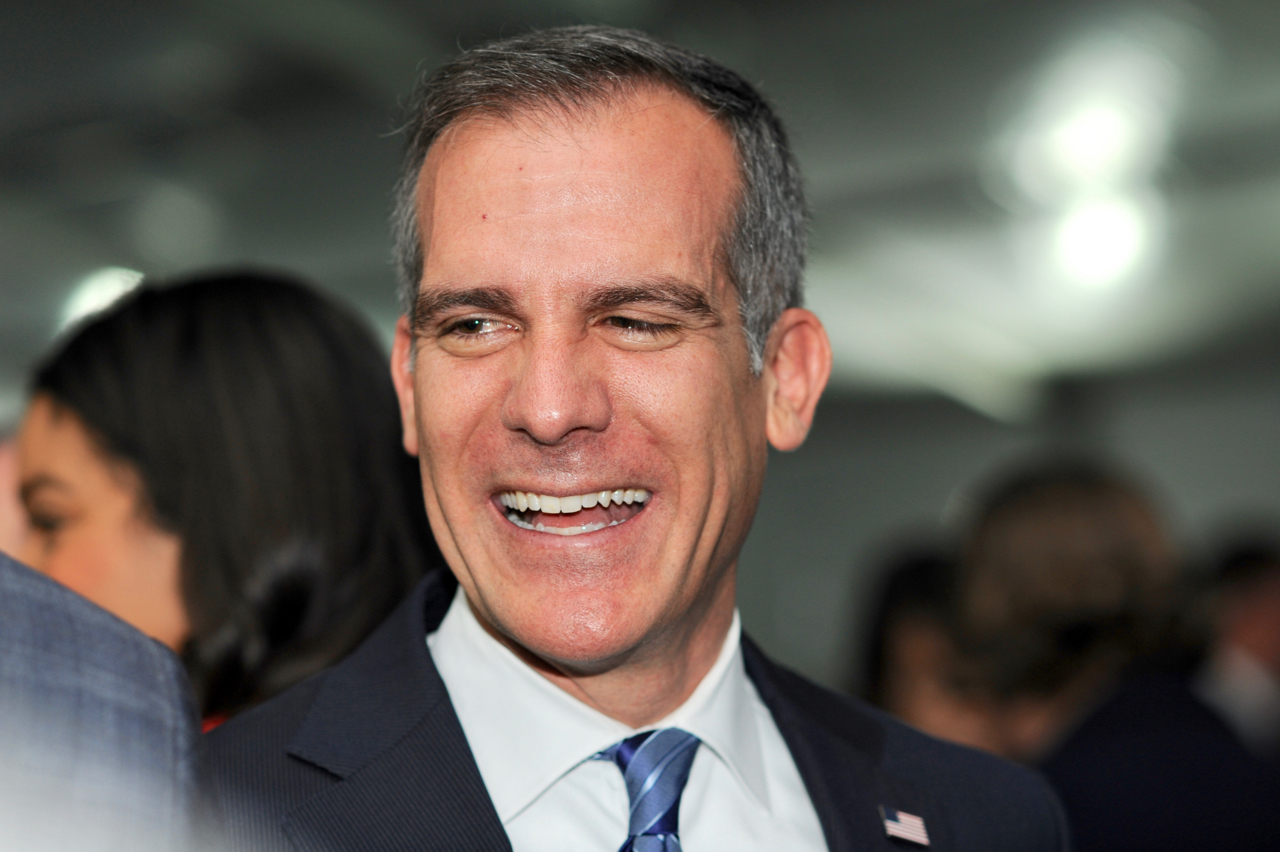

Los Angeles Mayor Eric Garcetti. (Kevin Sanders for California Globe)

Big Blow to Mayor Garcetti in the defeat of Measure EE in Los Angeles

Second time in 10 years LA voters defeat parcel tax increase

By Katy Grimes, June 5, 2019 11:18 am

Following the contentious Los Angeles Unified School District strike in January, the controversial property tax hike proposed by the school district went down in a resounding defeat Tuesday. Measure EE garnered only about 45 percent of voter approval when it needed a two-thirds majority vote to pass.

