A Farm in California. (Photo: California Department of Food and Agriculture)

California Split Roll Ballot Measure Destroys Prop 13 Protections for California Farmers, Threatens Rural Communities

Most food items will face higher property taxes several times, as they travel from the farm to processing, packaging, distribution, and grocery store

By Katy Grimes, February 20, 2020 3:44 pm

Agriculture was always considered sacred in the eyes of California’s property taxing agencies, and especially under Proposition 13. But that could change with the split roll property tax ballot initiative in November 2020.

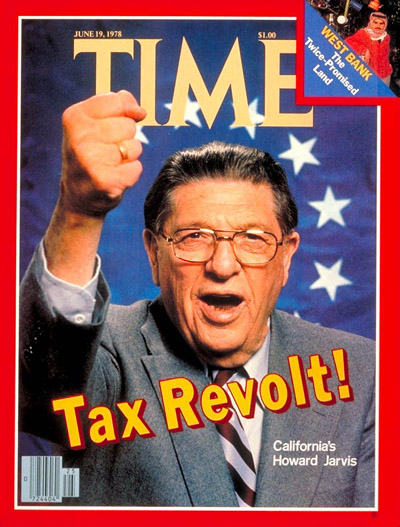

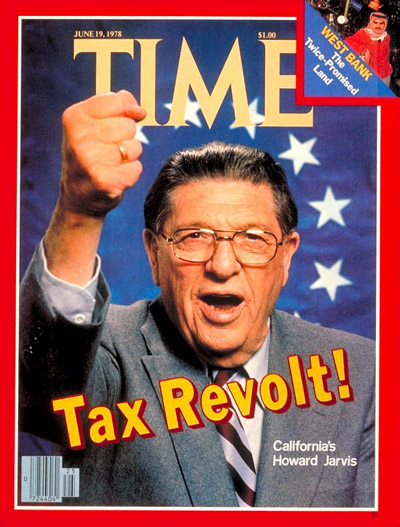

Prop. 13 was a 1978 ballot initiative to cap property tax increases for residential and business properties and provide certainty, so property owners would not be taxed out of their homes and businesses. Passed by 65% of California voters in 1978, Prop. 13 put a Constitutional cap on annual property tax increases. Prior to passage of Prop. 13, many seniors and those living on fixed incomes were forced from their homes because of skyrocketing property tax increases. According to the Howard Jarvis Taxpayers Association, author of Prop. 13, some properties were reassessed 50 – 100% in just one year.

The 2020 ballot initiative misleadingly called the “California Schools and Local Communities Funding Act of 2020,” known more commonly as the “split-roll” tax initiative, would reassess properties and hike taxes on all commercial and industrial properties, including manufacturing plants, retail stores and malls.

The split-roll property tax measure will also remove Prop 13’s protections for California farmers, triggering annual reassessments at market value for all agriculture-related facilities and improvements.

This amounts to a $12.5 billion-a-year split-roll property tax measure, and is backed by the state’s major labor unions, the SEIU, and California Teachers Association chief among them with its $6 million in contributions toward the effort.

Oddly, Attorney General Xavier Becerra’s Title and Summary makes a blanket statement that agriculture is exempted in the split roll initiative. But that is not true.

But it’s for the children…

This is particularly self-serving and devious for counties, which are in desperate need of new sources of revenue for unfunded public employee pension obligations. And it is potentially damaging to the state economy, because under the 1978 Proposition 13 ballot initiative, agriculture properties were not considered commercial or industrial.

Under the split roll ballot initiative to split residential and commercial/industrial properties, tax increase proponents recently admitted that they will redefine commercial and industrial structures to include barns, food processing structures for eggs, broccoli, citrus, lettuces, wineries, almonds, and just about anything that grows in the ground and that Californians and the rest of the country eats.

Milking barns, packing houses, processing facilities, and wineries would all be reassessed annually at current market value. But what these tax increase proponents miss is that almonds, fresh eggs, lemons and oranges and broccoli don’t just get picked in the field and end up on your plate – it takes many processes to make the food ready to sell in a grocery or neighborhood market.

