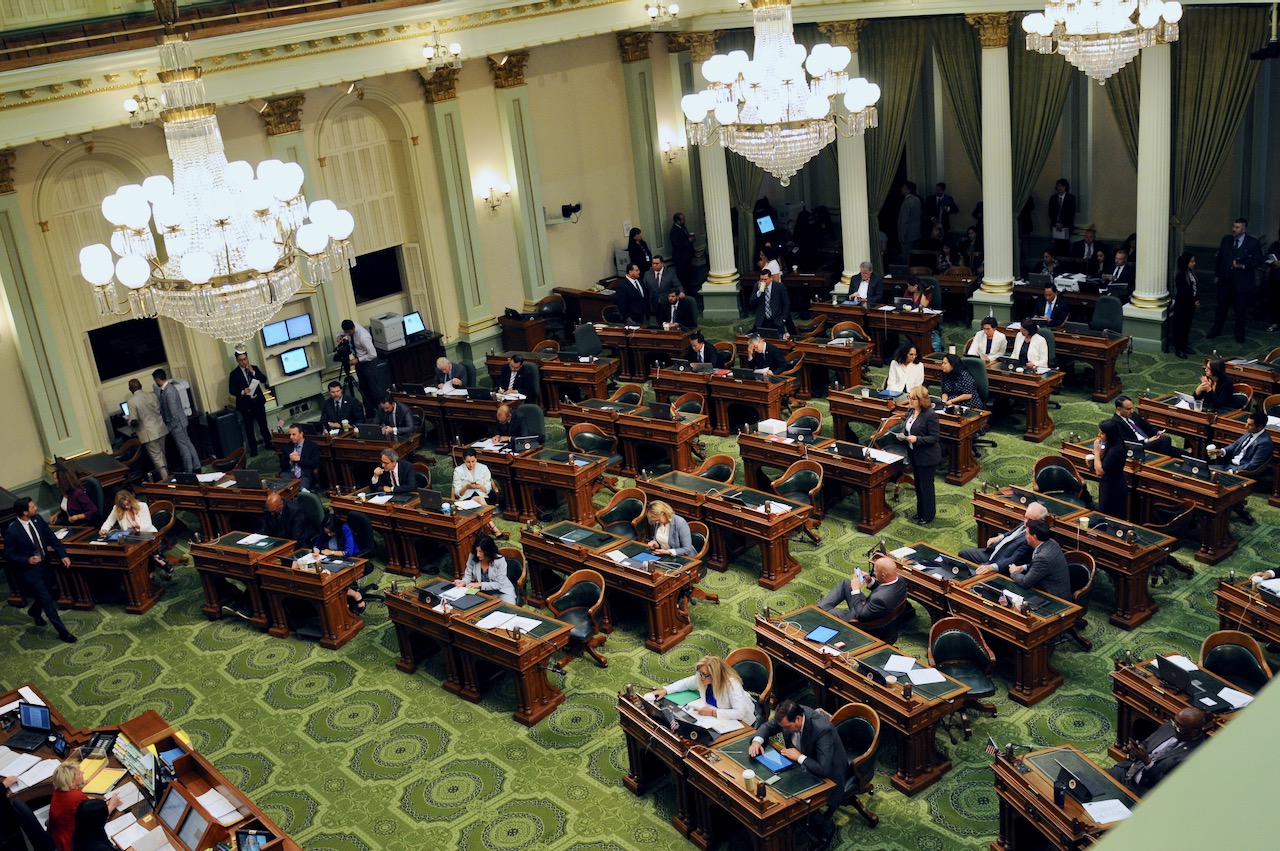

California Assembly Chambers. (Photo: Kevin Sanders for California Globe)

Drafting California Bond Legislation

A general obligation bond bill must be approved by the voters

By Chris Micheli, December 9, 2021 3:54 pm

Bills in the California Legislature can enact a bond, but those must go before the electorate before the state’s Treasurer can issue those bonds and go to the financial markets. There is a common misconception that all bond measures are approved only by the Legislature.

