California Supreme Court Justices (courts.ca.gov)

Pension Reform Waits for California Supreme Court

Increasing pension benefits retroactively by 50 percent or more for decades of work, is a big part of why California’s pension funds are in precarious shape

By Edward Ring, November 27, 2019 11:44 am

“When local government has reached the point where it’s spending nearly as much on pensions as it spends on base salaries, you still can’t do much.”

With markets fitfully advancing after a nearly two year pause, the need for pension reform again fades from public discussion. And it’s easy for pension reformers to forget that even when funds are obviously imperiled, with growing unfunded liabilities and continuously increasing demands from the pension funds, hardly anyone understands what’s going on. Unless you are sitting on a city council and facing a 10 percent budget deficit at the same time as your required pension contribution is increasing (again) by 20 percent, pension finance is eye-glazing arcana that is best ignored.

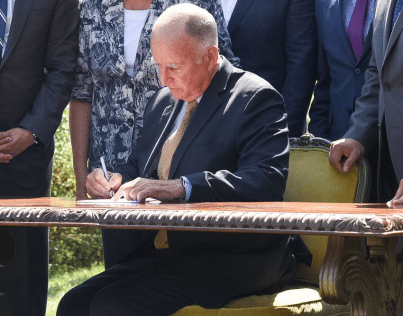

But when your local government has reached the point where it’s spending nearly as much on pensions as it spends on base salaries, and pension finance commands your attention, you still can’t do much. Pension reforms were approved by voters in San Jose and San Diego, among other places, but their impact was significantly reduced because of court challenges. Similarly, a moderate statewide pension reform passed by California’s legislature and signed by Governor Brown in 2013 has been repeatedly challenged in court.

The primary legal dispute is over what is referred to as the “California Rule.” According to this interpretation of California contract law, pension benefit accruals – the amount of additional pension benefit an employee earns each year – cannot be reduced, even for future work. Reformers find this appallingly unfair, based on the fact that when California’s public employee pension benefit accruals were enhanced, the enhancement was applied retroactively. Suddenly increasing a pension benefit by 50 percent or more, not only for future work, but for decades of work already performed, is a big part of why California’s pension funds are in the precarious shape they’re in today.

While pension benefits can be changed for new employees, there are over a million state and local government employees in California who are already working and whose pension benefit formulas – even for future work – cannot be changed unless the California Rule is struck down. Several active court cases are challenging the California Rule, and because of the decisive impact the eventual rulings in these cases may have, pension reformers have largely put their efforts on hold. So what’s the latest?

Earlier this year, in the case Cal Fire Local 2881 v. CalPERS, the California Supreme Court struck down one of the challenges to the state’s 2013 pension reform act. The plaintiffs argued that the ability of retirees to purchase so-called “airtime”was a constitutionally protected vested benefit that could not be taken away. Purchasing “airtime” was a common practice whereby upon retirement, a pension recipient could make a payment and in exchange have more years of service added to their pension formula, increasing their annual pension for the rest of their life. This was however a narrow ruling, only stopping purchases of airtime. The ruling did not address the larger issue of the constitutionality of the California Rule.

Additional cases pending before the California Supreme Court that could be decided next year are coming with lower court opinions of great interest to reformers. In the case Marin Association of Public Employees v. Marin County Employees’ Retirement Association, the appellate court opinion included the following: “While a public employer does have a ‘vested right’ to a pension that right is to a ‘reasonable’ pension – not an immutable entitlement to the most optional formula of calculating the pension. The legislature may prior to the employee’s retirement, alter the formula, thereby reducing the anticipated pension.” If the California Supreme Court embraces that opinion in a broad ruling, it is possible the California Rule could be the casualty.

