Gov. Newsom Backs Prop. 15 ‘Split Roll’ Property Tax Increase on Business

Newsom’s support brings out a state-wide backlash, warnings of a possible ‘tax jolt’

By Evan Symon, September 12, 2020 8:01 am

On Friday, Governor Gavin Newsom threw his support behind Proposition 15, which would change how both commercial and industrial properties are taxed, leading to immediate outcry from businesses, industry leaders, and tax groups across the state.

Prop 15 would amend the constitution and change the current tax law, which has been in place since 1978. Prop 15 would have commercial and industrial properties be taxed based on market value rather than the current method of taxing the purchased price with annual increases of 2% or the rate of inflation, whichever is lower. Under a ‘split roll system’, taxes would be assessed on commercial and industrial properties by market value, with residential properties still being assessed by purchase price.

Prop 15 would exempt commercial agriculture properties and on properties owned by business owners with less than $3 million or less in holdings in the state. Under Prop 15 they would still be assessed by purchase price. If passed, the new tax policy would be phased in during the 2022-2023 fiscal year, with commercial properties that have numerous small businesses not being taxed by market value starting in 2026 or later.

Proposition 13, the 1978 proposition that set up the current system in California, would be subsequently overturned.

Proponents of Prop 15

Governor Newsom agreed with proponents in that it was unfair that companies and corporations were being taxed the same way that average citizens were being taxed, and that the extra estimated $10 billion to $12 billion in revenue each year could be put to use for programs and departments in the state budget.

“It’s consistent with California’s progressive fiscal values, it will exempt small businesses and residential property owners, it will fund essential services such as public schools and public safety, and, most importantly, it will be decided by a vote of the people,” said Newsom in a statement on Friday. the governor said in a written statement released by his political advisors.

Supporters of Prop 15, including San Francisco Mayor London Breed, Senator and Vice Presidential nominee Kamala Harris (D-CA), and over two dozen members of congress, state legislators, and Mayors, welcomed the Governor’s support, as did many groups backing Prop 15’s passage.

“Governor Newsom’s endorsement of Prop. 15 represents another watershed moment in the push to close corporate tax loopholes so Californians can reclaim billions for schools and essential local services,” noted Yes on 15 Communications Director Alex Stack. “This is a critical boost of momentum for the campaign as we head into the final stretch.”

San Francisco Mayor London Breed pointed out similar reasons in her statement of support earlier this year.

“When I look at our dire budget deficits over the next couple of years, and then I see these revenue estimates showing how much we can invest in our community without having to raise any taxes on residents, it makes it more important for me to give my full support on this initiative,” stated Mayor Breed earlier this year.

Immediate backlash against Newsom, Agricultural concerns

However, throughout Friday, the Governor’s backing brought a cascade of backlash from many diverse groups, with many prominent lawmakers from different political parties, ethnic group leaders, tax groups, farm organizations, and others joining together in opposition.

The growing opposition has pointed out flaws in Prop 15, most notably finding that the figure stating that the ‘top 10 % of commercial and industrial properties would generate 92% of the revenue‘ is patently false.

Non-commercial farmers, namely family farmers and ranchers, have also come out en masse against Prop 15, citing that an undue tax burden, mixed with a rocky future due to disruptions caused by COVID-19, would hurt both farmers and consumers alike.

A loophole will also make farm improvements and fixtures taxable under the new system.

“California’s family farmers are keenly disappointed in the Governor’s support for raising taxes on agricultural property,” said the press release from California Family Farmers Against Prop 15. “Prop 15’s higher taxes on farms and ranches will hurt farmers and increase grocery prices for California consumers, many of whom are already struggling with the high cost of living in our state.”

Independent and Government leaders, such as members of the State Board of Equalization, found similar issues for farmers with a Prop 15 passage.

“Agriculture is a $50 billion industry in California that supports hundreds of thousands of jobs. Around 90 percent of California farms are still family owned,” noted State Board of Equalization member Ted Gaines. “The industry, as with so many others, is straining from the shocking and unforeseen effects of coronavirus. This massive jolt in tax costs could be the blow that leads to mass sales and closures of family farms and destroy legacies that stretch back more than a century.”

Minorities, small-business groups also come out strongly against Prop 15

Many small business owners, primarily immigrant and minority-owned small businesses, are also largely against Prop 15 due to the higher tax amount likely taxing many out of business.

“This is killing mom and pop shops,” Los Angeles general store owner and local community business representative Arthur Johnson explained to the Globe. “It’s just going to amplify gentrification in our neighborhoods and push us out.”