“Measure EE has been voted down, a rare win for common sense in a region that could use it,” the Los Angeles Daily News reported. “The measure was nothing more than a bailout for Los Angeles Unified’s irresponsibility. Its defeat should discourage the recent wave of tax hikes pitched as the solution for poorly run school systems.”

A yes vote would have authorized the LAUSD to levy an annual parcel tax for 12 years at the rate of $0.16 per square foot of building improvements to fund educational improvements, instruction, and programs.

Democratic Los Angeles Mayor Eric Garcetti and school district officials campaigned vigorously for Measure EE, and were counting on its passage largely for the cash infusion into the nearly insolvent mega-district.

What’s Going on at LAUSD?

California State Sen. John Moorlach (R-Costa Mesa) has issued many warnings about the Los Angeles Unified School District budget crisis, saying it is so big it could wipe out the California budget surplus… and perhaps the state budget.

Moorlach says the LAUSD has the largest unrestricted net deficit of any California school district, at $10.9 billion, and now that the district has to report the retiree medical unfunded liability on the balance sheet means it will increase LAUSD’s deficit by another $15 billion.

“The unrestricted net deficits for 2016 and 2017 were $10.5 billion and $10.9 billion, respectively,” Sen. John Moorlach (R-Costa Mesa) wrote in 2018. “For 2018 it is $19.6 billion, or 80 percent higher!” Moorlach said this is largely the result of net “other postemployment benefit (OPEB) liability and net pension liability for various retirement plans.”

Moorlach’s 2018 report, “Financial Soundness Rankings for California’s Public School Districts, Colleges & Universities,” found two-thirds of the 944 state school districts “bleed red ink.”

“LAUSD ranked 922nd, at a negative $2,315 per capita, based on its 2017 CAFR. Using the LAUSD’s new 2018 CAFR, that number now jumps to a negative $4,180 per capita. This is what every man, woman and child would have to pay to get LAUSD out of its negative condition,” Moorlach found.

This is why Mayor Garcetti and LAUSD officials were counting on passage of Measure EE and the anticipated cash infusion.

Ten years ago, Los Angeles voters were faced with a $100 per year parcel tax to raise about $100 million per year for LAUSD. “Measure E not only failed to reach the required two-thirds majority needed to pass the measure, but it was actually voted down 53 percent to 47 percent,” LADN reported.

“Nine years later, LAUSD is still a fiscal train wreck, and is led by a school board and superintendent who thought the best way to get out of the district’s financial hole was to dig a deeper hole and then ask for a $500 million per year tax increase through Measure EE.”

Notably, Garcetti’s Los Angeles spends one out of every five general fund dollars on retirement benefits for city employees, according to the city’s proposed annual budget.

- CAL DOGE Investigation: $1 BILLION California Solar Program Instead Funded Democrat Voter Registration & Activism Efforts - February 27, 2026

- Could President Trump End the Income Tax? - February 26, 2026

- Trump State of the Union: Democrats Showed They’re Not On the Side of The American People - February 25, 2026

This is great news! A hopeful sign. Especially since No on EE, according to Jon Coupal of HJTA, was outspent 5 to 1. It was further reported by him that the mayor’s henchmen warned business owners who opposed the parcel tax that “they would never work in this town again” or words to that effect. Also from Jon Coupal, and if I heard it right he is now looking into this with FPPC, it appears that tax dollars were used to push the tax, in the various ways this has always been done with impunity, to the point that I guess city and county and district and state leaders now think it’s legal, which it isn’t.

“What’s going on at LAUSD?” Maybe call it the “Education Industrial Complex.”

I’m really relieved that Measure EE failed. I want more money to go to schools, and I believe that real classroom teachers deserve to have fair pensions. I don’t trust that the money would actually get to the intended places. I don’t trust UTLA. UTLA is running a racist PAR program. Until they are clean up, no more money.

https://static1.squarespace.com/static/594addf4e3df28c2d6be15db/t/5c429a4dc2241ba6b9316b6a/1547868751425/LAUSD+PAR.pdf

Enough fleecing of the public with tax increases. How about a 10% tax on all money sent to Central America and Mexico by illegal aliens, and use that money to help schools educate illegal aliens. That would be a novel idea. Leave taxpayers the hell alone.