For two decades now in California, when it comes to pensions, “reasonable” has become a contentious word. Back in 1999, pension benefit formulas were still reasonable and financially sustainable. But starting in 1999, in most state and local government agencies, pension benefits were increased by roughly 50 percent, at the same time as the age of eligibility was lowered. Also beginning around this time, pension “spiking” became more common, where not only could “airtime” be purchased, but overtime pay, on-call pay, call-back pay, vacation and sick leave sold back, and recruitment bonuses could all be added to the base salary when calculating retirement pensions. These many changes are the reason California’s state and local public employee pension funds are financially stressed and demanding increasing payments that government agencies cannot afford.

The following information, recently compiled by Retirement Security Initiative, provides details on the recently settled Cal Fire Local 2881 v CalPERS case, along with four active cases before the California Supreme Court. Depending on how they are decided, options for pension reformers in the coming years could be greatly expanded.

California Pension Cases before the State Supreme Court

SUMMARY STATUS – DECIDED:

Cal Fire Local 2881 v. CalPERS

In March 2019, the California Supreme Court upheld one of Governor Brown’s (modest) changes to retirement benefits in PEPRA for public employees: eliminating the opportunity to purchase “airtime.” The court determined that this perk was different than the core pension benefit and therefore able to be modified.

PENDING:

Alameda County Deputy Sheriff’s Association, et al. v. Alameda County Employee’s Retirement Association

The Deputy Sherriff’s Association (and others) are challenging the elimination of overtime pay, on-call pay, call-back pay, vacation and sick leave sold back, recruitment bonuses, and other items from pension calculations. The appellate court upheld most of the modifications under the same reasoning of Marin. Both sides have asked for the Supreme Court to review.

Marin Association of Public Employees v. Marin County Employees’ Retirement Association

Four local unions challenged the elimination of callback and standby pay from their pension calculations. In a departure from California Rule, appellate court ruled the modifications were legal and employees only have a right to a reasonable pension. Court of Appeal sided against the unions. It is currently pending in the California Supreme Court.

Hipsher v. Los Angeles County Employees Retirement Association

The PEPRA law allows the modification of public pension benefits for public employees who are convicted of a felony for behavior while performing official duties. The court of appeals upheld the ability to alter the benefits in these narrow circumstances but requires due process for public employees. It is now awaiting review from the California Supreme Court.

McGlynn v. State of California

Six trial judges petitioned for retirement benefits for when they were elected in 2012, rather than when they took office in January 2013, which was after PEPRA changes. All courts have sided with the state. It is now pending review from the California Supreme Court.

DETAILED STATUS – DECIDED:

Cal Fire Local 2881 v. CalPERS

Supreme Court Case: S23995

Summary: This case presented the following issues: (1) Was the option to purchase additional service credits pursuant to Government Code section 20909 (known as “airtime service credits”) a vested pension benefit of public employees enrolled in CalPERS? (2) If so, did the Legislature’s withdrawal of this right through the enactment of the Public Employees’ Pension Reform Act of 2013 (PEPRA) (Gov. Code, §§ 7522.46, 20909, subd. (g)), violate the contracts clauses of the federal and state Constitutions?

The Supreme Court’s decision in March 2019: “We therefore affirm the decisions of the trial court and the Court of Appeal, which concluded that PEPRA’s elimination of the opportunity to purchase ARS credit did not violate the Constitution.”

Notable quotes from the Supreme Court’s opinion: “We conclude that the opportunity to purchase ARS credit was not a right protected by the contract clause. There is no indication in the statute conferring the opportunity to purchase ARS credit that the Legislature intended to create contractual rights. Further, unlike core pension rights, the opportunity to purchase ARS credit was not granted to public employees as deferred compensation for their work, and here we find no other basis for concluding that the opportunity to purchase ARS credit is protected by the contract clause. In the absence of constitutional protection, the opportunity to purchase ARS credit could be altered or eliminated at the discretion of the Legislature.” (page 3)

