Map of California

California Cities in Critical Condition

The one financial threat that was mentioned in all five of the California State Auditor’s requests was pensions

By Edward Ring, March 18, 2020 2:21 am

The recent and long overdue correction in the stock market, triggered by a global pandemic paralyzing huge segments of the U.S. and global economy, will cause sales tax revenues to crater for as long as “social distancing” mandates remain in place, and afterwards, even an extraordinary rebound is unlikely to make up for the loss.

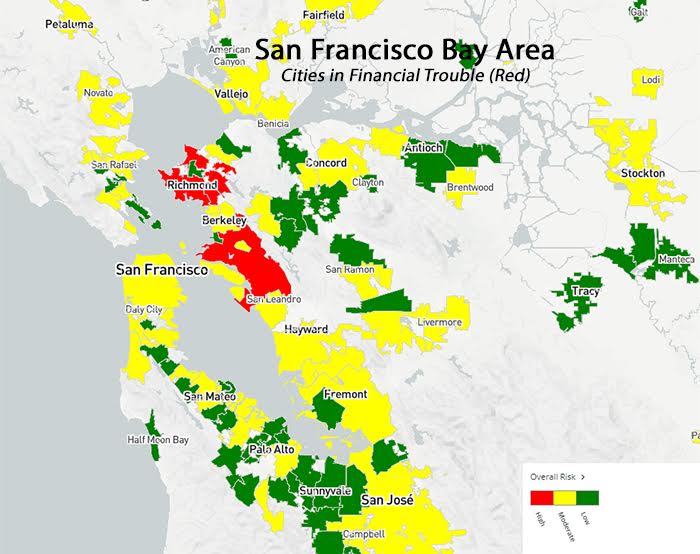

The specter of California’s cities and counties becoming insolvent is nothing new. Three major California cities have already declared bankruptcy, Vallejo in 2008, Stockton and San Bernardino in 2012. In October 2019, the California State Auditor’s Office reported on the fiscal health of 471 California cities.

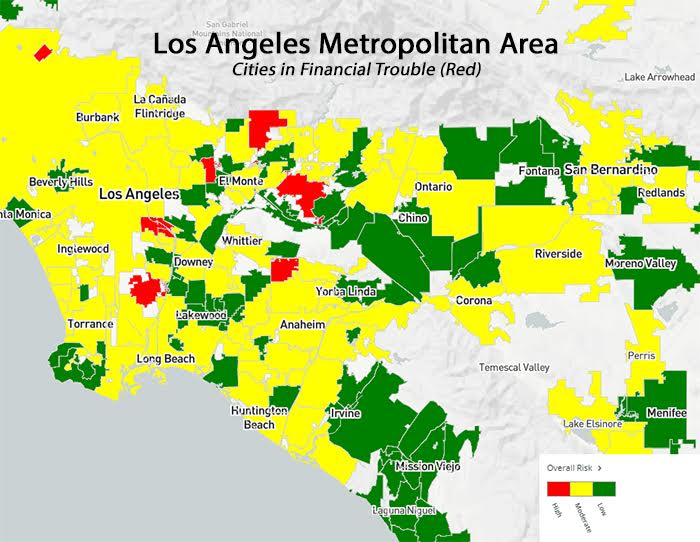

On what the California State Auditor’s office describes as a “Local Government High Risk Dashboard,” they identified 18 high risk communities: Compton, Atwater, Blythe, Lindsay, Calexico, San Fernando, El Cerrito, San Gabriel, Maywood, Monrovia, Vernon, Richmond, Oakland, Ione, Del Rey Oaks, Marysville, West Covina, and La Habra.

This so-called “dashboard” includes data for all the 471 cities on financial variables such as liquidity, debt, reserves, pensions and other retirement benefits. It also provides an excellent map. On this zoomed in segment, the financially troubled cities of (from north to south) Richmond and El Cerrito (contiguous), and Oakland can be seen highlighted in red.

