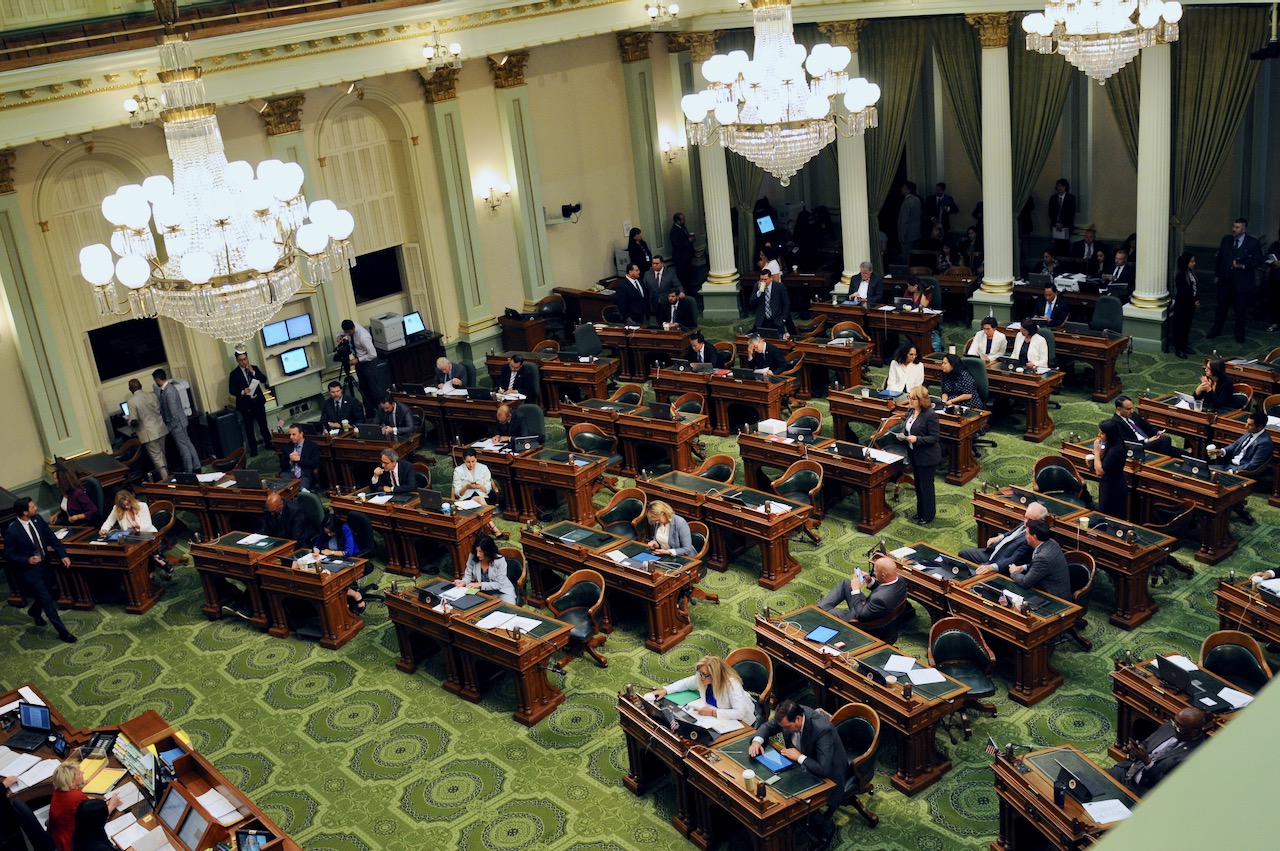

California State Assembly. (Photo: Kevin Sanders for California Globe)

Section 2229 Waivers in California Legislation

What is the purpose of this language?

By Chris Micheli, April 12, 2022 7:21 am

When readers are looking at bills that affect the California Revenue and Taxation Code, they might come across the following provision that would be near the end of a bill:

Notwithstanding Section 2229 of the Revenue and Taxation Code, no appropriation is made by this act and the state shall not reimburse any local agency for any property tax revenues lost by it pursuant to this act.

What is the purpose of this language? Revenue and Taxation Code Section 2229 requires the state to reimburse “any classification or exemption of property for purposes of ad valorem property taxation enacted by the Legislature.” As a result, the language above would be included in a bill that provides a classification or exemption from the imposition of the property tax. And, the language above is a disclaimer that reimbursement of lost revenues would not be required.

Pursuant to Section 2229, the reimbursement must be made when funds have been appropriated by the Legislature. In addition, the Legislative Analyst is required to review any classification or exemption of property to which this section is applicable and must report to the Legislature on its general economic effects. This report must be submitted at least one year prior to the date on which the classification or exemption is scheduled to terminate.

So, when a bill proposes a classification or exemption from the property tax, the bill can remain silent, in which case the Legislature must reimburse local governments for the lost revenues attributable to that exemption. On the other hand, if the Legislature does not want to reimburse local governments for their loss of revenue, then the above disclaimer language must be included in the bill.

- Probate Code Could Be a Basis for Statutory Interpretation Principles - February 22, 2026

- Conservation Banks - February 22, 2026

- Mergers of Unincorporated Associations - February 21, 2026