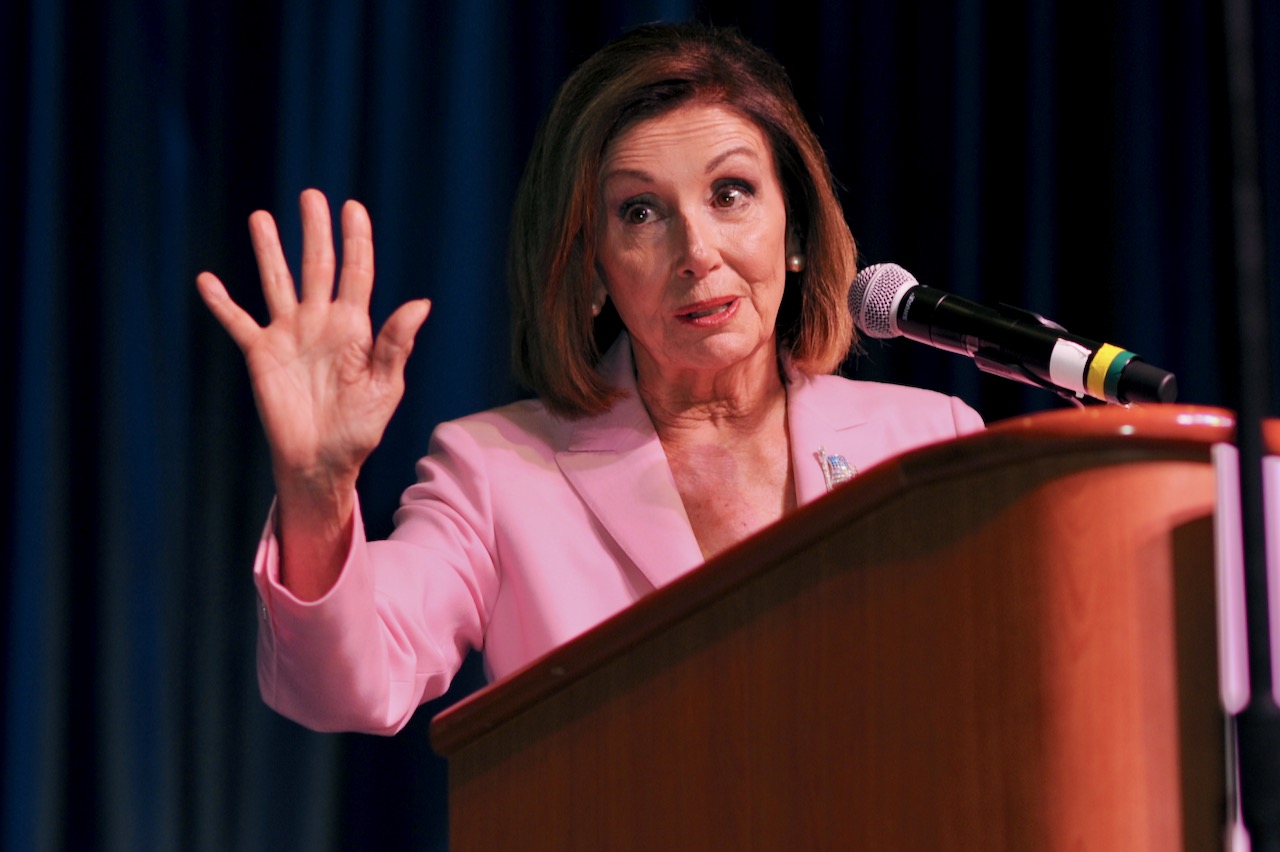

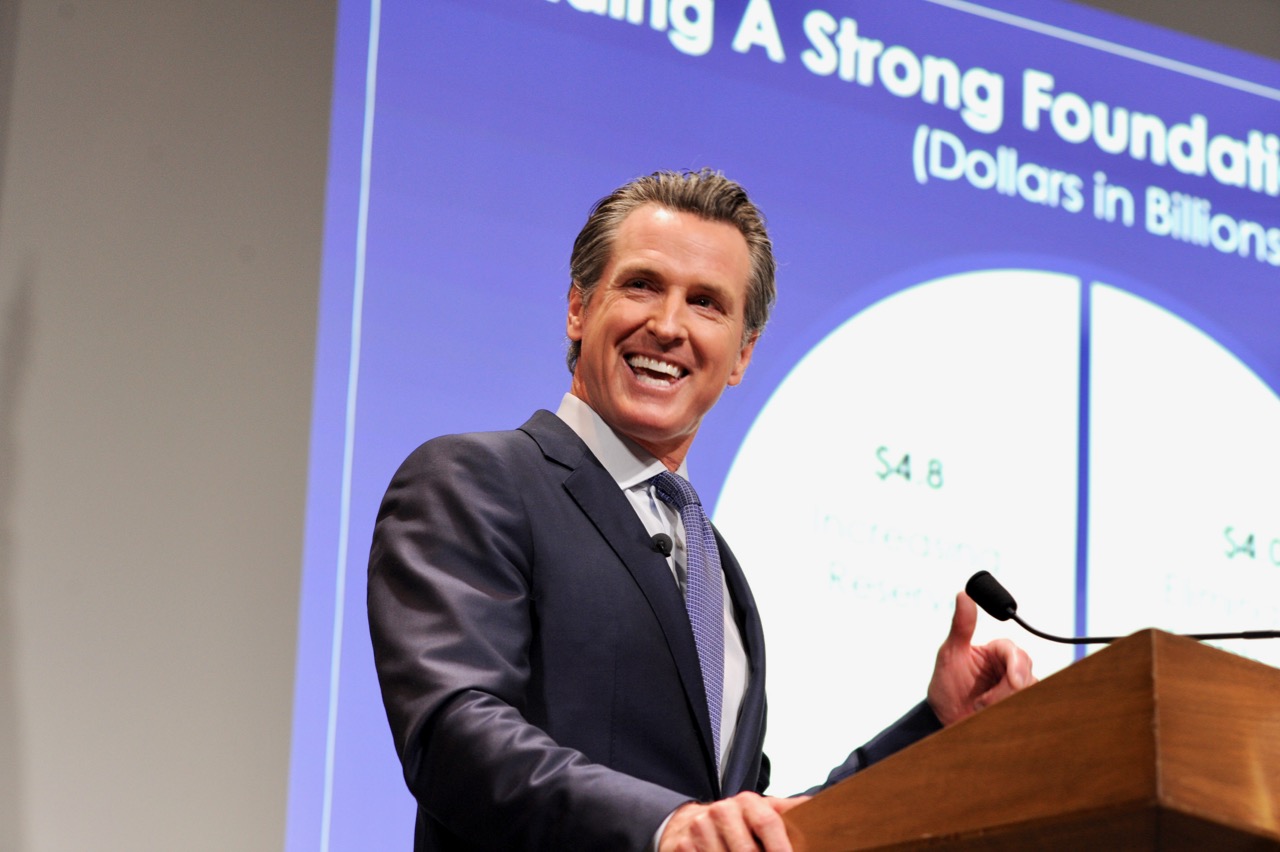

Gov. Gavin Newsom. (Photo: Twitter press conference)

Gov. Newsom Signs Three Small Business Related Bills

SB 1447, AB 1577, SB 115 expected to help small businesses recover from COVID-19, economic downturn

By Evan Symon, September 10, 2020 2:12 am

On Wednesday, Governor Gavin Newsom signed 3 bills into law aimed at assisting small businesses and construction in California.

Three bills signed by Gov. Newsom

Senate Bill 1447, authored by Senator Steven Bradford (D-Gardena), was the first bill signed on Wednesday. The bill institutes the Main Street Hiring Tax Credit, which allows businesses with less than 100 employees to get a tax credit against personal and corporate income taxes each year. The credits are good for $1,000 for each new employee hired between July and November, with a set limit of $100,000 per business.

The bill was tied back into the COVID-19 and economic crisis by having businesses qualify for the credit by instituting a minimum 50% loss of gross income bar from income made last year, ensuring that the credits will go to small businesses directly hurt by the crises.

SB 1447 was immediately put into law following the signing. Businesses will have five years to claim the credit and apply it to taxes that they owe.

Assembly Bill 1577, authored by Assemblywoman Autumn Burke (D-Marina del Rey) was also signed by the Governor. AB 1577 will exclude federal CARES Act funds, such as Paycheck Protection Program loans, Health Care Enhancement Act payments and similar programs from both federal and state income taxes and forgives the debt on them equal to the amount of the recipient;s payroll costs, mortgages, rents, and utility payments.

