Assemblywoman Lorena Gonzalez. (Photo: Kevin Sanders for California Globe)

The Many Unintended Consequences of AB 5

AB 5, combined with the $15/hour minimum wage, is going to kill small businesses in California

By Edward Ring, December 10, 2019 8:58 pm

AB 5 is a form of deplatforming, but less subtle and equally harmful. It is blatant oppression.

By now anyone who works as an independent contractor in California has heard of AB 5, which will force companies to reclassify them as employees. The justification for AB 5, which was reportedly written by the AFL-CIO, is to prevent companies from exploiting workers. Without AB 5, the reasoning goes, companies hire freelancers to do the same work employees would do, in order to avoid paying for benefits such as Social Security, Medicare, unemployment insurance, and workman’s compensation.

The Social Security argument has no merit, because freelancers are still required to pay Social Security taxes, and still get Social Security benefits when they retire. They pay the employee and employer share, because they’re self employed. Ditto for Medicare. The rate a self-employed independent contractor accepts in exchange for their services should take that into account.

While there may be some merit to the argument that companies hire freelancers to avoid paying unemployment insurance and workman’s compensation, there might have been other legislative solutions to that, such as setting up the means for independent contractors to purchase their own unemployment and workman’s compensation insurance – or, (gasp), roll a workman’s compensation individual option into Covered California.

Instead, AB 5 creates far more problems than it solves.

Predictably enough, those special interests with enough clout to carve out their own industries from being affected by AB 5 made their voices heard in Sacramento. Courtesy of CalMatters, here are some of the jobs that are exempt from the impact of AB 5:

Jobs Exempt from AB 5

Doctors: Physicians, surgeons, dentists, podiatrists, veterinarians, psychologists.

Some licensed professionals: Lawyers, architects, engineers.

Financial services: Insurance brokers, accountants, securities broker-dealers, investment advisors.

Real estate agents

Direct sales: Provided the salesperson’s compensation is based on actual sales rather than wholesale purchases or referrals.

Commercial fishermen (only exempt until 2023).

Builders & contractors: Construction firms that build major infrastructure projects and big buildings.

Professional services: Marketing, human resources administrator, travel agents, graphic designers, grant writers, fine artist.

Freelance writers, photographers: Provided the worker contributes no more than 35 submissions to an outlet in a year.

Hair stylists, barbers: Defined as a licensed barber or cosmetologist provided that person sets their own rates and schedule.

Estheticians, electrologists, manicurists (provided they are licensed).

Tutors: Provided they teach their own curriculum. Does not apply to public school tutors.

AAA-affiliated tow truck drivers

And who, overnight, will either have to be hired by the company they contract for, or be unemployed? Again, courtesy of CalMatters, here are some of them:

Jobs Affected by AB 5

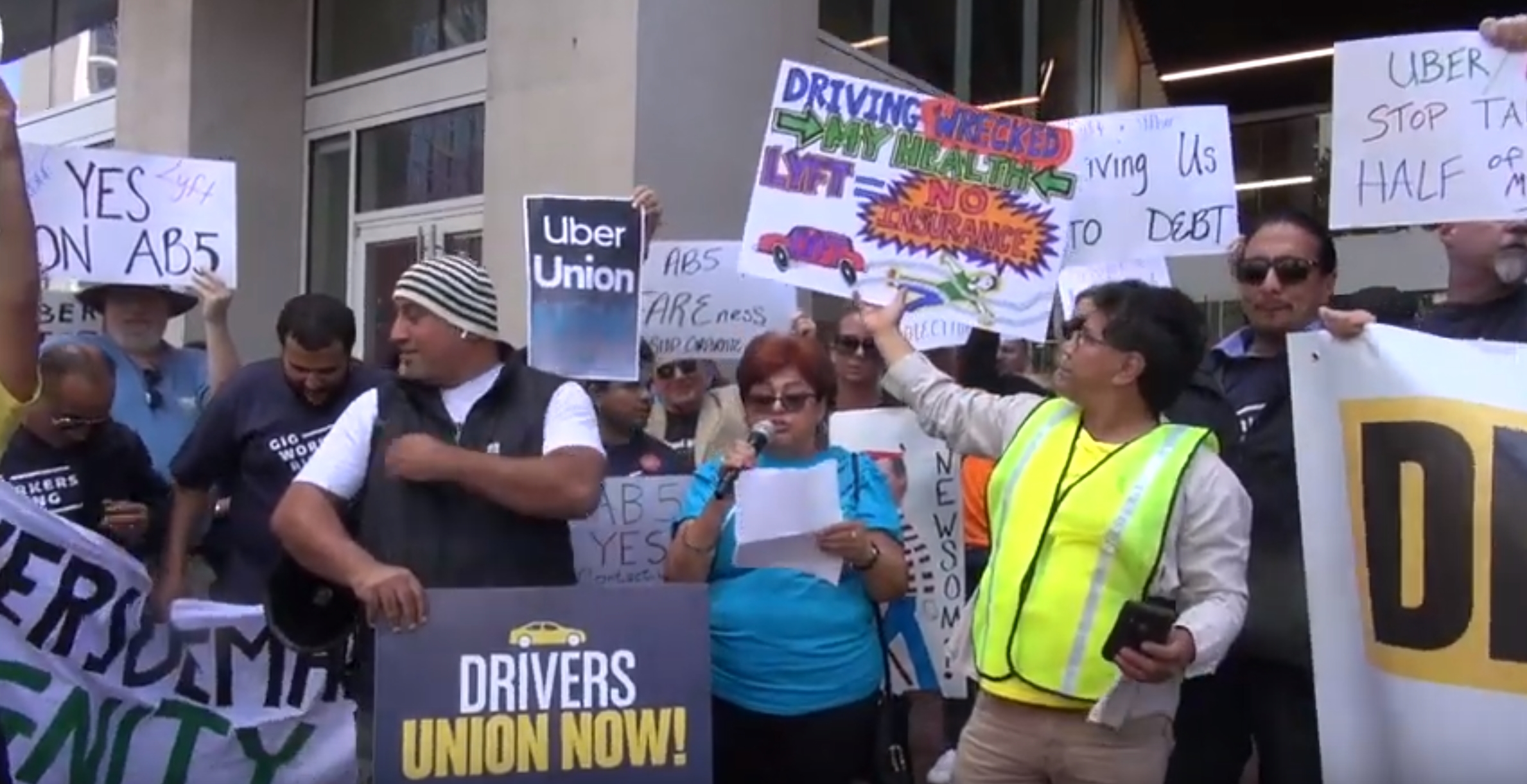

Rideshare & delivery services: Uber, Lyft, DoorDash, Postmates

Truck drivers: Heavy duty trucks, Amazon delivery trucks, some tow truck companies

Janitors & housekeepers: Commercial cleaning services

Health aides: Nursing homes, assisted living facilities

Newspaper carriers: The author agreed to delay implementation by one year in a concession to newspaper publishers.

Unlicensed manicurists: Licensed manicurists will get a two-year exemption.

Land surveyors, landscape architects, geologists

Campaign workers

Language interpreters

Killing the Gig Economy

There are several significant consequences of AB 5, chief among them, and the one most discussed, is that it threatens to kill the so-called “gig economy.” While no balanced assessment of the growing gig economy should fail to acknowledge the challenges it presents – less job security, no benefits – killing the gig economy is not the answer.

It is certainly no accident that ‘campaign workers’

are included on the list of workers affected by AB 5.

Many people working in the gig economy could not possibly work in any other way. They can choose their hours and they have steady work. For people who want to supplement full-time work, or balance their time between family obligations and work, the gig economy is unambiguously good. And since independent contractors still pay for and receive Social Security and Medicare, which are the main benefits they allegedly were going to lose, what’s really going on?

If you peruse the list of job descriptions exempt from AB 5, vs the list of those affected by AB 5, there isn’t a lot of logic. In general, highly compensated professionals are on the exempt list, but the trades were randomly distributed – hair stylists and estheticians are exempt, janitors and health aides are not. What’s going on?

Perhaps the most concise answer to that comes from California Governor Gavin Newsom, who personifies the alliance of big business and big labor that controls California. In a guest editorial for the Sacramento Bee, Newsom had this to say:

“This Labor Day, I am proud to be supporting Assembly Bill 5, which extends critical labor protections to more workers by curbing misclassification. While this step is important, we must do more to reverse the 40-year trends that have hollowed out our middle class and driven income inequality. We can do this by partnering with labor and supporting their efforts to create ways for workers to join together and speak with one voice. Across the country, unions are paving the path for new ways to organize – whether it’s the fight for a federal $15 minimum wage, organizing freelancers and contractors, or bargaining project labor agreements.”

“Partnering with labor.” “Paving the path for new ways to organize.”

