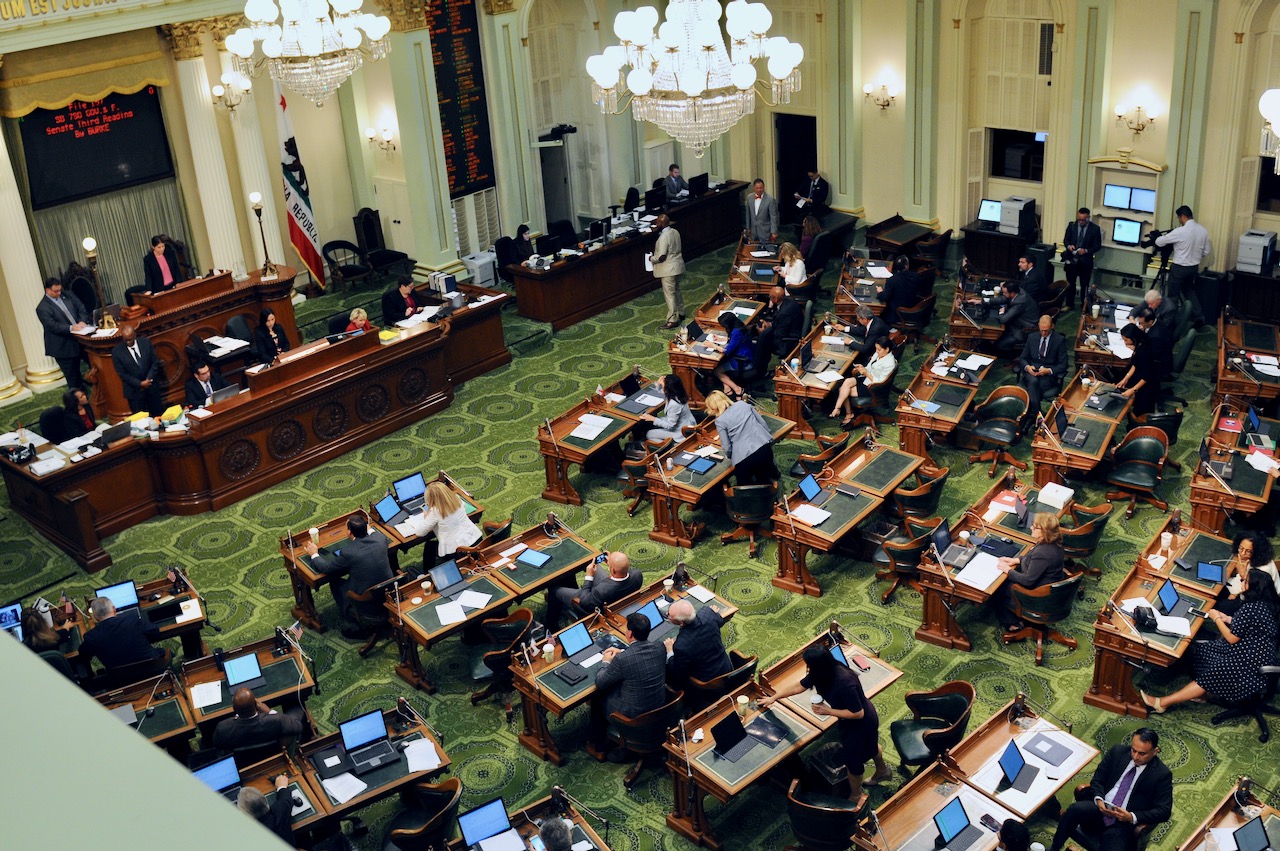

California State Assembly in Session. (Photo: Kevin Sanders for California Globe)

Categories of Bills per Legislative Session

For 2023 – 2024, there were 4,821 bills introduced

By Chris Micheli, September 23, 2024 1:12 pm

In reviewing bills over the past sixteen years in the California Legislature, I compiled the following chart which includes some of the common categories of bills. The chart is broken down by session year and number of bills introduced. Thereafter, among those introduced bills, there are thirteen categories that are listed along with how many bills each year that fit within each of those 13 categories, and the percentage of those types of bills in comparison to the number of bills introduced that session.

For the past seven 2-year Sessions, the numbers are cumulative for those two years and combine Assembly Bills and Senate Bills.

