California State Capitol. (Photo: Kevin Sanders for California Globe)

Frequently Asked Questions about California Local Governments

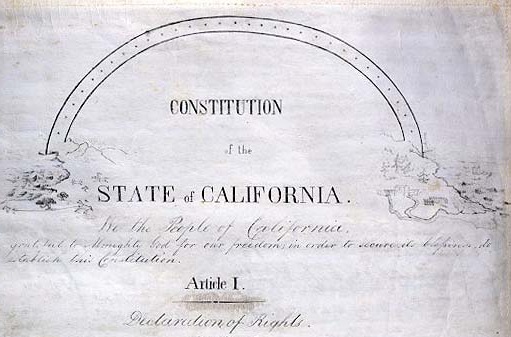

Does the California Constitution address local governments?

By Chris Micheli, December 18, 2023 9:05 am

How many local government entities exist in California? There are 58 counties, 482 cities, and over 2,000 special districts that comprise local government.

Does the California Constitution address local governments? Yes, Article 11 deals with local government.

How does the state Constitution deal with counties? Section 1 of Article 11 provides that the State is divided into counties, which are legal subdivisions of the State.

What laws must the State enact about counties? The Legislature is required to prescribe uniform procedures for county formation, consolidation, and boundary changes.

What laws must the State enact about cities? Section 2 of Article 11 requires that the Legislature prescribe uniform procedures for city formation and provide for city powers.

Can local governments adopt their own laws? Yes, Section 3 of Article 11 provides that, for its own government, a county or city may adopt a charter by majority vote of its electors voting on the question.

What can a charter city do? Section 5 of Article 11 provides that, in any city charter, the city may make and enforce all ordinances and regulations with respect to municipal affairs, subject only to restrictions and limitations provided in their charters and, in respect to other matters, they are subject to general laws of the State.

Can there be both a city and county combined? Yes, Section 6 of Article 11 provides that a county and all cities within it may consolidate as a charter city and county as provided by statute.

What are cities and counties authorized to do? Section 7 of Article 11 specifies that a county or city may make and enforce within its limits all local, police, sanitary, and other ordinances and regulations not in conflict with general laws applicable to all local governments.

Are charter cities and counties limited in what they can do? Yes, Section 7.5 prohibits a city or county measure proposed by the legislative body of a city, charter city, county, or charter county and submitted to the voters for approval from doing specified items.

Must counties provide services to cities? Section 8 of Article 11 states that the Legislature may provide that counties perform municipal functions at the request of cities within them.

Can local governments provide public works? Yes, Section 9 of Article 11 provides that a municipal corporation may establish, purchase, and operate public works to furnish its inhabitants with light, water, power, heat, transportation, or means of communication.

Can local government officials or contractors be paid extra by public entities? No, Section 10 of Article 11 specifies that a local government body may not grant extra compensation or extra allowance to a public officer, public employee, or contractor after service has been rendered or a contract has been entered into and performed in whole or in part, or pay a claim under an agreement made without authority of law.

Can the Legislature delegate local government functions to a private person or entity? No, Section 11 of Article 11 provides that the Legislature may not delegate to a private person or body power to make, control, appropriate, supervise, or interfere with county or municipal corporation improvements, money, or property, or to levy taxes or assessments, or perform municipal functions.

How are claims addressed? Section 12 of Article 11 specifies that the Legislature may prescribe procedures for the presentation, consideration, and enforcement of claims against counties, cities, their officers, agents, or employees.

Are there are property tax limitations on counties? Section 14 of Article 11 states that a local government, the boundaries of which include all or part of two or more counties, cannot levy a property tax unless that tax has been approved by a majority vote of the qualified voters of that local government voting on the issue of the tax.

- Seaport Infrastructure Financing in California - August 6, 2025

- Exclusive Rights of Pilotage - August 5, 2025

- Civil Action Mediation in California - August 4, 2025