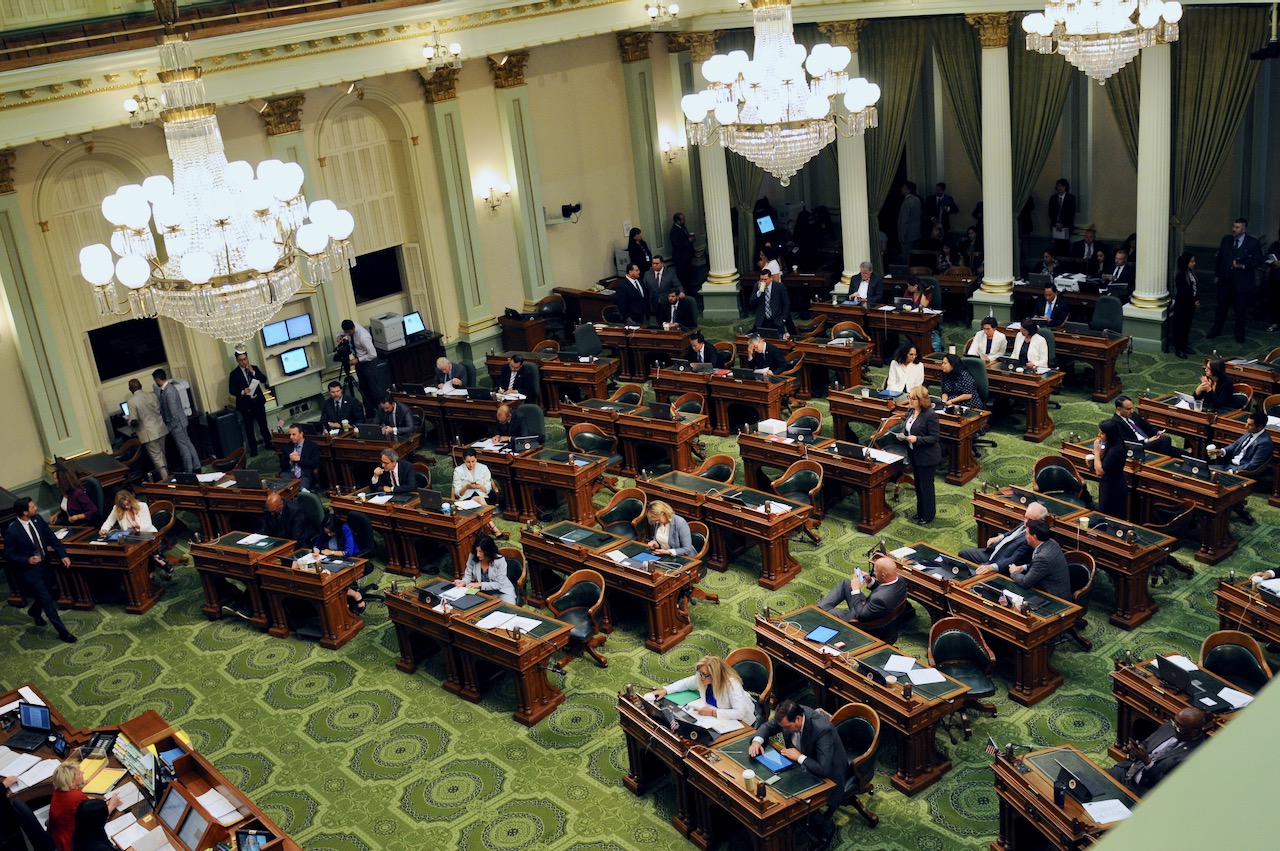

California State Assembly. (Photo: Kevin Sanders for California Globe)

AB 88: Stimulus Payments Trailer Bill

COVID-19 relief measures

By Chris Micheli, March 1, 2021 3:09 pm

On March 1, Assembly Bill 88 was gutted-and-amended as one of the COVID-19 relief measures. As a budget trailer bill, it will take effect immediately once chaptered. The bill is authored by the Assembly Committee on Budget and will amend Section 17131.11 of the Revenue and Taxation Code, amend Section 8151 of and to add Chapter 4.6 (commencing with Section 8152) to Division 8 of the Welfare and Institutions Code.

Section One of the bill would add a cross-reference in the Revenue and Taxation Code. Section Two of the bill would amend Section 8151 of the Welfare and Institutions Code to specify that the one-time $60 grant payments are to be made to grant recipients as of their eligibility date. The Department of Social Services would be granted the authority to establish the eligibility date.

Section Three of the bill would add Chapter 4.6 to the Welfare and Institutions Code, which would be titled “Exemption of Golden State Stimulus Payments and Golden State Grant Payments from Garnishment Orders. It would specify that a Golden State Stimulus payment by the State Controller or the Department of Social Services is automatically exempt from a garnishment order. However, the exemption would not apply to a garnishment order for child support, spousal support, family support, or criminal restitution.

In addition, a financial institution that directly receives from the State of California a Golden State Stimulus Payment is to exempt those payments from any garnishment order if the payment is marked appropriately. The financial institution must identify an exempt deposit using a lookback period during an account review, which the financial institution must perform at least once. The bill would define the terms “account review,” “garnishment order,” and “lookback period.”

Section Four of the bill would set forth legislative findings and declarations to demonstrate compliance with Revenue and Taxation Code Section 41. The purpose of this law change is to provide financial relief for low-income Californians who may have been adversely impacted by the COVID-19.

Section Five of the bill would appropriate $100,000 from the General Fund to the Franchise Tax Board to be allocated to existing California Earned Income Tax Credit outreach contracts to provide increased awareness of the Golden State Stimulus. The bill would also exempt a contract under this section from applicable state contract laws.

Section Six of the bill specifies that the bill is a budget trailer bill and so it will take effect immediately upon being chaptered.

- Frequently Asked Questions about Knowing When an Initiative Is Being Amended - May 1, 2024

- Frequently Asked Question about What Is Subject to Referendum - April 30, 2024

- Frequently Asked Questions about Voting on a Recall Petition - April 29, 2024