California State Capitol. Photo: Kevin Sanders for California Globe)

COVID Paid Sick Leave Program Bill Finalized

California business community sought a number of amendments and changes to the bill to ease compliance burdens

By Chris Micheli, March 15, 2021 6:21 am

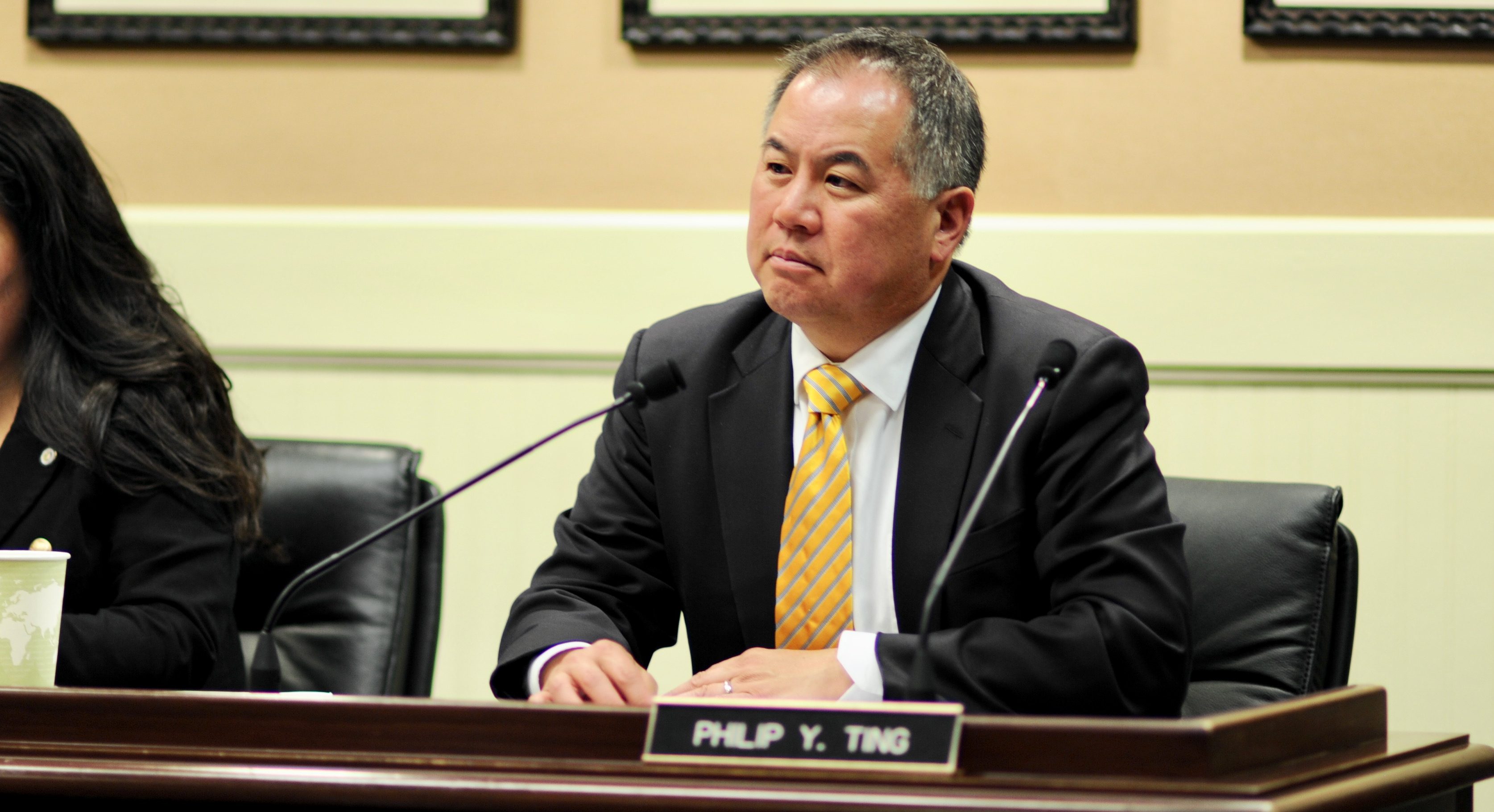

Senate Bill 95 by Sen. Nancy Skinner (D-Berkeley) and Assembly Bill 84 by Assemblyman Phil Ting (D-San Francisco) and the Assembly Committee on the Budget were amended on March 12 to provide a new supplemental paid sick leave program in California. The bills would add Sections 248.2 and 248.3 to the Labor Code. As a budget trailer bill, SB 95 or AB 84 would take effect immediately as a bill related to the budget. One of the bills is expected to be adopted Monday afternoon by the Assembly and Senate.

