Assemblyman Miguel Santiago. (Photo: Kevin Sanders for California Globe)

Assembly Bill To Raise Taxes For Higher Income Earners Faces Tough Legislative Votes

Wealthy Californians and businesses could see tax rates go from 13.3% up to 16.8%

By Evan Symon, August 3, 2020 1:01 pm

On Monday, a recently amended bill that would increase taxes on small businesses and taxpayers making over $1 million of taxable income a year began it’s month-long fight to be passed and approved by the end of the legislative session on August 31st.

An increased tax rate for millionaires, a projected $6.8 billion in additional revenue

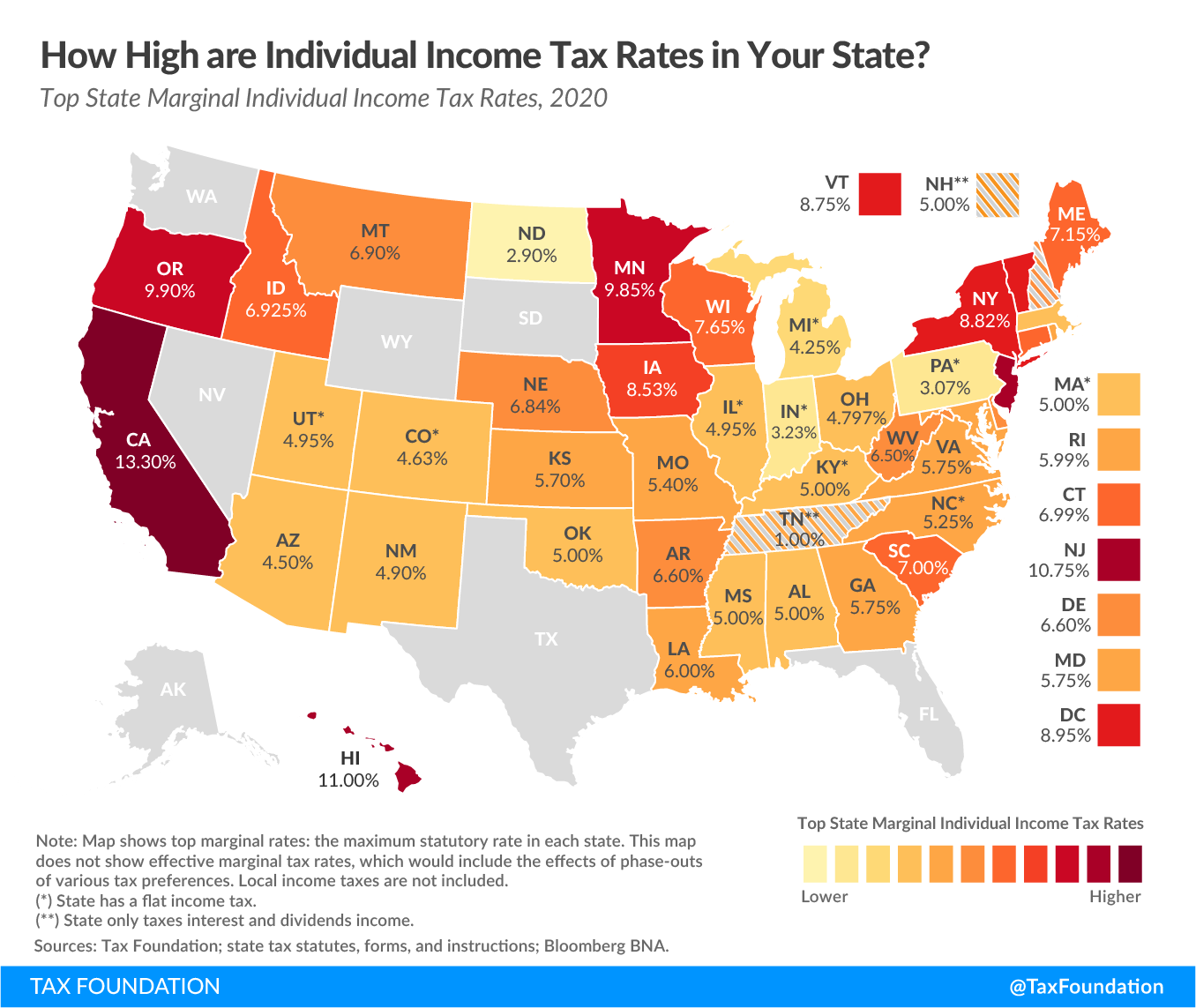

Assembly Bill 1253, authored by Assemblyman Miguel Santiago (D-Los Angeles) would increase the tax percentage for higher income California residents and small businesses from the current 13.3% to as much as 16.8%. For those making more than $1 million of taxable income, the tax rate jumps up by 1%, while for those making more than $2 million, it goes up to 3%. And for those who make $5 million or more a year, the tax rate will be moved up to 3.5%.

