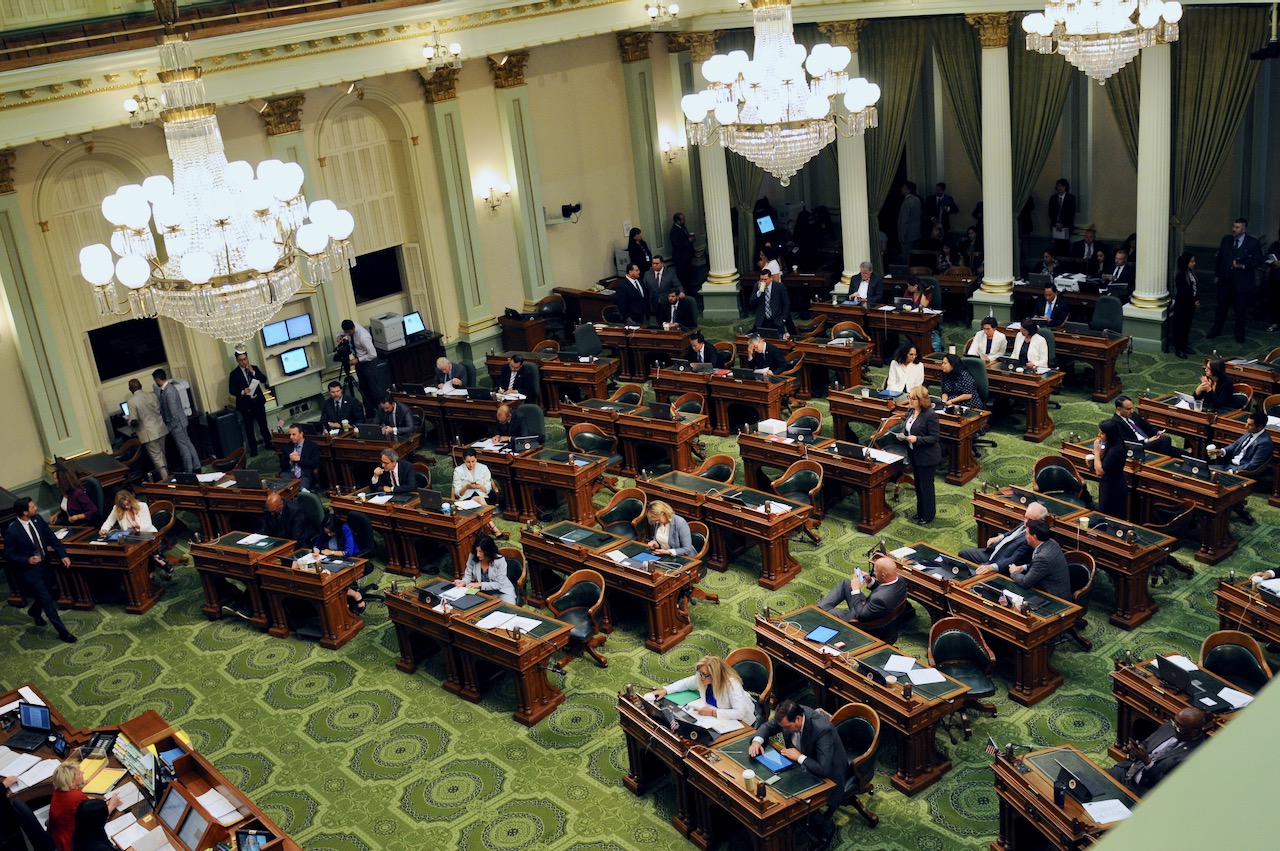

California State Capitol. (Photo: Kevin Sanders for California Globe)

Unique Provisions of California’s Budget Bill – Part IV

The California state budget is the largest in the nation

By Chris Micheli, October 25, 2022 3:46 pm

The California state budget is the largest in the nation, and it also represents the largest bill in page length and number of provisions. While its provisions are too many to cover, there are a number of them that are unique and readers should be aware of them. This article is the fourth in a series.

