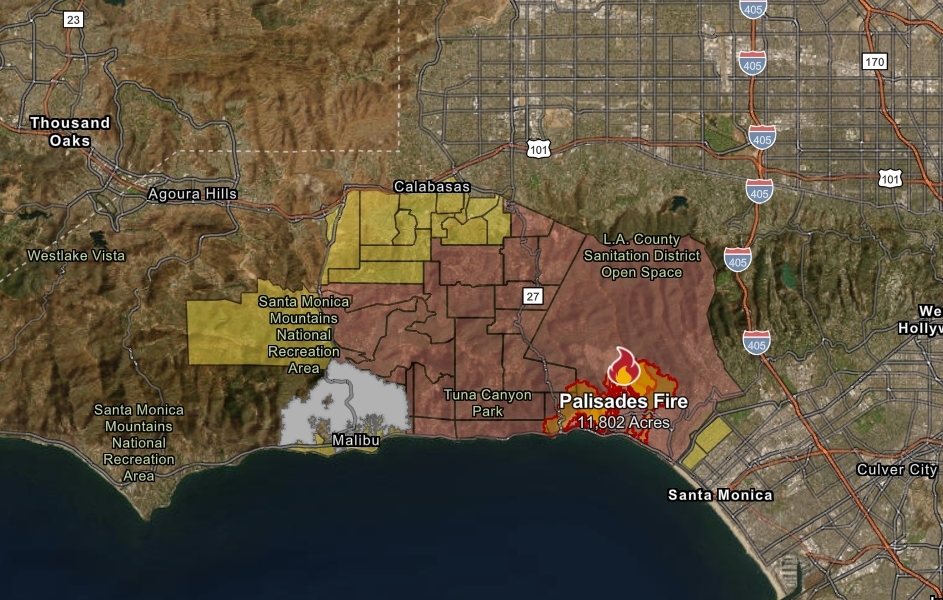

The 2025 Palisades Fire as of 1/8/2025 (Photo: CalFire)

California FAIR Plan Payouts So Far in Palisades and Eaton Fires

The Globe sent public records request to Ins Commish: ‘Where did FAIR get the additional $523 million? What is the funding source?’

By Katy Grimes, February 25, 2025 2:55 am

Earlier in February, the California FAIR Plan, the last resort fire insurance through the State of California, only had $377 million in the kitty available to payout claims, the Globe was told. After our visit to Pacific Palisades February 6th, the Globe heard that claims for the Palisades and Eaton fires were already being paid out. So somehow the FAIR Plan covered the gap to the $900 million goal to access the reinsurance.

Everyone has been nervous about this, knowing that the fire claims in Pacific Palisades and Los Angeles could wipe out the fund.

We sent the California Insurance Commissioner Ricardo Lara’s office a public records request on February 19, 2025, laying this out, and asking, “Where did FAIR get the additional $523 million? What is the funding source?”

In June, former state Senator Ted Gaines reported on the insurance crisis and the FAIR Plan for the Globe:

“California is and has been a lower-cost state for insurance but that did not accurately reflect the risk insurers faced, as the devastating wildfires of 2017 and 2020 proved,” Gaines said. “Those fires wiped out decades of insurer California profits and shed critical light on what rate adequacy really looks like. The low prices were an artifact of Prop. 103, which is acting as a price control, which always leads to shortages. It is proving a barrier to its stated goal of ensuring insurance is available to all Californians.”

Beyond Sen. Gaines’ explanation for how this happened, the real responsibility for California’s high insurance premiums lies in state politicians’ and the governor’s deluded “progressive” policy decisions and bad laws, driving up the high costs to rebuild. Most insurers say because of California’s high cost to rebuild, they can’t keep premiums artificially low any longer.

What are these high-cost-drivers?

- The California Environmental Quality Act (CEQA): As Ed Ring reported for the Globe, over 50+ years, “CEQA has acquired layers of legislative updates and precedent setting court rulings, warping it into a beast that denies clarity to developers and derails projects. When projects do make it through the CEQA gauntlet, the price of passage adds punitive costs in time and money.”

- Project labor agreements are one of the biggest obstacles to political collaboration between construction unions and groups representing business interests, Ed Ring explained. A PLA is “a pre-hire collective bargaining agreement with one or more labor organizations that establishes the terms and conditions of employment for a specific construction project.”

- federal, state, regional, and local agencies permitting, overlapping and conflicting regulations, and the agencies all have the power to halt building projects, allow a lawsuit, or rule change, require an entire new set of designs, and force and individual or builder to resubmit plans to every agency and start all over again (Ed Ring, summarized).