“In this regard, plaintiffs argue that a contractual right with respect to the opportunity to purchase ARS credit should be found because public employees reasonably expected that the opportunity would continue to be made available for the duration of their employment. The only cited basis for those “reasonable expectations,” however, is the belief that the opportunity to purchase ARS credit would continue to exist in the future because it “was in effect for ten years.” The argument proves too much. We have never held that statutory terms and conditions of public employment gain constitutional protection merely from the fact of their existence, even if they have persisted for a decade. Such a rationale would directly contradict the general principle that such terms and conditions are not a matter of contract and are generally subject to legislative change.” (page 35)

“Because we conclude that California’s public employees have never had a contractual right to the continued availability of the opportunity to purchase ARS credit, the question of whether PEPRA worked an unconstitutional impairment of protected rights does not arise.” (page 45)

Undecided Questions: Two major issues remain open, perhaps to be decided in the other pending cases:

1) The degree of protection for unearned benefits for future work by current employees.

2) The circumstance under which vested benefits can be changed once vested and whether a “comparable” benefit must be provided.

DETAILED STATUS – PENDING:

Alameda County Deputy Sheriff’s Association, et al. v. Alameda County Employee’s Retirement Association

Supreme Court Case: S247095

19 Cal. App. 5th 61 (1st Dist. 2018), review granted, 413 P.3d 1132 (Cal. Mar. 28, 2018).

Summary: This case includes the following issue: Did statutory amendments to the County Employees’ Retirement Law (Gov. Code, § 31450 et seq.) made by the Public Employees’ Pension Reform Act of 2013 (Gov. Code, § 7522 et seq.) reduce the scope of the pre-existing definition of pensionable compensation and thereby impair employees’ vested rights protected by the contract clauses of the state and federal Constitutions?

In the courts below: Deputy Sheriff’s union and others sued challenging the elimination of overtime pay, on-call pay, call-back pay, vacation and sick leave sold back, recruitment bonuses, and other items from pension calculations. The appellate court upheld most of the modifications under the same reasoning of Marin, but held some of the changes were illegal and would send others back to the trial court for further review. Both sides of this case asked the State Supreme Court for review.

Status: Briefing in Progress. Supplemental Briefs in response to friends of the court briefs. As of October 17, 2019, the most recent document was filed May 29, 2019.

Marin Association of Public Employees v. Marin County Employees’ Retirement Association

Supreme Court Case: S237460

2 Cal. App. 5th 674 (1st Dist. 2016), review granted, 383 P.3d 1105 (Cal. Nov. 22, 2016).

Petition for review after the Court of Appeal affirmed the judgment in an action for writ of administrative mandate. The court ordered briefing deferred pending the decision of the Court of Appeal, First Appellate District, Division Four, in Alameda County Deputy Sheriff’s Assn. v. Alameda County Employees’ Retirement Assn., A141913[, or further order of the court].

Four local unions challenged the elimination of callback and standby pay from their pension calculations. In a departure from California Rule, appellate court ruled the modifications were legal and employees only have a right to a reasonable pension.

Court of Appeal conclusion: “As will be shown, while a public employer does have a “vested right” to a pension that right is to a “reasonable” pension – not an immutable entitlement to the most optional formula of calculating the pension. The legislature may prior to the employee’s retirement, alter the formula, thereby reducing the anticipated pension.” Marin Ass’n. of Pub. Emps. v. Marin Cnty. Employees’ Ret. Ass’n, 206 Cal. Rptr. 3d 365, 380 (Cal. Ct. App. 2016), appeal pending in California Supreme Court, 383 P.3 1105 (2016).

Hipsher v. Los Angeles County Employees Retirement Association

Supreme Court Case: S250244

Petition for review after the Court of Appeal modified and affirmed the judgment in an action for writ of administrative mandate. The court ordered briefing deferred pending decision in Alameda County Deputy Sheriff’s Assn. v. Alameda County Employees’ Retirement Assn., S247095, which includes the following issue: Did statutory amendments to the County Employees’ Retirement Law (Gov. Code, § 31450 et seq.) made by the Public Employees’ Pension Reform Act of 2013 (Gov. Code, § 7522 et seq.) reduce the scope of the pre-existing definition of pensionable compensation and thereby impair employees’ vested rights protected by the contracts clauses of the state and federal Constitutions?

