Payday loans sign. (Photo: wikipedia)

California Legislation to Limit Predatory Lending Excludes Three Lenders

‘This bill would have the effect of eliminating most small dollar loan products in California’

By Katy Grimes, June 13, 2019 12:10 pm

Assembly Bill 539 by Assemblywoman Monique Limón (D-Santa Barbara) establishes an interest rate cap of 36 percent plus the federal funds rate for California Financing Law (CFL) licensee-provided consumer loans with principal amounts between $2,500 and $10,000. This bill also prohibits a CFL licensee from charging a penalty for prepayment of a consumer loan and establishes minimum loan terms.

The bill would bar predatory lenders, like payday small loan companies, from imposing excessively high interest rates on people who borrow $2,500 up to $10,000.

“Nearly half a million Californians are taking out more than 10 payday loans over the course of a year, paying an average percentage rate of 372 percent with a substantial number of these loans going to the elderly,” Limón wrote on her Assembly website. “More recently, payday lenders have pushed consumers toward much larger loans. Due to a loophole in state law, loans of less than $2,500 are required to charge interest rates of 36 percent or less, but loans above $2,500 do not have these same protections,” Limón wrote in an op ed.

But what about people who need an emergency loan and can’t get it from a bank? They know the non-bank lender charges a high rate of interest, but are willing to pay because of the emergency need. That is the free market at work.

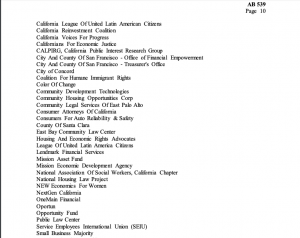

AB 536 attempts to limit the interest rates on these types of loans to 36 percent. However, three lenders, OneMain, Opportun, and Lendmark, listed as supporters of AB 539, also appear to be exempted from the bill merely because they already cap their interest at 36 percent. But these lenders understate their APRs through aggressive selling of add-on products, according to a recent Pew study. These add-on products are considered predatory because borrowers are unaware of how they impact the actual cost of the loan – a technicality left out of this bill.

“Pew’s research indicates that when states set rate limits under which consumer finance companies cannot make loans profitably, lenders sell credit insurance to earn revenue that they are not permitted to generate through interest or fees. In one fiscal year, five of the largest national installment lenders reported combined revenue of more than $450 million from ancillary products.”

“If real market forces were at work, it would be natural for a 36% loan product to beat a 100% loan product in a free market, so why is a regulation necessary?” former State Senator Ray Haynes recently wrote in an op ed. “One would expect market forces to resolve the problem without AB 539. As important, if a business could make a profit with a 36% loan, why wouldn’t all the businesses in that market reduce their interest to compete?”

“The three lenders who offer these lower interest rates are not entirely honest with the borrowers,” Haynes, an attorney, said. “They engage in a practice known as ‘loan packing,’ that is, they use undisclosed or deceptive practices to increase their profits by adding on ‘products’ that are of little value to the customer, but create large amounts of revenue to the lender, that more than make up for the lost interest. So, if you are an honest broker of high risk, low dollar loans, you charge 50% to 100% interest on the loan to make up for the high default rate by non-creditworthy borrowers. If you are a dishonest broker, you lure the borrower in with a promise of lower interest rates, then stick them with add-ons, like credit insurance or ‘debt protection’ products which add lots of revenue to the lender, with little benefit to the consumer. So, if a competitor wants to compete with the dishonest companies, they have to be dishonest too. Some companies won’t do that, so they just leave the market.”

Haynes reported that 80 percent of Assemblywoman Limón’s campaign contributions this year have originated from these dubious lenders. “She then introduces a bill that benefits these companies, sells it as a pro-consumer bill (which the NCLC says is anything but), and the consumer gets the shaft, while Democrats pretend to be the consumers’ friends. Assemblywoman Limon, chair of the policy committee that heard and passed the bill, said nothing about the contributions, said nothing about the sharp practices by the businesses from which she received contributions with a bill specifically designed to help these businesses, and then she advances the ‘pay to play’ agenda of the Sacramento Democrats.”

Opposed to AB 539, the California Financial Service Providers, the trade association for small-dollar consumer lenders, writes: “This bill would have the effect of eliminating most small dollar loan products in California, as this has been the result in other states that imposed unworkable rate caps…A consumer’s need for credit does not disappear once a rate cap is in place and industry shuts down. To meet their financial obligations, consumers are forced to choose costlier or unregulated options, such as overdraft programs, unregulated loans or bankruptcy…”

Also opposed, the California Hispanic Chamber of Commerce wrote: CHCC” represents the interests of more than 800,000 Hispanic business owners in California. We are deeply concerned about the impact AB 539 will have on small businesses and consumers. As proposed, AB 539 will limit lenders’ ability to provide a variety of short-term credit options to borrowers in need.”

AB 539 has passed two Assembly Committees, and was passed by the Assembly. It is now in the Senate referred to two committees.

How a more important financial bill??? Tax all money remittances to Mexico and Central America at 10%, and use the money to off-set schools and medical care for ILLEGAL ALIENS. That would go a long way to help CA’s economy.

Wow. Aren’t they sneaky. Basically this bill just eliminates the competition of rival lenders effectively monopolizing California under the guise of helping consumers.

Trash. Absolute trash. Guess it really pays to be a state legislator in bed with predatory lenders. I wonder how much campaign contributions they’ll get by pushing this bill onto the people. This is disgusting. This does absolutely nothing to help people in a financial pinch. Why don’t they just introduce a people led ballot initiative instead of sneakily trying to push this very shady bill.

Ah, but that wouldn’t benefit the backers of this bill. That would benefit the people and we can’t have that.