California State Capitol. (Photo: Kevin Sanders for California Globe)

US Pension Funds Lost $400 Billion on China Investments in July

Chief investment officer of CalPERS was actually recruited to this position by the Chinese Communist Party

By Katy Grimes, August 3, 2021 7:47 am

“Big Chinese tech stocks lost hundreds of billions of dollars in combined market value in July, reflecting rising investor concern about how the sector will fare under a barrage of regulatory pressure from Beijing,” the Wall Street Journal reported last week. “A large number of companies, including Alibaba, Baidu Inc. and JD.com Inc., have both Hong Kong shares and American depositary receipts.”

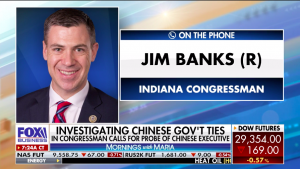

In February 2020, the Globe reported that Indiana Rep. Jim Banks sent California Gov. Gavin Newsom a letter calling for the investigation of the Chief Investment Officer Yu Ben Meng of the California Public Employees’ Retirement System, the largest public pension fund in the nation, for his “long and cozy relationship with China.”

“The fund [CalPERS] has invested $3.1 billion in Chinese companies, some of which have been blacklisted by the U.S. government,” Banks told FOX Business’ Maria Bartiromo in an interview.

“We learned that Mr. Meng, who is the chief investment officer of CalPERS, was actually recruited to this position by the [Chinese Communist Party] through something called the Thousand Talents Program,” Banks said. “Now he’s denied it.”

A 2017 article in the Chinese newspaper Society People, reported Meng was then recruited to the position at SAFE by Beijing’s Thousand Talents Program, which provides funding to U.S. citizens in exchange for information. Meng left CalPERS, and then came back.

In addition to the $360 billion in CalPERS assets, Rep. Banks said in his letter that the public employee pension fund has a notable history of “shareholder activism.”

The Globe did several follow up articles including when then-President Trump ordered all U.S. retirement funds to be pulled from Chinese investments.

Now, the Wall Street Journal is reporting that American investors are asking whether China Inc. is still worth the risk following a widening series of regulatory crackdowns that have wiped some $400 billion off the value of U.S.-listed Chinese companies.

Instead of investing in American companies, Investment Officers like Yu Ben Meng were investing pension funds in Chinese Communist Party high-tech companies.

The Wall Street Journal explains what happened:

“Beijing’s decision last week to curtail the operations of China’s for-profit tutoring industry along with its ongoing campaign to rein in tech companies. The moves fueled large declines across sectors of China’s stock markets and hammered Asia-focused funds stateside.

The investor retreat sent tutoring firm TAL Education Group’s TAL -8.08% American depositary receipts down some 70% in a matter of days to $6.19 Friday morning. TAL traded above $90 in February. American depositary receipts, or ADRs, are certificates issued to U.S. investors that represent a specified number of shares in a foreign company.”

Secretary of State Mike Pompeo warned in 2020, “California’s investment fund is invested in companies that supply the People’s Liberation Army (PLA) that puts our soldiers, sailors, Airmen and Marines at risk.”

In his letter to Gov. Newsom Rep. Banks said, “CalPERS 2018-2019 report confirms the Secretary’s statement.”

In a Tweet, Banks wrote:

.@GovernorNewsom, please explain why someone recruited by a Chinese org described by FBI as a “non-traditional espionage” program is making investment decisions for CalPERS. Also US dollars should never be funding Chinese military or oppression of Uighurs!https://t.co/EkzF4cQMg4

— Jim Banks (@RepJimBanks) February 13, 2020

By May 2020, President Trump said he wanted to cut investment ties between U.S. federal retirement funds and Chinese equities, in a move tied to the handling of COVID 19.

Instead of a response from Gov. Newsom, CalPERS created a brand new “fact sheet” about their investments, including, “CalPERS has been investing in China for decades.” It is common knowledge that CalPERS does make investments based on policy and politics. CalPERS has divested from Israel and tobacco to name a few.

