New Bill to Suspend Annual Tax Payments for Small Business

AB 664 would take effect immediately upon enactment if passed by 2/3 of both houses of the Legislature

By Chris Micheli, February 13, 2021 6:13 pm

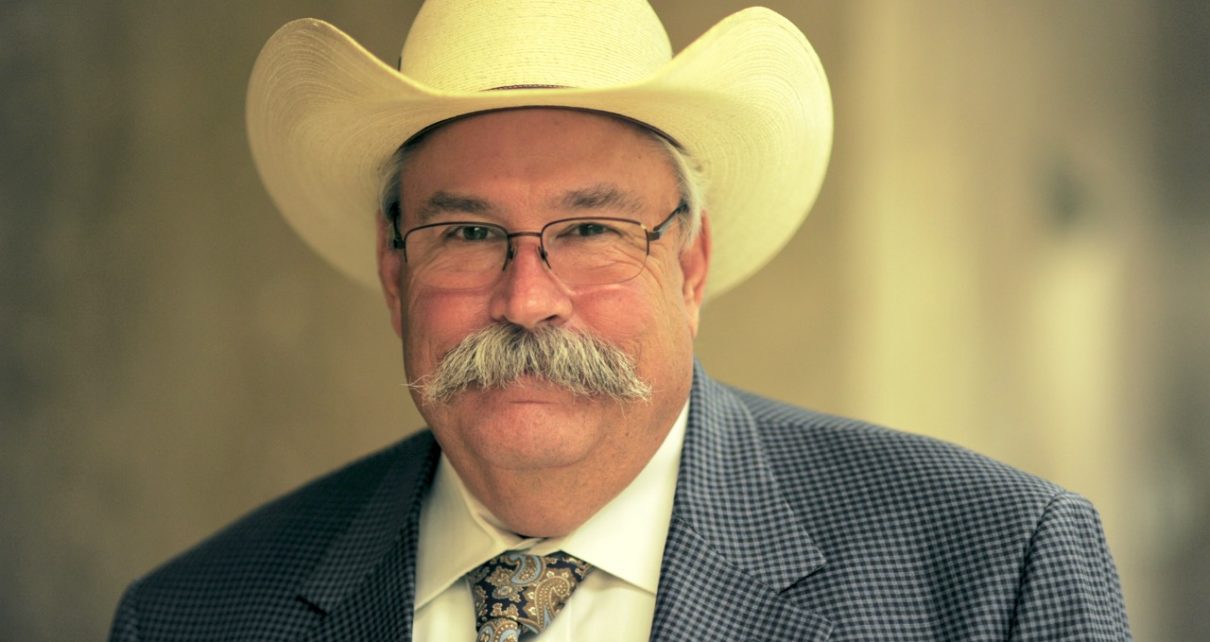

On February 12, Assembly Member Frank Bigelow introduced Assembly Bill 664 to suspend annual tax payments for small businesses. The bill would amend Sections 17935, 17941, 17948, and 19001, and add Section 19001.5 to the Revenue and Taxation Code. This measure contains an urgency clause and would take effect immediately upon enactment if passed by 2/3 of both houses of the Legislature.

Existing California law imposes taxes on corporations including an annual tax for doing business in this state. Section One of the bill would amend Revenue and Taxation Code Section 17935 by adding subdivision (g) as follows: “Notwithstanding Section 19001, for taxable years beginning on or after January 1, 2020, for every limited partnership that is a small business, as that term is defined by Section 14837 of the Government Code, payment of the tax imposed by this section shall not be due, and penalties or interest related to the payment of the tax for those taxable years shall not accrue, until the state of emergency declared by the Governor on March 4, 2020, related to the COVID-19 virus, has ended.”

Section Two of the bill would amend Revenue and Taxation Code Section 17941 with the same language, applicable to a limited liability company; Section Three of the bill would amend Section 17948 with this same language, applicable to a limited liability partnership. Section Four of the bill would make a technical amendment to Section 19001.

Section Five of the bill would add the same language to new Section 19001.5, applicable to a small business. The definition of “small business” is the same as found in Government Code Section 14837(d)(1)(A), which is an independently owned and operated business that is not dominant in its field of operation, the principal office of which is located in California, the officers of which are domiciled in California, and which, together with affiliates, has 100 or fewer employees, and average annual gross receipts of $15 million or less over the previous three years, or is a manufacturer with 100 or fewer employees.

AB 664 is expected to be heard in its first policy committee in March.

- Committee Versus Floor Lobbying - March 1, 2026

- Fishing Traps in California - March 1, 2026

- What Type of Lobbyist Do You Want to Be? - February 28, 2026

This makes sense, all things considered!

Just open the damn state back up and stop playing around!

So what the bill is saying here is that because you’re shut down, we’re just going to kick the can down the road for you a little, but you will still have to pay the tax for not being able to do business.. Honestly, this bill does not go far enough for the businesses that have been impacted by the onerous shut down orders of the state. To TRULY have an impact, both on the state and for these businesses, it should be written so that until the state of emergency is ended, small businesses (as defined by the current statutes) are absolved of any of the annual tax payments until this state of emergency is over.

Fun and games at the capitol building. Politicians on both sides are all in on the games. Power is power and they all lust for it.

Time to open the state back up, as a matter of fact the time was 10 mos. ago after we “flattened the curve”????

Oh and one other piece of business:

http://www.recallgavin2020.com