“Do you know how stupid a new tax plan has to be to have African-Americans like myself join with Blackstone and other real estate companies we’ve been battling for years to stop this? I vote Democrat until the day I die, but this, this is an exception. It would kill me otherwise.”

“Figures this would come in 2020.”

Other groups voiced similar concerns.

“Without a doubt, the largest property tax increase in state history will devastate Latino-owned small businesses and hurt thousands of workers who rely on these blue-collar jobs to feed their families,” said Julian Canete, President of the California Hispanic Chambers of Commerce. “The measure’s $11.5 billion-a-year property tax hike means increased rents for small businesses and ultimately, higher costs for consumers – pushing both family and small business budgets into the red.”

Fear of a massive tax jolt, polls show a very close margin

But the biggest issue was fear over a massive tax jolt, one in which could cost California many companies with headquarters in the state, along with the loss of many jobs, and a large percentage of the $10 to $12 billion in estimated revenue dwindling down over the coming years due to businesses leaving because of the property tax increase.

“Today, the governor supported $11.5 billion in higher property taxes, which will mean increased costs for the same small and minority-owned businesses he’s forced to close for the last six months. Now is not the time to support the largest property tax in California history and make our cost of living crisis even worse,” said the No on Prop 15 opposition group.

Other tax organizations weighed in as well.

“This is yet another attack on the longstanding taxpayer protections in Prop. 13,” Jon Coupal, President of the Howard Jarvis Taxpayers Association explained. “Special interests continue to push for new and higher taxes to pay for their out-of-control pensions, which have already directed existing tax revenue away from classrooms and other state priorities.”

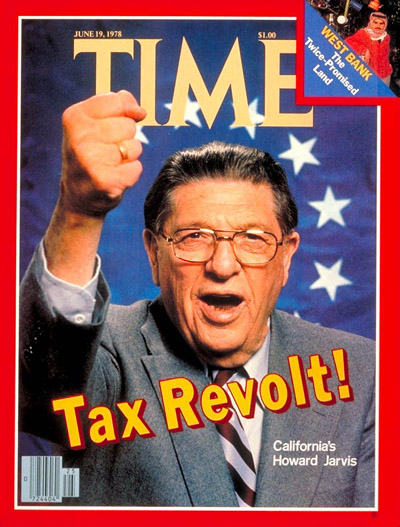

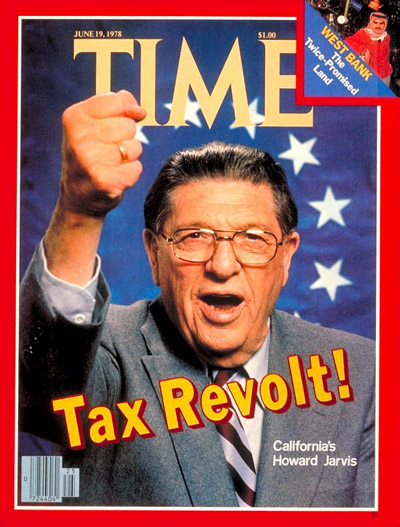

Prop 15 hits close to home for the Howard Jarvis Taxpayers Association. It’s founder, Howard Jarvis, helped develop and pass Proposition 13 in 1978. Its passage began a massive “tax revolt” in both California and across the United States, with many assessment rolls across the U.S. taking the same purchase value model on taxation, working almost as the capitalist version of rent control. The call for lower taxes possibly even helped Ronald Reagan be elected in 1980.

Recent polls have shown that results will be close with support teetering between 45% and 55% since last year. An April 2020 poll found that 53% of Californians support the Proposition, while subsequent polls place the number closer to 51%.

Prop 15 will be decided on by California voters on November 3rd.

- Bill to Require Law Enforcement Disclosure if AI Was Used To Help Write Reports - August 7, 2025

- Gov. Newsom Files FOIA Request To ‘Expose True Cost’ Of L.A. Federal Troop Deployment for Anti-ICE Riots - August 6, 2025

- California Redistricting: How Newsom’s Plan Will Demolish Hard Fought GOP Gains - August 6, 2025

Of course he would…. All the San Franfreakshow liberals want it….

“Supporters of Prop 15, including San Francisco Mayor London Breed, Senator and Vice Presidential nominee Kamala Harris (D-CA), and over two dozen members of congress, state legislators, and Mayors, welcomed the Governor’s support, as did many groups backing Prop 15’s passage.”

Hopefully this will be the ignition point that will finally galvanize the sane people just trying to live their lives in this formerly great state, to RISE UP against these brain dead communists out of SF and recall Newsom and all the rest of the idiots that make bad policy in Sacramento….