The Globe received a response Monday Feb. 24, 2025 from the California Department of Insurance, Legal Division-Government Law Bureau – we thanked them for their swift response. Here is what they sent and the information provided (emphasis the Globe):

“The Department concluded its search and found one responsive, public document linked as follows: Order No. 2025-1: Approving the California FAIR Plan Association’s Request to Issue. All other records are privileged and exempt from disclosure pursuant to Insurance Code sections 735.5, subdivision (c), 10097 and 12919, Government Code sections 7922.000, 7927.500, 7927.705, and 7929.000, and Evidence Code section 1040.”

WHEREAS, as of February 9, 2025, the FAIR Plan reports it has received 3,469 claims resulting from the Palisades fire and 1,325 claims from Eaton fire, which were the most destructive fires, in addition to over 500 claims related to other wildfire, wind, and non-catastrophe claims that fall outside the FAIR Plan’s reinsurance cover, and the FAIR Plan reports it is receiving new claims on a daily basis;

WHEREAS, since the January 2025 Southern California wildfires began, the Commissioner and the California Department of Insurance have urged the FAIR Plan to pay out claims to consumers as expeditiously as possible and have monitored the FAIR Plan’s payment of claims and its financial situation, and the FAIR Plan reports it is advancing payments of 50% of the dwelling coverage, 50% of the contents, and up to 12 months of Fair Rental Value on confirmed total losses;

WHEREAS, as of February 9, 2025, the FAIR Plan reports it has paid $914 million in claims and has reserved an additional $3.251 billion to pay remaining claims resulting from the Palisades and Eaton fires;

WHEREAS, the FAIR Plan has reported total retained earnings of $510 million as of December 31, 2024, before ignition of the January 2025 Southern California wildfires, but has now exhausted those funds and its remaining cash on hand of $1.2 billion is reserved for other liabilities that have been incurred but not yet paid;

WHEREAS, the FAIR Plan has reported that it does not yet have a line of credit in place or the ability to issue catastrophe bonds to pay for claims related to the January 2025 Southern California wildfires, but is continuing its efforts to secure a line of credit and access to catastrophe bonds to further enhance its ability to pay claims in the event of future disasters;

WHEREAS, the FAIR Plan reported that it has estimated its total loss from the Palisades and Eaton fires at approximately $4 billion and anticipates paying 75%, or $2.34 billion, of the remaining $3.125 billion reserved for unpaid losses from the Palisades and Eaton fires during March, April, and May 2025, in addition to other claims which are outside the FAIR Plan’s reinsurance cover which, due to advances in technology, is much faster than its historic pay rate of 66%;

WHEREAS, as of the date of this Order, the FAIR Plan has reported that, if the requested assessment is not approved by the Commissioner, it will not have sufficient funds, by the end of March 2025, to continue paying claims related to the January 2025 Southern California wildfires, losses from unrelated or subsequent events, and other operating expenses, including reinsurance for 2025-26 and the cost of increasing staff to respond to the disaster; and,

WHEREAS, based on the foregoing information, the Commissioner is satisfied that the FAIR Plan has demonstrated that it is in substantial danger of insolvency unless it is authorized to assess its member insurance companies $1 billion to be collected in March 2025, and that the requested assessment is necessary to provide the FAIR Plan with sufficient funds to keep operating and promptly pay claims

without interruption.

It is ordered:

1. The FAIR Plan’s request for an assessment in the amount of $1 billion is APPROVED;

2. The FAIR Plan must calculate each member insurer’s assessment participation in

accordance with the Plan of Operation (Ed. 8/27/24) and California Insurance Code sections 10094 and 10095;

3. This Order is final immediately upon execution;

4. Once served with an executed copy of this Order, the FAIR Plan may immediately begin issuing assessment participation notices to its member insurers, with member insurers to remit payment to the FAIR Plan within 30 days of the date that the FAIR Plan sends notice of the amount due; and,

5. The FAIR Plan maintains constant and immediate communication with Department staff to ensure the FAIR Plan remains solvent and continues to operate and promptly pay consumer claims without interruption.

IT IS SO ORDERED.

Executed this 11th day of February, 2025

By_____________________________

RICARDO LARA

California Insurance Commissioner

While this might buy some time for those unfortunately souls who lost their homes/lives/livelihoods in the January fires, it is deeply troubling to ALL of us as what incentive does a commercial insurance company have to remain in California and subject themselves to the capricious whims of “progressive” Democrats, who have ZERO business, actuarial, risk-management or practical experience in the real world?

This is what happens when “community organizers” are elected to office, folks…

STOP VOTING FOR DEMOCRATS!!! They ain’t your friends, and they WILL cheat on you….

WHEREAS, California Democrats have COMPLETELY mismanaged just about everything they touch, and are therefore considered an existential threat to the financial well-being of their constituents, and

WHEREAS Gavin Newsom’s signature looks like a Richter-scale reading, and is indicative of extreme narcissistic personality disorder, and

WHEREAS Ricardo Lara is an incompetent fool who the affected insurers should DEMAND an audit of his “billion dollar” reserve calculations to ensure that said funds are NOT MISAPPROPRIATED by corrupt California Democrat politicians.