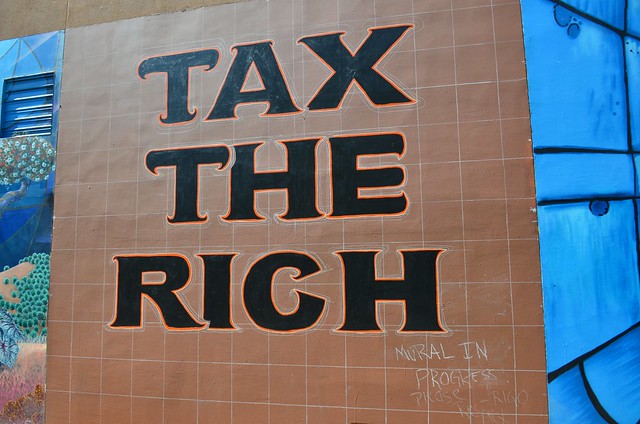

California Wealth Tax Proposed in Constitutional Amendment

ACA 8 would authorize the Legislature to impose a tax upon all forms of personal property or wealth, tangible or intangible

By Chris Micheli, March 23, 2021 11:23 am

On March 22, Assembly Members Alex Lee, Wendy Carrillo, Lorena Gonzalez, Miguel Santiago, Ash Kalra, Luz Rivas, and Mark Stone introduced Assembly Constitutional Amendment 8 to propose a wealth tax to be placed before the voters.

Officially, ACA 8 is a resolution to propose to the people of the State of California an amendment to the Constitution of the State, by amending Section 2 of, and adding Section 37 to, Article XIII thereof, and by amending Section 1 of Article XIII B.

ACA 8 would authorize the Legislature to impose a tax upon all forms of personal property or wealth, whether tangible or intangible, and would require any tax imposed to be administered and collected by the Franchise Tax Board and the Office of the Attorney General as provided in statute. ACA 8 would authorize the Legislature to classify any form of personal property or wealth for differential taxation or for exemption by a majority vote.

In addition, ACA 8 would require the Legislature to establish a task force on wealth tax administration. The task force would determine an adequate level of annual funding and staffing for the administration of a wealth tax imposed by the Legislature. The measure would establish two continuously appropriated funds in the State Treasury to cover, for the first two years of collection, the expenses of administration and collection of the wealth tax.

Finally, ACA 8 would remove the limitation on appropriations of the State and of local governments until such time as specified conditions are satisfied. As a constitutional amendment, ACA 8 would require a 2/3 vote of both houses of the Legislature, and no action by the Governor, in order to be placed on the statewide ballot.

ACA 8 has six “whereas” clauses that are similar to findings and declarations. As such, it declares that the State has long-term needs in education, health care, and infrastructure that are not being met by existing revenues. Wealth inequality among California residents has increased dramatically. California’s current tax system results in the very wealthiest Californians typically pay less because the existing income tax fails to adequately tax the investment income or wealth accumulations. Therefore, a tax on extreme wealth will restore fairness to the state’s tax system.

ACA 8 would amend Article XIII, Section 2 to provide that [new language in italics and removed language in strikeout]: “notwithstanding any other provision of this Constitution, the Legislature may provide for property taxation of all forms of tangible personal property, the taxation of all forms of personal property or wealth, whether tangible or intangible. Personal property or wealth that may be so taxed include, but are not limited to, shares of capital stock, evidences of indebtedness, and any legal or equitable interest therein not exempt under any other provision of this article. therein. The Legislature, two-thirds of the membership of each house concurring, Legislature may classify such personal property or wealth for differential taxation or for exemption. The tax on any interest in notes, debentures, shares of capital stock, bonds, solvent credits, deeds of trust, or mortgages shall not exceed four-tenths of one percent of full value, and the tax per dollar of full value shall not be higher on personal property than on real property in the same taxing jurisdiction.”

In addition, ACA 8 would add a new subdivision to Section 2 to provide that: “Any tax on personal property or wealth imposed under the authority of this section on or after the effective date of the measure adding this subdivision shall be administered and collected by the Franchise Tax Board and the office of the Attorney General as provided in statute.”

ACA 8 would also add Article XIII, Section 37 to provide a task force on wealth tax administration that would be established by the Legislature. This task force would be charged with determining an adequate level of annual funding and staffing for the administration and collection of a wealth tax. An adequate level of annual funding and staffing should additionally enable the Franchise Tax Board to hire and pay reasonable fees to any outside experts or outside counsel as appropriate and to help fully administer and collect the Wealth Tax.

The measure would establish in the State Treasury the Franchise Tax Board Wealth Tax Administration Fund. For each of the first two years for which the Wealth Tax is collected, $50 million or 1 percent of all projected revenues from the Wealth Tax, whichever is greater, would be deposited into the Franchise Tax Board Wealth Tax Administration Fund. During this time period, $25 million or ½ of 1% of all projected revenues from the Wealth Tax, whichever is greater, would be deposited into the California Department of Justice Wealth Tax Administration Fund.

ACA 8 would additionally amend Article XIII B, Section 1 to provide that the State’s appropriations limit, as well as for each local government, would be designated to not apply for any year, unless at least two out of three conditions have been satisfied. These possible conditions include spending per student, fraction of population without health insurance, and percentage of household whose housing costs are in excess of 50% of the household’s income.