The California Rule is described in Hipsher v. Los Angeles County Employees Retirement Assn., 24 Cal.App.5th 740, 754-754 (2018) “… with respect to active employees any modification of vested rights must be (1) reasonable, (2) bear material relation to the theory and successful operation of a pension system and (3) be accompanied by a ‘comparable new advantage,’” but that court noted that, after the Marin decision, there is no “must” related to a modification of a comparable new advantage and a modification need not be so accompanied. Id. At 754.

McGlynn v. State of California

Supreme Court Case: S248513

Petition for review after the Court of Appeal affirmed the judgment in an action for writ of administrative mandate. The court ordered briefing deferred pending decision in Alameda County Deputy Sheriff’s Assn. v. Alameda County Employees’ Retirement Assn., S247095, which includes the following issue: Did statutory amendments to the County Employees’ Retirement Law (Gov. Code, § 31450 et seq.) made by the Public Employees’ Pension Reform Act of 2013 (Gov. Code, § 7522 et seq.) reduce the scope of the pre-existing definition of pensionable compensation and thereby impair employees’ vested rights protected by the contracts clauses of the state and federal Constitutions?

Six judges who were elected to the superior court in mid-term elections in 2012, but who did not take office until January 7, 2013, maintain they are entitled to benefits under the Judges’ Retirement System II (JRS II), which were effect at the time they were elected, rather than at the time they assumed office.

Court of Appeal conclusion: “We conclude, as did the trial court, that the judges did not obtain a vested right in JRS II benefits as judges-elect, but rather obtained a vested right to retirement benefits only upon taking office, after PEPRA went into effect. We also conclude PEPRA’s provisions pertaining to fluctuating pension contributions do not violate the non-diminution clause of the California Constitution (Cal. Const., art. III, § 4), nor do they impermissibly delegate legislative authority over judicial compensation (Cal. Const., art. VI, § 19).” (pages 1-2)

ADDITIONAL REFERENCES

CalPERS Annual Valuation Reports – main search page

Moody’s Cross Sector Rating Methodology – Adjustments to US State and Local Government Reported Pension Data (version in effect 2018)

California Pension Tracker (Stanford Institute for Economic Policy Research – California Pension Tracker

Transparent California – main search page

The State Controller’s Government Compensation in California – main search page

The State Controller’s Government Compensation in California – raw data downloads

California Policy Center – How much will YOUR city pay CalPERS in a down economy?

California Policy Center – California Rule Does Not Protect “Airtime”

California Policy Center – Resources for Pension Reformers (dozens of links)

California Policy Center – Will the California Supreme Court Reform the “California Rule?”

- Ringside: Can Energy and Water Interests Find a Common Agenda? - February 26, 2026

- Ringside: What Will California Gas Prices Do in 2026? - February 19, 2026

- Ringside: Large Scale Desalination Belongs in California’s Water Strategy - February 12, 2026

Hyperbole.

Very few pensions were increased by fifty percent. For the most part it was only police and fire (and not all of them, either) Only those who retired at age 50 got a fifty percent increase. Those who retired at 55 or older received much smaller increases, or none at all.

Only those who retired at age 50 got a fifty percent increase. Those who retired at 55 or older received much smaller increases, or none at all.

Does it really matter if it was 50%, or 49.99%, or45% or 40%? NO. They were ALL retroactive pension increases where there was NOTHING given by the employee. Nada. Zero. Nothing. It was a “gift” of public $$$. You also leave out the BIGGEST part, the FRAUD that was used to pass SB400, using the BEST case financial model, leaving out the WORST case case, and the worst case was what actually happened and occurred. That is straight up fraud @Dogie Baby, like your comments! Take away SB400 and CalTURDS would be 100%++ funded.

