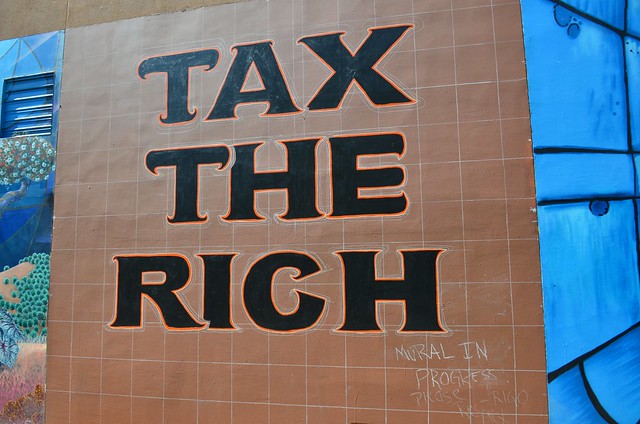

Should Last Summer’s Business Tax Hikes Be Curtailed?

California already has the country’s highest personal income tax rate and the highest base sales tax rate

By Chris Micheli, January 11, 2021 12:16 pm

Last June, the California Legislature passed the Governor’s proposals from his May Revise to raise $9 billion over three years by retroactively suspending the use of net operating losses (NOLs) for individuals and businesses, as well as retroactively capping the use of business tax credits. AB 85 (Budget Committee, Chapter 8), among its numerous provisions, provides:

- For each taxable year beginning on or before January 1, 2020 and before January 1, 2023, the total credits otherwise allowable under the personal and corporate tax laws, with a few specified exceptions, may not reduce the taxes imposed by those laws by more than $5 million. The law provides that the amount of any credit that is not allowed due to the application of this law will remain a credit carryover amount. This provision was estimated to raise $2 billion in the fiscal year.

- For each taxable year beginning on or after January 1, 2020 and before January 1, 2023, subject to certain exceptions related to a taxpayer’s income, the disallowance of a net operating loss deduction. The law extends the carryover period for a net operating loss deduction disallowed by this law. This provision was estimated to raise $1.8 billion in the fiscal year.

AB 85 was the revenues budget trailer bill within the overall 2020-21 budget package that was enacted just seven months ago. At that time, a $54 billion budget deficit was projected, despite acknowledgement of the job loss and business closing due to the pandemic in this state. At the time, the business community also argued for AB 85 to only apply for two tax years, as had been the case the prior two instances when the state took similar actions.

Fast forward to January 8 and Governor Newsom announced that the state budget anticipates a $4.6 billion increase in total revenue compared to the 2020-21 fiscal year, including a 5 percent increase in personal income tax revenue, as well as over 4% increase in local property tax revenues. Moreover, total state reserves are projected to be $22 billion. This surge of revenues to the General Fund raises the question whether the second two years, or at least the third year, of these NOL suspensions and tax credit limitations should be repealed.

At the very least, no further tax increases are warranted for the foreseeable future. California already has the country’s highest personal income tax rate and the highest base sales tax rate. With a record exodus of businesses and citizens from this state, and such a high cost-of-living, we should not only reject any calls for higher taxes, but also the Legislature should not introduce such legislation during the 2021 Session as such measures will send a chilling message to businesses and economic development efforts in California.

- Permissive Joinders in California - January 14, 2026

- Voluntary Expedited Jury Trials - January 13, 2026

- The Division of Property Concerning Reimbursements - January 13, 2026