The co-authors of the proposed Wealth Tax have described it as a 1% surcharge for amounts above $50 million, and 1.5% for amounts above $1 billion. They also claim there are 169 billionaires in California and so very few taxpayers will be impacted by the measure. They also estimate that the proposed Wealth Tax would generate over $22 billion annually, presumably based on a static economic model.

- Frequently Asked Questions about State Agency Ethics Training - April 26, 2024

- Frequently Asked Questions about When Elected Officials Take Office - April 25, 2024

- Frequently Asked Questions About Ethics Training for Local Agencies - April 24, 2024

Buffoonery and failure of knowing even the basics of Econ 101 in Sacramento is sending the state of CA into catastrophic economic levels, and these idiots in Sacramento keep doubling down on failure. Look at this quote from them: “ACA 8 has six “whereas” clauses that are similar to findings and declarations. As such, it declares that the State has long-term needs in education, health care, and infrastructure that are not being met by existing revenues. Wealth inequality among California residents has increased dramatically.” If anyone has some economic savvy, they know that if you give away everything to ILLEGAL ALIENS who have no right to be here, revenues are definitely not going to meet needs. In a normally run state, if your expenses surpass your revenues, YOU CUT EXPENSES instead of burdening a fragile business climate by raising taxes. CA is already 50th of all states in being a good place to run a business. If this moronic bill sees the light of day, does anyone think that retirees will remain as taxpayers in CA? Or corporations will continue to have a presence here? Hell no!!! Both retirees and corporations, a chunk of the tax base, will go to more financially welcoming states. If CA wants to survive as a state, THE PEOPLE need to fire the DemocRAT majority in Sacramento in favor of fiscally conservative, economic-smart, and law and order political candidates. Otherwise, kiss CA goodbye forever.

We will be kissing California goodbye forever as residents by year end…

There is just too much stupid emotion here and not enough logical thinking…

Nice weather and pretty scenery along the coast though…which will be a lot more affordable when the current owners start selling…

Florida real estate is about to explode…

TAX! TAX! TAX! The most popular word among Democraps. The only other word that is as popular is RACIST!

Hmmm, where did all the money go? Last year we had a surplus?

Gosh is that what happens when businesses have been shut down for a year?

Or is it because the left supermajority burns through money like it was monopoly money.

To name just a few (more) of the horrible expenditures:

1. Bullet train to no where

2. 1 Billion dollar BYD expenditure

3. Perkins Elmer lab 1 billion dollar deal

4. Stockton, Oakland implementing universal income (redistribution of wealth)

5. Navigation Centers and tent cities for the addicted, chronically homeless.

6. The neglected EDD system

It will never be enough money for these greedy give me’s! NEVER!

Feel free to add to my list????

I might add fraud to your list.

Neanderthals

You need taxes of all kinds at all levels for government to enrich/cherish/protect/save your existence…..why is it so hard to see you need more government to provide provide, provide and provide equally.

Queeg, you are always my ray of sunshine! Keep saying the truth!

All of these taxes and regulations have given California among the worst income desparity of any state.. Only the insane think that doubling down on what is not only not working, but achieving the exact opposite of what you want, is a smart thing to do

TAXES ARE RACIST!

This is the next to last step before they ban private property altogether. Yes it is coming and soon.

@CW, you are not being hyperbolic, that is a goal of the World Economic Forum, which consists of the billionaire globalists.

Look it up people this is not conspiracy.

Yup. They are promoting a world where you own Nothing. Not even the clothes on your back.

Taxing *billionaires* is part of a grand scheme *by billionaire* globalists to take away everything from the masses, including the clothes on their back…well, that definitely makes a heap of sense.

I suppose all y’all that are whining are billionaires, yea? No? Well, you have to pay your share of taxes. should they not?

I have had the opportunity to work for a startup founded and funded by an extremely hardworking, creative, humble, kind, charitable and wealthy individual. Over this person’s career, this one person has created many successful companies and well paying careers for hundreds of thousands of individuals. This person has left California. My point is that people of this caliber create opportunities for all us. ACA 8 will be force these creative and productive people out of California. When the likes of Assembly Members Alex Lee, Wendy Carrillo, Lorena Gonzalez, Miguel Santiago, Ash Kalra, Luz Rivas, and Mark Stone lose this tax base, they will come for you. Then what are you gonna do, when they come for you? California voters must reject ACA 8. It will be the death of California.

Unfortunately, most California residents aren’t paying attention to this and it’ll be too late…

The implications of this are pretty staggering actually…

Save yourselves and your earning capacity now, while you can….

THIS IS THE GREAT RESET AGENDA 30 KLAUS SCHWAB SATANIC NEW WORLD ORDER EVENTUALLY THE WEALTH TAX WILL TAKE EVERYTHING YOU OWN.

The politicians do not realize that the cheese can move. There are consequences to any action. At some point, people of means will vote with their feet. We did. We left CA 2+ years ago to live in a lower tax, lower regulatory state with a part time legislature. We were tired of voting against things that we saw as detrimental to businesses, large and small, only to see the item approved overwhelmingly. And, don’t get me started on taxes.

So, we scooted out of the state, easy peasy. I would imagine that those with extreme wealth could easily move to Florida, Nevada, Tennesse, wherever, and still keep a home in California to visit, as long as less than 6 months out of the year and be a non resident. The pols don’t really get it. They think they can nail the cheese to a wall, but the cheese moves 🙂