Southern California also has its share of financially troubled cities, as shown on the next map segment taken from the California State Auditor’s dashboard. Clockwise, starting from the top, the most financially endangered cities are Monrovia, West Covina, La Habra, Compton, Vernon and Commerce (contiguous), and San Gabriel.

Back in October 2019 when the California State Auditor warned Californians about 18 cities in immediate financial peril, the overall economic situation looked very different than it does today. And at that time, articles that reported on the auditor’s warning published by Reason, Governing, and Associated Press all pointed to underfunded pensions as a primary cause of their financial distress.

Not long ago, but still prior to the events of the past few weeks, during a hearing in the California State Assembly on February 26, the California State Auditor requested authorization to conduct in-depth audits of the financial health of five California cities, Blythe, El Cerrito, Lindsay, San Gabriel, and West Covina.

The one financial threat that was mentioned in all five of the California State Auditor’s requests was pensions.

- “Blythe has incurred substantial debt and increasing liabilities pertaining to its city employee retirement costs, which could result in the city needing to divert more of its general fund resources to cover these costs in lieu of providing essential public services.”

- “El Cerrito has not developed a long-term approach to improve its financial condition and has not addressed its increasing pension costs.”

- “Lindsay anticipates its pension and other post-employment benefit costs to at least double by fiscal year 2025-26.”

- “My office identified San Gabriel as the eighth most fiscally challenged city in California primarily because it has insufficient cash and financial reserves to pay its ongoing bills and it faces challenges in paying for employee retirement benefits.”

- “West Covina’s unfunded pension liability is very high compared to its annual revenues, and it has only set aside a portion of the funding it will need to pay for the pension benefits already earned by its employees. Its growing pension costs will also put additional pressure on its finances.”

The Market Correction Will Affect More Than Pension Payments

It’s interesting to wonder why California’s State Auditor selected five relatively small cities for the scrutiny of a state audit. The most troubled of the five, Blythe, was number three on the auditor’s ranking by overall financial risk, behind Compton and Atwater. The City of West Covina was number 17. So why not big cities? Why not Oakland, ranked number 13, or San Jose, ranked number 23, or big Los Angeles, ranked number 32? When the denominator is 471, being ranked 32 is not good – that puts Los Angeles in the worst seven percent.

But now what? Now that the economy is slowing, and the value of investments are correcting dramatically downward?

No matter what position one may take on the financial wisdom of offering defined benefit pension plans to public employees, one point needs to be reiterated at a time like this: While it is true that an 80 percent funded status is considered adequate for a pension fund, it refers to an average across the business cycle. It does not represent what should be necessary at the end of a bull market. California’s public employee pension funds, a few weeks ago and at what we now know was the end of an 11 year bull market, were only about 70 percent funded.

This cannot be stressed enough, because it puts into proper perspective what has to be faced today. A healthy pension system at the end of over a decade of extraordinary investment returns should be overfunded. Perhaps it is credible to be sanguine about falling a bit short of the 80 percent threshold after ten years of investment doldrums, but it is absurd, and dangerous, to pretend such a level of funding is adequate after ten or more years of spectacular investment gains.

And it isn’t just pensions, anymore, that are going to affect the financial health of cities across California, from San Jose and Oakland in the north down to Los Angeles in the south. The recent and long overdue correction in the stock market was triggered by a global pandemic that is going to paralyze huge segments of the U.S. and global economy for the next several weeks, if not months. This will cause sales tax revenues to crater for as long as “social distancing” mandates remain in place, and afterwards, even an extraordinary rebound is unlikely to make up for the loss.

The impact of investment losses will impact the pension funds in two ways. Obviously they are going to have to require more from taxpayers to cover their losses, and they were already phasing in a near doubling of their required contributions – which California’s cities and counties had no idea how they were going to pay for. But the other impact, lower revenue, will pose a much bigger challenge, affecting the ability of cities and counties to pay for anything, including the pension funds.