To get an idea of the magnitude of agriculture in California, the California Department of Food and Agriculture reports on the 2018 California Agricultural Production Statistics:

2018 Crop Year — Top 10 Commodities for California Agriculture

In 2018, California’s farms and ranches received almost $50 billion in cash receipts for their output. This represents a slight increase over adjusted cash receipts for 2017 1.

California’s agricultural abundance includes more than 400 commodities. Over a third of the country’s vegetables and two-thirds of the country’s fruits and nuts are grown in California. California is the leading US state for cash farm receipts, accounting for over 13 percent of the nation’s total agricultural value. The top producing commodities for 2018 include:

-

- Dairy Products, Milk — $6.37 billion

- Grapes — $6.25 billion

- Almonds — $5.47 billion

- Cattle and Calves — $3.19 billion

- Pistachios — $2.62 billion

-

- Strawberries — $2.34 billion

- Lettuce — $1.81 billion

- Floriculture — $1.22 billion

- Tomatoes — $1.20 billion

- Oranges — $1.12 billion

Proposition 13

Under Proposition 13 in 1978, the specificity of the property tax initiative defined real property as:

- land

- fixtures

- improvements

The new initiative is redefining these three steadfast definitions of real property, and what is taxable.

It’s always been clear that agricultural land is exempt from property tax reclassifications. However, state agricultural businesses are now concerned that any property improvements to their agricultural lands including dairy barns, wine grape irrigation, citrus fruit cleaning processes, or almond processing will no longer be considered exempt under agriculture considerations, and that and and property reassessments will increase property taxes on ranchers and farmers by millions.

This was exposed by proponents Schools and Communities First on their Agricultural Land Fact Sheet:

“Commercial or industrial structures on agricultural land would be taxed at fair market value, unless the property is owned by a small, independent owner. For example, a dairy barn, food processing facilities, and wineries would be reassessed as they are commercial and industrial.”

The initiative would not reassess row crops because those are exempt under the Constitution. However, when these crops go to packing facilities and processing areas, they would face higher property taxes.

And, under the Constitution, vineyards are not permanently exempt, as they are only exempt for the first three years after the season in which they were planted. Orchards are only exempt for the first four years after the season in which they were planted.

Where will the money actually go? Where the proponents say it will? Not so fast…

While public education would receive more funding from higher property taxes, the real outcome is that commercial and industrial property owners, and farmers and ranchers would be forced to pass the increased costs to tenants and on the cost of the food. And since most of the businesses in California are small businesses, whether they rent or own, they will be hit with this tax increase — as will anyone and everyone buying fruits, dairy products, meat, eggs, grapes and wine.

This is somewhat ironic given that Gov. Gavin Newsom’s wife, First Partner Jennifer Siebel Newsom, has been active in supporting Farm to School food programs for the purpose of boosting student nutrition.

Many government employees, organizations and labor unions could also be hit in the retirement pocket book, as public employee retirement managers like CalPERS and CalSTRS, and labor union pension accounts, invest in California commercial real estate properties.

Counties’ Disincentive to be Supportive of Agriculture

The Williamson Act of 1965 allows local governments to enter into contracts with private landowners for the purpose of restricting specific parcels of land to agricultural or related open space use, in exchange for lower property tax assessments. However, there is a disincentive to support agricultural land. Cities and counties throughout the state with massive unfunded pension and retiree healthcare obligations, are already incentivized to take out agricultural land, rezone, and allow commercial and industrial projects to be built which will yield a much higher rate of tax revenue.

According to Californians to Save Prop. 13, A Split-Roll Property Tax Will… Eliminate Prop 13 Property Tax Certainty for Farmers:

• Farming is a risky business, and California farmers have seen rising costs on nearly every aspect of their businesses – from labor and water to regulatory compliance. At the same time, they face volatile commodity prices, concerns over access to international markets and are subject to unpredictable acts of nature.

• Prop 13 protects California farmers by giving them certainty over what their property taxes will be so they can focus on growing the food that feeds the country instead of worrying about losing their farm due to skyrocketing property tax bills.

• According to the 2017 USDA Census of Agriculture, the 65,129 ranch and farm operations in California paid $1.126 billion in property taxes, an average of $17,299 per farm – the most of any state. A split-roll property tax will only increase the burden on California farmers.

