Congresswoman Nancy Pelosi speaking with attendees at a Trump Tax Town Hall in Phoenix, February 20, 2018. (Photo: Gage Skidmore)

California Congressional Stock Trading: Members Acquire Wealth While Holding Public Office

Nancy Pelosi defends lawmaker stock trades: ‘We’re a free market economy’

By Katy Grimes, February 27, 2024 8:44 am

Former House Speaker Nancy Pelosi has come under heat for alleged “insider stock trading,” becoming extremely wealthy while holding public office. Pelosi has always defended the trades, saying she isn’t a part of her husband’s stock decision, and denies that Mr. Pelosi made stock trades based on insider information she’s provided.

In 2021 when asked whether lawmakers and their spouses should be prohibited from trading stock while in Congress, Pelosi (D) said, “We’re a free-market economy. [Members] should be able to participate in that,” Pelosi told reporters.

Wait – what?!! Did Nancy Pelosi actually cheer on free markets, sounding like Milton Friedman? Isn’t she an old San Francisco leftist?

Remember the stock sell-offs by members of Congress in the early days of the COVID pandemic, after being privately briefed on the virus – just ahead of the stock market crash?

Pelosi is not alone in acquiring wealth while a member of Congress.

Capitol Trades, which provides U.S. politician stock market activity, reports today:

Former speaker, Nancy Pelosi, has become a poster child in the arena of Congressional Trading for the extensive stock trading trends of her husband, Paul Pelosi. After profiting from several high Market Cap stocks like Alphabet Inc.(GOOGL:US) and NVIDIA Inc. (NVDA:US), she recently reported a trade involving cybersecurity solutions provider, Palo Alto Networks Inc (PANW:US).

On Feb 12 and 21, Paul Pelosi purchased stock options of PANW in two transactions:

- Feb 12: He bought 20 call options with an expiration date of 1/17/25 and a total value between $100,001 and $250,000.

- Feb 21: He bought 50 call options with an expiration date of 1/17/25 and a total value between $500,001 and $1,000,000.

Considering data from the past three years, this is the Pelosis’ first trade in PANW. Other congressmembers who have been trading in the tech stock included Rep. Ro Khanna, who reported two trades of a maximum of $30,000 value under his Spouseand Child’s names. Additionally, Rep. Bill Keating invested up to $15,000 in Palo Alto stock on Jan 24.

Capitol Trades keeps track of members of Congress’ buying and selling stocks. And Pelosi isn’t the only member lining her pockets.

Here is Pelosi’s Capitol Trades dashboard showing 65 (total) trades totaling $55.79 million in volume:

Rep. Ro Khanna (D) has been a busy boy with 14,959 (total) trades totaling $268.52 million.

Other California Congressional Representatives making stock trades include:

Zoe Lofgren (D): 230 trades totaling $2.15 million

Scott Peters (D): 87 trades totaling $39.27 million

Doris Matsui (D): 23 trades totaling $21.05 million

Judy Chu (D): 3 trades totaling $383,000

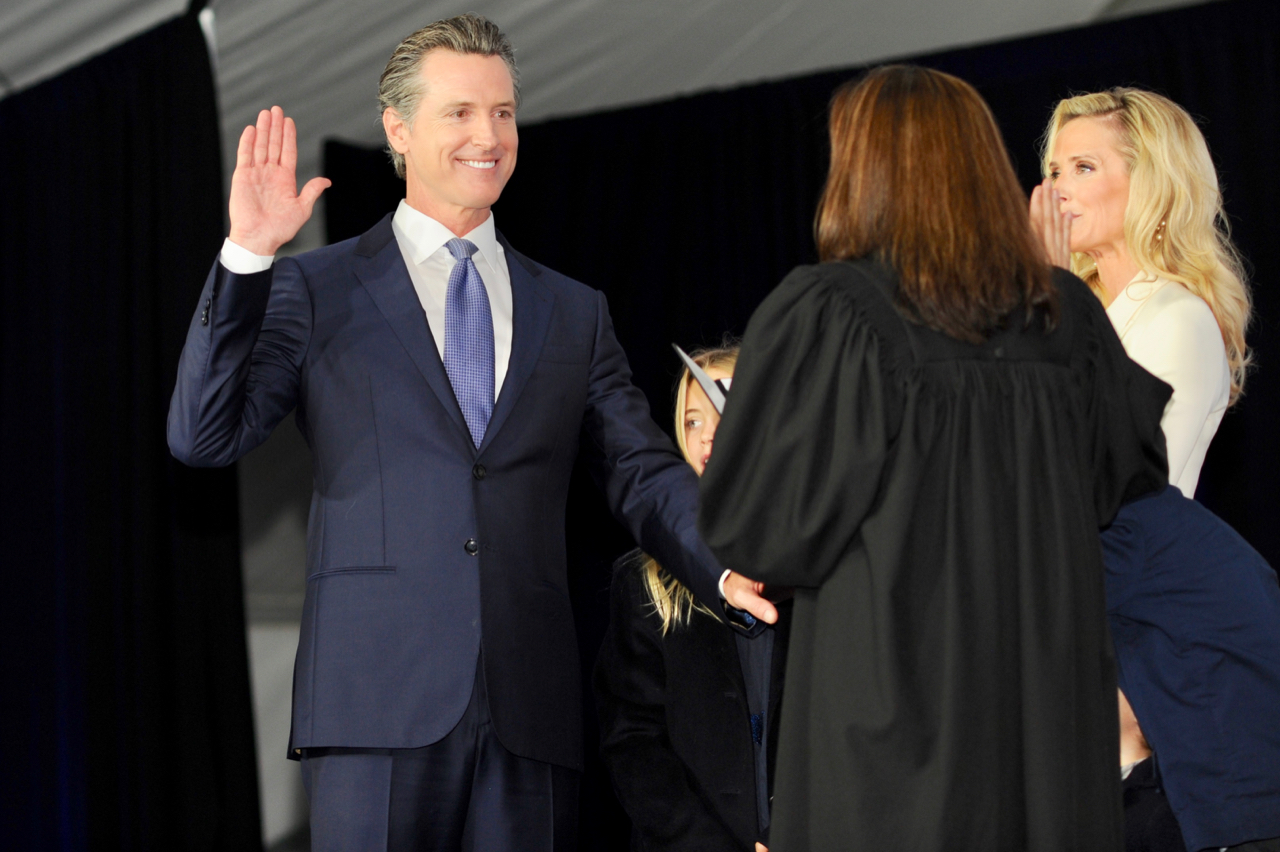

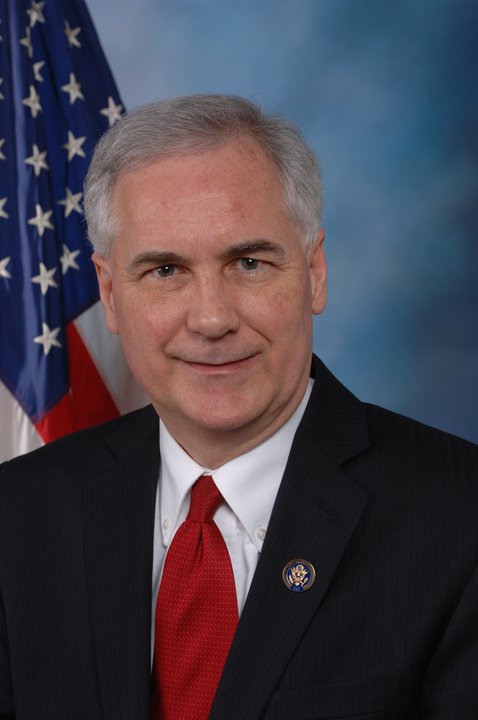

Mike Garcia (R): 20 trades totaling $1.31 million

Alan Lowenthal (D): 193 trades totaling $2.72 million

Brad Sherman (D): 11 trades totaling $3.46 million

Jim Costa (D): 1 trade totaling $33,000

John Garamendi (D): 4 trades totaling $57,000

Adam Schiff (D): 2 trades totaling $41,000

Dianne Feinstein (D) [deceased]: 2 trades totaling $108,000

In 2012 President Barack Obama signed the Stop Trading on Congressional Knowledge Act into law to outlaw trading on nonpublic information by members of Congress, the executive branch and all staff, but also to greatly expand financial disclosures, and make all of the data searchable so insider trading and conflicts of interest would be easier to detect.

However, there are reports that many members of Congress have not and do not fully comply with the law. “They offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant,” Business Insider reported in 2023.

In their 2023 article, “78 members of Congress have violated a law designed to prevent insider trading,” they reported: “Insider and several other news organizations have identified 78 members of Congress who’ve recently failed to properly report their financial trades as mandated by the Stop Trading on Congressional Knowledge Act of 2012, also known as the STOCK Act.” California Reps. Alan Lowenthal and Mike Garcia were on Business Insider’s list

The problem is that even with violations of the STOCK Act, nothing happens.

“A decade after its passage, the STOCK Act has done little to prevent the appearance of corruption and has fallen short of ensuring that Congress is prioritizing the public over their own interests,” campaignlegal.org reports.

Campaignlegal.org acknowledges that the STOCK Act “has provided greater transparency into the stock trading activities of our elected officials, yet it has also highlighted why transparency alone is not enough to prevent the appearance of corruption – or the actual occurrence of corruption.”