To review the chart, for example in the 2021-22 Session, the total number of ABs and SBs introduced was 4,476. Of those 4,476 bills introduced, 4,077 bills or 91 % of the total introduced bills required a majority vote; 205 of the introduced bills or 5% contained an urgency clause; 342 bills or 8% made an appropriation; 141 bills or 3% were special (rather than general) statutes; 1,316 bills or 29% contained a state-mandated local program; 3,741 bills or 84% were keyed fiscal; 1,120 bills or 25% made legislative findings and declarations; 963 or 22% made statements of legislative intent; 151 bills or 3% were tax levies; 80 bills or 2% contained a severability clause; 483 bills or 11% were ones that would take immediate effect upon enactment (there are four types of bills that fall under this category); 399 bills or 9% required a vote higher than majority for passage; and, 735 bills or 16% were non-fiscal measures.

The following are the statistics for the past 16 legislative years:

| Session Year | Number of Bills Introduced | Majority Vote Required | Contains Urgency Clause | Makes an Appropriation | Is a Special Statute | Mandates Local Program | Keyed Fiscal | Makes Legislative Findings | States Legislative Intent | Is a Tax Levy | Contains Severability Clause | Takes Immediate Effect | Higher Vote Required | Non-fiscal |

| 2023 – 24 | 4,821 | 4,497

(93%) |

176 (4%) | 287 (6%) | 202 (4%) | 1,420 (29%) | 3,935 (82%) | 1,177 (24%) | 947 (20%) | 114 (2%) | 45 (1%) | 407 (8%) | 368 (98%) | 886 (18%) |

| 2021 – 22 | 4,476 | 4,077 (91%) | 205 (5%) | 342 (8%) | 141 (3%) | 1,316 (29%) | 3,741 (84%) | 1,120 (25%) | 963 (22%) | 151 (3%) | 80 (2%) | 483 (11%) | 399 (9%) | 735 (16%) |

| 2019 – 20 | 4,848 | 4,446 (92%) | 197 (4%) | 303 (6%) | 139 (3%) | 1,281 (26%) | 3,779 (78%) | 1,108 (23%) | 1,031 (21%) | 165 (3%) | 65 (1%) | 432 (9%) | 402 (8%) | 1,069 (22%) |

| 2017 – 18 | 4,775 | 4,349 (91%) | 202 (4%) | 402 (8%) | 170 (4%) | 1,223 (26%) | 3,692 (77%) | 1,006 (21%) | 912 (19%) | 195 (4%) | 35 (.7%) | 508 (11%) | 426 (9%) | 1,083 (23%) |

| 2015 – 16 | 4,418 | 4,037 (91%) | 255 (6%) | 354 (8%) | 3 (.06%) | 1,115 (25%) | 3,399 (77%) | 964 (22%) | 881 (20%) | 169 (4%) | 28 (.6%) | 498 (11%) | 381 (9%) | 1,019 (23%) |

| 2013 – 14 | 4,233 | 3,822 (90%) | 284 (7%) | 333 (8%) | 6 (.1%) | 1,022 (24%) | 3,155 (75%) | 900 (21%) | 836 (20%) | 172 (4%) | 44 (1%) | 531 (13%) | 411 (10%) | 1,078 (25%) |

| 2011 – 12 | 4,280 | 3,952 (92%) | 288 (7%) | 327 (8%) | 13 (.3%) | 963 (23%) | 3,115 (73%) | 895 (21%) | 930 (22% | 143 (3%) | 46 (1%) | 523 (12%) | 328 (8%) | 1,165 (27%) |

| 2009 – 10 | 4,294 | 4,158 (97%) | 458 (11%) | 310 (7%) | 20 (.5%) | 981 (23%) | 3,481 (81%) | 922 (21%) | 1,076 (25%) | 214 (5%) | 34 (.8%) | 645 (15%) | 136 (3%) | 813 (19%) |

| Averages Over 15 Years | 4,248 | 4,037 (95%) | 247 (6%) | 315 (7%) | 73 (2%) | 1,083 (25%) | 3,308 (78%) | 953 (22%) | 918 (22%) | 160 (4%) | 46 (1%) | 480 (11%) | 333 (8%) | 941 (22%) |

As a result of these statistics, legislative observers could say that, on average over the past 15 years, the California Legislature has introduced 4,248 bills during its two-year sessions and, of those 4,248 bill introductions, over an average of two years, the following types of bills are the following percentages of those introduced bills:

- 95% require a majority vote

- 6% contain an urgency clause

- 7% make an appropriation

- 2% are special statutes

- 25% contain a state-mandated local program

- 78% are keyed fiscal

- 22% contain legislative findings and declarations

- 22% contain legislative intent statements

- 4% are tax levies

- 1% contain a severability clause

- 11% would take effect immediately (there are four types of bills in this category)

- 8% require a higher vote threshold than a majority vote, including 2/3, 4/5, etc.

- 22% are non-fiscal

- 3% would name the act contained in the bill

- Renewal of Judgments - February 18, 2026

- Hearings on Third-party Claims - February 18, 2026

- Cullen Earthquake Act - February 17, 2026