Legal books. (Photo: public domain)

What Is California’s SRIA?

Under existing law, all regulations are required to have an analysis of the potential economic impact of a regulation

By Chris Micheli, October 20, 2021 3:34 pm

What is SRIA? The acronym stands for “standardized regulatory impact analysis.” For those involved in significant regulatory work at California’s 200+ rulemaking agencies, departments, boards, and commissions, you have probably heard of a SRIA being done for any “major regulations.”

Under existing law, all regulations are required to have an analysis of the potential economic impact of a regulation. Specifically, pursuant to Government Code Section 11346.3, a state entity proposing to adopt, amend, or repeal any regulation must assess the potential for adverse economic impact on California business enterprises and individuals.

These rulemaking entities must also avoid the imposition of unnecessary or unreasonable regulations or reporting, recordkeeping, or compliance requirements. Unfortunately, this short analysis is done by completing the Economic Impact Statement, which is a 5-page, fill-in-the-blanks form, which is probably sufficient for most regulations.

The state entity, prior to submitting its proposed regulatory action to the Office of Administrative Law to begin the formal rulemaking process (i.e., part of the “initial statement of reasons”), must consider the proposal’s impact on business, with consideration of industries affected including the ability of California businesses to compete with businesses in other states. The state entity must even consider information supplied by interested parties.

What does this economic assessment include? The state entity must assess whether and to what extent it will affect the following:

- The creation or elimination of jobs within the state.

- The creation of new businesses or the elimination of existing businesses within the state.

- The expansion of businesses currently doing business within the state.

- The benefits of the regulation to the health and welfare of California residents, worker safety, and the state’s environment.

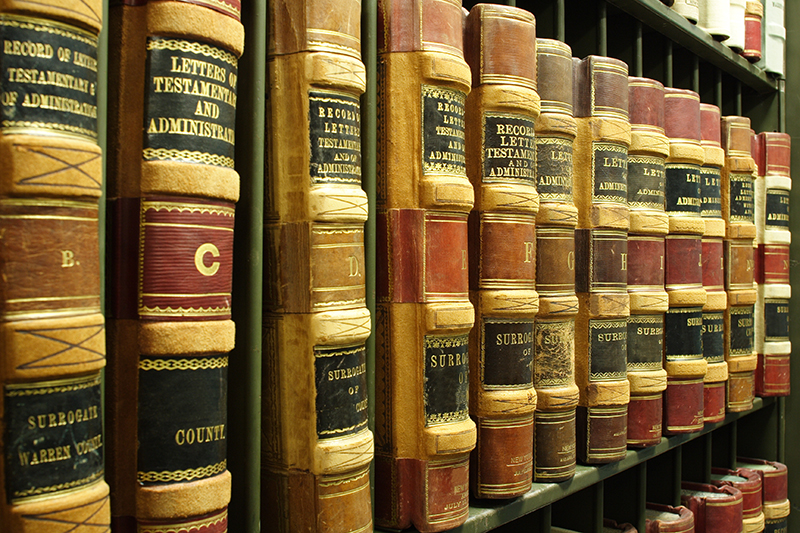

About a decade ago, the Legislature determined that, for the financially impactful regulations (about 10-12% of state regulations), a more thorough analysis should be done. As a result, they created the SRIA process which provides for a much more comprehensive analysis and applies only to the “major regulations.”

Government Code Section 11342.548 defines “major regulation” to mean any proposed adoption, amendment, or repeal of a regulation subject to review by the Office of Administrative Law pursuant to the APA that will have an economic impact on California business enterprises and individuals in an amount exceeding $50 million, as estimated by the state entity.

In other words, since November 2013, whenever a state entity proposes to adopt, amend, or repeal a major regulation, that state entity must prepare a standardized regulatory impact analysis pursuant to regulations adopted by the Department of Finance pursuant to Government Code Section 11346.36. Generally, speaking, the SRIA provides for more detailed analysis of both the compliance costs and potential health benefits of the regulation.

Specifically, the SRIA must address all of the following:

- The creation or elimination of jobs within the state.

- The creation of new businesses or the elimination of existing businesses within the state.

- The competitive advantages or disadvantages for businesses currently doing business within the state.

- The increase or decrease of investment in the state.

- The incentives for innovation in products, materials, or processes.

- The benefits of the regulations, including, but not limited to, benefits to the health, safety, and welfare of California residents, worker safety, and the state’s environment and quality of life, among any other benefits identified by the agency.

Why is this more detailed analysis required? According to the statute, “analyses conducted pursuant to this section are intended to provide agencies and the public with tools to determine whether the regulatory proposal is an efficient and effective means of implementing the policy decisions enacted in statute or by other provisions of law in the least burdensome manner. Regulatory impact analyses shall inform the agencies and the public of the economic consequences of regulatory choices, not reassess statutory policy.

“The baseline for the regulatory analysis shall be the most cost-effective set of regulatory measures that are equally effective in achieving the purpose of the regulation in a manner that ensures full compliance with the authorizing statute or other law being implemented or made specific by the proposed regulation.”

Pursuant to Government Code Section 11346.36, the Department of Finance adopted regulations for conducting the SRIA. These regulations are used to assist state entities adopting major regulations to:

- Assess and determine the benefits and costs of the proposed regulation, expressed in monetary terms to the extent feasible and appropriate. Assess the value of nonmonetary benefits such as the protection of public health and safety, worker safety, or the environment, the prevention of discrimination, the promotion of fairness or social equity, the increase in the openness and transparency of business and government and other nonmonetary benefits consistent with the statutory policy or other provisions of law.

- Compare proposed regulatory alternatives with an established baseline so agencies can make analytical decisions for the adoption, amendment, or repeal of regulations necessary to determine that the proposed action is the most effective, or equally effective and less burdensome, alternative in carrying out the purpose for which the action is proposed, or the most cost-effective alternative to the economy and to affected private persons that would be equally effective in implementing the statutory policy or other provision of law.

- Determine the impact of a regulatory proposal on the state economy, businesses, and the public welfare.

- Assess the effects of a regulatory proposal on the General Fund and special funds of the state and affected local government agencies attributable to the proposed regulation.

- Determine the cost of enforcement and compliance to the agency and to affected business enterprises and individuals.

- Estimate the economic impact.

Again, the SRIA must be included in the initial statement of reasons for the regulation that is submitted by the state entity to OAL and interested parties. That begins the formal rulemaking process.

- Rights in Eminent Domain Authority - February 2, 2026

- Unclaimed Property Law General Provisions - February 2, 2026

- Specialized Areas of Lobbying - February 1, 2026