Now that the United States has lost more than $400 billion in American public pension funds, how do we make that up?

- Trump State of the Union: Democrats Showed They’re Not On the Side of The American People - February 25, 2026

- Leaving California: Public Storage Relocates HQ from California to Texas - February 25, 2026

- California Democrats Propose Government Takeover of Healthcare, Banning Private Insurance - February 24, 2026

You can’t make this stuff up… the largest, UNDERFUNDED state pension system is being managed by someone with ties to the PLA…

If Feinstein’s chauffeur, Swallwell’s hookup with a Chinese honeypot spy, and Pelosi’s and Newsom’s questionable deals with Chinese companies (BYD & others) isn’t proof enough that California legislators are 100% in the tank, on the take from the ChiComs, how much more proof do we NEED???

I maintain that the California reservoirs are being drained to force the American farmers out of business, so the Chinese can buy up the land on the cheap to send the food back to China…. prove me otherwise….

This is like a Hollywood movie playing out in real-life….

CriticalD: I see it the same way. Crazy how these guys get away with this stuff

Is not crazy, it’s by design. Keep you in fear or looking the other way.. Four years of Orange man bad!!! Were they really trying to save our country from evil Trump, or fleece you while you were occupied on Twitter?

CriticalDfene9, your suspicions are appearing to be more and more like fact by the hour. There is now evidence that Prop 12, to be instituted next year, will result in “No Pork in California”. And what is the number one consumed agricultural meat product in China? You guessed it – Oink, Oink. As of next year, Californians may have no pork: https://www.thecentersquare.com/california/as-of-next-year-californians-may-have-no-pork/article_a45174c6-f45b-11eb-916f-7bd466a844dd.html

In fact, the frozen pork supply in China is part of the CCP’s overall national security strategy: https://www.americanthinker.com/blog/2020/05/how_china_is_buying_up_americas_food_supply.html

AND… Let’s NOT FORGET that Swallwell STILL sits on the Intelligence Committee…

Is he still sharing pillow talk with his ChiCom benefactors???

You can’t make this stuff up…

Crit –

Your theory on Calif draining the reservoirs as part of a CCP strike against our farmers makes a lot more sense than any thing else I have heard.

Taken over without a shot being fired… Leveraging the greed & avarice of California Democrats…

Sun Tzu is being applied by Xi…

Let’s not forget that the CCP is running California’s Employment Development Department, which fraudulently lost $31 million in our tax dollars.

Paul, I got a “pishing” email from my old expired Bank of America EDD card account. Looked like a genuine BOA email asking for the account information to be “updated” or the account would be terminated. I checked with BOA and they confirmed it was an attempt to collect personal information to use in identity theft. The origin of the perpetrators is unknown…….but of course China is a good bet.

Ironically, 400 Billion is close to what Gavin Newsom stole from CA with all his various scams,

Look at how many hold high positions around finance and regulatory are from China, also look at politicians how many have Chinese backgrounds. It seems many other politicians have sold out to China….I remember Jerry Brown praising China and visiting it many times, and calling part of China CA sister city in sort of form.

Follow the money and it will lead to China

This is not related but anybody following the lawsuits with covid, can tune in now to this live update:

https://www.lifesitenews.com/conference-stop-the-shot/

Right now as we speak, the CCP is cracking down on foreign investments in private businesses in China. It started with Hong Kong, now it’s extending into other areas like private education firms (tutoring) and the gaming industry which the CCP calls “opium”. We are heading toward economic withdrawal from the Chinese markets; the extent to which is not clear at this time.

Short-term pain for long-term gain, Raymond, if we do indeed withdraw from that market, even in a partial manner…

If our corporate “leaders” thought STRATEGICALLY, instead of just to pay themselves more, the better off this nation would be…. as Congressman McClintock said in the forest fire/management article nearby, if you’re in a room with a rattlesnake that’s coiled in the corner, you don’t monitor it, you dispatch it quickly…

This is full of pure lies and shit

Shill alert