Not only will sales tax revenue falter, but state income tax revenues will fall. California’s state government is highly dependent on income tax revenue from the wealthiest Californians. As reported by Cal Matters, “California’s tax system, which relies heavily on the wealthy for state income, is prone to boom-and-bust cycles. While it delivers big returns from the rich whenever Wall Street goes on a bull run, it forces state and local governments to cut services, raise taxes or borrow money in a downturn.”

California’s state and local governments have had over a decade to get their financial house in order. Instead, they have largely ignored the pension problem, with even Gov. Jerry Brown calling the PEPRA reforms of 2014 an inadequate compromise offering only incremental improvements. They have continued to make punitive demands on businesses, increasing taxes and spending at every opportunity. They have enacted regulations that make affordable housing and energy financially impossible for private sector interests to develop. They have emptied the prisons and opened the borders, putting additional stress on public services. They have created a state where one little push will end the good times.

That push has come.

Even the nonreligious may find an apt parable for today’s dilemma in Genesis Chapter 41, verses 17 through 33. During good years, you prepare for bad years. Too bad the wisdom of the ages emphatically does not apply in woke California.

- Ringside: Quantifying California’s Brave EV Future - July 25, 2024

- Ringside: California’s Water Economy – The Three Biggest Choices - July 18, 2024

- Ringside: An Overview of California’s Water Economy - July 13, 2024

California teachers unions raised a generation of K-12 students to hate “corporations” and the US market. Yet the teachers own public pensions depend on a healthy US market and stock returns. Make the teachers unions accountable for this pension meltdown.

Teacher pension fortunes go up and down wth the market; and not off the backs of state taxpayers. If teachers want to boycott and divest their public pension investments, then they alone take the financial risks of those demands.

Same holds true for CaPERS and all other governement pensions. They pay for the risks and active sabotage of the state’s economy and obstructions to any public pension reforms. It is no longer our obligation to ball out their misplaced social agendas.

If the teachers unions in this state were actually doing a credible job, we would protect and support them. But they are not – we remain one of the worst performing K-12 systems in the nation. Close it down, cash out the teacher pensions and start over again —with NO teachers unions tis time.

If government workers were actually being productive and getting work done rather than hiring their relatives and making up make work or out on paid leaves, we might care about them too. But we don’t any longer. They made their own beds, they now lie in them.

This has to happen now in order to save social security and all public pensions:

https://drive.google.com/file/d/0B90sU3A85q46OE9BZHJFSWEzbGM/view?uspdrivesdk

Represented by mouthpieces, such as Edward Ring, those that would destroy our pension for their own financial gain, never sleep and are always throwing out new bait to test the waters of gullibility.

As you read Edward Ring’s article, it becomes evident that he is not representing the interests of working people. Working people depend upon every resource they are able to cobble together to insure their financial security at retirement. Ring is representing the interests of large investors that would like nothing better than to eliminate public pension trust funds through out the United States. This group has essentially eliminated private pensions and are now focusing on public pension funds. They have convinced Californian’s that the 2008 recession was the fault of public pensions and, as a result, brought about quite a reduction in the financial security of future California public employee retirees.

Most of Ring’s argument would not stand up to critical evaluation. His argument is factually incorrect at every point, as well as illogical, because he is comparing apples to monkey wenches. There is absolutely no logical financial connection in his argument between public pension and the overall economy. As a matter of fact, he has it all wrong, because when retirees are financially secure, the economy is enriched. Since the facts and the logic do not back him up, he has created his own facts and his own logic. Despite his muddled arguments, he makes it perfectly clear his intend is to destroy pensions for the elderly.

One fact that is perfectly clear in our society is that the opulence of the wealthy has become a social crises and is a major reason for the human economic oppression we are observing throughout the United States. If any working person find that acceptable, they have got to be a masochist. The tragedy of his entire article is that he would destroy the financial security of millions of Americans, for the financial gain of a few.

Bill – it’s hard to know where to begin, but let’s go through some of the points you make: First, nobody is going to gain financially by reforming pensions, because even if they were all turned into 401Ks, the same state run pensions systems such as CalPERs and CalSTRS would manage the individual 401Ks. They already do. Look it up.