Let’s stand against and recall, agree. Newsom should get Firefighter gear and extinguish the fire.

WE (MILLIONS OF CALIFORNIANS) CANNOT BREATH!

http://www.recallgavin2020.com – if you signed a petition prior to June 10, 2020, you MUST sign again. The official petition is at the link below. You can print at home and gather up to five signatures.

print it. sign it. return it. NOW

Newsom supports Prop. 15? And the other Democraps? My what a shocking surprise! Grusom says Prop. 15 “will be decided by a vote of the people”. He says that when it’s a proposition he supports, but when the voters TWICE approved the death penalty in California he eliminates it with an executive order! I work for a small business that has been hit hard by Grusom’s “shelter in place”. It is a family owned business almost eighty years old and if Prop. 15 passes the owner has told me “that’s it, we are done”. And there are many more small businesses that will be destroyed as well. https://recallgavin2020.com

EXACTLY.

But what does this guy care?

He’s a psychopath. How much more evidence of it do you need?

https://recallgavin2020.com/

Don’t think for a second that any properties that are exempt in this bill will be exempt for long. Farmers should be very, very worried. Soon the 3 million cap will be lowered to zero.

And this will hit residential properties soon after. Democrats and leftists destroy everything. The Arthur Johnson interviewed said he will still vote democrat until he dies. What an idiot. That’s just one reason why this state has gone downhill.

The most important FACT is that this bill is a CONSTITUTIONAL amendment to our States Constitution. If passed it will require an act of God to reverse it in the future.

California has enough potential for natural disasters but they are nothing compared to the devastation Noisome is wreaking on the state.

If you don’t try to stop them when they come for the businesses don’t complain when they come for your home.

Tip for the ignorant. Any business expense, including taxes, is passed onto you, the consumer.

Vote NO on any taxes on CA residents, businesses and farmers. IDC about the 3 million cap when the Gov goes after one it soon will be all … I’m STILL ASKING where does the CA LOTTO MONIES go every day? CA LOTTO started in 1986 to fund schools Education and structure , teachers, And fix roads… But they got the gas tax by us to fund the same things. It’s ALWAYS the same things.. foreclosure will be coming Vote NO CA pays enough to help FUND the government.. ok this is why they want schools open at the risk of children BEFORE the election. To make Prop 15/13 even sound plausible. Then schools will close 11/4

This is where, once again, one need only refer to Tainter’s classic ‘The Collapse of Complex Societies’ in order to see the end result of this sort of nonsense.

It really ought to be required reading for anybody holding political office. (Assuming they can even read.)

I’ll make it easy for you: Problems engender solutions that cause further problems that engender further solutions…until the whole thing falls apart. Posturing and immediate popular appeal takes precedence over substance and the conservative, realistic long view. Vital infrastructures are neither maintained nor augmented. That which should be easy becomes hard due to governmental interference and rent seeking. Your productive classes begin to go elsewhere, leaving only an impoverished parasitical population beholden to an equally parasitical elite. And finally, some outside event pushes everything over the edge.

Take a look at the Mayan city states. Take a look at Angkor Wat. Hell, take a look at the Western Roman Empire, finally done in by the Plague of Justinian. (In turn brought about, one theory has it, by a massive volcanic eruption in Indonesia.)

(Earthquake anybody? Cascadia Subduction Zone perhaps? Plenty of possibilities here.)

California can still turn itself around, but it’s going to take a very hard turn to the right along with the realization in all quarters that the State government can’t be all things to all people. But it’s hard – increasingly hard – to see that happening with out a good deal of factional and inter-ethnic violence to get the ball rolling. And that’s the scary part.

I like reading history, but I don’t want to live it.

Just a thought.

VicB3

If Democrats read “The Collapse of Complex Societies” they would use it as a how-to manual. What Noisome is doing is deliberate, not total stupidity and ignorance. The mistake people make is assuming he and his ilk are simply well meaning but misguided simpletons when they are the exact opposite. They have a plan and they are implementing it as fast as they can.

No boundaries Comrades…they come to viciously loot, burn you out, they pillage you’re wealth through crushing taxation and deny your natural rights to work and feed and educate your family…..

When your left only with dandelion broth……..

Its a shame that the people we put in office missed the class on finance. They refuse to live with a buget. We as the people who foolishly trust them to take on the job to take on the task and we get screwed

How hard will Gavin the First and the Dem Party campaign for Prop 15?

While the Dem Party use its vote fraud operation to support Prop 15?