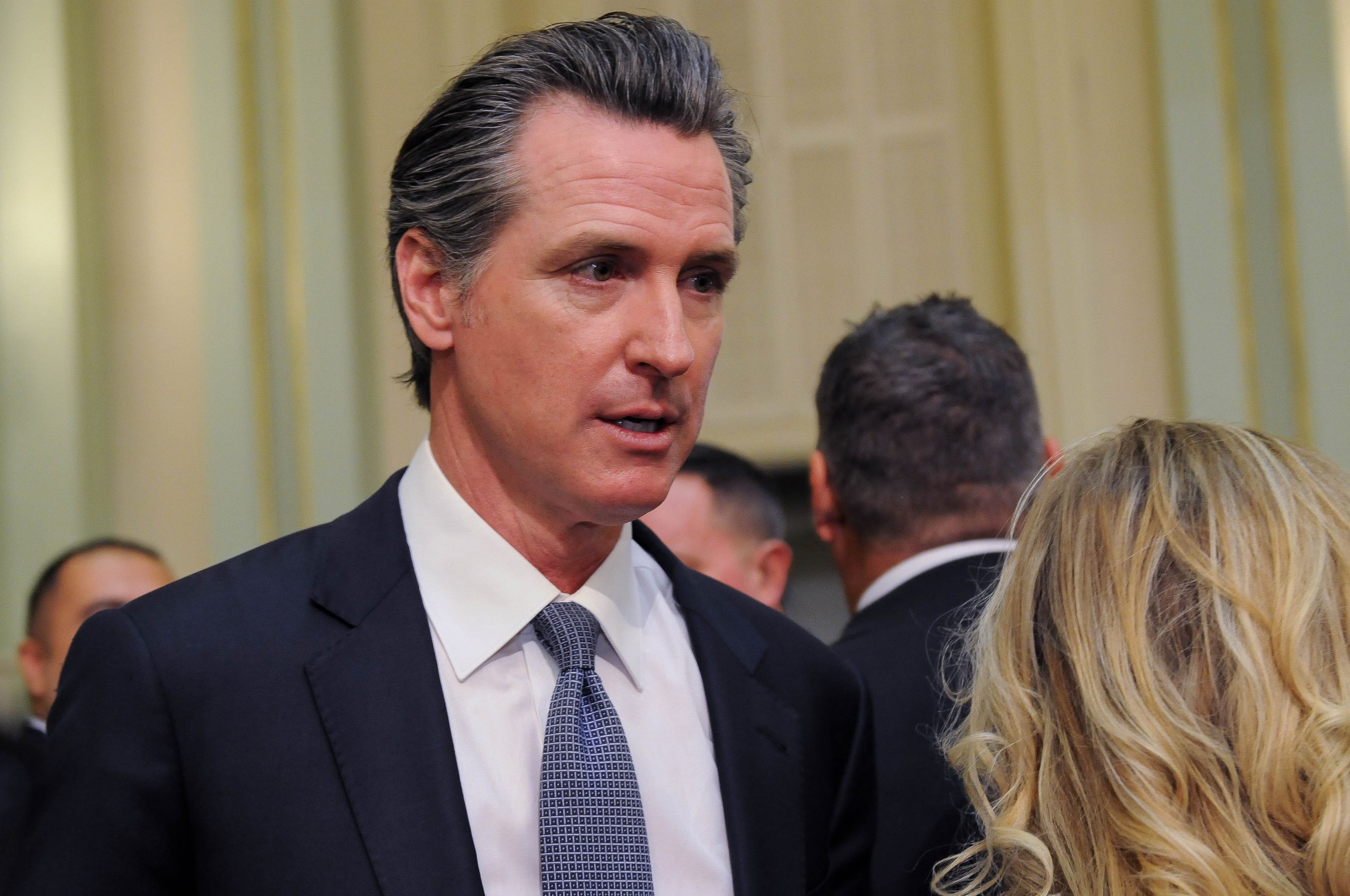

Governor Gavin Newsom. (Photo: Kevin Sanders for California Globe)

Gov. Newsom’s Credibility is Strained on the Middle Class Housing Issue

Gov. meeting with Californians ‘who struggle to live near their work’ after he fought to return settlement relief money

By Katy Grimes, August 15, 2019 1:26 pm

An email from the Governor Gavin Newsom’s press team Thursday is ironic given that Newsom and his administration tried to cover up a study proving that high government-imposed construction fees are contributing to the housing crisis: “In San Francisco, Governor Gavin Newsom to Discuss Housing Affordability with Teachers & Public Safety Professionals:”

In San Francisco today, Governor Gavin Newsom will meet with Californians who struggle to live near their work.

Housing affordability has been a top priority for the Governor. The state budget signed in June made a historic $1.75 billion investment in new housing and created major incentives – both sticks and carrots – to incentivize cities to approve new home construction. The budget also provided $20 million for legal services for renters facing eviction as well as $1 billion to help cities and counties fight homelessness.

Additionally, while Newsom is boasting about creating a fund to fight foreclosures and evictions, he actually fought all the way to the state Supreme Court to avoid using that money to help homeowners. Newsom is only creating that fund now because of a court order.

