California Bear Flag. (Photo: ca.gov)

Repeal AB 5: Innovation is Key to Recovery

A work environment like the 1990’s movie Office Space is the last thing many innovators want

By Eric Eisenhammer, April 30, 2020 3:08 pm

Millions of Californians have filed for unemployment since the Governor’s March “shelter in place” order, and experts warn the state unemployment fund will be insolvent in two weeks or less if some sort of corrective action is not taken.

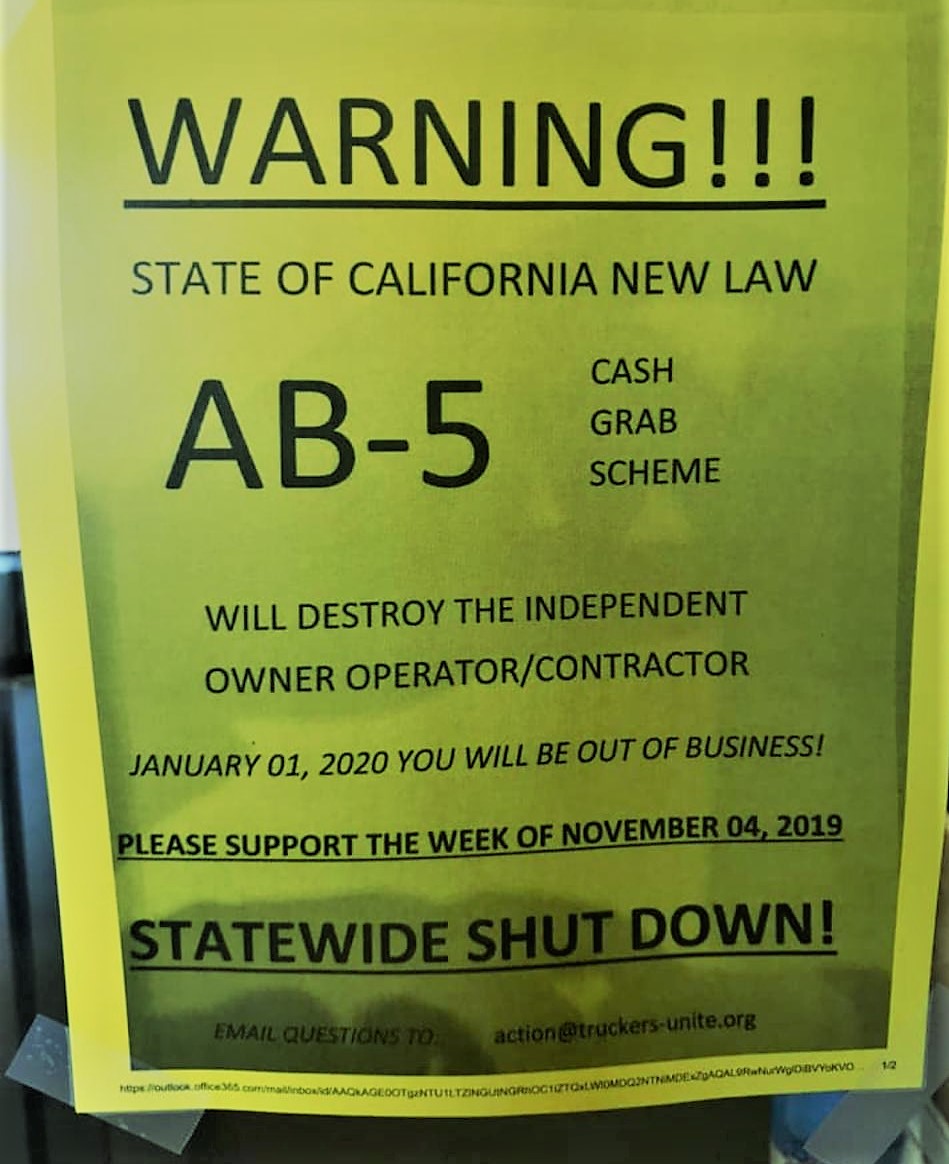

One important action policymakers can take to help us recover quickly is to repeal Assembly Bill 5 completely and immediately. AB 5 involuntarily reclassified many independent contractors as employees, resulting in higher taxes and a loss of flexibility for the workers we will need to power our recovery.

The nonpartisan Legislative Analysts’ Office estimates over 1 million California workers are impacted by AB 5. Among them are technology entrepreneurs including social media managers, bloggers, and digital marketers. Such creative professionals are the iconic tinkerers who have in many instances gained recognition by launching multi-million dollar companies beginning in a garage or a spare bedroom. This phenomenon did not end with high profile successes like Google and Facebook. Freelancers continue to launch successful startups today.

Some people prefer the security of employee status, but many others prefer to be an independent contractor for the flexibility to set their own schedule and work on their own terms. Innovators especially tend to chafe at the idea of a supervisor breathing down their neck. AB 5 stifles innovation by failing to recognize these important differences in people’s work preferences.

The counterproductive law is not only inconvenient and impractical — it also raises taxes. The change in classification from independent contractor to employee causes impacted workers to lose access to a range of tax deductions. A worker earning $50,000 with $15,000 in deductions could experience a tax increase of $3,000 or more. Tax deductions workers lose as result of AB 5 include vehicle mileage and wear and tear, equipment expenses, and subscriptions to trade publications.

Much of California’s current economic success has resulted from the innovation of Silicon Valley, where economic growth has reached 4 percent annually, about twice the rate of the country as a whole. We will need to tap into this innovative spirit to get our economy back on course.

When economists convened at a recent Stanford University summit on innovation, economists noted freedom to experiment and a willingness to embrace creative destruction as factors separating economies that thrive from those that have stagnated. Harvard Business Review named an opportunistic mindset pre-wired for novelty as first among five characteristics of innovators. HBR further noted non conformity among the traits shared by successful innovators.

If we are to regain our economic footing, we should celebrate the uniqueness of innovators and give them the freedom to do what they do best. AB 5 proponents may sincerely believe replacing flexible positions with employee positions does workers a favor. But a work environment like the 1990’s movie Office Space is the last thing many innovators want and it’s also the last thing our economy needs right now.

- Republican Campaign Worker Jordan Tygh is Standing Up to Liberal Bullies - May 18, 2021

- Repeal AB 5: Innovation is Key to Recovery - April 30, 2020

2 thoughts on “Repeal AB 5: Innovation is Key to Recovery”