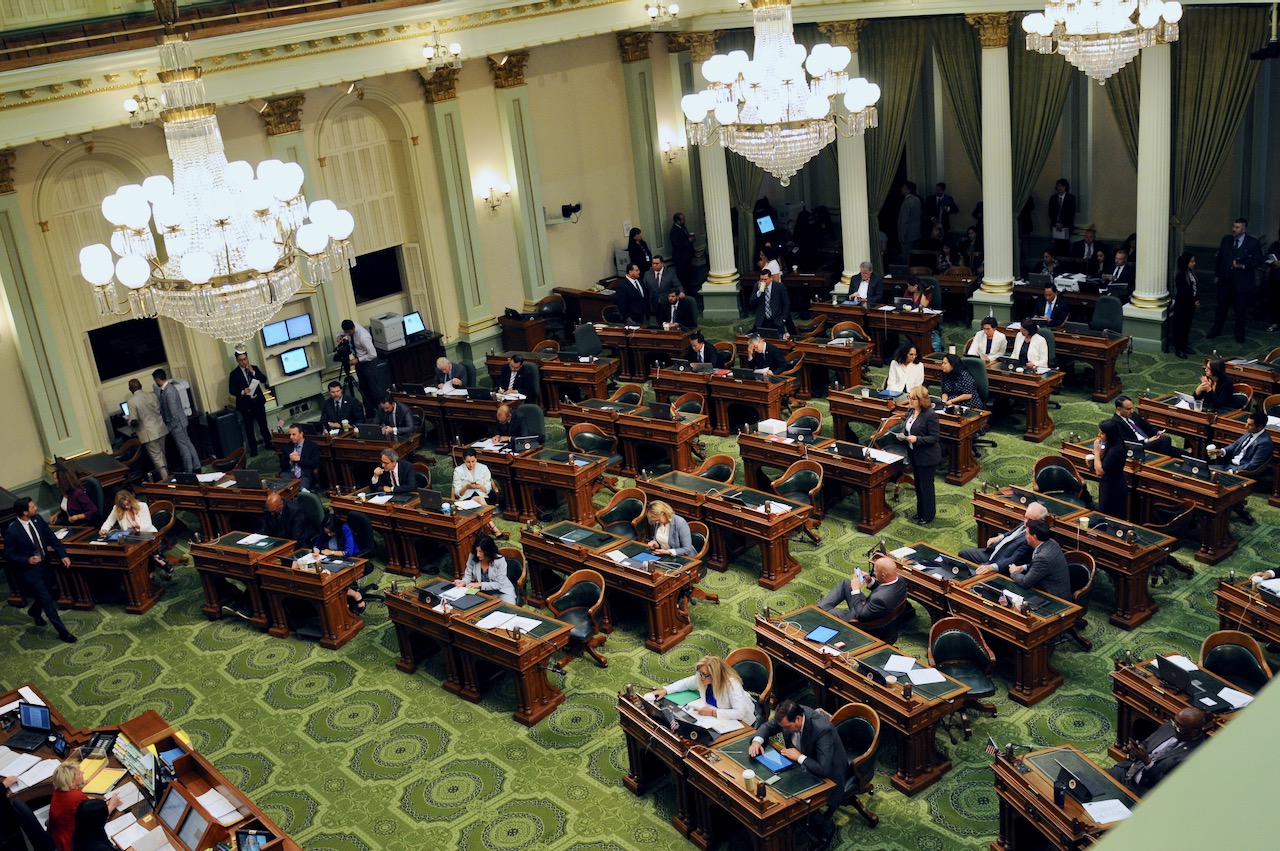

California State Capitol. (Photo: Kevin Sanders for California Globe)

Unique Provisions of California’s Budget Bill – Part II

The California state budget is the largest in the nation

By Chris Micheli, October 23, 2022 5:36 pm

The California state budget is the largest in the nation, and it also represents the largest bill in page length and number of provisions. While its provisions are too many to cover, there are a number of them that are unique and readers should be aware of them. This article is the second in a series.

So, what are some of these unique provisions of California’s Budget Bill?

Capturing All Amendments

In this section of the budget bill, it is intended to capture not only the budget act, but also any acts that amend the budget act (e.g., the budget bill junior). The following is the usual language contained in California’s Budget Bill:

SEC. 1.51.

For purposes of this act, a citation to a budget act includes all acts amending that budget act.

Funding Availability

The next section specifies that all of the appropriations contained in the state budget bill are available for expenditure from July 1, 2022 through June 30, 2023 (i.e., the start and end dates of the state’s fiscal year). Almost all state monies are appropriated from the state’s General Fund.

In addition, this section deals with capital outlay appropriations and specifies the purposes for which those appropriations are allowed. Unfortunately, this section is one that includes a lot of legalese. Note the following: “…any moneys in any special fund created by law therefor, are to be used for any proper purpose, expenditures shall be made therefrom for any such purpose only to the extent of the amount therein appropriated, unless otherwise stated herein.”

In addition to using the highlighted terms, the language itself could be redrafted in an easier way to understand it. The subdivision that follows the above language does not do much better.

SEC. 1.80.

(a) The following sums of money and those appropriated by any other sections of this act, or so much thereof as may be necessary unless otherwise provided herein, are hereby appropriated and available for encumbrance or expenditure for the use and support of the State of California for the 2022–23 fiscal year beginning July 1, 2022, and ending June 30, 2023. All of these appropriations, unless otherwise provided herein, shall be paid out of the General Fund in the State Treasury and shall be available for liquidation of encumbrances in accordance with Section 16304.1 of the Government Code.

(b) All capital outlay appropriations and reappropriations, unless otherwise provided herein, are available as follows:

(1) Studies, preliminary plans, working drawings, and performance criteria, appropriations are available for encumbrance or expenditure until June 30, 2023.

(2) All other capital outlay appropriations are available for encumbrance or expenditure until June 30, 2025.

(c) Whenever by constitutional or statutory provision the revenues or receipts of any institution, department, board, bureau, commission, officer, employee, or other agency, or any moneys in any special fund created by law therefor, are to be used for any proper purpose, expenditures shall be made therefrom for any such purpose only to the extent of the amount therein appropriated, unless otherwise stated herein.

(d) Appropriations for purposes not otherwise provided for herein that have been heretofore made by any existing constitutional or statutory provision shall continue to be governed thereby.

Budget Control Language

One of the important methods by which the Legislature can exert influence over the state budget is through the use of “budget control language,” which is basically a provision contained in the state budget that places condition(s) on the use of an appropriation.

The following examples comes from the California Budget Bill:

Of the funds appropriated in Schedule (3), $1,500,000 shall be available for administrative costs related to the management and claiming of federal reimbursements for court-appointed dependency counsel. To the extent these administrative costs are able to be reimbursed, any excess funding shall revert to the General Fund.

As the reader can see, these provisions of the state budget bill contain several important provisions that must be included in the annual appropriations measure.

- Attorney Work Product in California - August 7, 2025

- Seaport Infrastructure Financing in California - August 6, 2025

- Exclusive Rights of Pilotage - August 5, 2025

So leftist Democrat legislators have it sewn up.

I’m still trying to figure out how Newsom thinks there’s a “surplus” of money when public pension remains “unfunded”.

The idea of the 51st state of New California sounds better every day.