“Take away SB400 and CalTURDS would be 100%++ funded.”

Perhaps the moderator disapproved of my last comment. Suffice it to say, Rex The Wonder Dog! , you could not be more wrong.

Stephen as usual you are incorrect. Here is the percentage of pension increase Police and Fire retirees received after the formula changed from 2% at 55 to 3% at 50. In Sonoma County after the increase, the average retirement age dropped to 52 so the average pension increase was 84%. You can see why:

50 years of age = 110% increase

51 = 97% increase

52 = 84% increase

53 = 72% increase

54 = 61% increase

55 = 50% increase

56 = 46% increase

For most cities over two thirds of the payroll is for police and fire.

Ken Churchill,

To be honest, Mr. Churchill, the best you can say is I am partially incorrect. Yes, Sonoma County is different.

There are now eight different CalPERS formulas for local safety employees. Some, like the 3%@50 are no longer available for those hired after 2013.

What is commonly referred to as a “50 percent increase” is the safety increase from “2%@50” to the “3%@50” formulas, which is a very common increase, I believe, for CHP and many other police and fire workers. Not precisely a fifty percent increase because the 2%@50 formula incrementally increased to 2.7%@55 (the new PEPRA formula, since 2013, is 2.7%@57)

With 2%@50 (no longer available, I believe) a worker retiring with 30 years at age 55 would receive 81 percent of FAS.

A 3%@50 worker retiring with 30 years at age 55 would receive 90%… Not a fifty percent increase.

Your mileage may vary.

I haven’t looked at Sonoma County lately. As I recall, and I repeat, “Sonoma County is different”.

There are/were some local governments which have higher formulas for miscellaneous workers (3%@60, for example)

This was usually, but not always, to compensate for the lack of Social Security.

Sonoma County may be one of those.

For the most part, many state and local miscellaneous workers received much more modest pension increases. Mine, I believe, was typical. My formula increased from 2%@60 to 2%@55. For myself and many others, this resulted in approximately three percent increase in pension. Nowhere near the…

“Increasing pension benefits retroactively by 50 percent or more for decades of work, is a big part of why California’s pension funds are in precarious shape”

Cited (constantly, I might add) by Ed Ring.

And, for almost all state and local California public workers, pension formulas, as of 2013, have been decreased to below 1999 levels.

Quoting Stephen Douglas ……………….

“And, for almost all state and local California public workers, pension formulas, as of 2013, have been decreased to below 1999 levels.”

Current PUBLIC Sector pension should NOT be to what PUBLIC Sector pensions were in 1999, but to the retirement security currently granted comparable PRIVATE Sector workers …………… which is most often 3% in a 401K Plans and ZERO towards retiree healthcare benefits.

Police and fire take up 50% of our entire city’s budget. So those you dismiss as “only a few” go a long way to permanent fiscal instability.

Quoting ………………

“The primary legal dispute is over what is referred to as the “California Rule.” According to this interpretation of California contract law, pension benefit accruals – the amount of additional pension benefit an employee earns each year – cannot be reduced, even for future work. Reformers find this appallingly unfair, based on the fact that when California’s public employee pension benefit accruals were enhanced, the enhancement was applied retroactively. Suddenly increasing a pension benefit by 50 percent or more, not only for future work, but for decades of work already performed, is a big part of why California’s pension funds are in the precarious shape they’re in today.”

Appallingly unfair … in Spades. And completely the opposite the ERISA/PPA rules the Govern the operation of Private Sector DB Pension Plans wherein PAST service accruals are protected, but the Plan Sponsor can for ANY reason (or for NO reason at all) END all FUTURE Service accruals or reduce the rate of accrual for FUTURE Service.

