Bill to Repeal California Tax Credits = Backdoor Tax Increase

$65.2 billion per year in California income tax credits, deductions, exemptions, and exclusions targeted

By Katy Grimes, May 29, 2019 2:05 am

The $65.2 billion per year in various California income tax credits, deductions, exemptions, and exclusions, is now being targeted under the guise of “transparency and accountability.”

Senate Bill 468 by Sen. Hannah Beth Jackson (D-Santa Barbara), would not only seek to repeal these tax credits, it would create a new bureaucracy performing functions currently performed by a number of existing agencies.

Jackson says, “California has nearly 80 tax expenditures. These are provisions in the tax code – including tax credits, tax deductions, sales tax exemptions and income exclusions – that reduce the amount of tax collected in exchange for an intended public policy objective.”

The goal is more tax “revenue” into state coffers, even if that means repealing existing tax credits.

The California Teachers Association, in support of SB 468, said, “California has spent over $66.6 billion on the top ten most costly tax credits and exemptions in the past decade. Every dollar of a tax credit to the General Fund that does not generate its cost in new revenue takes approximately 40 cents out of California’s classrooms, representing the share of revenues that would have gone to Proposition 98 from the General Fund.”

The stated intent of the bill is to promote government accountability, however the bill would create another, costly bureaucracy, through the creation of the California Tax Expenditure Review Board, in an effort to repeal tax credits. As the California Taxpayers Association noted in their opposition, “Both the LAO and the State Auditor can initiate studies under their own authority or at the specific direction of the Legislature.” These agencies often independently analyze and make recommendations to the Legislature – without legislation directing them to do so.

Sen. John Moorlach (R-Costa Mesa) said he was having “buyer’s remorse” on the bill. Moorlach said going after 1031 exchanges to defer paying capital gains taxes on an investment property when it is sold, and ESOP employee benefit plans, should be reconsidered. “I hope another effort comes back instead of this,” Moorlach said.

