US Bankruptcy Court, Eastern District of CA. (Photo: www.caeb.uscourts.gov/Locations/Courts)

U.S. Business Bankruptcies Up 40% Since January 2023; Small Biz up 60%

Companies headquartered in California accounted for over 20% of all filings

By Katy Grimes, July 9, 2024 2:45 am

The American Bankruptcy Institute has bad news: Small business Chapter 11 business reorganization bankruptcy filings increased 60 percent from April 2023 to April 2024. Commercial Chapter 11 business filings increased 40 percent from April 2023 to April 2024, with high interest rates and high inflation to blame.

“Fading hopes of lower interest rates are likely contributing to the increase in filings, as companies that may have held out hope for rate cuts at the beginning of the year come to terms with the reality that they will remain higher for longer,” S&P Global reported.

This is on the heels of the National Federation of Independent Businesses newly released survey showing the highest Small Business “uncertainty” since 2020 during the pandemic, when “nonessential” businesses were forced to shut down, the Globe reported in June. “The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy,” said National Federation of Independent Business Chief Economist Bill Dunkelberg. “But for 29 consecutive months, small business owners have expressed historically low optimism and their views about future business conditions are at the worst levels seen in 50 years. Small business owners need relief as inflation has not eased much on Main Street.”

“Overall commercial filings increased 39 percent in April 2024 to 2,569 from 1,846 in April 2023,” ABI said.

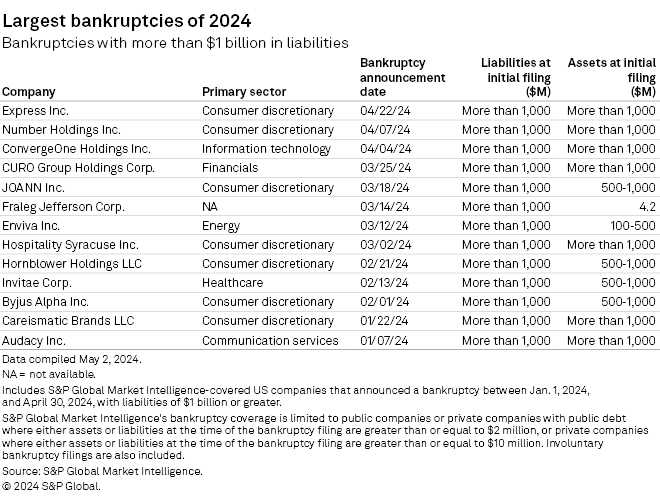

Some of the largest business bankruptcies with more than $1 billion in liabilities include JOANN Inc. fabric and sewing stores, fashion retailer Express Inc., Audacity Inc. audio content and entertainment company, energy company Enivia Inc., and Invitae Corp., a healthcare company.

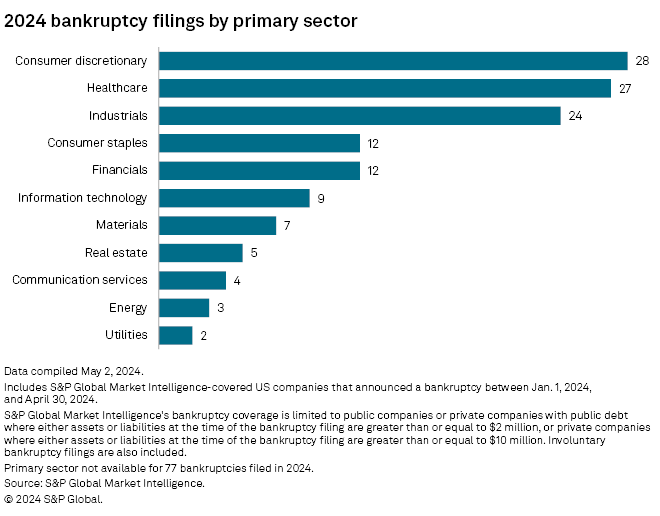

“Consumer discretionary remained the sector with the most year-to-date bankruptcies, with eight additional filings in April. Healthcare also recorded eight bankruptcies for the month, while the industrials sector added five,” S&P Global reported.