Let’s be clear. Newsom understands this partnership very well. Big labor controls the workers. Big business controls the market. Small competitors wither away under the twin onslaught of union pay scales and work rules they’re not ready to match, and regulations they’re not yet big enough to afford.

Consequences of AB 5

If you assume the government has any role whatsoever in protecting the rights of workers, then what Newsom euphemistically refers to as “misclassification” is, at the least, an issue worthy of honest debate. And even right-to-work advocates recognize that collective bargaining, properly regulated, has a valid role to play in the private sector. But AB 5 is a poorly conceived overreaction to the challenges of the gig economy.

The reason AB 5 passed is because it will make it easier for labor unions to organize workers in a host of industries. Clearly they have their sights set on those gig economy jobs where very large corporations like Uber and Lyft dominate the sector. Californians should ask themselves, given what unions have done to the public sector, do we really want them organizing rideshare workers, truck drivers, custodians and housekeepers, health aides, and so on down the list?

The biggest losers in the AB 5 implementation, ultimately, will not be the big companies like Uber and Lyft. These companies will adapt, one way or another, because they’re billion dollar companies. Don’t be surprised if they come to some sort of accommodation with California’s union controlled legislature, and withdraw their planned referendum to repeal AB 5.

Across all sectors, this is the defining theme: If you’re a billion dollar corporation, you’ll figure out how to manage AB 5, but if you’re a small company, you won’t. AB 5, combined with the $15/hour minimum wage, is going to kill small businesses in California. Does Gavin Newsom care? No. Because, as previously noted, he personifies the alliance of big business and big labor that controls California.

Freedom of Speech

The impact on small media companies is particularly troubling, unless you actually believe that corporate media stalwarts such as David Muir, Norah O’Donnell, Lester Holt, and Judy Woodruff actually engage in unbiased, genuine investigative journalism. Despite growing online censorship, the internet still provides an opportunity for truth seeking media entrepreneurs to deliver diverse points of view and contrarian analyses, and eke out a living. Not so fast.

Now, thanks to AB 5, the game just got tougher for anyone who writes for a small media company, whether it’s a community newspaper or a national website with a niche audience.

In a dazzling display of either blithe indifference or shocking cluelessness, the author of AB 5, Assemblywoman Lorena Gonzalez, agreed to exempt employers from having to hire their freelancers as employees so long as they didn’t contribute more than 35 articles per year. Exactly how might this work in practice? There are freelancers who are paid to contribute several posts per day, usually in the 200 word or less range, for which they are paid accordingly. Then there are freelancers who are paid to contribute lengthy feature length articles which can exceed 5,000 or even 10,000 words.

According to Gonzalez, apparently, there’s no difference whatsoever between these submissions. It reminds one of the contest Gimli and Legolas were having in the movie version of Lord of the Rings. They were competing to see who would kill more enemies. Legolas had just slain a gigantic war elephant. To which Gimli shouted “That still only counts as one!”

The reaction of freelance writers so far ranges from disbelief and denial to defiant schemes. But by this time next year, unless a successful referendum occurs, there will be a lot of silenced, bitter voices. AB 5 is a form of deplatforming, but less subtle and equally harmful. It is blatant oppression.

AB 5 and Political Campaigns

Less discussed but possibly of greater oppressive consequence is the impact AB 5 will have on political campaigns. It is certainly no accident that “campaign workers” are included on the list of workers affected by AB 5. But why? Working for a political campaigns is one of the most temporary of vocations. Most people hired by political campaigns either have other jobs in different industries, or they are accustomed to working in political jobs during campaign season then finding other work between campaigns. Now campaigns have to hire them as employees.

Understanding how AB 5 impacts campaign workers furthers understanding how big business and big labor control California. Because in the one-party state, a permanent army of full time union operatives, most of them supported by public sector employees, are easily seconded to political campaigns. Other vendors who are part of the one-party political ecosystem are found in political consulting firms, public relations and marketing firms, publishing and printing shops, and an assortment of nonprofits. The full time employees of these vendors are defacto campaign workers, with job security funded by the torrent of union political money that’s used explicitly for politics when campaigning for candidates and lobbying for legislation, and otherwise used indirectly for politics through public education campaigns.

The financial stability enjoyed by the one-party political operatives, and the firms that employ them, makes them immune to the impact of AB 5. Public sector unions alone collect and spend over $800 million per year in California. That money, and the army it pays for, constitutes a formidable foundation, atop which California’s many generous – and very liberal – billionaires add their tens if not hundreds of additional millions.

