CA Commercial Property Owners Facing Pervasive Tax Increases if Prop. 13 Split Roll Initiative Passes

With the state sitting on $7 billion surplus, opponents ask ‘why the attack on businesses?’

By Katy Grimes, December 3, 2019 3:08 pm

‘California’s assessable property is now worth $6.5 trillion with just last year’s increase resulting in $75 billion in revenue.’

Despite California’s record budget surplus of $7 billion in reserves, the Proposition 13 “split roll” property tax ballot initiative could end up being a tax windfall for state government coffers. With the state sitting on a sizable surplus, opponents ask why the attack on businesses?

The ballot initiative, referred to as “tax reform” by proponents, qualified for the November 2020 ballot, and is currently gathering signatures.

Proponents of splitting Proposition 13, which keeps escalating property taxes in check, are also selling the initiative as “higher funding for education.” Proponents have long claimed that because of Proposition 13, public schools have been robbed of necessary revenue, and that businesses have not been paying their fair share of property taxes.

While public education would receive more funding from higher property taxes, the real outcome is that commercial property owners would be forced to pass the increased costs to tenants, opponents say. And since most of the businesses in California are small businesses, whether they rent or own, they will be hit with this tax increase.

Backers of the property tax split roll include labor unions, social justice groups, teachers unions, environmental groups, housing advocates, Democratic Mayors of California cities, Democratic Presidential candidates, and Silicon Valley and San Francisco Bay Area philanthropic organizations: The Chan-Zuckerberg Initiative, East Bay Community Foundation, Liberty Hill Foundation, Northern California Grantmakers Association, The San Francisco Foundation and Silicon Valley Community Foundation.

Yet many government employees, organizations and labor unions could be hit in the retirement pocket book, as public employee retirement managers like CalPERS and CalSTRS and labor union pension accounts also invest in California real estate properties.

What is a ‘split roll?’

Under Proposition 13, a residential property’s overall tax rate is limited to 1 percent, with commercial and industrial property tax rate limited to 2 percent.

A “split roll” applies a different tax rate to commercial properties than to residential properties, removing the protections of Proposition 13 from commercial properties, allowing a higher tax rate on these properties.

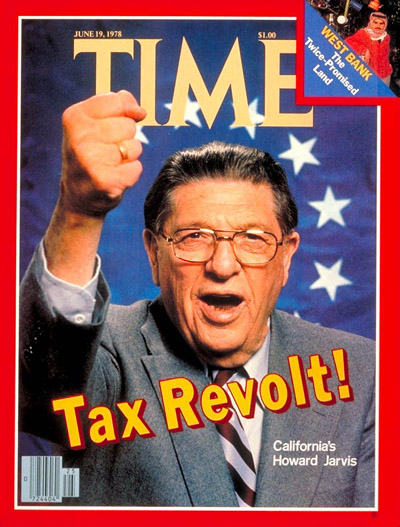

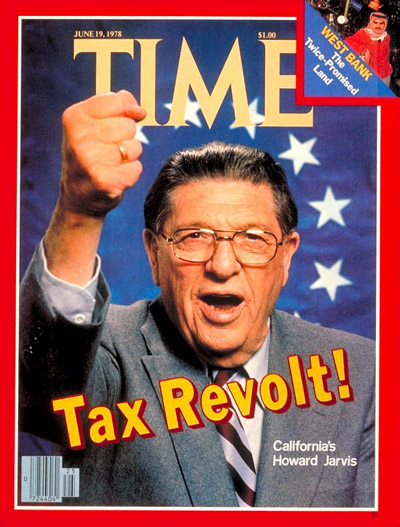

All previous attacks on Proposition 13 have come up short. But now, “proponents of the infamous ‘split roll’ initiative are on the streets collecting signatures for their new $12 billion property tax increase on Californians,” said Jon Coupal, President of the Howard Jarvis Taxpayers Association. Coupal explains Proposition 13 HERE.

“Although split roll is described by its proponents as ‘tax reform,’ it really is just a targeted tax increase on business,” the Cal Chamber recently reported. “Since the goal of government unions and progressive advocacy groups is a large tax increase, their strategy is to target increased taxes on businesses as more politically viable than general tax hikes on California residents.”

Historic Proposition 13

The latest onslaught on California’s historic Proposition 13 is now in full gear. Passed by 65% of California voters in 1978, Prop. 13 put a Constitutional cap on annual property tax increases. Prior to Prop. 13’s passage, there was no limit to how high an assessor could increase a property’s value in any year. Homeowners and commercial property owners were being taxed out of ownership of their properties by tax bills they could no longer afford. “Californians were angered by government’s inability or unwillingness to solve this problem and channeled their frustration into overwhelming support for Prop. 13 at the ballot box,” the Cal Chamber wrote.