Second, in what amounts to heresy to libertarians, I have consistently argued for strengthening Social Security, and have often called for merging the public employee pension funds with the Social Security Trust Fund. There are strong arguments for this, although the practical implementation of such a project renders it a nearly impossible dream. Here’s the latest proof of that:

https://amgreatness.com/2020/03/15/government-pensions-are-dividing-americans-and-damaging-the-economy/

Next, Bill, my position has never been to “destroy” public sector pensions, but to reform them so they aren’t financially unsustainable. Making the ERISA standards which keep private sector pension plans solvent applicable to public sector pension plans would go a long way towards doing that. Why is there a double standard? Why, for that matter, is the California legislature’s attempt to roll out a pension plan for private sector workers not disclosing what long term earnings assumption they intend to use? Perhaps because it isn’t anywhere near the ridiculous 7.0 percent (or more) that public sector pension funds still use?

And let’s talk about that 7.0 percent “risk free” rate of return. Can you count on getting 7.0 percent, risk free, from any investments you make as an individual? How would you do that? The last time a CD paid 7.0 percent was back in the 1980s. Bank savings accounts rarely pay more than 1.5 percent. Why is it, Bill, that when the market crashes, private citizens have to cope with diminished retirement savings, but public employees just sail along, pressuring their unions to force politicians to raise taxes to help the pension funds?

The problem with YOUR argument, Bill, and I say this with respect, is that America today, California in particular, pays far more attention to the retirement security of public employees than to ordinary private sector workers. And the repercussions are everywhere. Why do you think there’s no public sector money for infrastructure any more, which means that the dizzying assortment of building fees, per home, are now up around $100K (or more) to pay for infrastructure? This is how payments to the pension funds drive up home prices. Why do you think overtime costs in the public sector are out of control? It’s because it’s cheaper to pay overtime than to hire another public employee and try to fund their pension benefits.

It is important to close by reiterating that nobody is trying to get rid of your pensions. Even some of the big libertarian organizations such as the Reason Foundation and the Arnold Foundation have modified their policy recommendations towards fixing pensions instead of scrapping them for 401Ks. The best retirement security package, which could be extended to all Americans, would be a combination of a small pension, a 401K plan, and Social Security. That is what’s done in the Federal System, and it works. Why don’t we work together on that?

If you think the pension systems for California’s public employees are not disrupting the economy, and are not completely out of control, you may want to review the latest financial statements and press releases from CalPERS and CalSTRS.

We would probably agree that the American economy has become too financialized, and that has harmed ordinary workers. But public employee pension funds are part of that financial game. They are huge players in private equity deals, hedge funds, and countless other speculative investments in debt, real estate, and foreign securities including in fascist China. If they weren’t trying to earn an impossible 7.0 percent per year to perpetuate the lie that unreformed pensions are affordable, all the speculative risk taking and shady investment schemes would end. Deal with it.

You live in Lala land. IMO The problem is public employees have become pension grubbers who focus on nothing other than how they can maintain their grip on their slimy pension. The amount of people who did nothing but cause damage through laziness, incompetence and politically biased actions who want to sit at home and collect 100-400k a year is absurd. Every admin employee of Imperial County breaks every law imaginable on a routine basis to shower their ‘partners’ with gov funds. The Imperial County Supes sank all the county’s pension funds into GS arranged fund that has no doubt cratered. Now they will steal more homes from the poor and disabled to make up for it (using zoning and land use laws selectively). You and the rest of your pension grubbing thieves and commie police are going to get stiffed bigtime. Count on it. The police don’t patrol in our part of the county (yeah) because they are cutting services to bolster their pension funds. You screwed everyone on the left and right. And now you don’t have the firepower to stop us from telling you and your pension to FO. The constitution can’t save you. 1 year from now, nobody will give a rat’s butt your pensions are ‘guaranteed’. The gig is up gov tool. You and your brethren have done nothing but serve globalist elites, and now they are going to feed you to the public like a solyent green cracker to avoid public backlash and to keep their ill gotten gains.