The California business community sought a number of amendments to the bill, including a state tax credit to cover the costs associated with this new sick leave program for those costs not covered by the federal tax credits. They also objected to the retroactive application of the bill to January 1 of this year. And, they requested several changes to the language to ease compliance burdens, most of which were made to the bill’s provisions.

Section One of the bill would add Labor Code Section 248.2. It would define the following terms:

- “COVID-19 supplemental paid sick leave” means supplemental paid sick leave provided pursuant to this section.

- “Employer” means an employer that employs more than 25 employees.

- “Covered employee” means an employee who is unable to work or telework for an employer because of a specified reason.

- “Firefighter” means an active firefighting member of specified departments.

A covered employee would be entitled to COVID-19 supplemental paid sick leave and an employer would be required to provide COVID-19 supplemental paid sick leave to each covered employee if that covered employee is unable to work or telework due to any of the following reasons:

- The covered employee is subject to a quarantine or isolation period related to COVID-19 as defined by an order or guidelines of the State Department of Public Health, the federal Centers for Disease Control and Prevention, or a local health officer who has jurisdiction over the workplace.

- If the covered employee is subject to more than one of the foregoing, the covered employee shall be permitted to use COVID-19 supplemental paid sick leave for the minimum quarantine or isolation period under the order or guidelines that provides for the longest such minimum period.

- The covered employee has been advised by a health care provider to self-quarantine due to concerns related to COVID-19.

- The covered employee is attending an appointment to receive a vaccine for protection against contracting COVID-19.

- The covered employee is experiencing symptoms related to a COVID-19 vaccine that prevent the employee from being able to work or telework.

- The covered employee is experiencing symptoms of COVID-19 and seeking a medical diagnosis.

- The covered employee is caring for a family member who is subject to an order or guidelines or who has been advised to self-quarantine.

- The covered employee is caring for a child whose school or place of care is closed or otherwise unavailable for reasons related to COVID-19 on the premises.

In addition, a covered employee would be entitled to the following number of hours of COVID-19 supplemental paid sick leave: 80 hours of COVID-19 supplemental paid sick leave, if the covered employee satisfies either of the following criteria:

- The employer considers the covered employee to work full time.

- The covered employee worked or was scheduled to work, on average, at least 40 hours per week for the employer in the two weeks preceding the date the covered employee took COVID-19 supplemental paid sick leave.

A covered employee who does not satisfy the criteria is entitled to an amount of COVID-19 supplemental paid sick leave as follows:

- If the covered employee has a normal weekly schedule, the total number of hours the covered employee is normally scheduled to work for the employer over two weeks.

- If the covered employee works a variable number of hours, 14 times the average number of hours the covered employee worked each day for the employer in the six months preceding the date the covered employee took COVID-19 supplemental paid sick leave.

- If the covered employee has worked for the employer over a period of fewer than six months but more than 14 days, this calculation must instead be made over the entire period the covered employee has worked for the employer.

- If the covered employee works a variable number of hours and has worked for the employer over a period of 14 days or fewer, the total number of hours the covered employee has worked for that employer.

The total number of hours of COVID-19 supplemental paid sick leave to which a covered employee is entitled is in addition to any paid sick leave that may be available to the covered employee. A covered employee may determine how many hours of COVID-19 supplemental paid sick leave to use, up to the total number of hours to which the covered employee is entitled. The employer must make COVID-19 supplemental paid sick leave available for immediate use by the covered employee, upon the oral or written request of the covered employee to the employer.

Each hour of COVID-19 supplemental paid sick leave must be compensated at a rate equal to the following:

- For nonexempt covered employees, by the highest of the following:

- Calculated in the same manner as the regular rate of pay for the workweek in which the covered employee uses COVID-19 supplemental paid sick leave, whether or not the employee actually works overtime in that workweek.

- Calculated by dividing the covered employee’s total wages, not including overtime premium pay, by the employee’s total hours worked in the full pay periods of the prior 90 days of employment.

- The state minimum wage.

- The local minimum wage to which the covered employee is entitled.

- COVID-19 supplemental paid sick leave for exempt covered employees must be calculated in the same manner as the employer calculates wages for other forms of paid leave time.

A covered employee who is entitled to an amount of COVID-19 supplemental paid sick leave must be compensated for each hour of COVID-19 supplemental paid sick leave at the regular rate of pay to which the covered employee would be entitled as if the covered employee had been scheduled to work those hours, pursuant to existing law or an applicable collective bargaining agreement.

