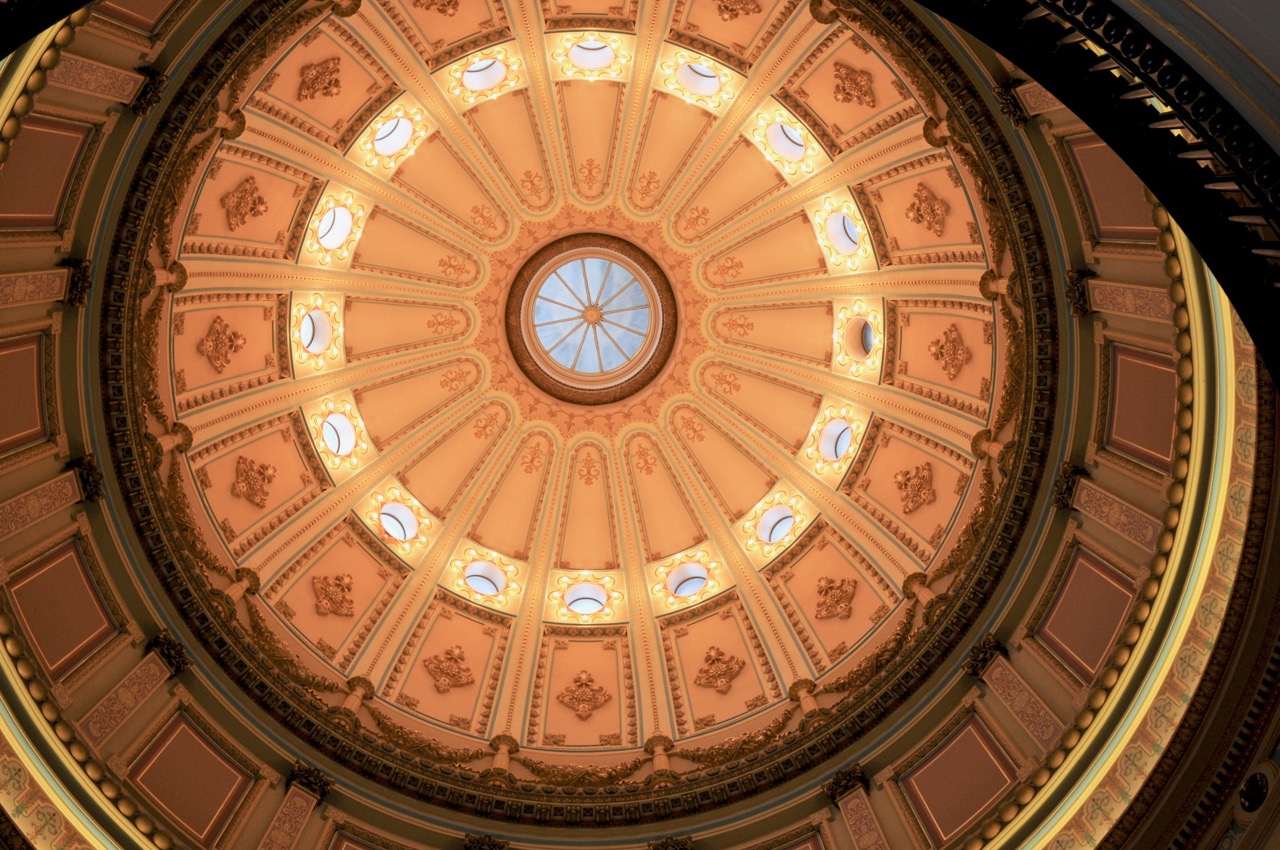

California State Capitol. (Photo: Kevin Sanders for California Globe)

Assignment of Wages under the Labor Code

An assignment of wages to be earned is revocable at any time by the maker

By Chris Micheli, June 4, 2023 6:30 am

The California Labor Code, in Division 2, Part 1, Chapter 2, provides laws related to the assignment of wages. Chapter 2 was enacted in 1937 by Chapter 90. Labor Code Section 300 defines the phrase “assignment of wages.” It also prohibits the assignment of wages that are earned or to be earned unless the following conditions are met:

- The assignment is contained in a separate written instrument, signed by the person by whom the wages or salary have been earned or are to be earned, and identifying specifically the transaction to which the assignment relates.

- Where the assignment is made by a married person, the written consent of the spouse of the person making the assignment is attached to the assignment, with specified exceptions.

- Where the assignment is made by a minor, the written consent of a parent or guardian of the minor is attached to the assignment.

- Where the assignment is made by a person who is unmarried or who is an adult or who is both unmarried and an adult, a written statement by the person making the assignment, setting forth specified facts, is attached to or included in the assignment.

- No other assignment exists in connection with the same transaction or series of transactions and a written statement by the person making the assignment to that effect is attached to or included in the assignment.

- A copy of the assignment and of the written statement provided is filed with the employer, accompanied by an itemized statement of the amount then due to the assignee.

- At the time the assignment is filed with the employer, no other assignment of wages of the employee is subject to payment and no earnings withholding order against the employee’s wages or salary is in force.

In addition, a sum not to exceed 50 per centum of the assignor’s wages or salary is allowed to be withheld by, and be collectible from, the assignor’s employer at the time of each payment of wages or salary.

Moreover, the employer is entitled to rely upon the statements of fact in the written statement provided without the necessity of inquiring into its truth, and the employer does not incur liability by reason of any payments made by the employer to an assignee under any assignment in reliance upon the facts so stated. An assignment of wages to be earned is revocable at any time by the maker.

Finally, this section of law does not apply to deductions which the employer may be requested by the employee to make for the payment of life, retirement, disability or unemployment insurance premiums, for the payment of taxes owing from the employee, for contribution to funds, plans or systems providing for death, retirement, disability, unemployment, or other benefits, for the payment for goods or services furnished by the employer to the employee or the employee’s family at the request of the employee, or for charitable, educational, patriotic or similar purposes.

- Frequently Asked Questions about State Agency Ethics Training - April 26, 2024

- Frequently Asked Questions about When Elected Officials Take Office - April 25, 2024

- Frequently Asked Questions About Ethics Training for Local Agencies - April 24, 2024