’s budget expands Medi-Cal to undocumented immigrants, but does not add more doctors. More people on Medi-Cal with no more doctors means less care for everyone, at greater expense to taxpayers.

California has the most billionaires, but also the highest concentration of homelessness, and one-third of the nation’s welfare recipients. It ranks as one of the highest tax states, and has some of the most expensive real estate in the entire country. Gasoline prices are more than 40 percent higher in California than the national average.

Nearly 20 percent of Californians lacked enough resources to meet their basic needs in 2016, according to the most recent data from the California Poverty Measure, making a $1.7 billion tax increase deeply problematic.

- Why California Has an Oil and Gas Crisis… and China’s Involvement - March 11, 2026

- Yamaha Leaving California for Business-Friendly, Crime-Free Kennesaw Georgia - March 10, 2026

- Marathon, Chevron, PBF Warn Governor Newsom of Widespread Refinery Shutdowns, Fuel shortages, Economic Collapse - March 10, 2026

“$21 billion state surplus”? Aren’t you all in debt to the tune of $1,200,000,000,000???

Yes, media is lying about surplus. That is are emergency fund money, which already has been spent on something else. I think it went to lawyers for illegal immigrants.

Please sign the petition to begin the Recall Gavin Newsom process.

https://www.thepetitionsite.com/464/323/661/recall-governor-gavin-newsom/

Good read. Well written. Feeling informed.

While he”s at it I propose a new name for this state. ” TAXAFORNIA” This Governor has to much in Surplus and wants more. Leaving this state in 2 yrs or less. I am a blue collar worker tired of the stupidity in Sacramento.

Taxation without representation, literally!