While members of Congress are resistant to banning member stock trades, voters want a ban in place. “Three-quarters of voters agree that members of Congress should not be able to trade stocks while serving in office, according to a new poll released Thursday,” the Hill reported in 2022.

The Hill continued: The survey by Convention of States Action, found that 76 percent of voters believe that lawmakers and their spouses have an “unfair advantage” in the stock market. “In an era of hyper-partisanship, voters in all parties agree that members of Congress should not be enriching themselves using ‘insider information’ while serving the people,” Mark Meckler, the group’s president, said in a statement. “This issue has received a lot of attention, and this data verifies the American people want this practice to end once and for all.”

Ironically, in 2022, Rep. Ro Khanna, “the member of Congress with the highest number of possible conflicts of interest stemming from stock trades, the lawmaker’s office told SFGATE he will vote for any of the proposed lawmaker stock trading bans if they come up for a vote on the House floor.”

By 2023, Capitol Trades reported Rep. Ro Khanna, in March 2023, executed a considerable amount of trades, most notably in the healthcare sector.

As per the filing, he bought $65,000 to $150,000 worth of Johnson & Jonson(JNJ:US), $51,000 to $115,000 worth of Unitedhealth Group Inc (UNH:US) and $15,000 – $50,000 of Merck & Co Inc (MRK:US). This was in addition to relatively smaller quantities of other healthcare stocks including Medtronic PLC (MDT:US), Abbott Laboratories (ABT:US), Amgen Inc (AMGN:US), Vertex Pharmaceuticals Inc (VRTX:US), Illumina Inc (ILMN:US), and Moderna (MRNA:US).

Rep. Chip Roy (R-TX) has proposed that members of Congress and spouses to put their investments into a blind trust while they hold office, leaving any trading to investment managers.

Perhaps channeling her inner, ‘near perfect vacuum of outer space’?

That these people are disgusting phonies and hypocrites is the least of it.

More criminal behavior without consequences from our Dem/Marxist ‘Ruling Class.’ Great. Not!

At least we are being reminded of it, for the record, even if our hands are tied at the moment, by Katy Grimes. And what’s on the record will become important again soon, God willing.

They make the rules but never follow them and look how they DOJ treated Martha Stewart for insider trading!!!!!!!