• We should reject the split-roll measures and maintain Prop 13 protections that have kept property taxes affordable and provided every taxpayer who buys a home, farm or business property with certainty that they will be able to afford their property tax bills in the future.

California ranks relatively high in property tax rankings, 17th out of the 50 states, even with Prop. 13. California also ranks right up at the top of the 50 states in nearly all taxing categories: income taxes, corporate taxes, gas taxes, sales taxes, wealth taxes, utility taxes… and lawmakers are looking at imposing estate taxes and even exit taxes for people trying to move out of California.

Wednesday, warning that an initiative on property taxes threatens harm to rural communities, the California Farm Bureau Federation voted to oppose it. CFBF President Jamie Johansson said measures that increase costs for family farmers and ranchers undermine their ability to supply jobs, especially in rural California, and their ability to supply food and farm products for customers in California and worldwide.

Rob Lapsley, president of the California Business Roundtable and co-chair of Californians to Stop Higher Property Taxes said, “Whether on a tree or vine, at a dairy or at a processing facility, every fresh fruit, vegetable and gallon of milk we buy at the grocery store will cost more under this property tax initiative. At a time when families are already struggling to make ends meet and provide healthy, farm-to-fork options for their families, we simply cannot afford the largest property tax increase in California history.”

Backers of the property tax split roll include labor unions, social justice groups, teachers unions, environmental groups, housing advocates, Democratic Mayors of California cities, Democratic Presidential candidates, and Silicon Valley and San Francisco Bay Area philanthropic organizations: The Chan-Zuckerberg Initiative, East Bay Community Foundation, Liberty Hill Foundation, Northern California Grantmakers Association, The San Francisco Foundation and Silicon Valley Community Foundation.

The Demonic Party has limits on evil. “California Schools and Local Communities Funding Act of 2020,” is damnable lie meant to confuse the voter.

Be careful voter. Twisted again!

Already voted no. Why? Because I read the damn thing instead of just reading the Headliner.

You already voted in the November election?

If you already voted then you don’t know what you are voting on. Either read up next time or do us a favor and stay home in November.

Prop. 13 is on the March ballot. Have you even looked at it?

Vote No

Let’s not be forced out of our homes, or California!

Vote NO on this new, and tricky Prop 13!

This article is about the split-roll initiative aimed at the November ballot. It has nothing to do with Proposition 13 on the March ballot, which is a school bond.

Just pack up and get out!

I used to work of Michelson Dairy Equipment and Ross Holm… I feel sorry for farmers that sold their soul to environmentalist that are digging their graves.

Let’s face it! The taxpayers of California can agree to have their taxes increased by voting yes on Prop 13 to supposedly help the children receive a much better education. But let’s face it! Raising property taxes will not achieve that goal. There is so much more involved with providing quality education to student in California than just money. And let’s face it! There is NO effective financial accountability and/or management of the educational funds. Never has…and more importantly never will. Let’s face it! Voting yes would just be throwing more money down an endless deep well in California.

Let’s face it! If you want a higher quality of education for children in California schools, hire teachers who are highly qualified, extremely passionate and who can be paid wages that are on par with other individuals in other professions with comparative educational credentials.

This is not about Proposition 13 on the March primary ballot. It’s about the split-roll initiative that will be on the November general election ballot. Proposition 13 on the primary ballot is a school bond.

Very well said, this cannot pass. So much is wrong about this proposed measure. I am very saddened to see all who is supporting this measure, you would think they were better educated and informed about how devestating this could be for many seniors living on a fixed income, those renting living paycheck to paycheck all Californians will pay the price for politicians to take our money and do as they please. VOTE NO

The support from Unions and Teachers is self serving, their promised pensions can not be fully funded by the State and they want their pensions which by the way are very close if not more than their pay while actively employed, I call this GREEDY, I worked for 40 years for my pension from the united food workers and it is less than half of what my monthly earnings were, so the teachers and the others can pound sand!

Why do we tolerate a state Attorney General who constantly lies to us?

This attorney general lied for Brown and now for Newsome . He and Kevin Deleon have their own agenda and it’s not what’s best for us. Why else would they have called this school bond Prop 13 it’s not only to trick us voting yes

EXACTLY!! We need to vote him out!