The rate itself, if passed, would also be imposed retroactively to the beginning of this year, meaning those paying quarterly taxes could be seeing large adjustments in September if passed and signed by Governor Newsom by then.

Assemblyman Santiago wrote the bill as a way for the state to get more tax revenue following a $54.3 billion state budget deficit being announced earlier this year and a projected drop in state tax revenue by as much as $32 billion next year. He argues that, because of inequalities in California and a greater need for government assistance during the downturn, the wealthiest Californians should pay more, as lower income Californians are suffering the most. The Assemblyman also argued that any revenue-generating idea should be put out there for lawmakers to decide on.

“When you take a look at the state, there’s a lot of pain and suffering out there, and we need to put every idea on the table,” said Assemblyman Santiago. “We’re not talking about increasing taxes on the average person. This is an idea that should be debated.”

The Franchise Tax Board (FTB) has said that, under AB 1253, only .5% of tax filers would be affected. However, as also noted, those 0.5% also paid about 40% of all tax income collected in 2018. If the bill is approved, Santiago has said that this would ultimately bring in $6.8 billion more annually.

However, opponents have said that this is flawed.

Opponents say that tax increase would lead to less millionaires paying taxes, less jobs

“Do you have any idea how many millionaires would leave the state?,” explained Lionel Putney, an account with many millionaire clients in California, to the Globe. “Many of my clients already moved to Texas and Nevada because of that 13.3% rate being the highest in the nation.

“If this happens, we’ll see a mini-exodus, even more than what’s been happening now. So that extra $6.8 billion on top of already paying 40% of all taxes the FTB reported? That would fall significantly. Combined we’re talking billions, especially if some businesses move out as well.

“And that also means job loss. A client of mine who moved from Sonoma County to Harris County in Texas took with him his large consulting business, and that was a few dozen jobs lost in California. It may not seem like much, but when thousands of wealthy people are fleeing, it adds up. Think well-paying business jobs they had. Domestic and landscaping jobs that employed immigrants, some of whom were relying on this job to stay in this country based on their visa. All that city revenue gone, hurting schools and other places.

“Santiago and others want this money to go to schools and replace lost income for social programs, but all it would be doing is replacing money that was leaving because of higher taxes in the first place. It’s a bad idea.”

Other opponents have agreed with this assessment.

“During the worst recession in decades, it would be an astonishingly bad idea to enact a massive tax increase,” said California Taxpayers Association spokesman David Kline.

AB 1253 has also seen some backlash among Democratic Assemblymembers and Senators. Many have stated that they want no real tax increases, with many supporting business organizations that are largely for less taxes.

“It’s also an election year,” added Putney. “Many don’t want to tell their highest donors that they just cost them potentially millions more in taxes. And they don’t want to be known as the reason for a large business moving out of the state from their own district.

“Remember, if this passes, the new rate will be apparent in the quarterlies, almost two months before election day. You can’t backtrack from that.

“Saving social programs to give relief during this crisis can get votes, but taking away jobs and a tax line through raising taxes past a point for wealthier people can lose a lot more.”

AB 1253 is currently awaiting a hearing in the Senate Government and Finance Committee.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

If they refuse to read a basic book on economics (I recommend Thomas Sowell’s “Basics of Economics”), then take the time to look at the results of the last couple tax increases. Did previous tax increases raise State Tax Revenue or did it decrease. Did the last couple tax increases increase the number of larger employers in the state or did it decrease that number. I’ve never earned 5 million a year, but my guess is that someone with that level of income could live wherever they chose. I would guess someone earning 5 million a year would also be able to recognize when local politicians thought they were stupid and would not put up with their nonsense. We have done a poor job of picking leadership in this state.

Marxists have little interest in revenue which is why they shut down the states economy. They simply want to destroy those who have succeeded. Newsoms corrupt friends will get richer and richer no matter what the tax rate is.