Gov. Gavin Newsom (Photo: Kevin Sanders for California Globe)

Governor Newsom Issues His First Vetoes

Gun ‘safety’ and another tax

By Katy Grimes, July 16, 2019 7:36 am

Last week Gov. Gavin Newsom signed 116 bills, and issued his first vetoes.

AB 603 by Assemblywoman Melissa Melendez (R-Lake Elsinore), would allow retired peace officers of California State University to carry a concealed weapon, just as peace officers of the University of California Police Department are allowed, along with all other retired peace officers in California. The bill is merely bringing parity to all retired police officers. Both the Senate and Assembly passed the bill with very few no-votes.

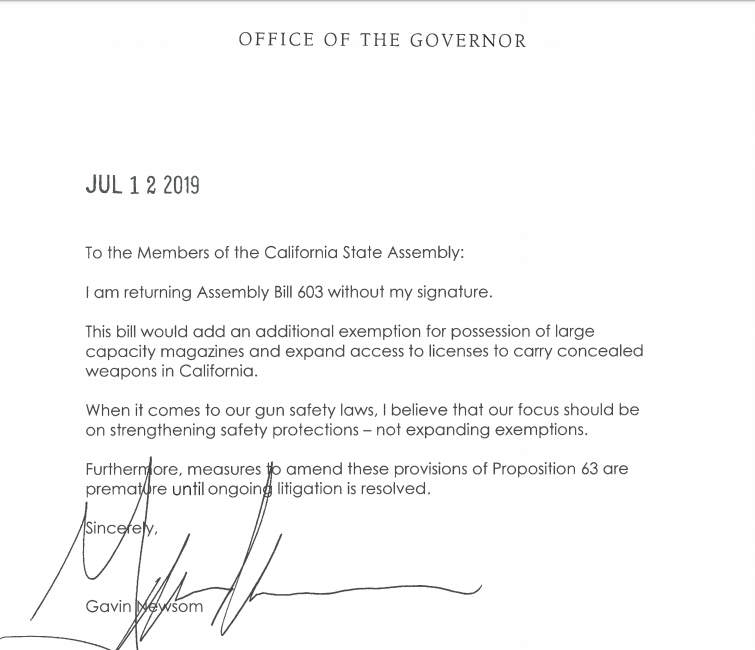

The Governor’s veto message ignored the many bipartisan committee debates which already covered the ground in which his veto is based. Gov. Newsom said the bill would have “added an additional exemption for exemption for possession for large capacity magazines, and expand licenses to carry concealed weapons in California.” Newsom said when it comes to “gun-safety laws, the focus should be on strengthening safety protections – not expanding exemptions.”

The veto message is here.

AB 618 by Assemblyman Mark Stone (D-Scotts Valley), would have allowed the Cities of Emeryville (Alameda County) and Scotts Valley (Santa Cruz County), to impose a transactions and use tax for either special or general purposes up to 0.25% above the 2% cap.

Assemblyman Mark Stone said, “Like many cities throughout our state, the Cities of Emeryville and Scotts Valley have limited resources with which to manage a wide range of services. Allowing these cities to take to voters the option to raise their transaction and use tax rate gives them the best opportunity to provide the services their residents expect.”

Gov. Newsom’s veto message said, “The cities of Emeryville and Scotts Valley have not yet reached the statewide cap of 2%, making it unclear why additional taxing authority is needed.”

AB 618 would have authorized the City of Scotts Valley and the City of Emeryville to increase their sales tax rate as high as .25 percent, exceeding the two percent threshold. Scotts Valley already has a sales tax rate of nine percent. the Howard Jarvis Taxpayers Association opposed AB 618 and offered this: “Authorizing new taxes that will likely be used to pay down unfunded pension liabilities rather than providing new services, is a poor rational for further regressive taxation.”

The Governor’s veto message is here.

- Globe Interview: Gubernatorial Candidate Jon Slavet - February 6, 2026

- New Fraud Uncovered in California: $8.6 billion COVID-era Relief - February 6, 2026

- California is One of the Terrible 10 Blue States on Taxes - February 5, 2026

Yep, he’s a nut job for sure!