The Los Angeles Times reported in “One reason housing is so expensive in California? Cities, counties charge developers high fees” what really happened:

In California, local government fees on housing construction, which can be used on parks, traffic control, water and sewer connections and other services, were nearly three times the national average in 2015, according to a 2018 Terner Center report. In some cities, researchers found, fees can amount to 18% of median home prices.

In early July, The Times asked the governor’s office when the report would be released, and did not receive an answer. Last week, The Times submitted a public records request to the state housing department, which initially refused to release the study because it was awaiting approval from Newsom’s office. The department added that it would make the study public after that happened and one day after providing it to the Legislature for review. The Times contended there was no legal reason to withhold the report and told Newsom’s office it planned to write about the delay. The housing department then released the study late Monday.

Newsom’s office did not respond to a request for comment on why it did not release the report in June and whether the governor planned to act on the study’s findings.

The $331 million was part of a special fund designed to help California homeowners hit hard by the recession-era mortgage crisis. But former Gov. Jerry Brown, and state lawmakers diverted the money.

LAT explains:

The money diverted to state budget needs was a small portion of what both California homeowners and the government received from the national settlement agreed to by 49 states in 2012. Those states, along with the federal government and the District of Columbia, had earlier filed suit against the nation’s five largest mortgage servicers: Ally (formerly known as GMAC), Bank of America, Citigroup, J.P. Morgan Chase and Wells Fargo. The legal action alleged a number of federal law violations, and the financial institutions agreed to pay more than $20 billion to homeowners affected by the mortgage crisis. The companies also agreed to pay the states a total of $2.5 billion.

California’s share of the state payments was $410 million, to be used for a variety of services directed by then-Atty. Gen. Kamala Harris. But most of the money was used instead for budget-balancing items which, while related to housing, were long-term costs that further shrank the funds available for basic government services. A coalition including representatives for Asian American and Latino communities sued the state in 2014 over its decision to use the money to help erase a projected budget deficit. A Sacramento judge ruled for the coalition in 2015 and the 3rd District Court of Appeal agreed with that ruling last year.

State leaders, however, refused to back down. At the end of the 2018 legislative session, lawmakers and Brown crafted a bill that said the money was used correctly, and the enacted law sought to give the Legislature the power to “abrogate,” or revoke, the appeals court order to replenish the spent money.

The California Supreme Court refused earlier this week to hear an appeal by the administration disputing lower court rulings that found the state mistakenly used a portion of the money — paid by large banks and lenders as part of a nationwide legal agreement in 2012 — to pay off housing bonds. In some cases, those bonds were enacted a decade before the mortgage settlement. In all, three years of state budget expenses were covered by a portion of what California received from the mortgage settlement.

Real Clear Politics also tags Sen. Kamala Harris on the hypocrisy issue:

In 2012, just months after Harris secured those funds along with the other state AGs, then-California Gov. Jerry Brown diverted $331 million from California’s portion of the settlement to pay off state budget shortfalls incurred before the housing crisis.

Although Harris initially spoke out against Brown’s diversion of the funds, she remained silent on a subsequent court battle that began in 2014 – even after she left the attorney general’s office and for the last year and a half while serving as senator and during her presidential bid this year.

The press release credited Newsom on the housing affordability issue: “Housing affordability has been a top priority for the Governor.”

“Neil Barofsky, an attorney who represented the groups that fought the cash diversion in the courts, said it was disappointing that state officials spent so many years on ‘frivolous appeals, culminating in what he called the ‘ginned- up legislative action’ last year designed to block repayment of the money and the appeals court ruling,” the LAT reported.

Meanwhile, if you “Click here for more details on the Governor’s actions to date on housing and homelessness,” remember the rest of the story. However, it is good if California homeowners and renters actually realize some relief from the high-cost of housing.

- Gavin Newsom’s Sunday Circuit on Affordability is Dishonest - February 23, 2026

- Another One Bites the Dust: Jelly Belly Announces Layoffs and Administrative Offices Consolidating Out of California - February 23, 2026

- Gavin Newsom Accused of Racism, Demeans Black Audience on Book Tour: ‘I am like you. I’m a 960 SAT guy. I can’t read’ - February 23, 2026

Why is no one ever talking about the reversing the tax policy of Ronald Reagon! The change in deprication rules not only killed Americas Saving and loan industry, but has been the driver of our apartment home shortage!

President Ronald Reagan established a Commission on Housing in 1981 to help chart a new path for the rest

of this century. Policies such as:

Achieve fiscal responsibility and monetary stability in the economy; Encourage free and deregulated housing markets; Rely on the private sector; Promote an enlightened federalism with minimal government intervention; Recognize a continuing role of government to address the housing needs of the poor; Direct programs toward people rather than toward structures; and

Assure maximum freedom of housing choice.

The Commission said If these principles are followed, the American economy will provide housing that is adequate to the needs of the people, available to those who seek it, and affordable in the context of a growing national prosperity.

After Reagan’s presidency, these policies were not followed and government intervened every step of the way attempting to control the market. That’s what is wrong.