What makes PUBLIC Sector workers so “special” that they deserve not only MUCH MUCH richer pensions, but FAR stronger Legal protections from change, even for FUTURE service not yet worked ………. and all while the Taxpayers are now responsible for all but the 10% to 20% of total Plan costs paid for by employEE contributions (INCLUDING all the investment earnings thereon) ?

“What makes PUBLIC Sector workers so “special” that they deserve not only MUCH MUCH richer pensions, but FAR stronger Legal protections from change, even for FUTURE service not yet worked ………”

Seriously? Or is that a rhetorical question?

When Congress crafted ERISA, it sought to reduce abuses in the system for private employee pensions. At first, Congress imagined an ERISA that included government plans. However, Congress ultimately decided that regulation of such government plans was better left in the hands of state and local governments.

State and local employees are of the few not required to participate in Social Security. (Along with Railroad workers).

Should a private sector worker with a 3% 401(k) match and social security be compared with public worker with a 9.2% employer normal cost?

Hint… It varies if the worker earns $30,000 a year vs. $130,000.

It’s complicated.

Quoting Stephen Douglas…………..

“State and local employees are of the few not required to participate in Social Security. (Along with Railroad workers). Should a private sector worker with a 3% 401(k) match and social security be compared with public worker with a 9.2% employer normal cost?”

As Ken Churchill stated about you above …………….. “Stephen as usual you are incorrect. ”

That applies here as well.

Nationwide about 70% of all Public Sector workers DO PARTICIPATE in Social Security. So at least “on average”, perhaps the 3% into a 401K Plan might be compared to a Public Sector with a normal cost of 3%+(1-0.7)x6.2% = 4.8%. But if VALUED APPROPRIATELY (i.e. way Private Sector Plans do, and the way Moody’s evaluates a Plans financial strength), Non-saftey worker pensions typically have a NORMAL COST with the Taxpayers share being in the range of 20% to 30% of pay, and for Safety workers in the range of 30% to 50% of pay.

Way Way MORE than the 9.2% (which should really be 4.8% as I demonstrated) of pay that you tried to sneak in above. But we’re used to it Stephen ….. you’re always trying to mislead the readers.

State of Hawaii breached land owner contracts for the social good when it confiscated land held primarily. in the names of the first missionary families. Time to apply the “Hawaii Rule” – for the greater social good and reign in the public pension mess. Actually, this was fraud ab initio so as a contract, it fails.

Taxpayers were promised there would be no future costs to them – all benefits would be covered by increased investment incom – fraud in the inducement. There are so many principles of law already in operation that supercede the alleged “California Rule”. Nor are the public sector employees “innocent victims”. They have objected, protested and sabotaged every single attempt to reform these one-sided oppressive contracts.

The last thing the employees themselves should be called are innocent parties, who “just want what they were promised”. Guess what, taxpayers want what they were promised too – that these increased defined benefit pensions would not cost taxpayers a cent.

All contracts have the implied covenant of good faith and fair dealing – these pension contracts were never fair since they really exist between the taxpayers, now and well into the future and are not contracts between the few chosen, union-backed elected officials and the unions. No, these contracts contracted massive payments by people who may not even have born when the alleged agreement was originally put in place.

The California Rule is nonsense and is being greatly abused by those with a direct and personal interest in supporting this Rule, to the great unilateral expense of those now stuck with paying for the contract terms. That violates all good faith and fair dealing.

The California Rule cannot stand. Shame on the unions for cramming this down a very unwilling group of non-participants who never agreed to be bound by these public pension terms. You can never impose taxes to the degree these public pensions inflict on the one truly innocent group in this discussion -those who never voted for these original terms but are now stuck with paying for them.

Taxpayers were promised there would be no future costs to them – all benefits would be covered by increased investment incom – fraud in the inducement.

