President Donald Trump (Twitter)

California Supreme Court Strikes Down Trump Tax Return Requirement to be on the State Ballot

The unanimous ruling from the Supreme Court nullified new law signed by Gov. Gavin Newsom

By Katy Grimes, November 21, 2019 11:12 am

‘Today’s ruling is a victory for every California voter.’

~Jessica Patterson, Chairwoman, California Republican Party

The California Supreme Court ruled Thursday morning that President Donald Trump will not have to release his tax returns in order to be listed on California’s 2020 primary ballot.

The unanimous ruling from the state Supreme Court nullified Senate Bill 27 , passed by the California Legislature and signed into law by Gov. Gavin Newsom. Senate Bill 27 was aimed at forcing President Donald Trump to release five years of his tax returns if he wanted to be on the state’s March 3, 2020 Primary Election Ballot.

“Today’s ruling is a victory for every California voter,” said Jessica Patterson, Chairwoman of the California Republican Party and Plaintiff in the lawsuit. “This unanimous decision solidifies the California State Constitutional provisions to place candidates on the ballot, and the important fact that the legislature may not place additional restrictions on those requirements.”

“We are pleased that the courts saw through the Democrats’ petty partisan maneuvers and saw this law for what it is – an unconstitutional attempt to suppress Republican voter turnout.”

“Democrats must stop wasting time and taxpayer dollars on political tricks and instead focus their efforts and resources on fixing California’s serious problems such as homelessness, our failing education system and the skyrocketing cost of living,” Patterson added.

“Now that this nonsense is over with, it would be great to see Democrats focus on the actual problems facing Californians,” Assemblyman Devon Mathis (R-Visalia) said in a press statement. “When they passed the SB 27, Democrats proved they never let the Constitution get in the way of wasting taxpayer dollars or trying to silence those who disagree with them. Thank you to the Supreme Court for striking down this illegal voter suppression effort and upholding our nation’s laws and values. Despite what Democrat lawmakers would like to believe, California is still subject to the United States Constitution.”

Five different plaintiffs’ lawyers, including President Trump’s lawyers, and lawyers for Jessica Patterson argued in the U.S. District Court in September that the new law was unconstitutional because the requirements for candidates running for president are outlined in the U.S. Constitution, and therefore the jurisdiction of the federal government.

United States District Judge Morrison C. England, Jr.tentatively granted all five plaintiffs motions for preliminary injunction on SB 27 in September.

October 1, 2019 Judge England, granted injunctions barring Senate Bill 27. “Judge England’s opinion makes clear that California’s SB 27 was fatally unconstitutional in multiple respects: qualifications clause, First Amendment, Equal Protection, and also pre-empted by the federal statutes,” California Attorney Harmeet Dhillon said.

Dhillon was right, and the Supreme Court Justices agreed.

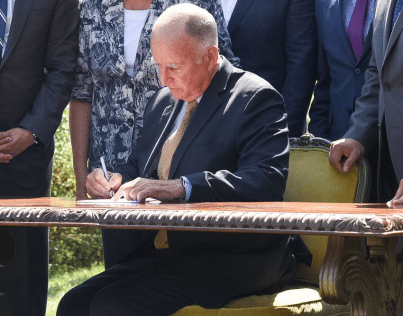

Both the District Court and Supreme Court judges acknowledged that California Gov. Jerry Brown vetoed the 2017 previous tax return bill, SB 149, saying that passage of the bill would have set a dangerous precedent for potential partisan mischief, creating “an ever-escalating set of different state requirements for presidential candidates.” Brown also said it “may be unconstitutional” to require President Trump and future presidential candidates to disclose their income tax returns in advance of the 2020 presidential election. “Today we require tax returns, but what would be next?” Brown wrote in his veto message. “Five years of health records? A certified birth certificate? High school report cards? And will these requirements vary depending on which political party is in power?”

Also notable is the precedence this ruling could have on the 10 other states which also passed similar laws attempting to require President Trump to release multiple years of tax returns in order to be included on primary ballots.

“The Golden State is the fifth largest economy in the world, yet the priorities of California Democrats and the governor are out of touch with California’s needs,” Senate Republican Leader Shannon Grove said. “There are real issues that need to be addressed, such as keeping the power on for families, making housing affordable, and tackling the out-of-control homeless crisis. Instead of combating these problems, Democrats continue to pursue bad legislation, like SB 27, which interferes with our elections, is unconstitutional, a waste of taxpayer money, and a direct attack on democracy.”

“Governor Newsom’s signing of SB 27 was clearly a political stunt to suppress the speech of millions of Californians at a time when he should be focusing on the real problems facing California,” said Assemblywoman Melissa Melendez (R-Lake Elsinore). “His focus should be the ever-growing homelessness crisis, sky-high gas prices, affordable housing, sustainable water supplies and alleviating the tax burdens on Californians who face the extremely high-cost of living in a ‘tax-first’ state. The California Supreme Court is sending a message to Governor Newsom: end this political theater because Californians deserve better.”

Melendez was the lead plaintiff in Melendez v. Newsom, one of the five lawsuits, which sought to invalidate Senate Bill 27 from taking effect and prevented President Trump from appearing on the ballot during the March 3rd Primary Election.

Case closed.

‘When they passed the SB 27, Democrats proved they never let the Constitution get in the way of wasting taxpayer dollars or trying to silence those who disagree with them.’

~Assemblyman Devon Mathis

- Trump Responds, Issues Global 10% Tariff on all Countries - February 21, 2026

- What is Trump’s Plan B After Supreme Court Strikes Down Tariffs? - February 20, 2026

- New BLS Data Shows Union Membership Drives Falling Flat - February 19, 2026