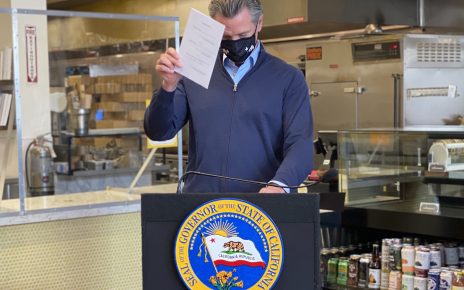

Newsom Can’t Hide Behind a Pandemic

In his 2021 State of the State Address, Governor Newsom’s focus, to the exclusion of nearly everything else, was to defend his response to the COVID-19 pandemic. A quick review of the 3,634 word transcript indicates only 20 percent of...