None of this is good news.

ABI reports:

- The 45,592 total U.S. bankruptcy filings in April 2024 increased 28 percent from the April 2023 total of 35,497.

- Noncommercial bankruptcy filings also registered a 28 percent increase, to 43,023 in April 2024 from the April 2023 noncommercial total of 33,651.

- The number of consumers filing for chapter 7 increased 33 percent to 26,778 in April 2024 from the 20,199 who filed in chapter 7 last year, while chapter 13 filings increased 21 percent to 16,172 in April 2024 from the 13,398 chapter 13 filings in April 2023.

The Globe counted 8 healthcare bankruptcies in April 2024.

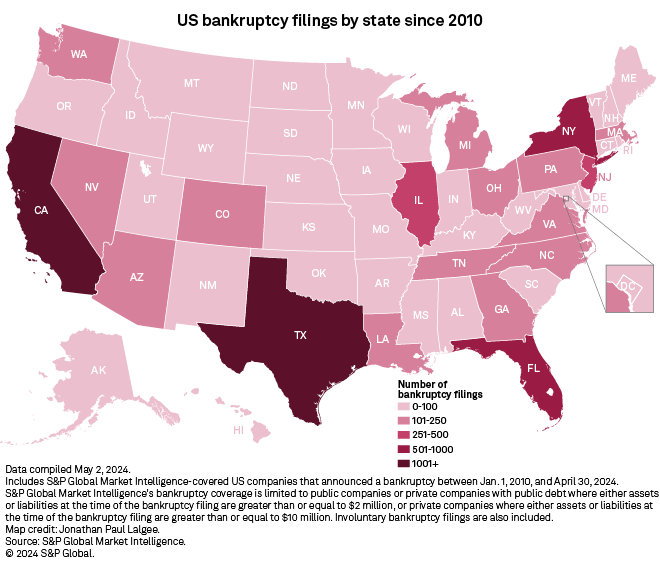

How did California do? “Among individual states, companies headquartered in California accounted for over 20% of all filings, with 14 in April,” S&P Global reported.

Chapter 11 is business reorganization, Chapter 7 is Liquidation, Chapter 13 is Individual Debt Adjustment, referred to as a wage-earner payback plan.

Read more about the NFIB small business “uncertainty” here.

- Bankruptcy filings including all chapters totaled 45,592, a 28% increase from the April 2023 total of 35,497.

- Commercial chapter 11 filings increased 40 percent to 542 in April 2024 from the 378 filings recorded in January 2023.

- Commercial filings were 2,569, a 39 percent increase in April 2024 compared to the 1,846 filed in April 2023.

- Subchapter V small business elections increased 60 percent to 233 in April 2024 from the 146 filings last January.

- Individual filings increased 28% to 43,023 in April 2024 from the 33,651 filed in April 2023.

- Legislation Would Conceal California High-Speed Rail Records from Public - February 18, 2026

- ‘King of Cringe’ Rep. Eric Swalwell isn’t just Weird – He May Have Legal Troubles - February 18, 2026

- Why is Gov. Newsom Giving $90 Million in Taxpayer Funds to Planned Parenthood? - February 17, 2026

One piece of data that is missed is companies that simply dissolve without going through the bankruptcy process.

I have tried to locate statistics on this but have not found them.

You are right and it is data I also have tried to locate. When business owners make the decision to just close and sell off equipment, there isn’t any measurement for that.

The Secretary of State processes Article of Incorporation – ARTS-CL and three different types of forms for Dissolution of a corporation – Form ELEC STK, Form DISS, or Form STK

What would be interesting is to know how many of these forms get processed yearly and if the trend is up or down.

https://www.sos.ca.gov/business-programs/business-entities/forms/corporations-california-domestic

The Biden regime, the Newsom regime and rest of the criminal Democrat mafia in political office are doing everything they can to ensure that as many businesses are shut down as possible? It’s what their nefarious globalist paymasters pay them to do?