Correct! It was fraud in the inducement, as CalTURDS had developed three different models of how much the retroactive pension scam would cost: 1) best case; 2) middle neutral case; and 3) worst case. The CalTURDS Board gave ONLY the BEST CASE scenario, duping the CA legislature. Not only fraud, but it also qualifies under BOTH Criminal and Civil RICO law, both of which apply TREBLE DAMAGES upon conviction. I have said many times all it will take is ONE of the participating Muni’s to bring a civil RICO action against CalTURDS and it will be GAME OVER.

“– fraud in the inducement.”

Sounds impressive. Tell it to the judge.

Then hold your breath.

Hope some of these legal arguments are considered in the current appeal and thinking about this highly troubling issue that is bankrupting far too many local entities, as well as our system of governance itself:

State of Hawaii breached land owner contracts for the social good when it confiscated land held primarily. in the names of the first missionary families. Time to apply the “Hawaii Rule” – for the greater social good and reign in the public pension mess. Actually, this was fraud ab initio so as a contract, it fails.

Taxpayers were promised there would be no future costs to them – all benefits would be covered by increased investment incom – fraud in the inducement. There are so many principles of law already in operation that supercede the alleged “California Rule”. Nor are the public sector employees “innocent victims”. They have objected, protested and sabotaged every single attempt to reform these one-sided oppressive contracts.

The last thing the employees themselves should be called are innocent parties, who “just want what they were promised”. Guess what, taxpayers want what they were promised too – that these increased defined benefit pensions would not cost taxpayers a cent.

All contracts have the implied covenant of good faith and fair dealing – these pension contracts were never fair since they really exist between the taxpayers, now and well into the future and are not contracts between the few chosen, union-backed elected officials and the unions. No, these contracts contracted massive payments by people who may not even have born when the alleged agreement was originally put in place.

The California Rule is nonsense and is being greatly abused by those with a direct and personal interest in supporting this Rule, to the great unilateral expense of those now stuck with paying for the contract terms. That violates all good faith and fair dealing.

The California Rule cannot stand. Shame on the unions for cramming this down a very unwilling group of non-participants who never agreed to be bound by these public pension terms. You can never impose taxes to the degree these public pensions inflict on the one truly innocent group in this discussion -those who never voted for these original terms but are now stuck with paying for them.

This is proof that Unions are not only a threat to the vitality of our free market, they are nothing more than what they have always been, a Crime Syndicate that all participants are guilty, including the greedy pensioners. Time to make California a Right to Work State, and bust the Unions by making it a crime to force Union membership in all Private and Public sectors.

With this proposal on the books from AG Bacerra to take away Prop 13 Property Tax (extortion fees) cops, Don Baccera want’s to raise 12.5 billion more in tax revenue…how do you think that will go people?

Recently SCOTUS, after two Trump judicial appointments, effectively made all government employment “right to work” after their ruling in Janus vs AFSCME. This is why it has become existential for the Democrats and the deep state to take Trump down. Democrats and their union hand maidens are now operating in frog brain survival mode.

However, in the no-competition world of government services, unionize government workers have all our heads in their noose. So when they elect who sits on the other side of the Democrat employee union bargaining table, they own the game and they own us.

JFK needs to be reviled for unionizing government employees. An over-looked but major turning point in this country’s history. You cannot be a free and healthy country when government services are owned by one party whose sole goal is the perpetuation and growth of that very same control.

There is plenty of blame to go around, but a no-competition world of government services is a figment of your imagination.

What kind of magic do you believe will occur if the Supreme Court invalidates the California rule? In the few municipal bankruptcies so far, it has been ruled that pensions could be cut, but they weren’t, or only minimally. Bondholders took more of a cut than employees.

Employee pensions have been cut in most states since 2008-2009. And public workers have agreed to pay freezes or even reductions. With the recovery, salaries have begun to increase again, but at a lower rate than private sector salaries.

I have no objection to eliminating the California rule, but don’t expect miracles.

Is this reform of the previous reform that was also reformed ? Or is this new reform ?

Start with your local “non-partisan” school boards – do not ever elects a Democrat or teacher union backed candidate to any local school board. The hand that rocks the cradle rules the world – by stealth the Democrats have stolen a generation.

