Assemblyman Alex Lee. (Photo: votealexlee.com)

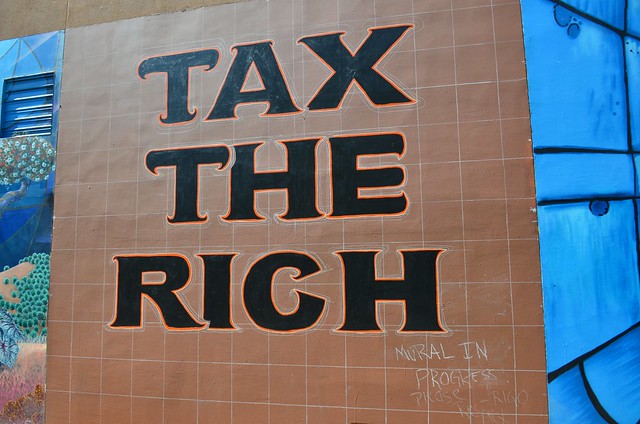

New Wealth Tax Introduced in California

The Legislature may provide for the taxation of all forms of personal property or wealth

By Katy Grimes, January 21, 2023 8:08 am

On January 19, a new wealth tax was introduced in the California Legislature. Assembly Constitutional Amendment (ACA) 3 was introduced by Assemblyman Alex Lee (D-Palo Alto), along with co-authors Assembly Members Ash Kalra, Wendy Carrillo, Matt Haney, Corey Jackson, Liz Ortega, and Miguel Santiago, and Senators Maria Elena Durazo, Lena Gonzalez, and Lola Smallwood-Cuevas.

ACA 3 is a resolution to propose to the people of the State of California an amendment to the California Constitution, by amending Section 2 of Article XIII, and by amending Section 1 of Article XIII B, relating to public finance. As a constitutional amendment, ACA 3 will require a 2/3 vote in both the Assembly and Senate before it would go before California’s voters on the next statewide ballot.

ACA 3 begins with six WHEREAS clauses including that California has long-term needs that are not being met by existing revenue sources; wealth inequality among state residents has increased dramatically; a tax on extreme wealth will restore fairness to California’s tax system and raise significant revenue to meet new and existing urgent needs; and, the State’s appropriations limit needs to be updated so that it also permits the state and local government to meet their basic obligations in a changing and more challenging world.

The first change that ACA 3 would make is to amend Article XIII, Section 2 to provide that the Legislature may provide for the taxation of all forms of personal property or wealth, tangible or intangible and classify personal property or wealth for differential taxation or for exemption. In addition, any tax on personal property or wealth imposed would be administered and collected by the Franchise Tax Board and the Department of Justice, as determined by the Legislature in statute.

The second change that ACA 3 would make is to amend Article XIII B, Section 1 to modify the Gann Limit or the State Appropriations Limit (SAL). The SAL would not be exceeded unless two out of three conditions have been satisfied. The first would require expenditures per student to place California in the top 10 states. The second would determine that California is among the 10 states with the lowest fraction of population without health insurance. The third would determine that California is no longer among the top 10 states with the highest percentage of households whose costs are in excess of 50% of household income.

This is a secondary tax on wealth that was already taxed at the point of acquisition, consumption, or income already made. A wealth tax will not simply be for the wealthy, it will end up consuming all citizens of California. This kind of tax is and should be illegal in any way, shape, or form. The idea that you can tax wealth already created or generated beyond income is an unfathomable absurdity and needs to be stopped.

Tax Billionaires today, so tomorrow we can tax the middle class and poor. Don’t be fooled this is the plan

“The first change that ACA 3 would make is to amend Article XIII, Section 2 to provide that the Legislature may provide for the taxation of all forms of personal property or wealth, tangible or intangible and classify personal property or wealth for differential taxation or for exemption. In addition, any tax on personal property or wealth imposed would be administered and collected by the Franchise Tax Board and the Department of Justice, as determined by the Legislature in statute.”

This statement should scare the snot out of homeowners…As I read it, the state would be able to tax un-realized gain on homeowners houses. This is over and above county real estate taxes. We need to hammer our Assembly persons to vote against this monstrosity. If it passes the migration out of Taxifornia will be beyond belief.

Hammer your assembly member about this, as Tom said. And others, if you can get through to them:

https://www.assembly.ca.gov/assemblymembers

Hammer your senator for good measure:

https://www.senate.ca.gov/senators

newsom thinks that he will be off to the swamp before biting the hands that has kept him in power will impact his dream to be king.

What are the exemptions and limits? Like where does the tax start?

The California Legislature is full of out of touch idiots. Taxing people for things they were already taxed on. If this goes through it will be time to organize and remove any politician who votes for it.