Thank you again Katy Grimes for this excellent, comprehensive article about the threat to California farmers and rural communities (and really, all of us who live here), from the split-roll tax ballot measure.

I finally had a chance tonight to look at the event at the link below, and it was wonderful. Very meaningful even for someone who isn’t a farmer but has followed these unfair and frustrating water issues in the Central Valley and elsewhere for many years now. Wanted to share it. If you haven’t seen it, hope you’ll take a look.

(About 44 mins long):

“Trump Speaks to Farmers and Rural Stakeholders on Water Issues in Bakersfield, California”

https://www.youtube.com/watch?v=OMx9Y6GkRV8

So if this passes, farms across the state will begin to shut down. Even before shutting down they will begin to lay off their farmworkers. And yes this will include immigrant farmworkers. You can’t employ labor if you are struggling to keep your farm. And yes a large majority of the farm laborers are immigrants. Don’t suppose they factored that in. It will be harder and harder for immigrants to get work in California.

Democrats are stupid and never look ahead at what could happen.

Democrats are by no means stupid. They are very good at masking their greed as “good for society”. They are just like everyone else, “what’s in it for me”. Except they are getting it by taxing which is taking money at the point of a gun. In big government countries who has all the money, the producers or the politicians? As our Government get’s bigger look where the wealthiest are of the country is now as opposed to 20 years ago. It’s no longer places like Silicon Valley or Seattle, it’s Washington DC, that makes nearly nothing.

Prop 23 I believe also included a provision that provided a Lotto to generate revenues to fund California schools. Wonder if that is in affect and how much of the revenue goes to schools. No matter how much Tax money the politicians raise, they will always want more. Wake up Californians.

Fight for your rights! Whatever it takes don’t lay down and take it! Little by little our land is taken over one way or another. There are so many other answers, high taxes are not the answer. They say it is for our children but it is just greed. Then let’s talk about the people who will lose their farms and people who will lose their jobs. I do believe that if we stand up long enough and hard enough and let America hear our voice that somewhere out there we can make a difference again!

Get those Democrats out of office. The liberals in this country are destroying America! “These Democrats out of office in November.

Stand up and fight! Let your voice be heard and do not run! In a time when people are filled with greed and self

indulgence, thinking only of their deep pockets and not of the people working hard to keep our country going, I do believe our voices can still be heard above the bureaucracy. This is to keep your farms, your jobs, your homes, your heritage. Stay focused and determined and fight against this all of California.

Leftists and Taxes – Prop 13

In California, if they repeal Prop 13, the property tax limitation, in effect you will not own your own land you will be just renting it from the government. It will get so bad that it will be cheaper to rent than “so called own” your own property. At a 5 percent tax rate it would only take 20 years and you would be paying for your house twice, once from the seller of the property and once from the property taxes. This will especially will be true with governmental rent control to keep the rental prices low to provide for all the homeless and illegal aliens.

What most people are not aware of is that, originally 100% of the County property taxes went to the County and were used where you lived for projects that were needed in your immediate area. However, over the years the state (of California) has been siphoning off more and more of those funds from the County Property Taxes to the point that a very small percentage of those taxes actually go to the Counties, but yet the Counties are required to pay for all the costs associated with of administering the determinations of values and and collections of those taxes. The state then audits the counties to determine if they are correctly collecting the taxes and can make adjustments by taking more taxes.

So when Gavin Newsom cavalierly gives free stuff to illegal aliens like free-health-care just remember where he is getting those free funds from, out of your pocket. And by they way, did not Gavin Newsom promise to give free health care to all; how did that turn into just free healthcare for selective illegal aliens shortly after he obtained the office of Governor?

HR 01-22-2020

HR Additional comments:

So Prop 13 will be on the chopping block, aka the 2020 ballot initiative.

[California’s Attorney General Xavier Becerra rigs ballot with biased split roll summary” The “split roll” initiative, which would split commercial properties away from Proposition 13’s property-tax protections, is a tax increase. No reasonable observer could come to another conclusion. Yet Becerra’s official title doesn’t mention that point: “Increases funding for public schools, community colleges and local government services by changing tax assessment of commercial and industrial property. – The Orange County Register By THE EDITORIAL BOARD | opinion@scng.com |

PUBLISHED: October 21, 201]

Something to think about before any ballot initiative is voted on, is that, it is the State that is promoting this initiative not the property owners.