However, a bill authorizing the sale of state general obligation bonds to finance specified projects or activities is a bond measure and, subsequent to its enactment, a general obligation bond bill must be approved by the voters. What are the main provisions of a bond bill?

In the bill’s Title, after the Relating Clause, there will be phrase similar to the following: “…by providing the funds necessary therefor through an election for the issuance and sale of bonds of the State of California and for the handling and disposition of those funds.”

In the Legislative Counsel’s Digest, there will be a description of the bill similar to the following: “This bill would enact the __ Bond Act of 2022 to authorize the issuance of bonds in an amount not to exceed $___ million to provide funding for the ____. The bill would provide for the handling and disposition of the funds.” There will also be a sentence at the end of the Digest similar to the following: “The bill would provide for the submission of the bond act to the voters at the June 7, 2022 statewide primary election.”

In addition, the Legislative Counsel’s Digest Keys would look like the following:

Vote: 2/3 Appropriation: no Fiscal Committee: yes Local Program: no

In the next part of the bill, the substantive text adding or amending statutory language, the following or similar language would be set forth to be codified by enactment of the bill:

“The State General Obligation Bond Law (Chapter 4 (commencing with Section 16720) of Part 3 of Division 4 of Title 2 of the Government Code), as amended from time to time, except as otherwise provided herein, is adopted for the purpose of the issuance, sale, and repayment of, and otherwise providing with respect to, the bonds authorized to be issued by this article, and the provisions of that law are included in this article as though set out in full in this article. All references in this article to “herein” refer both to this article and that law.

“Bonds in the total amount of ___ hundred million dollars ($___), not including the amount of any refunding bonds issued pursuant to Section ___, may be issued and sold to provide a fund to be used for carrying out the purposes expressed in subdivision (b) and to reimburse the General Obligation Bond Expense Revolving Fund pursuant to Section 16724.5 of the Government Code. The bonds, when sold, issued, and delivered, shall be and constitute a valid and binding obligation of the State of California, and the full faith and credit of the State of California is hereby pledged for the punctual payment of both principal of, and interest on, the bonds as the principal and interest become due and payable.

“The bonds authorized by this article shall be prepared, executed, issued, sold, paid, and redeemed as provided in the State General Obligation Bond Law (Chapter 4 (commencing with Section 16720) of Part 3 of Division 4 of Title 2 of the Government Code), as amended from time to time, and all of the provisions of that law, except subdivisions (a) and (b) of Section 16727 of the Government Code, shall apply to the bonds and to this article and are hereby incorporated in this article as though set forth in full in this article.

“Notwithstanding Section 13340 of the Government Code, there is hereby appropriated from the General Fund in the State Treasury, for the purposes of this article, an amount that will equal the total of the following: (a) The sum annually necessary to pay the principal of, and interest on, bonds issued and sold pursuant to this article, as the principal and interest become due and payable.

“For the purposes of carrying out this article, the Director of Finance may authorize the withdrawal from the General Fund of an amount not to exceed the amount of the unsold bonds that have been authorized by the committee to be sold for the purpose of carrying out this article, excluding refunding bonds authorized pursuant to Section ___, less any amount borrowed pursuant to Section ___ and not yet repaid and any amount loaned from the General Fund pursuant to this section not yet returned to the General Fund. Any amounts withdrawn shall be deposited in the fund. Any money made available under this section shall be returned to the General Fund plus an amount equal to the interest that the money would have earned in the Pooled Money Investment Account from proceeds received from the sale of bonds for the purpose of carrying out this article.

“All money deposited in the fund that is derived from premium and accrued interest on bonds sold, in excess of any amount of premium used to pay costs of issuing the bonds, shall be reserved in the fund and shall be available for transfer to the General Fund as a credit to expenditures for bond interest, except that amounts derived from premium may be reserved and used to pay costs of bond issuance before any transfer to the General Fund.

