Assemblywoman Lorena Gonzalez. (Photo: Kevin Sanders for California Globe)

California Lawmakers Could Ruin the Gig Economy if AB 5 is Signed into Law

The turmoil that will be created by this decision effects virtually every industry in California

By Katy Grimes, September 9, 2019 3:52 pm

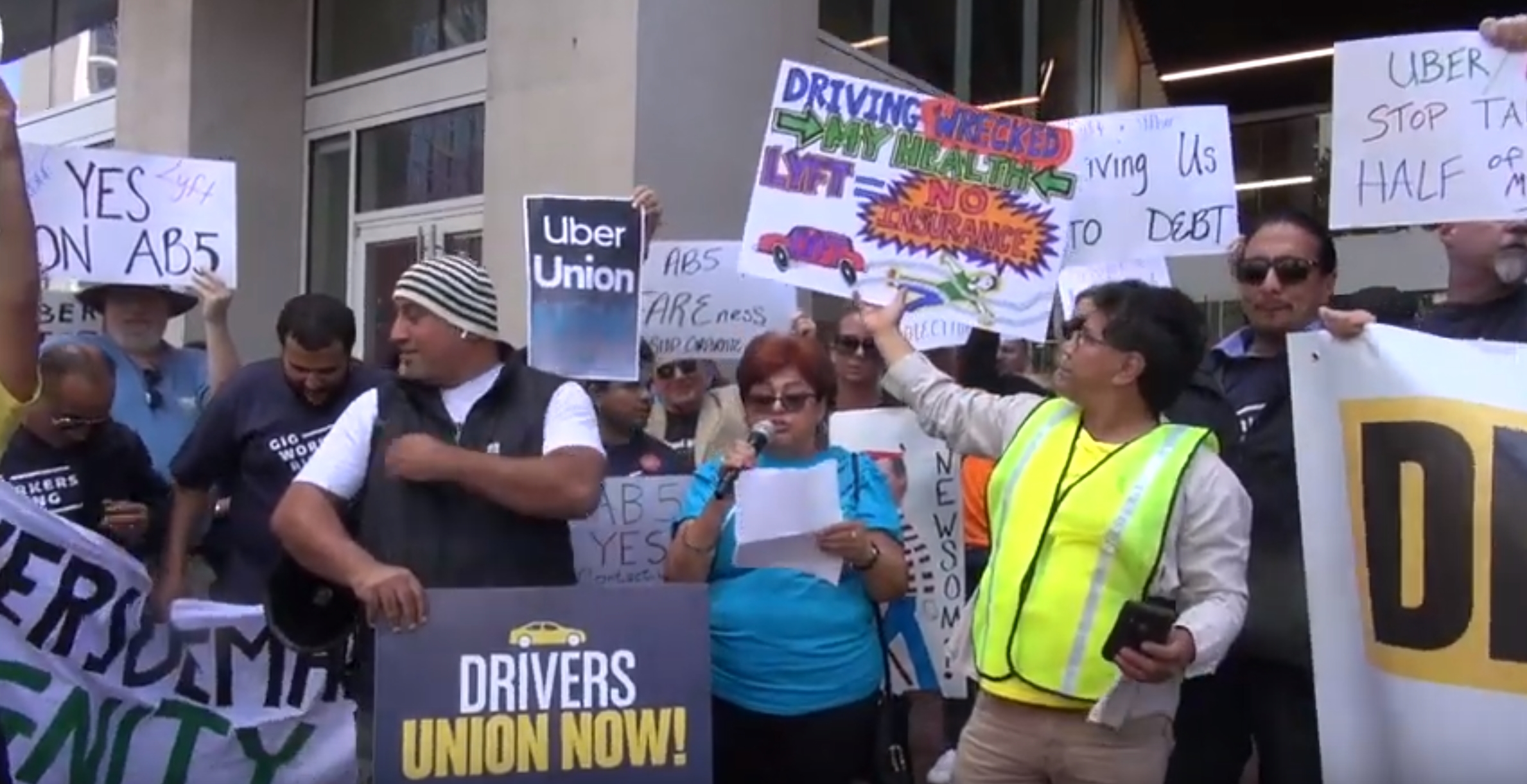

Assembly Bill 5 by Assemblywoman Lorena Gonzalez (D-San Diego) could destroy California’s Gig economy if passed and signed into law. The Gig economy includes ride-share businesses like Uber and Lyft, and food delivery services Postmates and DoorDash.

A gig economy is a free market system in which freelance, temporary and flexible job positions are common and organizations contract with independent workers for short-term engagements. Last year, the Bureau of Labor Statistics reported that 55 million people in the U.S. are “gig workers,” which is more than 35 percent of the U.S. workforce. That number is projected to jump to 43 percent by 2020, Forbes reported.

The Service Employees International Union is pushing a separate ride-share driver bill to organize drivers, ignoring the April decision by the National Labor Relations Board and the US Department of Labor determining that that Uber drivers are independent contractors.