When ever we find out lawmakers are not following the rules, then we call them out and remove them from office. We have the power to do it but will we???

Hmm, so very interesting!

As most of these astute congressional stock trader represent Silicon Valley and areas of California surely know the inside scoop don’t ya think? They socialize and fundraise with the SV elite. Ro Khanna thinks he is being sly trading under his spouse and children’s names!! Yes, they are laughing all the way to the bank, just not to the Silicon Valley Bank😏

Okay! I’m all for “blind trust” I will get my step brothers ex wife to be my investment banker!

Then she can give up her housekeeping job at Marriott!

DUH!

Do any of these “law breakers” get fined or punished?

Heck No! All the outrage is just political theater, same story different day.

“An honest public servant can’t become rich in politics. ”

-attributed to Harry S Truman

Truer words never spoken.

The Stock Act was signed into law by President Barack Obama on April 4, 2012.

It required that ALL public officials to report any stock investments be published in a gov.com database that would be assessable to all citizens of the country.

In November 2011, 60 Minutes reported on Congressional stock investments.

Both sides of the isle “courageously” created The Stock Act.

One year after the act, Spring 2013, all congressional members came up with a amendment that would void public accessibility.

Bills such as this take weeks if not months to hammer out.

But not this time.

On Friday April 11, 2013

The Senate and the House passed the amendment in largely empty chambers using a fast-track procedure known as unanimous consent. It took about 30 seconds.

As it occurred, Congressional members had their suitcases packed and afterwards immediately left DC for Spring Break.

On Monday April 15, 2013 the amendment was signed by president Obama.

The signing occurred the same day as the Boston Marathon Bombing.

“April 15, 2013, the President signed into law:

S. 716, which eliminates the requirement in the STOCK Act to make available on official websites the financial disclosure forms of employees of the executive and legislative branches..”

The amendment did not eliminate reporting completely:

The Cannon House Office Building:

“This is where the public records are kept, for those who can handle traveling to Washington, D.C.,” said,

Craig Holman, the government affairs lobbyist for Public Citizen United

As Katy Grimes noted, many members of Congress have not and do not fully comply with the law. “They offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant,” Business Insider reported in 2023.

It looks like members of Congress from the criminal Democrat mafia are especially guilty of profiting from insider trading?

Not surprisingly Nancy Pelosi and her husband shamelessly are guilty of it. Pelosi is like a corrupt mafia mob boss? She learned everything she knows from her father Thomas D’Alesandro, Jr., who was a constant companion of Benjamin “Benny Tratta” Magliano and the mob. Her father was a congressman from Maryland and then mayor of Baltimore whose political machine was tainted by constant scandal. Pelosi learned about patronage, ruthlessness, and the credo of the party boss: never admit to anything, never apologize, and attack when challenged.

As for Democrat Rep. Ro Khanna, the member of Congress with the highest number of possible conflicts of interest stemming from stock trades, maybe he should voluntarily put his investments into a blind trust while he’s in office instead of waiting for legislation that will force him to do it?

It’s interesting that Democrat Sen. Dianne Feinstein had two trades totaling $108,000 even though she was in failing health and has since died? It looks like Congressional Democrats not only keep voting after they die but they also benefit from insider trading?

The simple solution is to require that elected officials place their finances in a blind trust while they are in office and for one year following returning leaving office but it will never happen. I find it hard to beieve that “Ho” Khanna’s wife and child are that knowledgeable about firewall’s to make any type of informed decision about Palo ALto networks hardware- which btw is the prefered network euipment venor of the State along with CISCO. Ido like the picture of old sack of skin Pelosi though, I wonder which brand of personal lubricant Paul Pelosi prefers on that fist prior to insertion?

What agency of the government is responsible to monitor and report violations of the 2012 STOCK ACT. (I assume that this ACT is Federal Law.) Are these violations CRIMINAL or MISDEMEANORS? And, are these violations actively pursued by the DOJ?