For sale/SOLD sign. (Photo: HUD.gov)

New Report Finds 19% Of All Homes in California are Investor Owned

83% of all homes in Sierra County are investor owned

By Evan Symon, July 28, 2025 2:45 am

According to a new report by BatchData, 19% of all homes in California are investor owned, with some counties as high as 80% of the homes bought by speculators.

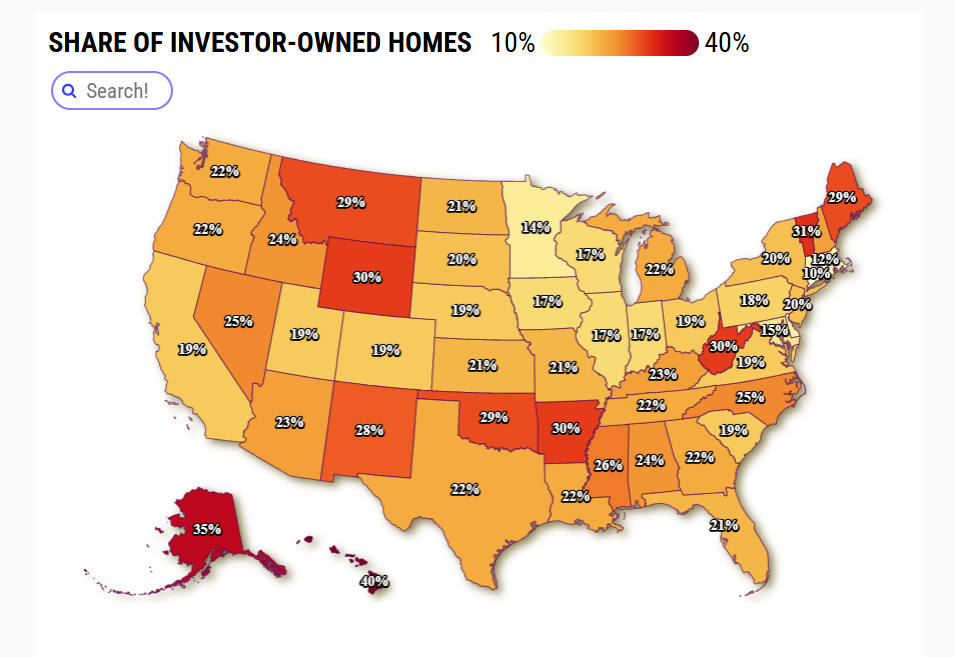

The report found that while California has nearly one-fifth of their homes investor owned, it is still relatively lower than the 20% national average. Out of all states, California is 36th, well beyond states like Hawaii with 40% of homes speculator owned, Alaska at 35% or Vermont at 31%. Below California were Northeastern states like Connecticut with 10% and Massachusetts and Rhode Island with 12% respectively. However, when it came to total number of houses being investor owned, California was second with 1.47 million. Only Texas, with 1.66 million, was higher.

When broken down within the state, California showed some surprising figures. Seven California counties reported 50% or more of total homes as investor owned – Sierra, Trinity, Mono, Alpine, Plumas, Modoc and Calaveras. Sierra County topped the list with a shocking 83% of all homes investor owned. On the opposite end of the spectrum, the most expensive counties managed to keep away the most speculators. Ventura County came in with the lowest percentage total in the state at only 14%. Los Angeles County stood at only 15%, with the Counties of San Francisco, San Diego and Orange at 16%.

All told, the report found that, even with California behind the national average in percentage of homes investor owned, the sheer number in California is playing a role in the housing affordability crisis and the high cost of new homes. While some properties from investors are simply flipped or rented out to people who want to live there, others are kept private for summer home or Airbnb uses. This has caused some Californian cities to crack down on investor owned homes in recent years, with Beverly Hills moving towards a total rental home ban, while others like Santa Ana opted for short-term rental bans.

“With traditional buyers sidelined by affordability constraints, investors are providing essential marked liquidity while targeting distinct property segments and geographic markets,” read the BatchData report.

However, California’s sky high prices have been both a blessing and a curse when it comes to investors. While many big-time housing investors can buy up homes and property in high-rent areas, the high home costs weeds out smaller investors, who account for 85% of all investor owned property in the country. Big-time investors also sell off 76% more properties than they buy. Add in factors like California’s home insurance crisis, many desirable homes being at at-risk areas, and many investor homes being in HOA locations that 70% of home buyers and renters simply don’t want to buy or rent from, and California’s 19% suddenly makes a lot of sense. There’s also the investor nightmare of more and more Californian home sellers opting to go for lower bids if they are being bought by a family or people found to not be speculators.

While BatchData doesn’t go into any housing solutions, it does make clear that California’s current situation is both keeping many investors away and forcing many millionaires to sell homes for millions less than the asking price. At the same time, home affordability remains high thanks in part to investors, as well as California’s median home price currently at $866,100. But with home prices dropping statewide, it is unknown if speculators will buy more or if many looking to buy homes will jump at the chance first.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

The worst thing is when Joe and Mary Normie try to buy a home, before the bank can approve financing a cash offer from an investor snatches it up. Surely the control freaks in the Dunce Dome can find a way to level the playing field.

Each time I am solicited to sell, I share a check list of easily understood criticisms about how their constant harassment does nothing but erode the desire to work hard, make mortgages, stay settled and enjoy life.

I use the phone number and give them a response, apparently they seldom hear. I request removal of my property from ‘The List’ and convince them that contacting me is a bad business model, futile waste of time, energy, $$$ other resources, and then it all seems to rapidly abate.

The Gateway Pundit reported that according to the National Association of Realtors, from April 2024 to March 2025, Chinese nationals spent $13.7 billion on existing homes in the U.S. This represents an 83% jump from the prior year and makes them the top foreign investors in U.S. residential real estate in spending and transaction volume. Senator Josh Hawley (R-MO) introduced the Protecting Our Farms and Homes from China Act in the Senate, Rep. Mary Miller (R-IL) introduced a companion bill in the House.

The Tucker Carlson network released a 95 minute documentary from Maine’s Steven Robinson alleging that Chinese gang trafficking primarily in drugs, are buying up rural U.S. properties and turning them into drug labs. The documentary, “High Crimes: The Chinese Mafia’s Takeover of Rural America,” specifically cites property record searches in the state of Maine, showing not only over 150 properties where this is happening, but also connections between the property transfers, Chinese nationals and criminals, and the Democrat Governor of Maine Janet T. Mills. Maine Governor Mills’ brother, an attorney, appears to be the attorney of record for these property transfers.

Air bnbs are taking over your neighborhoods as well. I recently contacted one rental in a city that prohibits air bnbs. there were multiple owners of a single 1 bedroom apartment on beachfront condo bldg. Of course, when I notified their overlord (in Ireland supposedly although corp headquarters is listed in NoCal) of course you get the run around…..

Air bnbs are taking over your neighborhoods as well. I recently contacted one rental in a city that prohibits air bnbs. there were multiple owners of a single 1 bedroom apartment on beachfront condo bldg. Of course, when I notified their overlord (in Ireland supposedly although corporate headquarters is listed in NoCal) of course you get the run around…..and the air bnb masters continue to gobble up properties in the area in the great ‘get rich quick scheme of the current era

Let me guess. Blackrock, Vanguard and the CCP, three peas in the proverbial pod