So, what are some of these unique provisions of California’s Budget Bill?

Savings from Efficiencies

This section, with specified exceptions, requires adjustments to items of appropriation to reflect any net savings achieved through efficiencies or cost-reduction measures. The Director of Finance is granted authority to make adjustments to items of appropriation.

SEC. 4.05.

Notwithstanding any other law, each item of appropriation provided in this act or other spending authority provided outside of this act, with the exception of those for the California State University, the University of California, Hastings College of the Law, the Legislature, and the Judicial Branch, shall be adjusted, as appropriate, to reflect the net savings achieved through operational efficiencies and other cost-reduction measures including, but not limited to, reorganizations, eliminations of boards and commissions, rate changes, contract reductions, elimination of excess positions, and the cancellation or postponement of information technology projects. The Director of Finance shall allocate the necessary adjustment to each item of appropriation or other spending authority to reflect savings achieved. The Director of Finance may authorize an augmentation to any item of appropriation provided in this act or outside this act to reflect the costs related to reorganizations, consolidations, or eliminations of agencies, departments, boards, commissions, or programs. The Department of Finance shall make the final determination of the budgetary and accounting transactions to ensure proper implementation of reorganizations and eliminations.

DOF Reporting

This section is intended to make public how departments use position authority for positions authorized for funding in their respective departments. The Department of Finance is required to report to the Legislature by each January 10 and post this information on its website.

SEC. 4.11.

To promote greater transparency in how departments use position authority, the Department of Finance shall report to the Joint Legislative Budget Committee and Legislative Analyst by January 10 of each year the past year actual numbers for each of the following: (1) percentage of vacant positions for each department, by month; (2) total authorized positions for each department; and (3) average percentage of vacant positions throughout the year for each department. This report shall be posted on the Department of Finance’s website and easily accessible by the public from the department’s eBudget website.

DGS Reimbursements

These sections of the California Budget Bill (Sections 4.72 and 4.75) require reimbursement to the Department of General Services for activities related to engineering assessments and electric vehicle charging infrastructure at state facilities, as well as for centralized costs billed through the statewide surcharge.

Payments for Attorneys’ Fees

Section 5.25 requires payment of attorneys’ fees arising from actions in state courts against state agencies to be paid from items of appropriation that support the state operations of the affected agency, department, board, bureau, or commission. The Controller can only make these payments in full and final satisfaction of the claim, settlement, compromise, or judgment for attorney’s fees incurred in connection with a single action.

Eligibility for Federal Programs

This section (Section 8.50) provides, in making appropriations to state agencies that are eligible for federal programs, it is the intent and understanding of the Legislature that applications made by the agencies for federal funds under federal programs are to be for the maximum amount allowable under federal law. Therefore, any amounts received from the federal government are hereby appropriated from federal funds for expenditure or for transfer to, and disbursement from, the State Treasury fund established for the purpose of receiving the federal assistance subject to any provisions of this act that apply to the expenditure of these funds.

Use of Federal Funds for Same Purpose

This section authorizes the Director of Finance to reduce state appropriations if federal trust funds are received for the same purpose. The following language provides:

SEC. 8.52.

(a) The Director of Finance may reduce items of appropriation upon receipt or expenditure of federal trust funds in lieu of the amount appropriated for the same purpose and may make allocations for the purpose of offsetting expenditures. Allocations made for the purpose of offsetting existing expenditures shall be applied as a negative expenditure to the appropriation where the expenditure was charged.

Reporting of Federal Fund Reductions

This section expresses the intent of the Legislature for it to be notified when there are reductions to federal funds appropriated in the state budget bill. The following is an example of that language:

SEC. 8.53.

