Sen. John Moorlach’s 2019 Financial Soundness Rankings for California’s 482 Cities

‘There is not much positive news’

By Katy Grimes, January 6, 2020 6:47 am

Sen. John Moorlach (R-Costa Mesa) just released his new report on the finances of the state’s 482 cities. Gird your loins for more generally bad news – only 43 percent were in positive territory for 2018, down from 46 percent for 2017.

The total combined negative unrestricted net positions* for the 482 cities got worse, going from $22.7 billion in the red in 2017 to $31.5 billion in 2018. That is a 39 percent increase in these unfunded liabilities in just one year. It is also like the 40 percent increase in one year in unfunded liabilities for the state’s 944 school districts, as detailed in my December 11, 2019 School Districts Report. Although for the schools, the total negative number was worse at $70.9 billion.

*Net assets on the balance sheet fall into several categories, including temporarily restricted, permanently restricted and unrestricted net assets. Permanently restricted net assets are funds contributed for a specific purpose. Unrestricted net assets hold no restriction regarding their usage. The agency uses these funds to pay general expenses or to fund specific purposes of the group.

For the first time, new regulations by the Governmental Accounting Standards Board (GASB) required municipal audited financial statements to include retiree medical liabilities. Balance sheets refer to this as Other Post-Employment Benefits (OPEBs).

With the OPEB addition, more cities are seeing their unrestricted net positions (UNPs) dip further into the red, the report finds. “Cities are supposed to provide their financial statements within a reasonable time after the ending of each fiscal year on June 30. For consistency, this report includes the financial statements for June 30, 2018, meaning the cities have had 18 months to complete this essential part of transparent government.”

“Despite that long-time frame, 17 cities have not yet completed their 2018 statements,” Moorlach says. “In those cases, I have extrapolated the data from past statements to produce 2018 numbers for this report. The data for those cities are shown in boldface. The 17 delinquent cities are Adelanto, Amador, Artesia, Blue Lake, California City, Coalinga, Compton, Etna, Fort Jones, Fowler, Isleton, Maywood, McFarland, Riverbank, Sonoma, Westmorland and Windsor.”

Jump to page 11 to see the UNP for each of California’s cities. My own city of Sacramento’s UNP is $6.7 million.

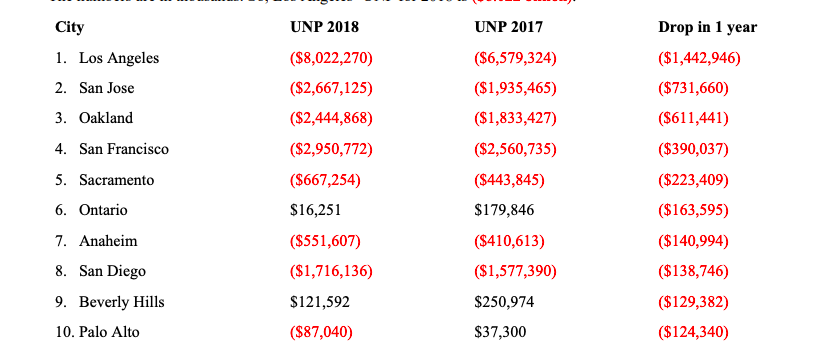

Los Angeles’ UNP for 2018 is $8.022 billion.

The City of Los Angeles

“How does a city with 4 million residents increase its Unrestricted Net Deficit by $1.4 billion in one year?” Moorlach asks. “The net increase in the reported liabilities for pensions and Other Post-Employment Benefits explains $1.2 billion of the 22 percent jump. Although Los Angeles enjoys 10 percent of the state’s population, its Unrestricted Net Deficit’s growth is 16 percent of the combined increase by all of California’s 482 cities.”

Moorlach says on January 10, 2020, Gov. Gavin Newsom will release his preliminary budget proposal for the 2020-21 state budget. “Hopefully, he will take account of the cities and how elected leaders in Sacramento can provide assistance in encouraging strategies to pursue for fiscal relief.”

To read Sen. Moorlach’s entire report, it is available HERE.

Cities Getting Worse

Bonus Round:

- Globe Interview: Gubernatorial Candidate Jon Slavet - February 6, 2026

- New Fraud Uncovered in California: $8.6 billion COVID-era Relief - February 6, 2026

- California is One of the Terrible 10 Blue States on Taxes - February 5, 2026

How did you calculate $6.7 billion for Sacramento?

The numbers I am finding in the report are reported in thousands and, for Sacramento, the UNP is ($667,254). 667,254 * 1,000 is $667,254,000 or $677 million.

Did I miss something?

Thank you for pointing this out — it was a typo. Corrected. Katy

No problem, new taxes can cure these billion/trillion dollar financial holes in a nanosecond. These dedicated, esteemed, GED educated government employees are totally worth multi million dollar $$ pensions at age 50-55. If they were in the private sector they could make more, or even invent the next Google. We’re lucky to have them all working for us. They have my respect and honor. TY government employees, we could never make it without you, you’re the BEST!

Rex, I understand that you jest; while I don’t disagree that govt. employees, for the most part, serve us well, receiving a full pension, in many cases “spiked” because of lax rules, at the age of 50 or 55 simply is not sustainable. In California, Gray Davis saddled the state financially for years, even decades, to come. Of course, human nature is greedy and those who enjoy these inflated pensions, and in many cases health care on top of that, I doubt they’ll “do the right thing” and give some of it back or even be receptive to the notion of negotiating more stringent qualification rules. for the future. You’re right, more taxes is the answer. Hold on to your wallet is my advice, or go somewhere where they haven’t swallowed the California poison yet. Remember, CA public employee pensions are literally billions upon billions of dollars in the red..your grandchildren will still be paying this debt. But the good news is they’ll have a bullet train to ride in CA, also with a price tag that no knows where it will end. But maybe by the time the bullet train is completed CA will have figured out how to fix its EDD and DMV depts..but not likely. The smartest guys in the room might be state prisoners who are getting unemployment payments.. Welcome to California..