And finally Senate Bill 115, a Senate Budget and Fiscal Review Committee trailer bill, appropriates $561 million this year in stimulus and construction projects across the state.

“Small businesses are the lifeblood of the economy”

Governor Newsom, signing the bills in a Sacramento Deli, decided to enact the bills to help protect small businesses fiscally after months of uncertainty. During the signing, Newsom noted that surveys in California found that as many as 44% of small businesses were considering closing down due to COVID-19 and the economic crisis, and that the state needed to help them.

“Small businesses are the lifeblood of the economy,” said Newsom on Wednesday. “So often, these open-ended tax credits go to a handful of well resourced companies, not necessarily the companies that need it the most.

“Small businesses are feeling vulnerable to the pressures of this pandemic. So much so that they believe they are likely to close in the not too distant future. That is a jaw-dropping percentage of small businesses that are looking at the prospect of a financial cliff.”

Senator and SB 1447 co-author Anna Caballero (D-Salinas) was at the signing and also gave a short speech in defense of protecting small businesses, particularly those owned and operated by immigrants.

“They’re looking for hope,” stated Senator Caballero. “They’re looking for leadership, and they’re looking for the opportunity to be able to access resources to make them successful. Immigrants come to this country looking for the American dream, and, quite frankly, to California looking for the California dream.

“In many instances, they’re wondering if they’re going to survive this pandemic economically, because of the requirement to shelter in place and to keep their families safe. They need to retain their employees. It’s going to be critically important to them to be able to access this resource.”

Concerns over the bills despite near unanimous support

While the bills were almost all passed unanimously last month, many detractors noted that the budget, especially in upcoming fiscal years, will take a hit due to the loss of projected income stemming from these bills and lost future revenue. Others argued that many businesses already rehiring and hiring after recovering from this spring and summer can take advantage of state programs even if they are financially sound again.

“California is banking on saving small businesses by getting some of that money later rather than not signing these and seeing if they survive for full tax payments later,” explained Texas-based taxpayer watchdog Larry Chambers to the Globe. “California is hedging bets and is keeping small businesses open now to keep the revenue stream going. Other states aren’t doing anything hoping on a full recovery soon.”

“It all depends on the global economic recovery and when COVID-19 goes away. No state is right in what they’re doing right now. It all depends if this is a shorter or longer term problem.”

Assemblyman Marc Levine (D-San Rafael), one of the few members to vote against any of the bills, brought up the point about already recovering businesses taking advantage of the newly signed bills.

“We’re really taking some easy wins with a tax credit so that we can claim that we’ve created more jobs through our legislation,” explained Assemblyman Levine earlier this week. “When in fact these are jobs that probably would be created by a growing economy.”

Unless noted as taking place immediately, the bills will become active starting January 1st.

Governor Newsom, with hundreds of other bills awaiting his signature as of Wednesday, is expected to ramp up his signing and vetoing powers in the coming weeks.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

Recall Gavin 2020! Make California Great Again!1

If small businesses are the lifeblood of the economy why did Noisome stick a knife in their backs? Open up California!

On a more pragmatic manner than the comments above, there is also a bill on the Governors’ desk that requires employers to offer jobs to past employees first. This is not a new job, but a continuance of a job that was interrupted. Would bringing back an employee count under this new tax break. It appears not, since they are talking about new hires. But if you are requiring employers to offer to bring back all previous employees first (even if they were bad employees who were about to be terminated for other reasons), then how can an employer actually get this tax credit. They may never be back to the full strength and bring all people back. They may have found they don’t need them, so they would get no benefit from this bill.

Continued erosion of private contract law…..so sad…..

Let’s be real here folks…

The “pandemic” didn’t kill small businesses or their employees, but overreaction by Democratic legislators hell-bent on tubing the economy to tank Trump’s re-election DID…

Think seriously about the REAL reason the economy is in the dumper… BAD DEMOCRAT POLICIES killed small businesses, and now DUMBASSES like Newsom want to play the benevolent heroes to fix their own screw-ups….

STOP VOTING FOR DEMOCRATS!!! They are EVIL and STUPID….