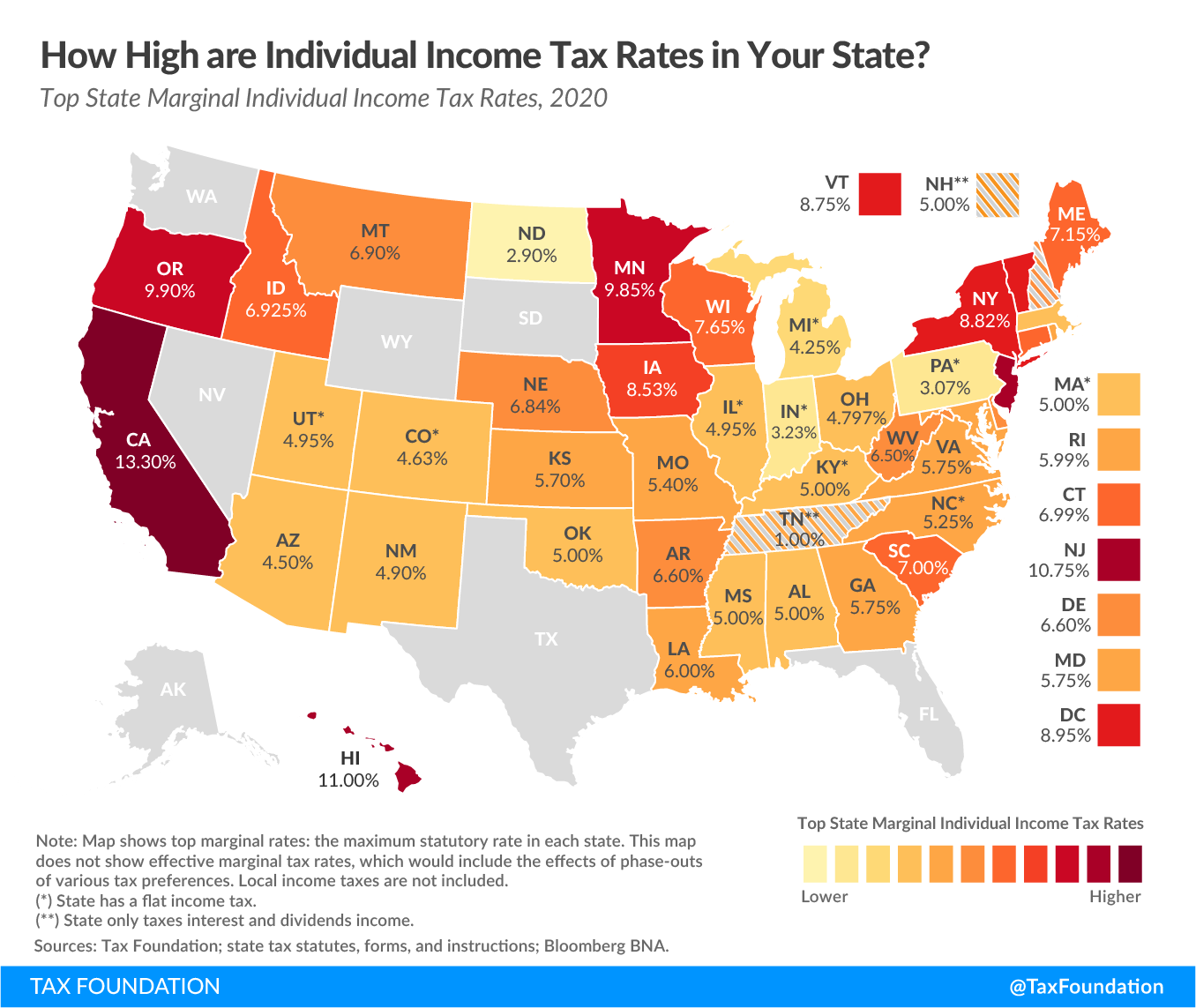

“More recently, the State Auditor conducted an assessment of several of the state’s primary tax expenditures and recommended improvements to some, while noting that others appear to be achieving their objects,” Cal Tax said. “To provide a more accurate and comprehensive assessment of state revenue impacts, we suggest that any tax expenditure study incorporate ‘multipliers’ and their effects on the economy. Additionally, we believe it is critical to examine California’s policies in the context of competitiveness with other areas of the country.”

SB 468 passed the Senate on party lines.

- Chevron Warns of Irreversible Harm to California’s Economy and Energy Security in Letter to gov. Newsom - March 4, 2026

- St. HOPE Charter School Teachers Seeking to Oust SCTA Teachers Union - March 4, 2026

- Nationwide Gas Prices Jump 11 Cents; California Still Leads with the Highest Gas Prices - March 3, 2026

This is the most expensive “TAX” sate in the union. We tax everything and the tax payers can’t even get roads without potholes. Why in the world should taxpayers be willing to pay yet another tax which will dribble down the hole of waste and bureacracy? Jesus, give us a break will you! You will chase the wealthy out of the state and then you will be left with nothing. I know we are leaving if you pass SB 378 to increase/establish gift, estate and generation-skipping transfer taxes during life and at death after December 31, 2020. Enough is enough. A tax revolt is coming and you guys are to blame. MJ

““California has spent over $66.6 billion on the top ten most costly tax credits and exemptions in the past decade….”

That’s funny, I thought money I earned was My Money, not a gift from the state.

Screw the greedy CTA.

Exactly!!!

And the other greedy public sector unions that get quid pro quo preferential treatment from liberal legislators all across California….

Wake up and see this for what it is, California voters -it’s a coordinated effort to get you to pay more all the time for limited benefits to you…you’re being ripped off by public sector employee unions!!!

It’s time for another Proposition 13 style uprising by this generation’s “Silent Majority”….

“The California Teachers Association, in support of SB 468, said…”

Full stop here!!!

Anything that is supported by these self-dealing greedy public sector unions should be reflexively rejected by voters…

These unions divert taxpayer funds for their personal benefit and fill the election coffers of liberal legislators like H-B Jackson, who relies on these unions for her re-election funding….

It’s a revolving door for union pension benefits and programs and taxpayers get little in return for their ever-increasing ďemands for more money…

Stop electing Jackson to office Santa Barbara!!!!

The California globalist democrats must raise taxes to reduce the general populations wealth to that of other third world economy’s. The goal is to lower our standard of living so everyone (except our rulers) is equal. Remember Agenda 21 states “private property is not sustainable”. As goes Ca. so goes the nation (unless the people wake up and vote them out)

I left California permanently after that last fuels tax increase by the greedy bureaucrats and corrupt legislators. Time for the remaining same, hardworking folks to depart also. Many lower cost and lower taxed states all over America the beautiful…..