Dressed up with a dishonest ballot title, the “California Schools and Local Communities Funding Act of 2020” would remove the limitation on annual commercial property tax increases. The initiative would provide an exception from reassessment under the new rules for businesses with property value up to $3 million.

The Orange County Register wrote a blistering editorial about the ballot title: “Xavier Becerra rigs ballot with biased split roll summary. It’s the most disreputable ballot description we’ve seen.”

Jon Coupal recently explained in an op ed just how California already reaps the financial benefit with property owners’ tax increases, even under Prop. 13:

“During this past summer there were dozens of media stories about big increases in property tax revenues. Orange County was typical. The taxable value of real estate went up $33 billion to over $600 billion. Assessments increased in all of Orange County’s 34 cities.

Further north, San Mateo County saw a 7.1% increase in its assessment roll for 2019-2020, the ninth consecutive year of increases. County Assessor Mark Church, in a press release, said there was record growth in commercial and mixed-use development which helped to push the total roll value to a new high.

Other counties showed similar gains: Santa Clara County, up 6.79% to $516 billion; Sacramento County, up 6.53% to $179 billion; Alameda County, up 7.13% to $321 billion; Fresno County, up 5.84% to $90.46 billion; and even Sonoma and Napa Counties saw big increases in assessed values notwithstanding losing over 5,600 structures to the horrific fires of 2017.

All told, statewide assessable property is now worth $6.5 trillion with just last year’s increase resulting in $75 billion in revenue.

“When Prop. 13 was passed in 1978, the local property tax assessments were $6 billion,” the Cal Chamber reports. “Local property tax levies are now projected to have grown $19 billion over the last decade alone—from $50 billion in 2008–2009 to $69 billion in 2018–2019.”

With this 15-fold increase since 1978, the argument by progressives that Proposition 13 starves local governments and schools for revenue is disingenuous.

Enshrined in the California Constitution Under Proposition 13, the ballot initiative also:

- prohibits the state legislature from enacting new taxes on the value or sale of properties.

- requires a two-thirds vote of the state legislature to increase non-property taxes.

- requires local governments to refer special taxes to the ballot and require a two-thirds vote of electors.

- makes the state government responsible for distributing property tax revenue among local governments.

Why would voters even consider another tax hike?

California ranks relatively high in property tax rankings, 17th out of the 50 states, even with Prop. 13.

California also ranks right up at the top of the 50 states in nearly all taxing categories: income taxes, corporate taxes, gas taxes, sales taxes, wealth taxes, utility taxes… and lawmakers are looking at imposing estate taxes and even exit taxes for people trying to move out of California.

As the Cal Chamber notes, Californians are even paying 48% more for electricity than the rest of the nation.

The Cal Chamber listed several concerns about the repercussions of a Prop. 13 split:

Split Roll Will Increase Costs for Consumers

Split Roll Will Hurt California’s Economy

Small Businesses and Their Employees Hardest Hit

Initiative Includes No Accountability Measures for New Revenue

Problem of Budget Volatility Will Be Exacerbated

Massive Additional Revenue Not Necessary

“As for the stated justification for higher taxes, there is a fake reason and a real reason, neither of which is particularly compelling,” Jon Coupal said. “The fake reason is that government needs the additional funds for critical programs. Given the inordinate amount of existing revenue coupled with waste in government, taxpayers would rather see elected officials prioritize the revenue we already give them.”

- Sen. Weiner’s Bill is Turning Every Neighborhood in California into a Dangerous Political Experiment - February 11, 2026

- California to Feed College Students via ‘CalFresh for Students Act’ - February 10, 2026

- Exclusive: New Civil Rights Complaint Against UC Berkeley for Discrimination - February 10, 2026

Greed and power know no bounds.

This will be framed as rich business owners not paying their fare share. It will pass because a majority of people in California are ignorant. ( wanted to say stupid but trying to keep it civil). Businesses do NOT pay taxes! The cost of doing business is passed on to the consumer. Always!

I know a 81 year old barber, 53 years in business in same location….his rent was doubled due to a recent sale of the small strip center he is a tenant.

Haircuts have gone from 14 dollars to 22 dollars.

No winners here except government. And now the taxers want much much more.

heads up landlords –

First they will go after Commercial property and next it will be Investment properties.

Retail vacancies will jump as stores on the margin will close up shop – accelerating whats already happening.

Bracerra is a criminal. In the House demokrat Imran Awan data security disaster, the server with the incriminating evidence DISAPPEARED. Bracerra pulled another server out of the closet and handed IT over to the investigators. They were not amused, but as they are demokrats, there are no consequences.