Also consider what the percentage of voters were property owners when prop 13 was passed in the 1970’s to what percentage of voters are property owners today in the 2020’s. With the influx of aliens into California and property owners leaving that percentage has probably significantly diminished.

The headlines say, “No, there will not be any ballot measures to repeal Prop 13 residential property tax cap in the upcoming election” This is partially true.

[The California Secretary of State website said there is an initiative called “The California Schools and Local Communities Funding Act of 2020.” It has received at least 25% of required signatures to qualify for the Nov. 2020 ballot. This initiative would undo the property tax caps of Prop 13, but only for commercial and industrial properties. This initiative would not take away the Prop 13 protections for residential properties, California Secretary of State Spokesperson Sam Mahood said. – Author: Monica Coleman (ABC10) Published: 6:59 PM PST January 7, 2020]

So if the taxes are only on the Commercial Properties what could be the problem you might ask? (1) It is an incursion into the Prop 13 protections and just a stepping stone to removing all limitations in taxes. (2) Who do you think will pay those property taxes on businesses anyway, the businesses will just pass the tax costs on to their customers the consumers. (3) More businesses will leave California due to the already high taxes, business fees and excessive regulations.

HR 01-22-2020

Commercial properties today

personal property tomorrow

Tax creep

Thank you for informative post….Cannot believe this could possibly pass…except our children have been indoctrinated to believe “Free Stuff” is good. Easy to absorb that thought…..but There is “No free lunch”. When workers are taxed, property confiscated…..it won’t be fun Kiddos. Read carefully and vote even more carefully.

I do not want anymore taxes period. Don’t care what CTA says.

This is exactly what I have been trying to tell everyone on the neighborhood post site! Everyone needs to read this entire article and vote “NO” on this proposition!!!!

When prop 13 hits the residents I’m taking the money from my 5 properties here in Calif. to another state.of course the market will be flooded and will have no equity by then. So trying to decide when the best time to get out of here.

now is best…..Ca does not have a tax shortage they have a spending problem ie. the Browndogel railroad for billions!……..lets cut and run!

Vote NO on 13…..vote NO

vote no ! this is insanity.

Please implore anyone that can vote to vote NO on the prop. My company is closing it’s warehouse here in Orange County and moving to Nevada. The main reason they gave us was the cost of doing business here. If this prop passes watch the wave of businesses leave this state.

From what I understand, the Split Roll Ballot measure which will lift the cap on Prop 13 for industrial and agricultural property will be on the November 2020 Ballot. The March 3rd, Prop 13 is a $15 Billion School Bond. Too much $$ and not clear where the money will go. Everyone forgot we passed a $9 Billion School Bond in 2015. Where did that $$ go?

Just to put it into perspective, $9 billion spread across a state of 40 million people isn’t actually that much money: $225 per person. Much of that went into badly-needed renovations and infrastructure updating for 30 to 50-year old schools, but there’s still a lot of renovating left to accomplish; just getting smart boards with overhead projectors that tie to the teacher’s laptops makes a huge difference for teachers (I’ve seen this with my own eyes as an elementary school volunteer), but many schools still lack this pricey but vital tool, just as one example.

Never vote for a Bond of any kind. The state needs to learn live with in it’s means. They already tax us enough.

https://oag.ca.gov/system/files/initiatives/pdfs/19-0008%20%28The%20California%20Schools%20and%20Local%20Communities%20Funding%20Act%20of%202020%29_1.pdf

Link to actual text of the measure. Agriculture is exempt. This is misinformation.

Here is the website with the actual text of the measure. On pages six and 11, it says that agriculture is exempt. This article is misinformation.

https://oag.ca.gov/system/files/initiatives/pdfs/19-0008%20%28The%20California%20Schools%20and%20Local%20Communities%20Funding%20Act%20of%202020%29_1.pdf

Storm the California State Legislature and burn the place down. That’s about all you can do now. California is ‘off the chain.’ The people who run it are insane and should run out of the state. Sad, very sad.