Gov. Gavin Newsom has thrown in his support for this takeover of independent contractors. In a recent op ed, Newsom said, “Reversing the trend of misclassification is a necessary and important step to improve the lives of working people. That’s why, this Labor Day, I am proud to be supporting Assembly Bill 5, which extends critical labor protections to more workers by curbing misclassification.”

Business industry policy experts warn that the turmoil that will be created by this decision effects virtually every industry and its freelance, flexible and independent workforce in California from beauticians to real estate agents, from construction workers to Gig workers and everything in between.

The problem is two fold: the bill is based on the legally flawed California Supreme Court Dynamex decision, and more than just Uber and Lyft would be forced to reclassify their drivers from independent contractors to employees.

In 2018, the California Supreme Court’s decision in Dynamex Operations West, Inc. v. Superior Court of Los Angeles dealt a blow to independent contractors. The Court ruled that the Dynamex delivery drivers were employees, rejecting its own prior test for determining whether workers should be classified as either employees or independent contractors,” Forbes reported.

According to many legal analysts, what the Court did was legislate from the bench by adopting a new rule for the narrow purpose of interpreting California’s Industrial Welfare Commission’s wage orders.

In August, in response to the threat of unionization following the change from independent contractors to employees, Uber, Lyft and Doordash promised to take the fight to unionize their independent contractor drivers to voters, by committing $60 million to fund a California ballot initiative in 2020, unless lawmakers allow independent contracting employment for more than 300,000 drivers and delivery workers in the state.

And now this week, many industries and business associations are weighing in with amendments of their own on AB 5, hoping to overwhelm the bill’s supporters in the Legislature.

A partial list of separate amendments to exempt the following classifications:

- Physical Therapists

- Design Industry (engineering, project management, etc):

- Franchisors and Franchisees

- Interpreters/Translators

- Health Care Industry

- Single Truck Owner-Operators

- Forestry Industry

- Newspaper Carriers and Distributors

Many newspaper editorial boards have come out in opposition to AB 5 as newspaper delivery drivers would be impacted. The Sacramento Bee editorial board ‘warned, “The bill, as currently written, could force many California newspapers out of business. That’s because the bill would require newspapers to treat newspaper carriers as employees rather than independent contractors. This would disrupt and destabilize the newspaper industry at a time when accurate, credible news is most needed – and most threatened.”

AB 5 also provides exemptions for a number of specific occupations and professions, demonstrating that the Dynamex decision is flawed and wrong.

C. Jarrett Dieterle and Steven Greenhut of the R Street Institute addressed the exemption issue in a recent editorial titled, Crony carve-outs in California independent-contractor fight:

“In the aftermath of a far-reaching California Supreme Court decision regarding worker classification, state lawmakers are poised to fail one of the most basic tests of good governance: the equal application of the law. Instead of fixing a ruling that threatens the gig economy as well as many, more established industries, the Legislature is working on carve-outs for politically connected industries. This is the wrong approach.”

State labor representatives have also started hedging, claiming that “conversations” are needed about exemptions for hand-picked industries. Gonzalez-Fletcher has openly acknowledged that lawmakers are “meeting with countless industries” about carve outs and that “[e]verybody is lobbying for an exemption.” This type of government by exemption gives credence to critics who suspect that the legislation is a union-backed effort to quash competition.

At last count, there were already more than 30 industries/professions exempted in the carve-out of AB 5, making crystal clear that this bill was aimed at the ride-share industry. But it will serve to take out independent truck drivers, tow-truck drivers, and a number of driving-related jobs, if allowed to pass.

The U.S. Chamber of Commerce released a letter in opposition of AB 5 saying, “The bill as written threatens to undermine longstanding business relationships by codifying the California Supreme Court’s misguided 2018 decision in Dynamex Operations West, Inc. v. Superior Court.”

AB 5 is expected to be voted on this week in the State Senate.

- While Newsom Fiddles, California’s Gas & Oil Crisis Ramps Up with Tensions Between the US and Iran - February 22, 2026

- Trump Responds, Issues Global 10% Tariff on all Countries - February 21, 2026

- What is Trump’s Plan B After Supreme Court Strikes Down Tariffs? - February 20, 2026

what do yo know about ride share drivers? I make very good money and has allowed me to be flexible. Mind your own business. You should be puttting your efforts to something that actually is good for America. Your a commie. Stop your meddling so the union can get my money. THis is rediculous. Why havent you gone to the rideshare workers for their opinions? Oh I know because you want to run peoples lives… I am sick of you Democratic socialist taking my rights away. THis is America,,, oh well maybe not anymore..

Being an independent software developer I agree. They just want to increase the union numbers along with adding more money into the tax coffers and control our lives.

Apparently, Karen sides with big corporations who misclassify workers in order to increase their bottom line. If you read the text of said bill (AB5) you might realize that the only “ruin” is to the profiteers (big corps). They will have to pay for minor things like unemployment insurance, disability insurance, social security and medicare. The taxpayers of California and the nation have to footthe bill for these services while the corporations rake in the dough.

“A gig economy is a free market system in which freelance, temporary and flexible job positions are common and organizations contract with independent workers for short term engagements”. Am I right in thinking that sounds like any and all politicians are part of the gig economy? Just saying.