In addition, an employer is not required to pay more than $511 per day and $5,110 in the aggregate to a covered employee for COVID-19 supplemental paid sick leave taken by the covered employee unless federal legislation is enacted that increases these amounts beyond the amounts that were included in the Emergency Paid Sick Leave Act established by the federal Families First Coronavirus Response Act (Public Law 116-127).

If that occurs, the new federal dollar amounts would apply to this section as of the date the new amounts are applicable under the federal law. Be aware that a covered employee who has reached the maximum amounts is allowed to choose to utilize other paid leave that is available to the covered employee in order to fully compensate the covered employee for leave taken.

An employer is prohibited from requiring a covered employee from using any other paid or unpaid leave, paid time off, or vacation time provided by the employer to the covered employee before the covered employee uses COVID-19 supplemental paid sick leave or in lieu of COVID-19 supplemental paid sick leave.

In order to satisfy the requirement to maintain an employee’s earnings when an employee is excluded from the workplace due to COVID-19 exposure under the Cal-OSHA COVID-19 Emergency Temporary Standards, an employer may require a covered employee to first exhaust their COVID-19 supplemental paid sick leave under this section.

If an employer pays a covered employee another supplemental benefit for leave taken on or after January 1, 2021, that compensates the covered employee in an amount equal to or greater than the amount of compensation for COVID-19 supplemental paid sick leave to which the covered employee is entitled, then the employer may count the hours of the other paid benefit or leave towards the total number of hours of COVID-19 supplemental paid sick leave that the employer is required to provide to the covered employee. This may include paid leave provided by the employer pursuant to any federal or local law in effect or that became effective on or after January 1, 2021, if the paid leave is provided to the covered employee under that law.

In terms of enforcement, the remedies available to redress any unlawful business practice may be used to enforce this section. The Labor Commissioner will enforce this section as if COVID-19 supplemental paid sick leave constitutes “paid sick days,” “paid sick leave,” or “sick leave.”

The Labor Commissioner is required to make publicly available a model notice. Only for purposes of COVID-19 supplemental paid sick leave, if an employer’s covered employees do not frequent a workplace, the employer may satisfy the notice requirement by disseminating notice through electronic means, such as by electronic mail.

The requirement to provide COVID-19 supplemental paid sick leave would take effect 10 days after the date of enactment of this section, at which time the requirements would apply retroactively to January 1, 2021. The requirement to provide COVID-19 supplemental paid sick leave applies retroactively to January 1, 2021 in order to protect the economic well-being of covered employees who took leave beginning on or after January 1, 2021.

For any leave taken, if the employer did not compensate the covered employee in an amount equal to or greater than the amount of compensation for COVID-19 supplemental paid sick leave to which the covered employee is entitled, then upon the oral or written request of the employee, the employer is required to provide the covered employee with a retroactive payment that provides for the compensation. This retroactive payment would be paid on or before the payday for the next full pay period after the oral or written request of the covered employee.

The requirement to provide COVID-19 supplemental paid sick leave would remain in effect through September 30, 2021, except that a covered employee taking COVID-19 supplemental paid sick leave at the time of the expiration of this section would be permitted to take the full amount of COVID-19 supplemental paid sick leave to which the covered employee otherwise would have been entitled.

Section Two of the bill would add Labor Code Section 248.3. The bill would define the following terms:

- “COVID-19 supplemental paid sick leave” to mean supplemental paid sick leave provided by this section of the law.

- “Provider” means a provider of in-home supportive services under specified sections of the Welfare and Institutions Code.

- “Work” means providing authorized in-home supportive services under specified sections of the Welfare and Institutions Code.

The bill would specify that a provider is entitled to COVID-19 supplemental paid sick leave if that provider is unable to work due to any of the following reasons:

- The provider is subject to a quarantine or isolation period related to COVID-19 as defined by an order or guidelines of the State Department of Public Health, the federal Centers for Disease Control and Prevention, or a local health officer who has jurisdiction over the workplace. If the provider is subject to more than one of the foregoing, the provider shall be permitted to use COVID-19 supplemental paid sick leave for the minimum quarantine or isolation period under the order or guidelines that provides for the longest minimum period.

- The provider has been advised by a health care provider to self-quarantine due to concerns related to COVID-19.

- The provider is attending an appointment to receive a vaccine for protection against contracting COVID-19.

- The provider is experiencing symptoms related to a COVID-19 vaccine that prevents the provider from being able to work.

- The provider is experiencing symptoms of COVID-19 and seeking a medical diagnosis.

- The provider is caring for a family member who is subject to an order or guidelines.