The opposition, on the other hand, relies primarily on volunteers. When they scrape their way to having a paltry war chest to fund a campaign, there’s no extra money. AB 5 will have a chilling effect on underfunded political campaigns, making it even harder for them to challenge incumbents in the one-party state.

One final and very sad question raised by AB 5 is how it will affect signature gathering campaigns for ballot initiatives. To-date, it is impossible to qualify a state ballot initiative in California without relying on paid signature gatherers. Nonetheless, it is a powerful expression of citizen democracy and represents the only remaining way Californians can preempt their bought and paid for legislators. Changing signature gatherers from independent contractors to employees will add another layer of cost onto a very costly enterprise. But big labor and big business will not care. Another million, another ten million, that is not a concern. For the authentic grassroots campaigns, on the other hand, AB 5 could be the difference between success and failure.

One may hope all of California’s new one-party aristocracy, from Lorena Gonzalez to Gavin Newsom, are terribly proud of AB 5.

- Ringside: Long Term Electricity Storage - July 23, 2025

- Ringside: One Way to Avoid Gasoline Lines in 2026 - July 18, 2025

- Ringside: Is California’s Water Infrastructure Ready for Climate Whiplash? - July 10, 2025

What effect is AB5 going to have on contract computer programmers? They aren’t licensed engineers, so they are not exempt under the law. Yet plenty of tech companies have contractors working side by side with employees. Converting them all to employees is going to create the same problems that converting other groups will have. Yet I’ve read nothing about it.

You’re right. Independent contractors in tech are not exempt. And not only programmers are endangered, but also QA, documentation, sales, IT, etc. The silence you hear is the tech industry with its head in the sand.

Great story, Ed. The only thing I’d add, as the owner of a small media company, is that I wouldn’t characterize freelance writers as “exempt.” You write freelance writers and photographers are exempt from AB5 “Provided the worker contributes no more than 35 submissions to an outlet in a year.” Well, that’s a ton of writers, including some for our own site, who will lose work. CNBC reported that Vox has cut “hundreds” of jobs, mostly sportswriters who cover daily events on California’s many teams. This law will have profound consequences — mostly negative, in my personal opinion. https://www.cnbc.com/2019/12/16/vox-media-to-cut-hundreds-of-freelance-jobs-ahead-of-californias-ab5.html

Ken – I think I cover that here – love the analogy to Gimli and Legolas:

In a dazzling display of either blithe indifference or shocking cluelessness, the author of AB 5, Assemblywoman Lorena Gonzalez, agreed to exempt employers from having to hire their freelancers as employees so long as they didn’t contribute more than 35 articles per year. Exactly how might this work in practice? There are freelancers who are paid to contribute several posts per day, usually in the 200 word or less range, for which they are paid accordingly. Then there are freelancers who are paid to contribute lengthy feature length articles which can exceed 5,000 or even 10,000 words.

According to Gonzalez, apparently, there’s no difference whatsoever between these submissions. It reminds one of the contest Gimli and Legolas were having in the movie version of Lord of the Rings. They were competing to see who would kill more enemies. Legolas had just slain a gigantic war elephant. To which Gimli shouted “That still only counts as one!”

Yep, I loved that part of the story. And I would have LOL’ed if I weren’t so busy crying over the great writers whose work would go unpublished because of this law. I think there are First Amendment issues here, as well. Should elected officials be writing laws that limit the ability of a free press to cover those elected officials?

We are a small safety and health services company and in addition to our existing staff we work with nearly 20 exceptional independent contractors throughout the state who are out there saving lives and preventing injuries for our clients. There may 5,000 of these such experts in the state who now will lose the opportunity to work independently. Some larger loss control firms have left the state already.

I’ve been following AB5 closely and want to thank you for your article. Your words have helped clarify a few things for me and I’m grateful.

My situation:

I own a classical piano studio where I contract classical pianists who want to teach from home (or the home of their students). They have complete control over their hours, clientele, curriculum, and also have a say in their pay (WELL above minimum wage) and what their clients are charged. Like most professional musicians, they have other jobs outside of teaching. (Ex. Church musicians, symphony musicians, music directors, private events, etc.) Many piano teachers struggle to find students, collect tuition, and plan performance opportunities for their students so that’s where I step in to help.

With that being said, it seems like my business falls equally between fine artists and tutors which appear to be exempt …. but I don’t want to be foolish! Is there a place where I can get more details to help define these groups?

Thanks again!

Please take this out of the sides of our businesses