It is the intent of the Legislature that reductions to federal funds appropriated in the Budget Bill enacted for each fiscal year, resulting from federal audits, be communicated to the Legislature in a timely manner. Therefore, notwithstanding any other law, an agency, department, or other state entity receiving a final federal audit or deferral letter shall provide a copy of it to the Chairperson of the Joint Legislative Budget Committee within 30 days.

Collecting Federal Funds for Indirect Costs

This section expresses the intent of the Legislature that the State attempt to collect federal funds for certain state indirect costs. The following is an example of that language:

SEC. 8.54.

(a) It is the intent of the Legislature that the State of California collect federally allowable statewide indirect costs, except where prohibited by federal statutes. If the Department of Finance determines a state agency is not recovering allowable statewide indirect costs from the federal government as required by Sections 13332.01 and 13332.02 of the Government Code, the Department of Finance may reduce any appropriation for state operations for the state agency by an amount not to exceed 1 percent and transfer that amount to the Central Service Cost Recovery Fund, the General Fund, or both, as allocated by the Department of Finance.

Administrative Approval Process for Federal Funds

This section expresses the intent of the Legislature that the State provide flexibility and streamlining of the administrative approval process for providing funds to meet certain matching requirements. The following is an example of that language:

SEC. 8.75.

(a) In order to maximize the state’s receipt of federal funds, it is the intent of the Legislature in enacting this section to provide flexibility and streamline the administrative approval process for providing funds, including funds from the General Fund, to meet state matching requirements and take full advantage of funding opportunities made available under the Infrastructure Investment and Jobs Act (P.L. 117-58). It is also the intent of the Legislature in enacting this section to more generally provide flexibility for budgetary adjustments to appropriations for infrastructure and infrastructure-related purposes, to expend unanticipated federal funds received by the state that are available for such purposes, and offer the use of state funds, if applicable.

(b) In the event that unanticipated formula or competitive fund opportunities are made available for a state department under the Infrastructure Investment and Jobs Act, the Director of Finance may provide the department a letter of commitment, if one is needed, for funds from an existing appropriation, including funds from the General Fund, if the department lacks an alternative viable funding source and provided the proposed use of the additional federal funds is consistent with general uses of the appropriated funds provided as match, to indicate the state’s commitment to meet the state match requirements mandated for Infrastructure Investment and Jobs Act programs.

(c) In the event that unanticipated formula or competitive fund opportunities under the Infrastructure Investment and Jobs Act are awarded to a state department, the Department of Finance may adjust any item in Section 2.00 or create a new item to provide funds from an existing appropriation, including funds from the General Fund, if the department lacks an alternative viable funding source, to meet state match requirements mandated for Infrastructure Investment and Jobs Act programs provided the proposed use of the additional federal funds is consistent with general uses of the appropriated funds provided as match.

(d) The Department of Finance may allocate unanticipated federal funds to effect or reduce, in whole or in part, in an amount equal to the federal funds to be allocated, any item of appropriation for infrastructure and infrastructure-related purposes, including appropriations from existing federal funding sources, if consistent with the purposes for which the unanticipated federal funds were made available. Any savings pursuant to this section shall revert to the fund from which the appropriation was made.

(e) The Department of Finance may create a new budget item to accommodate unanticipated federal funds from the Infrastructure Investment and Jobs Act intended for infrastructure purposes should an applicable item of appropriation not exist in the state budget.

(f) Any adjustment pursuant to this section shall not be made prior to 30 days after the Director of Finance notifies the Chairperson of the Joint Legislative Budget Committee in writing of the purposes of the planned adjustment, and justification for the adjustment amount. The Chairperson of the Joint Legislative Budget Committee, or the chairperson’s designee, may shorten or waive that 30-day period by written notification to the Director of Finance.

- Frequently Asked Questions about State Agency Ethics Training - April 26, 2024

- Frequently Asked Questions about When Elected Officials Take Office - April 25, 2024

- Frequently Asked Questions About Ethics Training for Local Agencies - April 24, 2024

One thought on “Unique Provisions of California’s Budget Bill – Part IV”