“Pursuant to the State General Obligation Bond Law (Chapter 4 (commencing with Section 16720) of Part 3 of Division 4 of Title 2 of the Government Code), all or a portion of the cost of bond issuance may be paid out of the bond proceeds, including any premium derived from the sale of the bonds. These costs shall be shared proportionally by each program funded through this bond act.

“The ___ may request the Pooled Money Investment Board to make a loan from the Pooled Money Investment Account, in accordance with Section 16312 of the Government Code, for purposes of carrying out this article. The amount of the loan shall not exceed the amount of the unsold bonds that the committee, by resolution, has authorized to be sold for the purpose of carrying out this article, excluding refunding bonds authorized pursuant to Section ___, less any amount withdrawn pursuant to this section and Section ___ and not yet repaid. The ___ shall execute any documents required by the Pooled Money Investment Board to obtain and repay the loan. Any amounts loaned shall be deposited in the fund to be allocated by the board in accordance with this article.

“Any bonds issued pursuant to this article may be refunded in accordance with Article 6 (commencing with Section 16780) of Chapter 4 of Part 3 of Division 4 of Title 2 of the Government Code, which is a part of the State General Obligation Bond Law. Approval by the voters of the state for the issuance of the bonds described in this article includes the approval of the issuance and sale or exchange of any bonds issued to refund any bonds originally issued under this article or any previously issued refunding bonds. Any bond refunded with the proceeds of a refunding bond as authorized by this section may be legally defeased to the extent permitted by law in the manner and to the extent set forth in the resolution, as amended from time to time, authorizing that refunded bond.

“Notwithstanding any other provision of this article, or of the State General Obligation Bond Law, if the Treasurer sells bonds pursuant to this part that include a bond counsel opinion to the effect that the interest on the bonds is excluded from gross income for federal tax purposes under designated conditions or is otherwise entitled to any federal tax advantage, the Treasurer may maintain separate accounts for the investment of bond proceeds and for the investment of earnings on those proceeds. The Treasurer may use or direct the use of those proceeds or earnings to pay any rebate, penalty, or other payment required under federal law or take any other action with respect to the investment and use of those bond proceeds required or desirable under federal tax law or to obtain any other advantage under federal law on behalf of the funds of this state.

“The Legislature hereby finds and declares that, inasmuch as the proceeds from the sale of bonds authorized by this article are not “proceeds of taxes” as that term is used in Article XIII B of the California Constitution, the disbursement of these proceeds is not subject to the limitations imposed by that article.”

Finally, there will like be a “plus section” or two of uncodified language similar to the following:

SEC. 2. Section 1 of this act shall take effect upon the approval by the voters of the Bon Act of 2022, as set forth in that section.

SEC. 3. Section 1 of this act shall be submitted to the voters at the June 7, 2022, statewide primary election in accordance with provisions of the Elections Code and the Government Code governing the submission of a statewide measure to the voters.

The above provisions are not exhaustive, but cover most of the major provisions contained in a bond bill that is considered by the California Legislature.

- Probate Code Could Be a Basis for Statutory Interpretation Principles - February 22, 2026

- Conservation Banks - February 22, 2026

- Mergers of Unincorporated Associations - February 21, 2026

This is where the financially ILLITERATE, LOW-INFORMATION California voters REFLEXIVELY vote in favor of BONDED INDEBTEDNESS, which is what these bills should be REALLY called, because just calling them Bonds gives these LIV’s the impression that this is free money from heaven to support whatever pet project is supposedly funded by it…

Or NOT, in the case of water bonds that were SUPPOSED to be used to BUILD ADDITIONAL capacity or storage but have mysteriously not been used for their intended purpose, several years later…

I will vote against this bill , not only because the state has mishandled important funds in the past, but because California has over spent on every project without accountability or regard for the taxpayers. I have lost all confidence in the present administrations due to their mismanagement of tax dollars and their blatant disregard for transparency necessary and public trust.