- The provider is caring for a child whose school or place of care is closed or otherwise unavailable for reasons related to COVID-19 on the premises.

A provider would be entitled to the following number of hours of COVID-19 supplemental paid sick leave:

- A provider is entitled to 80 hours of COVID-19 supplemental paid sick leave if the provider worked or was scheduled to work, on average, at least 40 hours per week in the two weeks preceding the date the provider took COVID-19 supplemental paid sick leave.

- A provider who does not satisfy the criteria above is entitled to an amount of COVID-19 supplemental paid sick leave as follows, up to a maximum of 80 hours of COVID-19 supplemental paid sick leave:

- If the provider has a regular weekly schedule, the total number of hours the provider is normally scheduled to work over two weeks.

- If the provider works a variable number of hours, 14 times the average number of hours the provider worked each day for the employer in the six months preceding the date the provider took COVID-19 supplemental paid sick leave. If the provider has worked over a period of fewer than six months but more than 14 days, this calculation shall instead be made over the entire period the provider has worked.

- If the provider works a variable number of hours and has worked over a period of 14 days or fewer, the total number of hours the provider has worked.

The total number of hours of COVID-19 supplemental paid sick leave to which a provider is entitled would be determined on the first day that the provider uses COVID-19 supplemental paid sick leave under this section of law and would be in addition to any paid sick leave that may be available to the provider under Section 246.

A provider may determine how many hours of COVID-19 supplemental paid sick leave to use, up to the total number of hours to which the provider is entitled. The COVID-19 supplemental paid sick leave is available for immediate use by the provider, and the provider would be required to inform the recipient of the need to take sick leave and submit a sick leave claim to the county consistent with established procedures in that county.

A provider is not entitled to more than the total number of hours of COVID-19 supplemental paid sick leave to which the provider is entitled. Each hour of COVID-19 supplemental paid sick leave is to be compensated at the regular rate of pay to which the provider would be entitled if the provider had been scheduled to work those hours pursuant to existing law or an applicable collective bargaining agreement. A provider would be required to use any other paid or unpaid leave before the provider uses COVID-19 supplemental paid sick leave or in lieu of COVID-19 supplemental paid sick leave.

In addition, if a provider takes paid leave on or after April 1, 2021 that compensates the provider in an amount equal to or greater than the amount of compensation for COVID-19 supplemental paid sick leave to which the provider is entitled, the hours of the other paid benefit or leave may be counted towards the total number of hours of COVID-19 supplemental paid sick leave to which the provider is entitled.

The other supplemental benefit for leave taken that may be counted does not include paid sick leave to which the provider may be entitled to under Section 246, but may include paid leave provided by any federal or local law that becomes effective on or after April 1, 2021, if the paid leave is provided to the provider under that law for any of the same reasons.

Moreover, the entitlement to COVID-19 supplemental paid sick leave as set forth in this section takes effect 10 days after the date of enactment of this section, at which time the entitlements apply retroactively to January 1, 2021. Furthermore, the entitlement to COVID-19 supplemental paid sick leave as set forth in this section would apply retroactively to January 1, 2021.

In this regard, for any leave taken, if the provider was not compensated in an amount equal to or greater than the amount of compensation for COVID-19 supplemental paid sick leave to which the provider is entitled, then the provider would be entitled to a retroactive payment that provides for that compensation. For any retroactive payment, the number of hours of leave corresponding to the amount of the retroactive payment must be counted towards the total number of hours of COVID-19 supplemental paid sick leave that the provider is entitled.

In addition, the COVID-19 supplemental paid sick leave provided under this section would be in addition to any unused sick leave benefits put in place by the federal Family First Coronavirus Response Act (Public Law 116-127), which a provider may still use until March 31, 2021. The entitlement to COVID-19 supplemental paid sick leave as set forth in this section would remain in effect through September 30, 2021.

Section Three of the bill would appropriate $100,000 to the Labor Commissioner for staffing resources to implement and enforce the provisions related to the COVID-19 supplemental paid sick leave.

Section Four of the bill provides that SB 95 is a bill providing for appropriations related to the Budget Bill and will therefore take effect immediately upon being chaptered in law. This bill is supposed to be heard and voted upon Monday in both houses of the Legislature.

- Miscellaneous Civil Action Proceedings - February 23, 2026

- Probate Code Could Be a Basis for Statutory Interpretation Principles - February 22, 2026

- Conservation Banks - February 22, 2026

This looks like a sure fire way to get businesses to shut down permanently. How can a business pay these wages?

Every evil bill passed since the ‘state of emergency’ should be voided.