To be honest, we are not talking about pension reform here. We are talking about pension reduction, which is fine, it’s a valid topic for discussion, but do not confuse the two.

“Increasing pension benefits… …is a big part of why California’s pension funds are in precarious shape”

Ed Ring

A (much) bigger part is two huge market losses, two serious recessions, lowest interest rates in just about anyones memory, optimistic investment outlooks and failure to properly fund pension plans; by CalPERS, by most other public and private plans, and even by what is considered the best run pension system in the world…

—————————————————

The world’s best pension system is being pushed to the brink

By Julia Horowitz, CNN Business

Updated 6:36 AM ET, Fri November 22, 2019

(The Netherlands)

—————————————————

“When local government has reached the point where it’s spending nearly as much on pensions as it spends on base salaries, you still can’t do much.”

Ed Ring

The lions share of those costs is not because of current pension costs.* It is payments on the unfunded liability, what “should” have been paid in the past, but wasn’t. If we eliminate all pensions going forward, or switch to a Defined Contribution plan, those costs will still be there, and they will still be increasing.

*Although those costs, the annual normal costs, are almost universally considered too low.

Pension reduction, which Ed is referring to here, may also be required, because, as they say, “math”.

If pensions as we know them are significantly reduced, don’t be surprised if…

The reductions include reduced pensions for current retirees.

Some public sector salaries are increased to compensate for the lower pensions.

I support paying good employees well, particularly it is insurance they will not cheat, bribe or extort their employers (we the taxpayers). I also support equally comensurate public benefit in return from said well-compensated public employees.

But future pension benefits paid by present available dollars only – they can save for reitirement out of pocket, sign up for social security, and/or take advantage of any defined-contribution plan voters decide to offer that tax dollar funded entity.

No more future promises paid by others not party to the pension contracts, no blank checks paid by those not party to the contracts and no more demands, unrealistic expectations and pouting.

Also we need to finally end public employee unions ability to choose who sits on both sides of the pubic bargaining table – their chosen union representatives and their chosen elected, endorsed and funded public entity officials.

Disband publc employee unions and build in appropriate employment terms and obligations into the Civil Service Act. Undo the damage inflicted on this country when JFK unionized government employees in the 1960s’. It is not too late to undo this wrong turn.

Just because JFK owed the Chicago unions his close POTUS election does not mean we need to be paying for his personal favor decades later.

^^^ Ahhh, the typical progressive response when logic exposes the holes in their emotion-driven thought processes, although this one relies less on name-calling than usual….

Ever-increasing tax payer obligations in perpetuity are not “contracts”. They are unfunded mandates. Contract law has nothing to do with them, nor does the so called “California Rule” apply, since they are not contracts but are legislative mandates with no sunset clause nor statute of limitations.

There is a common law and black letter law Rule Against Perpetuities, and for good cause. Put these unfunded taxpayer obligation before the voters on a periodic basis and any “contractual” obligations exist only as long as the last voter mandate approved them to exist.

Pension obligations existing in perpetuity with no upper limits? Unheard of. Claiming this late in the game voters wrote a blank check to each and every government employee, no and in the future forever is absurd on its face .

What the four corners of mutually bargained for “contract” needed to look like:

Party A represents all government employees now and in the future, and demands a blank check in perpetuity with no upper limits as to amount of duration, to be paid in full by state taxpayers now and in perpetuity, who are represented only by current elected officials known as Party B.

Party B, the current elected officials, with full understanding their next re-election campaign depends upon agreement with these terms, accepts these terms in the affirmative and Party B commits all present and future state taxpayers in perpetuity to unknown contract term amounts and duration.

Apply the Rule Against Perpetuities – no single public pension contract obligating taxpayers shall be written for terms longer than 21 years. They may be affirmatively renewed; but shall never last unchanged in perpetuity.