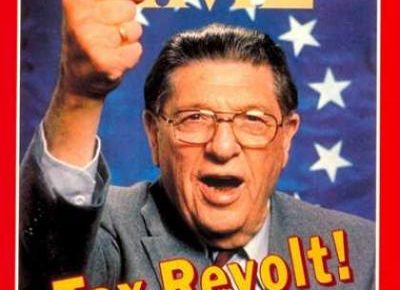

LA Taxpayers Association Coalition Announces Launch of the Taxpayer Protection and Government Accountability Act

The Los Angeles Taxpayers Association works on state and local levels in California to promote sound tax and regulatory policy. President Aidan Chao recently put together an extensive coalition in support of the Taxpayer Protection Act initiative. According to Chao,...